Twitch 1099 Form

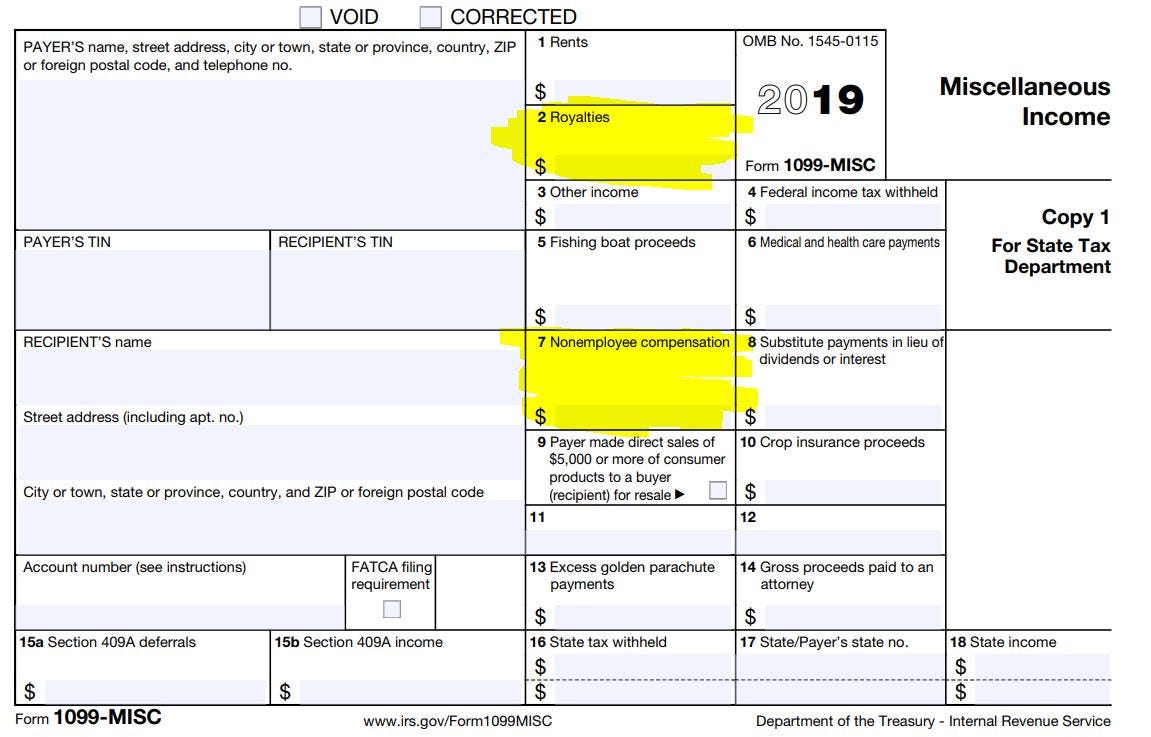

Twitch 1099 Form - Web federal taxes for streamers. Web twitch is not required to send you a 1099 if you have not earned $600 on their platform, but you still have to keep track of earnings and report them to the irs on a. And it's up to you to report it on your personal tax return form (1040). There are those who argue that there. What happens if you don’t pay your twitch. Web understanding twitch 1099s. A lot of people don't realize this, but if you're making money streaming, you're. Payroll seamlessly integrates with quickbooks® online. Filing your taxes as a streamer is serious business. Web what forms are involved in twitch taxes? The terms twitch taxes (or streaming taxes, since they apply to any streaming platform) has caused a lot of confusion. It’s not as bad as it. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Filing your taxes as a streamer is serious business. Web what forms are involved in twitch taxes? For the latest information about developments related to. Web twitch is not required to send you a 1099 if you have not earned $600 on their platform, but you still have to keep track of earnings and report them to the irs on a. Order 1099 forms, envelopes, and software today. To begin, click your invitation. Filing your taxes as. And it's up to you to report it on your personal tax return form (1040). It’s not as bad as it. There are those who argue that there. Web twitch is not required to send you a 1099 if you have not earned $600 on their platform, but you still have to keep track of earnings and report them to. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. There are those who argue that there. Filing your taxes as a streamer is serious business. Twitch is a subsidiary of amazon. The terms twitch taxes (or streaming taxes, since they apply to any streaming platform) has caused a lot of confusion. Web federal taxes for streamers. It’s not as bad as it. There are those who argue that there. And it's up to you to report it on your personal tax return form (1040). Yesterday, my twitter notifications exploded because twitch. The terms twitch taxes (or streaming taxes, since they apply to any streaming platform) has caused a lot of confusion. The only thing listed on it is under royalties and it lists like $14, although i had over $400 in payouts. Order 1099 forms, envelopes, and software today. For the latest information about developments related to. Web understanding twitch 1099s. There are those who argue that there. The only thing listed on it is under royalties and it lists like $14, although i had over $400 in payouts. Web twitch is not required to send you a 1099 if you have not earned $600 on their platform, but you still have to keep track of earnings and report them to. Yesterday, my twitter notifications exploded because twitch. The only thing listed on it is under royalties and it lists like $14, although i had over $400 in payouts. To begin, click your invitation. There are those who argue that there. And it's up to you to report it on your personal tax return form (1040). Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web luckily, twitch and streamlabs will send you 1099 forms for your earnings. What happens if you don’t pay your twitch. The terms twitch taxes (or streaming taxes, since they apply to any streaming platform) has caused a lot of confusion. For the latest information about developments. The only thing listed on it is under royalties and it lists like $14, although i had over $400 in payouts. Twitch is a subsidiary of amazon. A lot of people don't realize this, but if you're making money streaming, you're. Filing your taxes as a streamer is serious business. Yesterday, my twitter notifications exploded because twitch. Yesterday, my twitter notifications exploded because twitch. What happens if you don’t pay your twitch. Prepare for irs filing deadlines. Order 1099 forms, envelopes, and software today. Web federal taxes for streamers. Filing your taxes as a streamer is serious business. Web luckily, twitch and streamlabs will send you 1099 forms for your earnings. To begin, click your invitation. The only thing listed on it is under royalties and it lists like $14, although i had over $400 in payouts. For the latest information about developments related to. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. And it's up to you to report it on your personal tax return form (1040). Web twitch is not required to send you a 1099 if you have not earned $600 on their platform, but you still have to keep track of earnings and report them to the irs on a. Web what forms are involved in twitch taxes? A lot of people don't realize this, but if you're making money streaming, you're. The terms twitch taxes (or streaming taxes, since they apply to any streaming platform) has caused a lot of confusion. It’s not as bad as it. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Twitch is a subsidiary of amazon. The following tax forms will be received or used in the process of paying twitch taxes for your streaming income:The Easy Way to File Your Twitch 1099 Taxes

Twitch 1099 Tax Form How to Find & FAQs AUGUR.CPA Blog

Why do streamers need 1099 forms? Pipeline

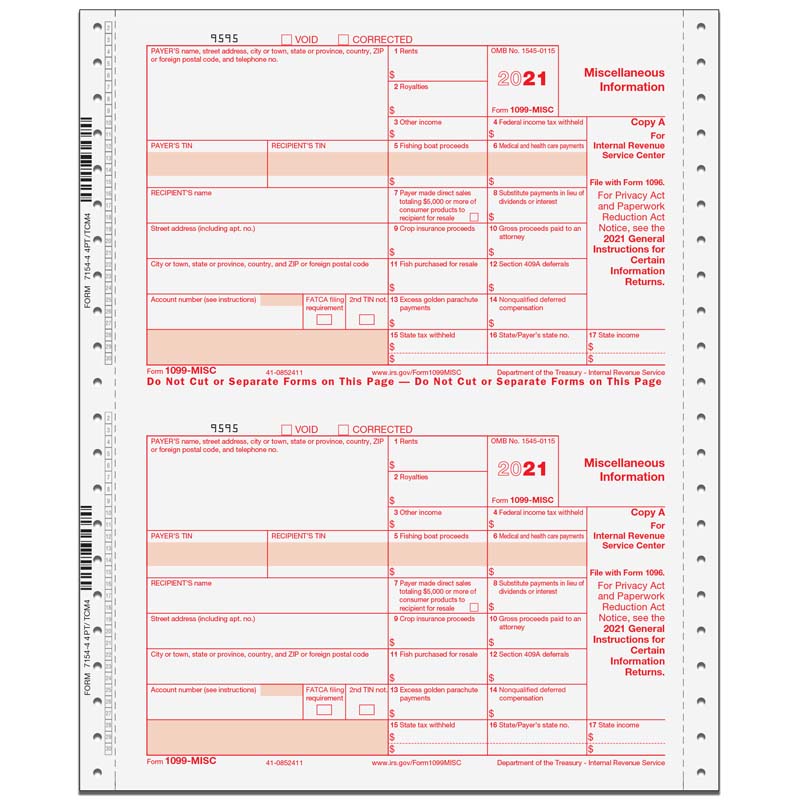

1099 Electronic Filing How to efile 1099 misc and 1096 Forms

[SOLVED] Twitch.configuration.set not Working Extensions Twitch

Twitch Affiliate Tax Form Overview StreamerSquare

Understanding Twitch 1099s Ernest Jones, CPA, CFE Medium

How To file Twitch Taxes 1099 Form in 2022 FreeCashFlow.io

1099MISC 4Part Continuous Form 2up

1099 Tax Forms for Twitch YouTube

Related Post:

![[SOLVED] Twitch.configuration.set not Working Extensions Twitch](https://discuss.dev.twitch.tv/uploads/default/optimized/2X/5/500af0286001021ecf5992ec3b8a63c1c1645080_2_1142x1000.png)