Underpayment Penalty Form

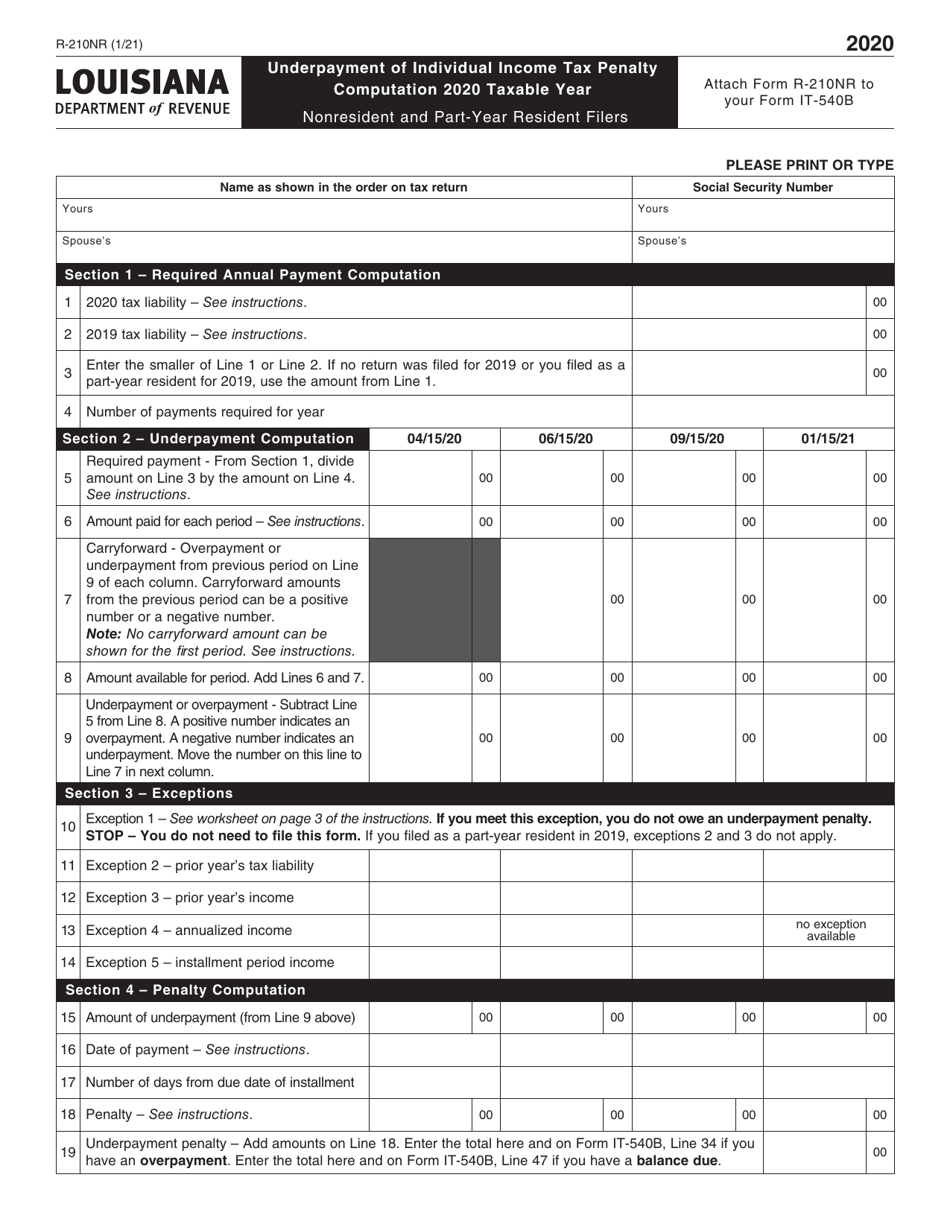

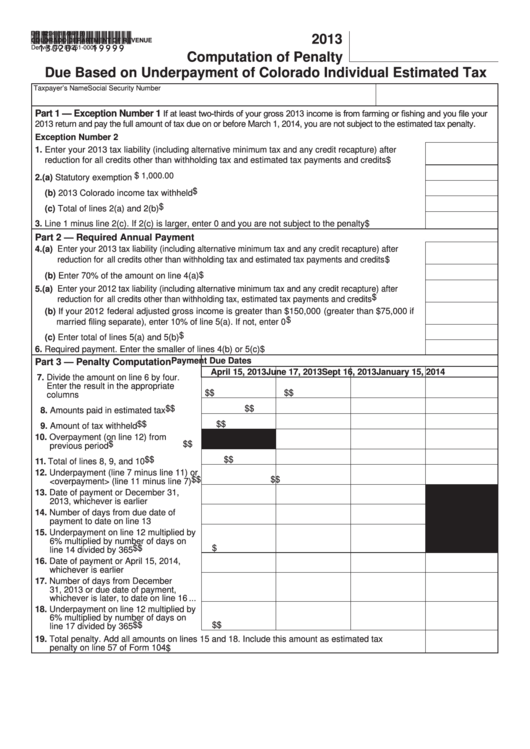

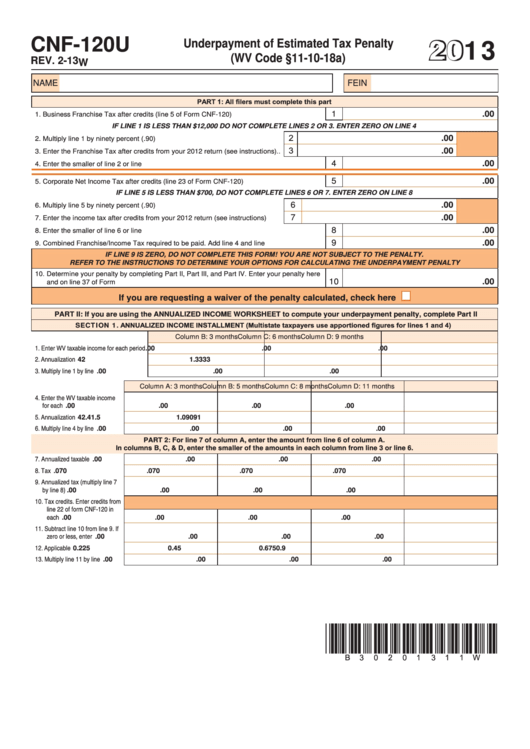

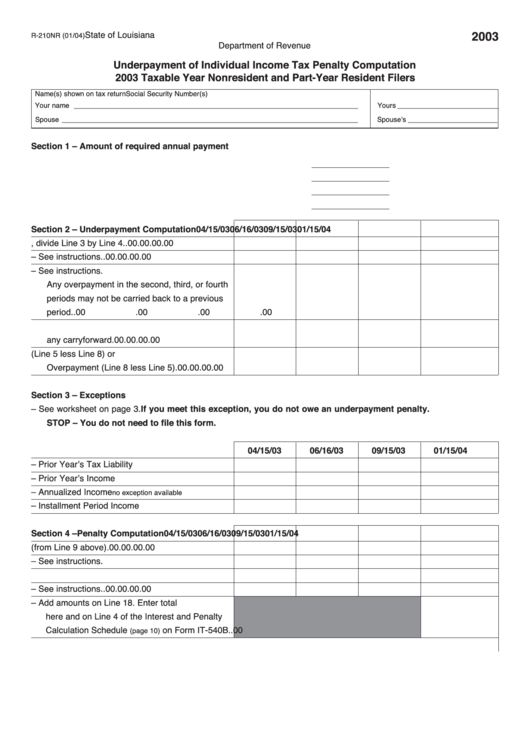

Underpayment Penalty Form - Underpayment of estimated tax by individuals, estates, and trusts. For more information, see understanding your irs notice or letter. Web to determine if they must disclose an underpayment and pay a penalty, taxpayers should refer to irs form 2210. Penalties eligible for first time abate. This amount may not exceed 25 percent. Web calculate, pay or remove the underpayment of estimated tax by corporations penalty when you don’t pay estimated tax accurately or on time. Web taxpayers can work through irs form 2210 to determine whether they owe a tax underpayment penalty when they file their taxes. They may also apply the penalty if the payments you. Web underpayment, or tax that was reported on time, but not paid on time). Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web if you file your taxes and find that you paid less than what you owed, you will need to use form 1040, 1040a or form 2210 to determine the underpayment amount. Please read the instructions carefully and ensure all applicable sections of the form are. Underpayment of estimated tax by individuals, estates, and trusts. Web form 2210 is used. Web to determine if they must disclose an underpayment and pay a penalty, taxpayers should refer to irs form 2210. What is irs form 2210? Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to see if you owe a penalty for underpaying your estimated tax. Web on this page: The irs will generally figure your. Who must file irs form 2210? What is irs form 2210? Web calculate, pay or remove the underpayment of estimated tax by corporations penalty when you don’t pay estimated tax accurately or on time. Web failure to file on time leads to a penalty of four and a half percent of the owed tax for each month the return is. Do personal taxes with expert help do business taxes with expert help. Web full service for personal taxes full service for business taxes. Web taxpayers can work through irs form 2210 to determine whether they owe a tax underpayment penalty when they file their taxes. Penalty relief by administrative waiver. Web on this page: Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to see if you owe a penalty for underpaying your estimated tax. Web failure to file on time leads to a penalty of four and a half percent of the owed tax for each month the return is late. Ad fill out any legal form in minutes.. Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to see if you owe a penalty for underpaying your estimated tax. Web if you file your taxes and find that you paid less than what you owed, you will need to use form 1040, 1040a or form 2210 to determine the underpayment amount. Underpayment of estimated. Web if a penalty applies, you might have to file irs form 2210. Easy to use, save, & print. It’s simple to end up with an unsatisfactorily. Web underpayment of estimated tax by corporations. Web on this page: It’s simple to end up with an unsatisfactorily. Web underpayment of estimated tax by corporations. The irs typically will calculate the underpayment penalty for you, but in certain circumstances, you may. Who must file irs form 2210? Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form. How to qualify for first time abate. Easy to use, save, & print. The irs typically will calculate the underpayment penalty for you, but in certain circumstances, you may. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web underpayment of estimated tax by corporations. Web taxpayers can work through irs form 2210 to determine whether they owe a tax underpayment penalty when they file their taxes. Easy to use, save, & print. Penalty relief by administrative waiver. How much is a tax underpayment. Web on this page: Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web to determine if they must disclose an underpayment and pay a penalty, taxpayers should refer to irs form 2210. What are tax underpayment penalties? How to qualify for first time abate. Department of the treasury internal revenue service. Web taxpayers can work through irs form 2210 to determine whether they owe a tax underpayment penalty when they file their taxes. Web underpayment of estimated tax by corporations. Ad uslegalforms.com has been visited by 100k+ users in the past month Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to see if you owe a penalty for underpaying your estimated tax. Web if a penalty applies, you might have to file irs form 2210. Web if you file your taxes and find that you paid less than what you owed, you will need to use form 1040, 1040a or form 2210 to determine the underpayment amount. Who must file irs form 2210? First time abate and unpaid tax. What is irs form 2210? How much is a tax underpayment. The irs typically will calculate the underpayment penalty for you, but in certain circumstances, you may. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of. Web 1 day agoin the case of debit vouchers, § 24.3 (e) provides that a debtor has 15 days after the bill date to make payment, and on the 16th day after the bill date, the bill is. Penalty relief by administrative waiver. Web who should use this form corporations taxed under ch.Form R210NR Download Fillable PDF or Fill Online Underpayment of

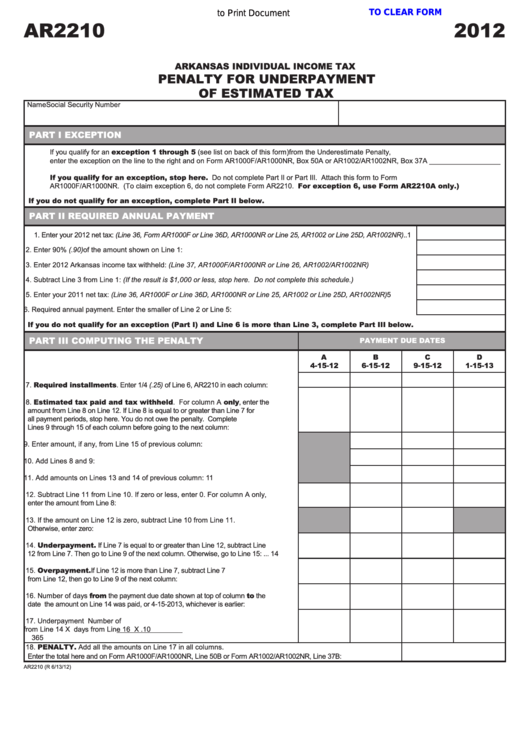

AR2210 Individual Underpayment of Estimated Tax Penalty Form

Fillable Form Dr 0204 Computation Of Penalty Due Based On

Form Cnf120u Underpayment Of Estimated Tax Penalty 2013 printable

Fillable Form R210nr Underpayment Of Individual Tax Penalty

Penalty for the Underpayment of Estimated Taxes! YouTube

AR2210A Annualized Individual Underpayment of Estimated Tax Penalty…

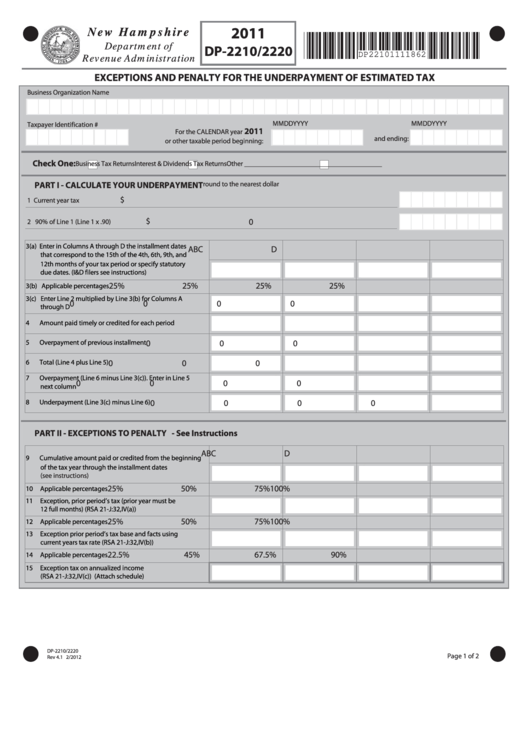

Form Dp2210/2220 Exceptions And Penalty For The Underpayment Of

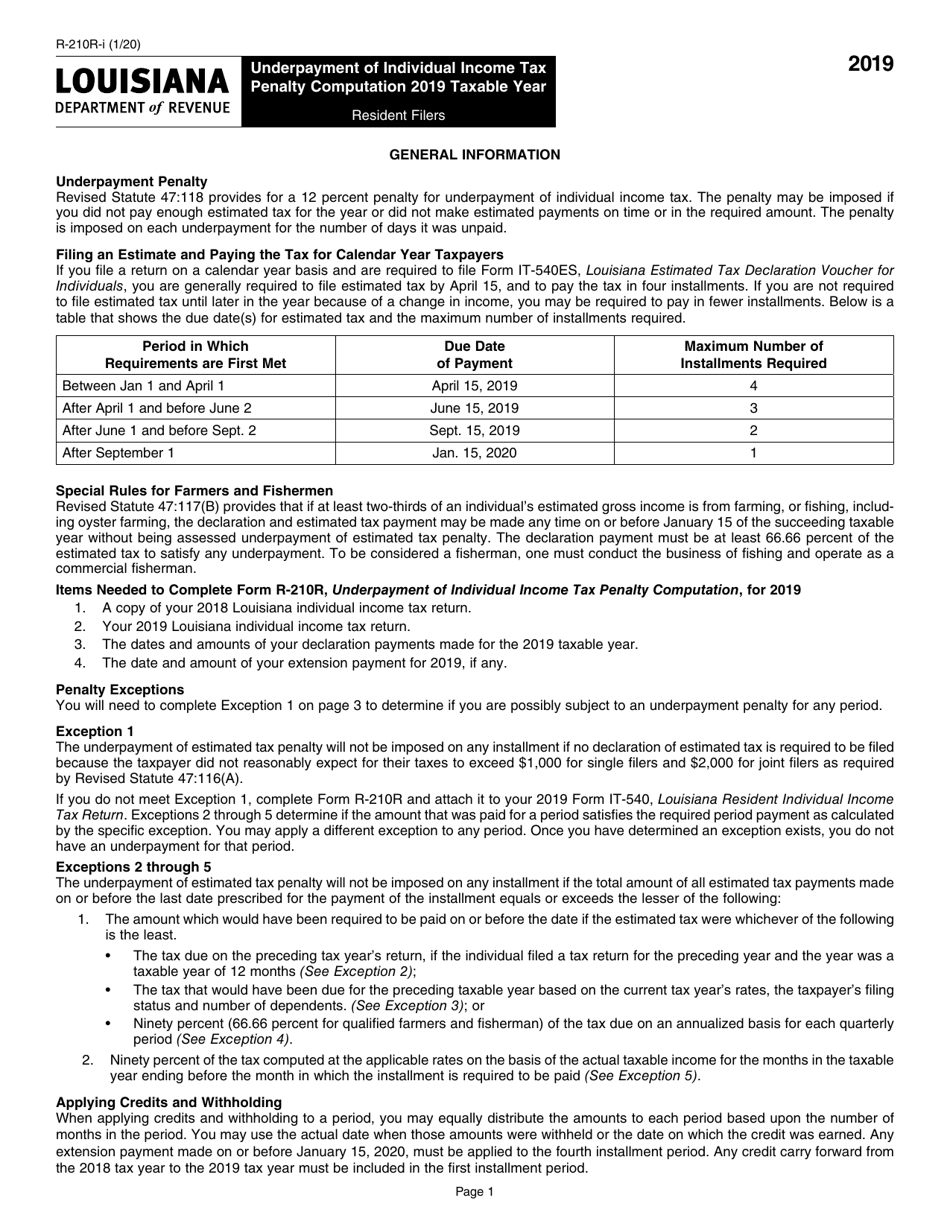

Download Instructions for Form R210R Underpayment of Individual

Fillable Form Ar2210 Penalty For Underpayment Of Estimated Tax 2012

Related Post: