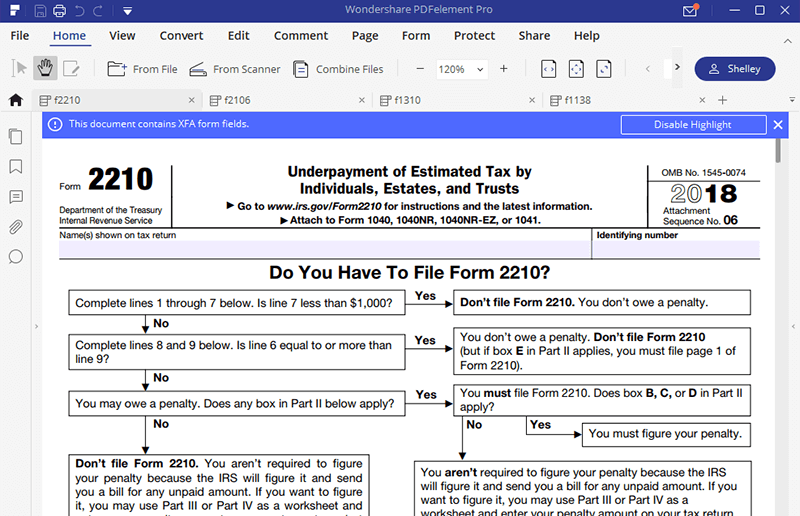

Federal Form 2210

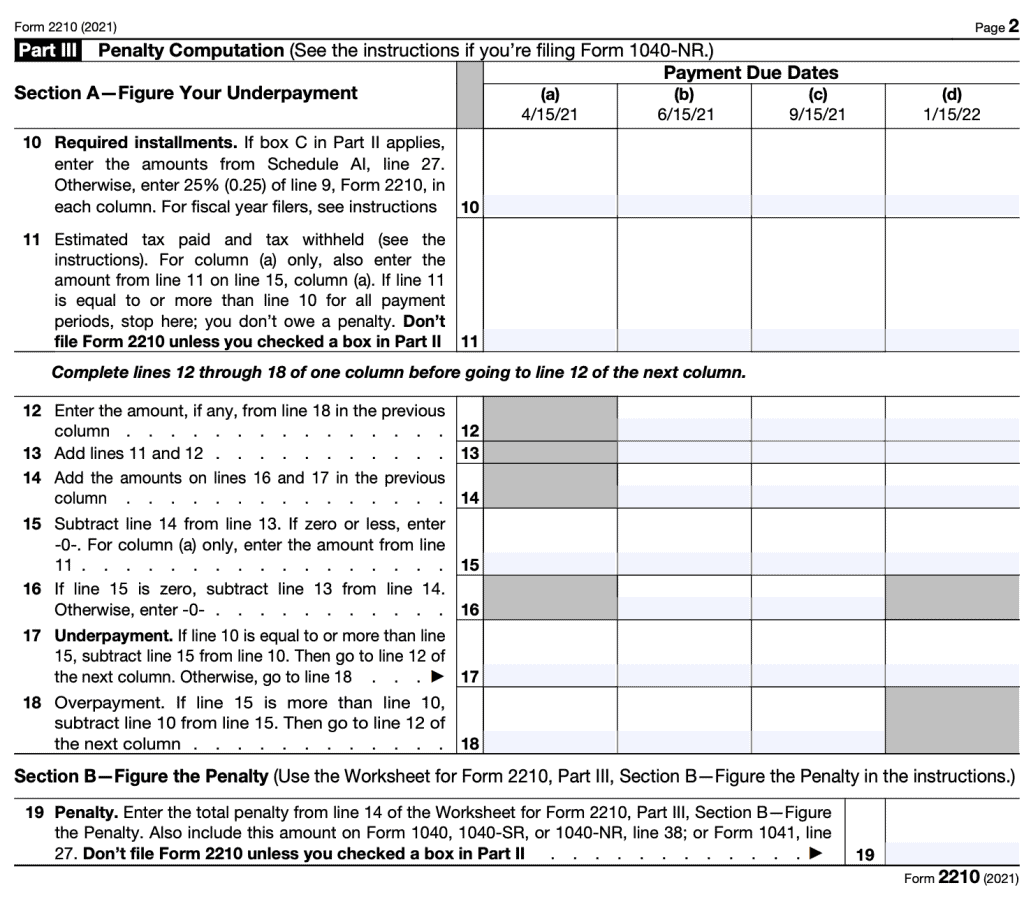

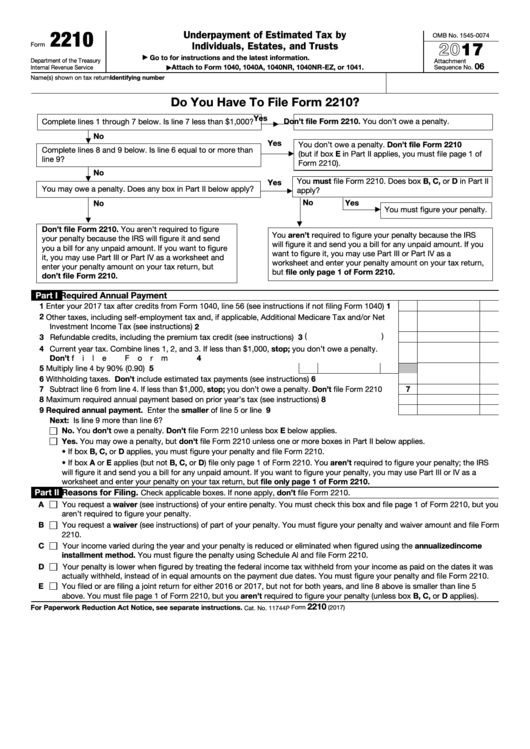

Federal Form 2210 - Department of the treasury internal revenue service. Part ii reasons for filing. This form is for income earned in tax year 2022, with tax returns due in april. Ad access irs tax forms. Web the irs states that you do not need to file form 2210 if: Form 2210 serves primarily as a personal guide on how much a taxpayer should expect to pay as a penalty for tax. Web and enter your penalty on your tax return, but file only page 1 of form 2210. When estimated tax payments are late, filing tax form 2210 is mandatory. Web how do i add form 2210? Web what is form 2210 underpayment penalty? Use bold text to identify titles. You owe a sum of less than $1,000 after deducting your withholding and any refundable tax credits. Easy, fast, secure & free to try. If none apply, don’t file form 2210. This form is for income earned in tax year 2022, with tax returns due in april. Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of. Web and enter your penalty on your tax return, but file only page 1 of form 2210. Department of the treasury internal revenue service. When estimated tax payments are late, filing tax form 2210 is mandatory. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. Part ii reasons for filing. Web how do i add form 2210? Below, you'll find answers to frequently asked questions about form 2210, underpayment of estimated tax by. Use bold text to identify titles. Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast. Web use form 2210 to determine the amount of underpaid estimated tax and. Web 1.replace text in all caps with standard title form text (i.e., for each word capitalize the first letter). Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Part ii reasons for filing. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest. Web to request relief under the expanded estimated tax penalty waiver, taxpayers who haven’t yet filed their 2018 federal income tax return must attach a. Easy, fast, secure & free to try. Underpayment of estimated tax by individuals, estates, and trusts. Below, you'll find answers to frequently asked questions about form 2210, underpayment of estimated tax by. Form 2210 is. Easy, fast, secure & free to try. Your income varies during the year. When estimated tax payments are late, filing tax form 2210 is mandatory. Web there were 10 million people in 2017 paying penalties for underpayment of taxes. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Download or email irs 2220 & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april. Web what is form 2210 underpayment penalty? Department of the treasury internal revenue service. Your income varies during the year. Your income varies during the year. Use bold text to identify titles. According to the irs website, form 2210 is known as underpayment of estimated tax by individuals, estates and trusts. Web 1.replace text in all caps with standard title form text (i.e., for each word capitalize the first letter). Form 2210 serves primarily as a personal guide on how. This form is for income earned in tax year 2022, with tax returns due in april. Underpayment of estimated tax by individuals, estates, and trusts. Web and enter your penalty on your tax return, but file only page 1 of form 2210. Ad access irs tax forms. Web we last updated the underpayment of estimated tax by individuals, estates, and. Web solved•by intuit•15•updated july 12, 2023. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Solved • by turbotax • 2479 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates, and. Web 1.replace text in all caps with standard title form text (i.e., for each word capitalize the first letter). Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. Use bold text to identify titles. Part ii reasons for filing. Underpayment of estimated tax by individuals, estates, and trusts. Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast. Web how do i add form 2210? Department of the treasury internal revenue service. Ad access irs tax forms. Web and enter your penalty on your tax return, but file only page 1 of form 2210. Easy, fast, secure & free to try. Part ii reasons for filing. Web and enter your penalty on your tax return, but file only page 1 of form 2210. Complete, edit or print tax forms instantly. Web file only page 1 of form 2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due.IRS Form 2210Fill it with the Best Form Filler

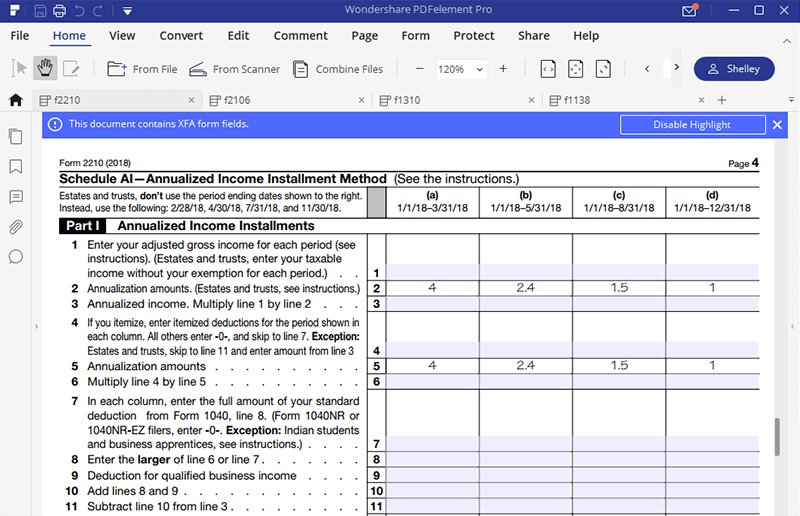

IRS Form 2210 A Guide to Underpayment of Tax

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

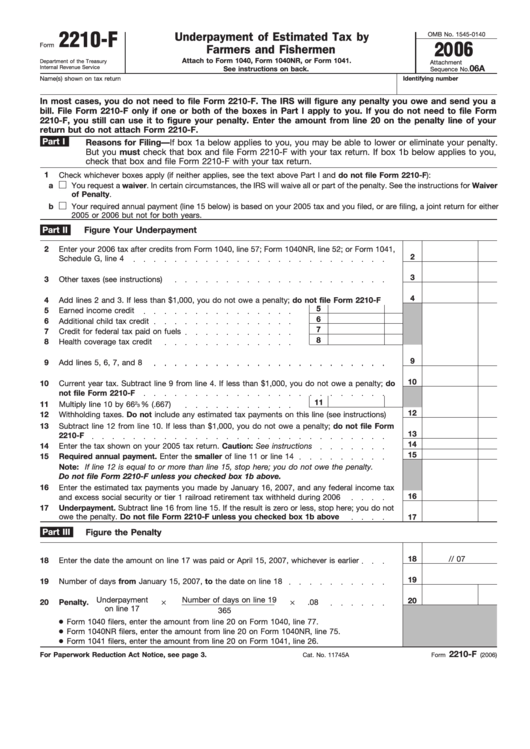

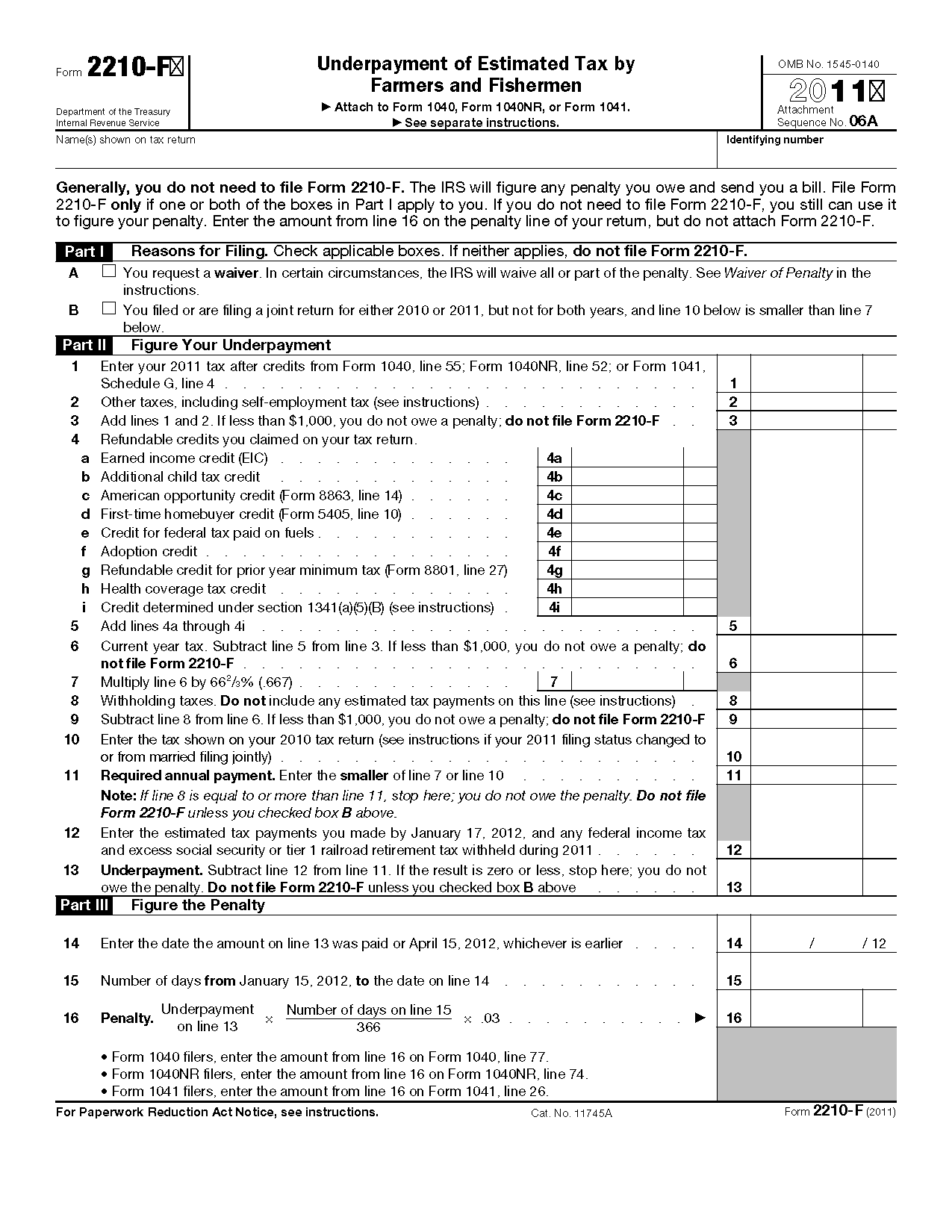

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

Form 2210F Underpayment of Estimated Tax by Farmers and Fishermen

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

IRS Form 2210Fill it with the Best Form Filler

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Form 2210Underpayment of Estimated Tax

Related Post: