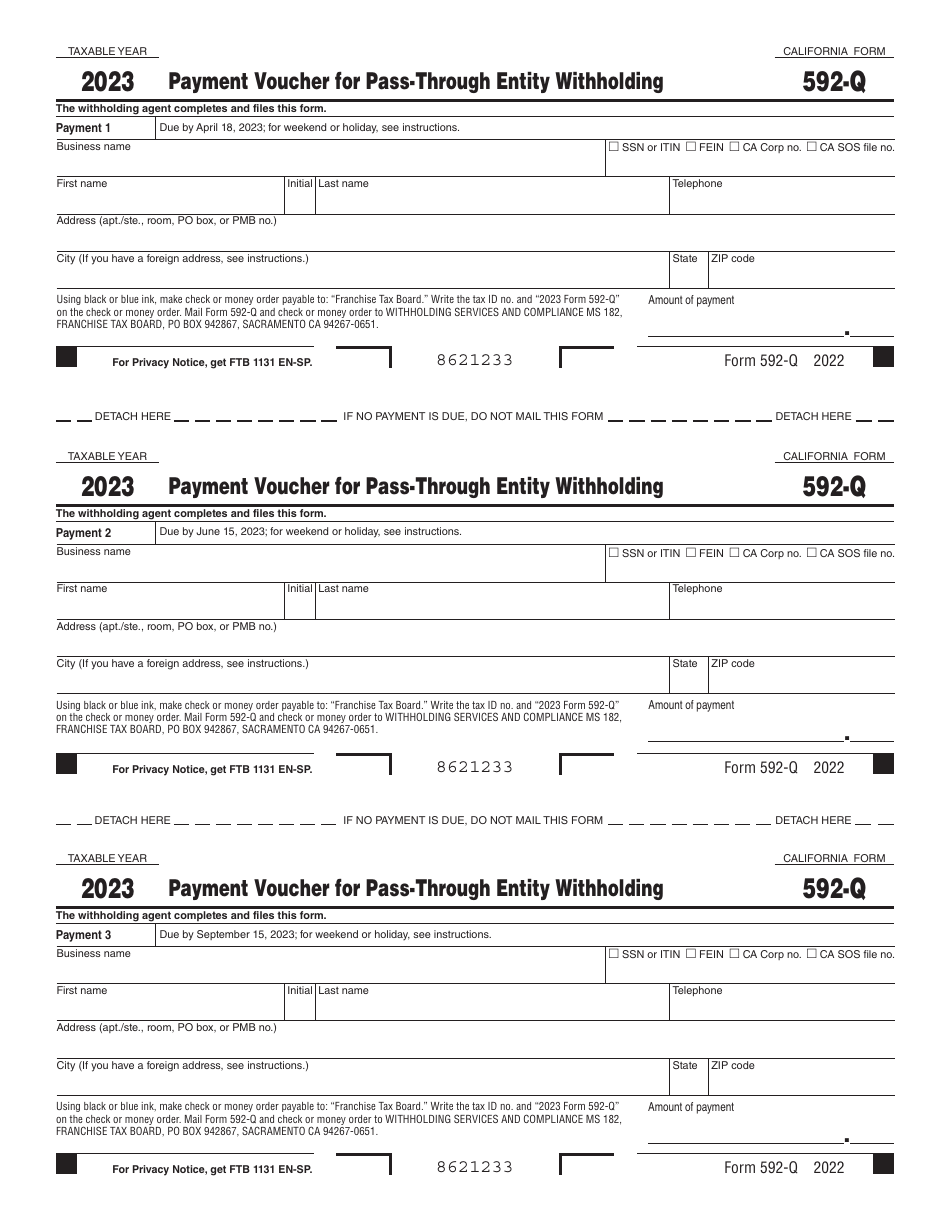

Form 592-Q

Form 592-Q - Web do not use form 592 to report tax withheld on foreign partners. The payer uses form 592 to. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The withholding agent completes and files this form. Web two new forms: Web form 592 is a return that is filed quarterly. Web you want to electronically file california form 592 to the franchise tax board (ftb). The withholding agent completes and files this form. Web daily tax report: If no payment is due, do not mail this form. The withholding agent completes and files this form. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. June 16, 2023, 5:00 am utc. The withholding agent completes and files this form. Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. Quick and easy to set up. Web do not use form 592 to report tax withheld on foreign partners. Web daily tax report: Form 4197, info on tax. Web form 592 is a return that is filed quarterly. Quick and easy to set up. Web two new forms: Web daily tax report: Web you want to electronically file california form 592 to the franchise tax board (ftb). Form 590 does not apply to payments of backup withholding. If no payment is due, do not mail this form. Web form 592 is a return that is filed quarterly. Web you want to electronically file california form 592 to the franchise tax board (ftb). Web daily tax report: Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due. Web two new forms: Web daily tax report: Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. The payer uses form 592 to. Web form 592 is a return that is filed quarterly. If no payment is due, do not mail this form. Web how to complete california form 592. June 16, 2023, 5:00 am utc. The withholding agent completes and files this form. Quick and easy to set up. Web form 592 is a return that is filed quarterly. The withholding agent completes and files this form. The payer uses form 592 to. Web daily tax report: Quick and easy to set up. The payer uses form 592 to. Web two new forms: Quick and easy to set up. Web daily tax report: Web how to complete california form 592. Quick and easy to set up. Web daily tax report: Web you want to electronically file california form 592 to the franchise tax board (ftb). The withholding agent completes and files this form. The withholding agent completes and files this form. Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. Web you want to electronically file california form 592 to the franchise tax board (ftb). Web do not use form 592 to report tax withheld on foreign partners. Web daily tax report: Web two new forms: Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. Web form 592 is a return that is filed quarterly. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 4197, info on tax. Web do not use form 592 to report tax withheld on foreign partners. June 16, 2023, 5:00 am utc. The payer uses form 592 to. Form 590 does not apply to payments of backup withholding. The withholding agent completes and files this form. Quick and easy to set up. Web daily tax report: The withholding agent completes and files this form. Web two new forms: If no payment is due, do not mail this form. Web how to complete california form 592. Web you want to electronically file california form 592 to the franchise tax board (ftb).Form 592Q Download Fillable PDF or Fill Online Payment Voucher for

va form 21 592 Fill Online, Printable, Fillable Blank vaform21p

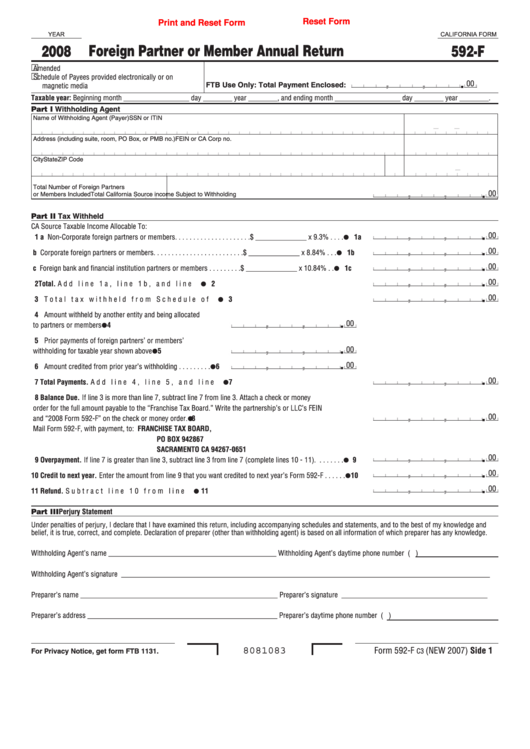

Fillable California Form 592F Foreign Partner Or Member Annual

48 Form 592 Templates free to download in PDF

DD Form 592 Payroll for Personal Services Certification and Summary

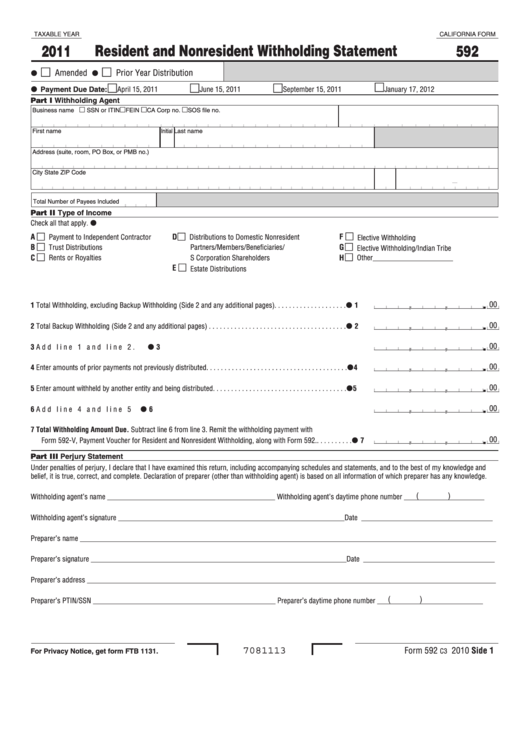

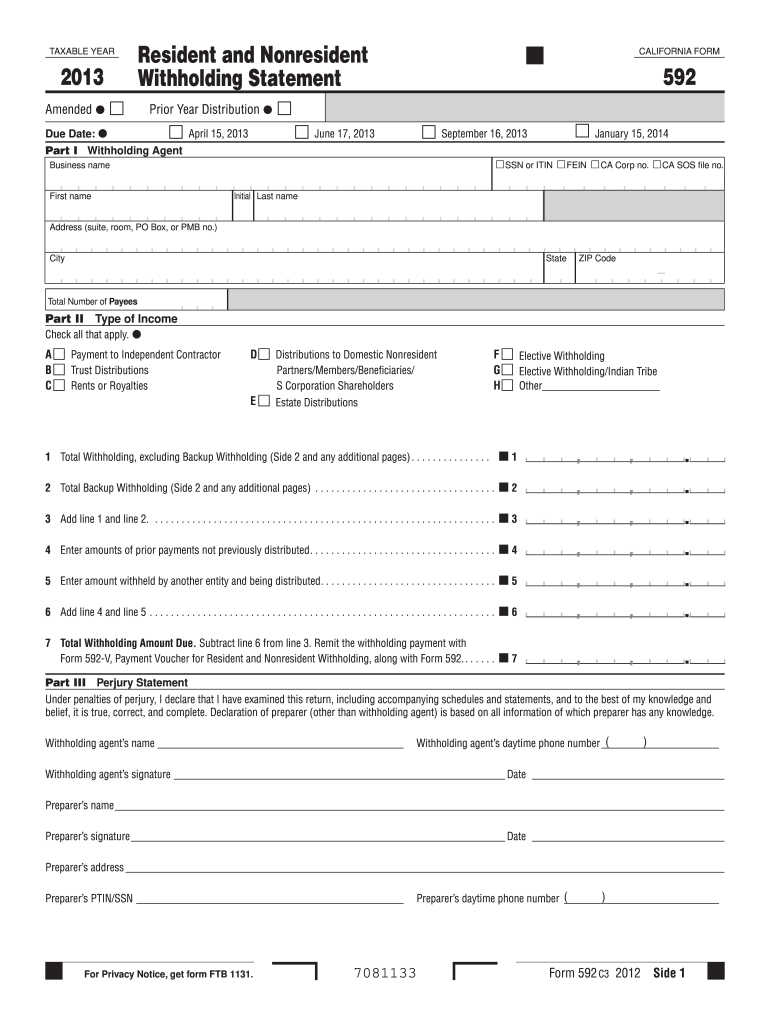

Fillable Form 592 Resident And Nonresident Withholding Statement

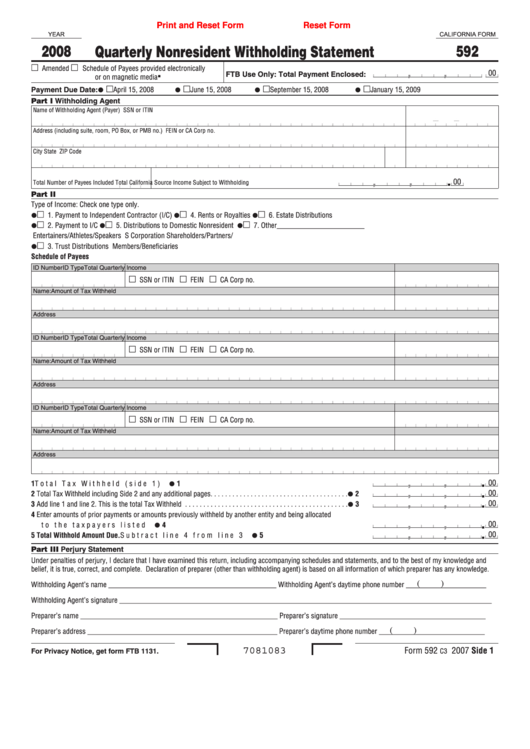

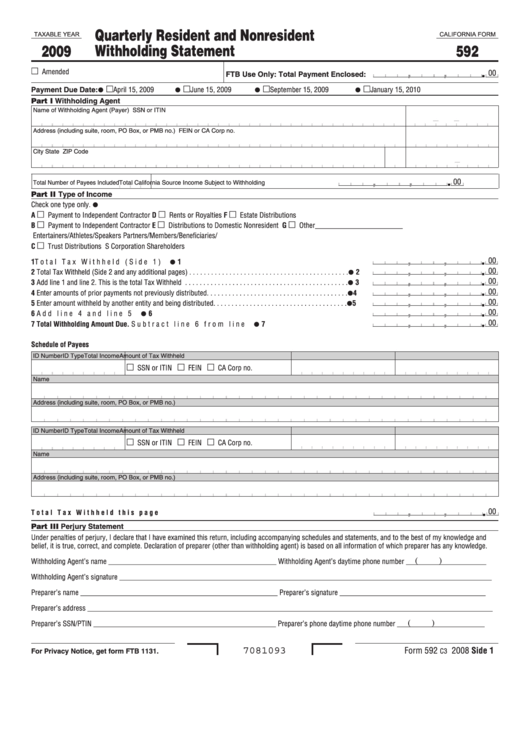

Fillable California Form 592 Quarterly Resident And Nonresident

2021 Form CA FTB 592F Fill Online, Printable, Fillable, Blank pdfFiller

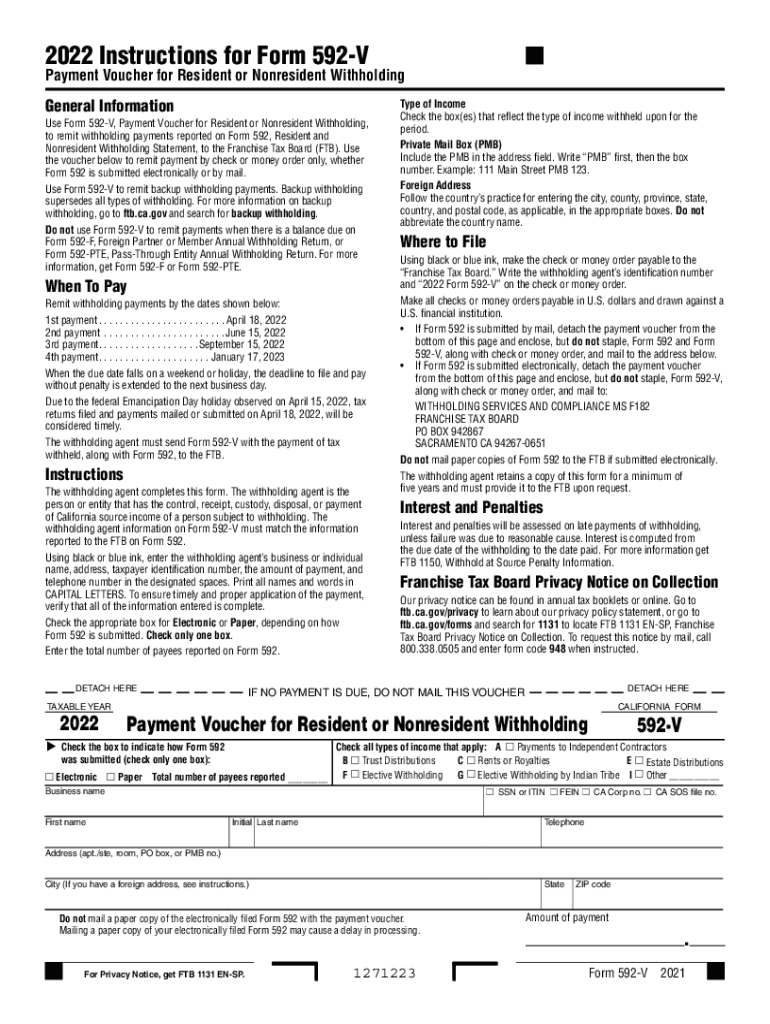

Form 592 V Fill Out and Sign Printable PDF Template signNow

Form 592 Fill Out and Sign Printable PDF Template signNow

Related Post: