Turbotax Form 8862

Turbotax Form 8862 - Web form 8862 is a federal individual income tax form. Information to claim certain credits after disallowance. Taxpayers complete form 8862 and attach it to their tax return if: Web if we deny your claim for certain credits, you may have to pay us back, file form 8862 or we could ban you from claiming the credits in the future. Please see the faq link. Adhere to our simple actions to get your irs 8862 prepared quickly: Web sign in to turbotax and select fix my return; Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web generating individual form 8862 for earned income credit (eic) after disallowance in proconnect. Easily fill out pdf blank, edit, and sign them. Information to claim earned income credit after disallowance to your return. Age requirements for taxpayers without a qualifying child. Watch this turbotax guide to learn more.turbotax home: Last updated june 07, 2019 4:10 pm. Search for earned income credit and select the jump to link. Web turbotax deluxe online. For 2021, special rules applied regarding the age requirements for certain filers claiming the earned. Taxpayers complete form 8862 and attach it to their tax return if: Adhere to our simple actions to get your irs 8862 prepared quickly: December 2022) department of the treasury internal revenue service. Web generating individual form 8862 for earned income credit (eic) after disallowance in proconnect. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Estimate how much you could potentially save in just a matter of. Information to claim certain credits after disallowance. Information to claim earned income credit after disallowance to your return. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web sign in to turbotax and select fix. Watch this turbotax guide to learn more.turbotax home: Information to claim certain credits after disallowance. Web form 8862 is a federal individual income tax form. Turbotax can help you fill out your. Easily fill out pdf blank, edit, and sign them. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Estimate how much you could potentially save in just a matter of minutes. Age requirements for taxpayers without a qualifying child. Web sign in to turbotax and select fix my return; Web filing tax. Estimate how much you could potentially save in just a matter of minutes. Web form 8862 is a federal individual income tax form. Web solved • by turbotax • 7270 • updated february 25, 2023. For 2021, special rules applied regarding the age requirements for certain filers claiming the earned. Delayed refund for returns claiming certain credits. Web if we deny your claim for certain credits, you may have to pay us back, file form 8862 or we could ban you from claiming the credits in the future. Upload, modify or create forms. Web solved • by turbotax • 7270 • updated february 25, 2023. Web sign in to turbotax and select fix my return; Web to. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Information to claim certain credits after disallowance. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Ad edit, sign or email irs 8862 & more fillable. June 7, 2019 4:10 pm. Ad download or email irs 8862 & more fillable forms, register and subscribe now! If your earned income credit (eic) was disallowed or reduced for something other than a math or. December 2021) department of the treasury internal revenue service. Web irs form 8862 information to claim certain refundable credits after disallowance is used if. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Age requirements for taxpayers without a qualifying child. If your earned income credit (eic) was disallowed or reduced for something other than a math or. June 7, 2019 4:10 pm. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. You can generate form 8862, information to claim certain. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web if we deny your claim for certain credits, you may have to pay us back, file form 8862 or we could ban you from claiming the credits in the future. December 2021) department of the treasury internal revenue service. Last updated june 07, 2019 4:10 pm. Save or instantly send your ready documents. Web sign in to turbotax and select fix my return; Information to claim certain credits after disallowance. Web to resolve this rejection, you'll need to add form 8862: Web solved • by turbotax • 7270 • updated february 25, 2023. Web turbotax deluxe online. Web filing tax form 8862: Upload, modify or create forms. Information to claim certain credits after disallowance.2021 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

How To File Form 8862 On Turbotax House for Rent

PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

Form 8862 Pdf Fillable Printable Forms Free Online

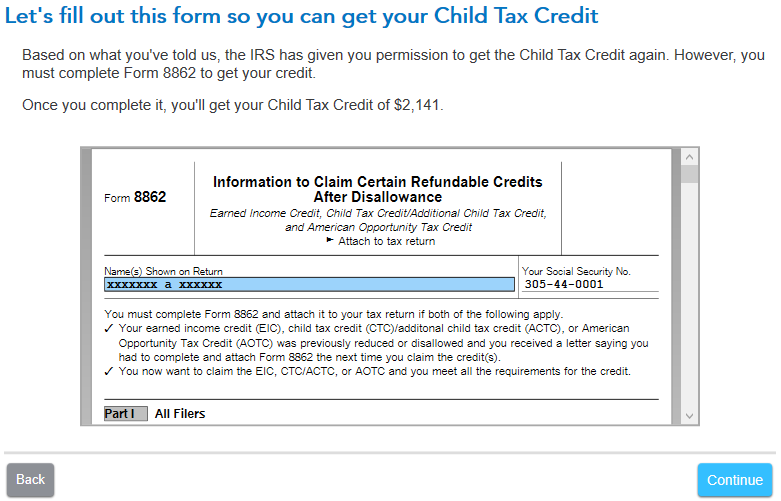

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

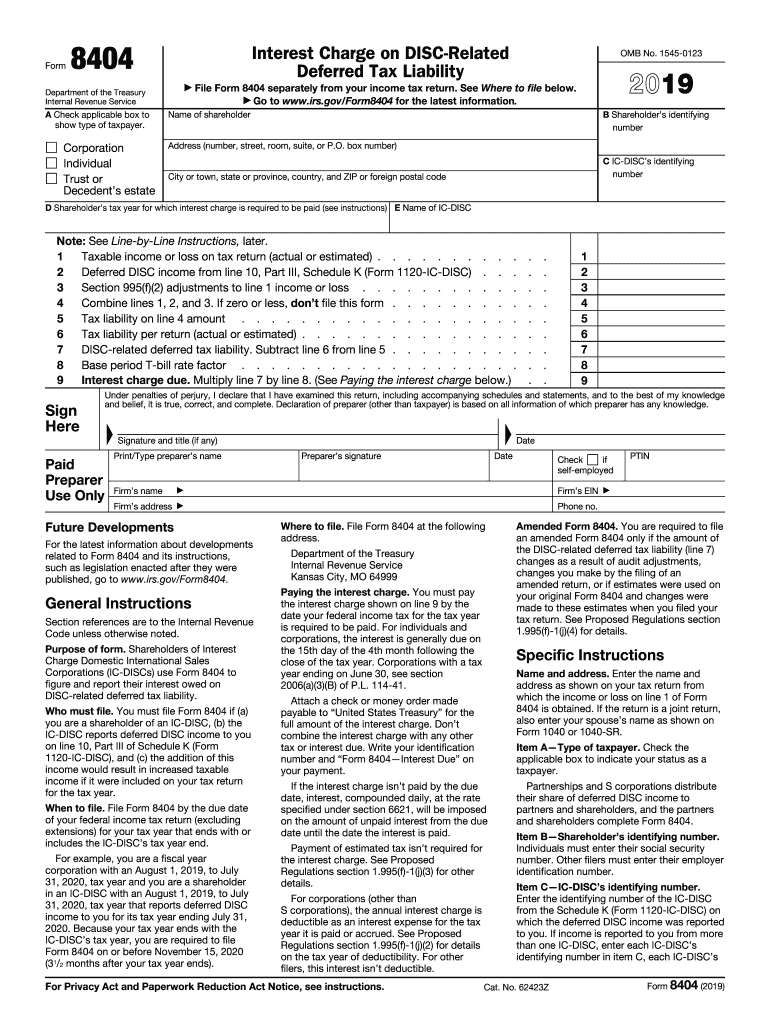

Form 8404 Fill Out and Sign Printable PDF Template signNow

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

how do i add form 8862 TurboTax® Support

How to file form 8862 on TurboTax ? MWJ Consultancy turbotax YouTube

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737-768x501.jpg)