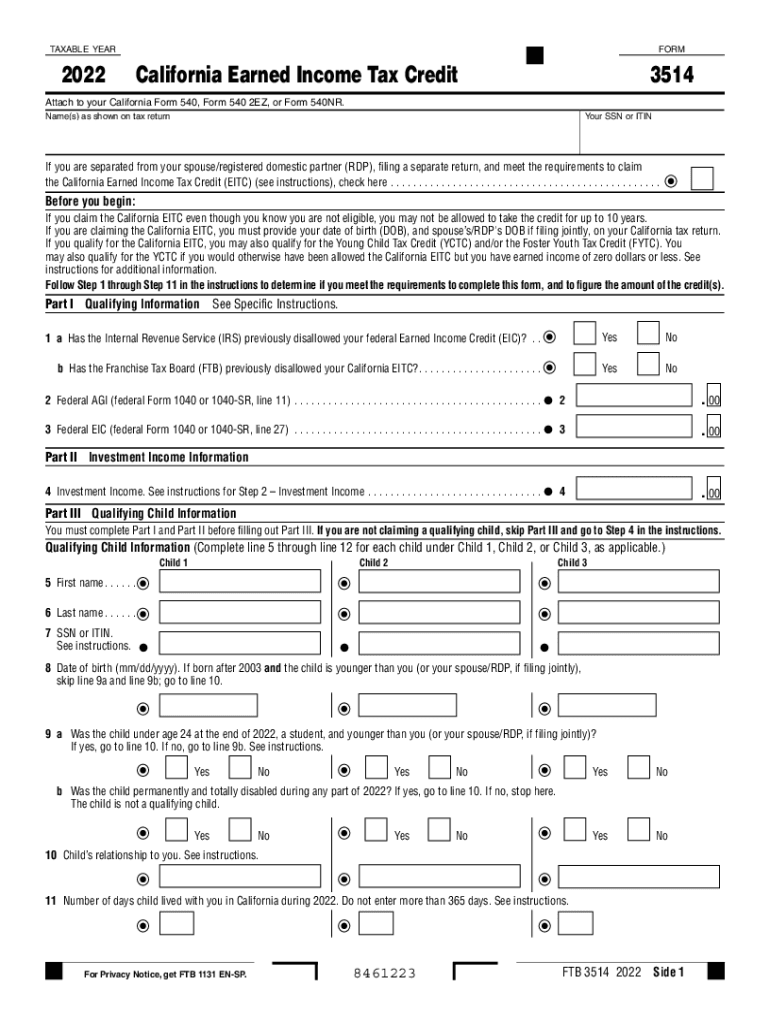

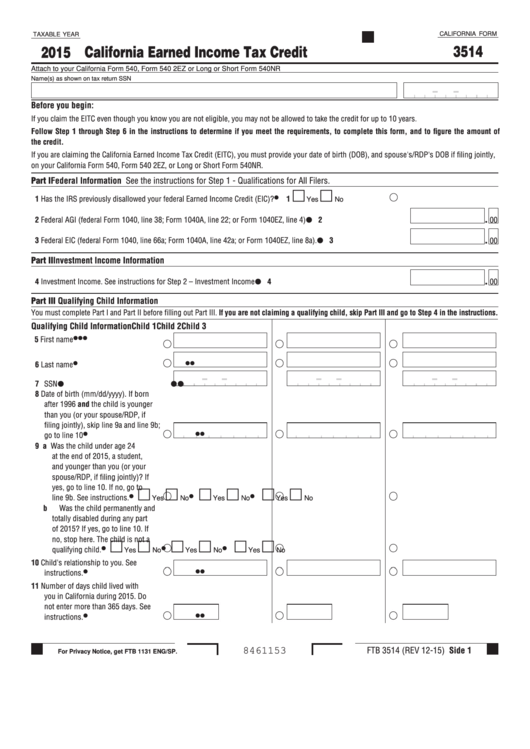

California Form 3514

California Form 3514 - Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web 2020 california earned income tax credit. For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. Easily fill out pdf blank, edit, and sign them. If you don't have a sein or business license number, then you should be able to. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. You can download or print. If you claim the california earned income tax credit (eitc) even though you know you are not eligible, you may not be allowed to. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web we last updated california form 3514 ins in may 2021 from the california franchise tax board. You do not need a child. Web earned income tax credit toolkit. For information on the availability of the credit, eligibility requirements, and how to obtain the necessary. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. This form is for income earned in tax year 2022,. You do not need a child to qualify, but must file a california. However, with our predesigned web templates, things get simpler. Easily fill out pdf blank, edit, and sign them. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Schedule p (540), alternative minimum. You can download or print. Schedule p (540), alternative minimum. For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. If you claim the california earned income tax credit (eitc) even. If you claim the california earned income tax credit (eitc) even though you know you are not eligible, you may not. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Return to forms and publications. If. This form is for income earned in tax year 2022, with tax returns due in april. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april. However, with our predesigned web templates, things get simpler. Web the ca eitc reduces your california tax obligation, or. However, with our predesigned web templates, things get simpler. Web return and complete and attach the california eitc form (ftb 3514). Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. You do not need a child to qualify, but must file. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web forms and publications search | california franchise tax board. Gavin newsom on monday proposed a major expansion of california's economic. Save or instantly send your ready documents. Web most taxpayers are required to file a yearly income tax. You do not need a child to qualify, but must file a california. This form is for income earned in tax year 2022, with tax returns due in april. You do not need a child to qualify, but must file a california income tax return to. Web forms and publications search | california franchise tax board. If you claim the. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. For information on the availability of the credit, eligibility requirements, and how to obtain the necessary. You do not need a child to qualify, but must file a california. Web (getty images). Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web california individual forms availability. Save or instantly send your ready documents. Schedule p (540), alternative minimum. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. This form is for income earned in tax year 2022, with tax returns due in april. You do not need a child to qualify, but must file a california. Web form 3514 your ssn or itin before you begin: For more information, visit the ftb and irs websites. Web follow the simple instructions below: Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. Return to forms and publications. For information on the availability of the credit, eligibility requirements, and how to obtain the necessary. Web we last updated california form 3514 ins in may 2021 from the california franchise tax board. This form is for income earned in tax year 2022, with tax returns due in april. You do not need a child to qualify, but must file a california. Web 2020 california earned income tax credit. You can download or print. You do not need a child to qualify, but must file a california income tax return to. However, with our predesigned web templates, things get simpler.Fill Free fillable forms for the state of California

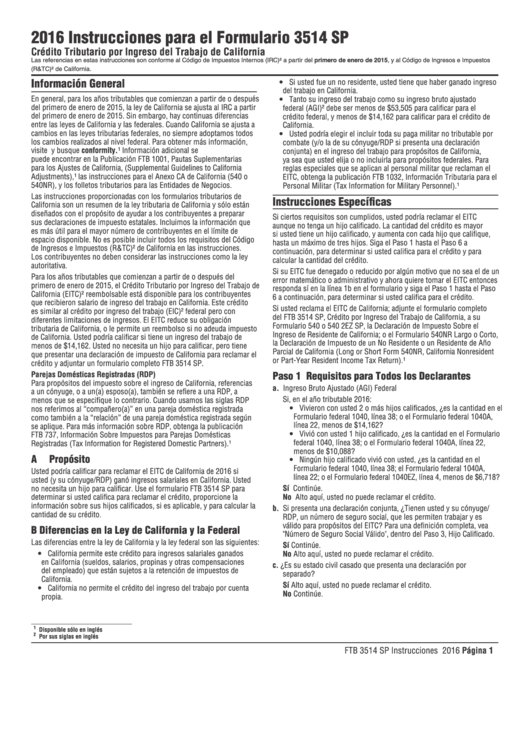

Instrucciones Para El Formulario 3514 Sp Credito Tributario Por

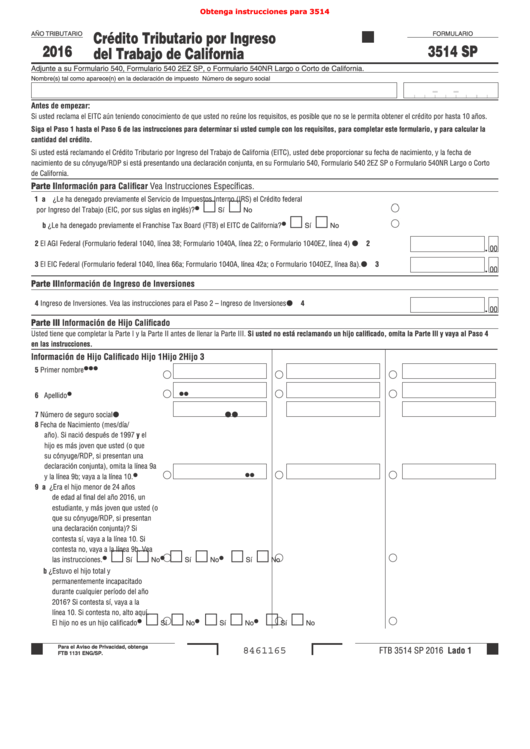

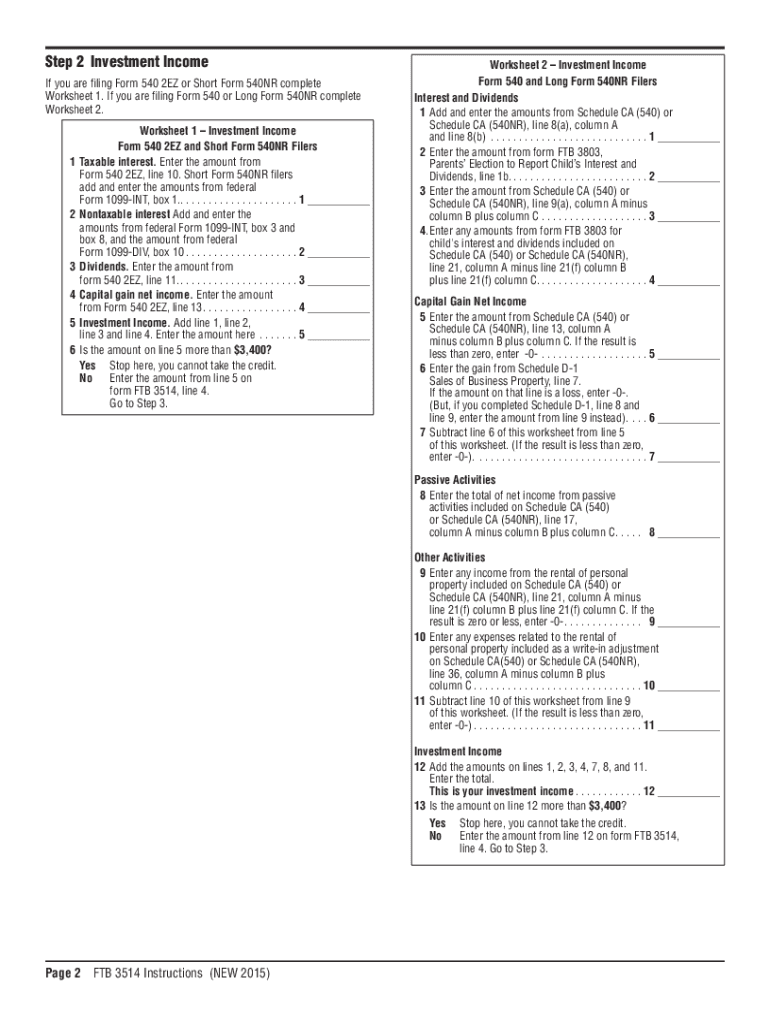

Fillable Formulario 3514 Sp Credito Tributario Por Ingreso Del

Ftb3514 Fill Out and Sign Printable PDF Template signNow

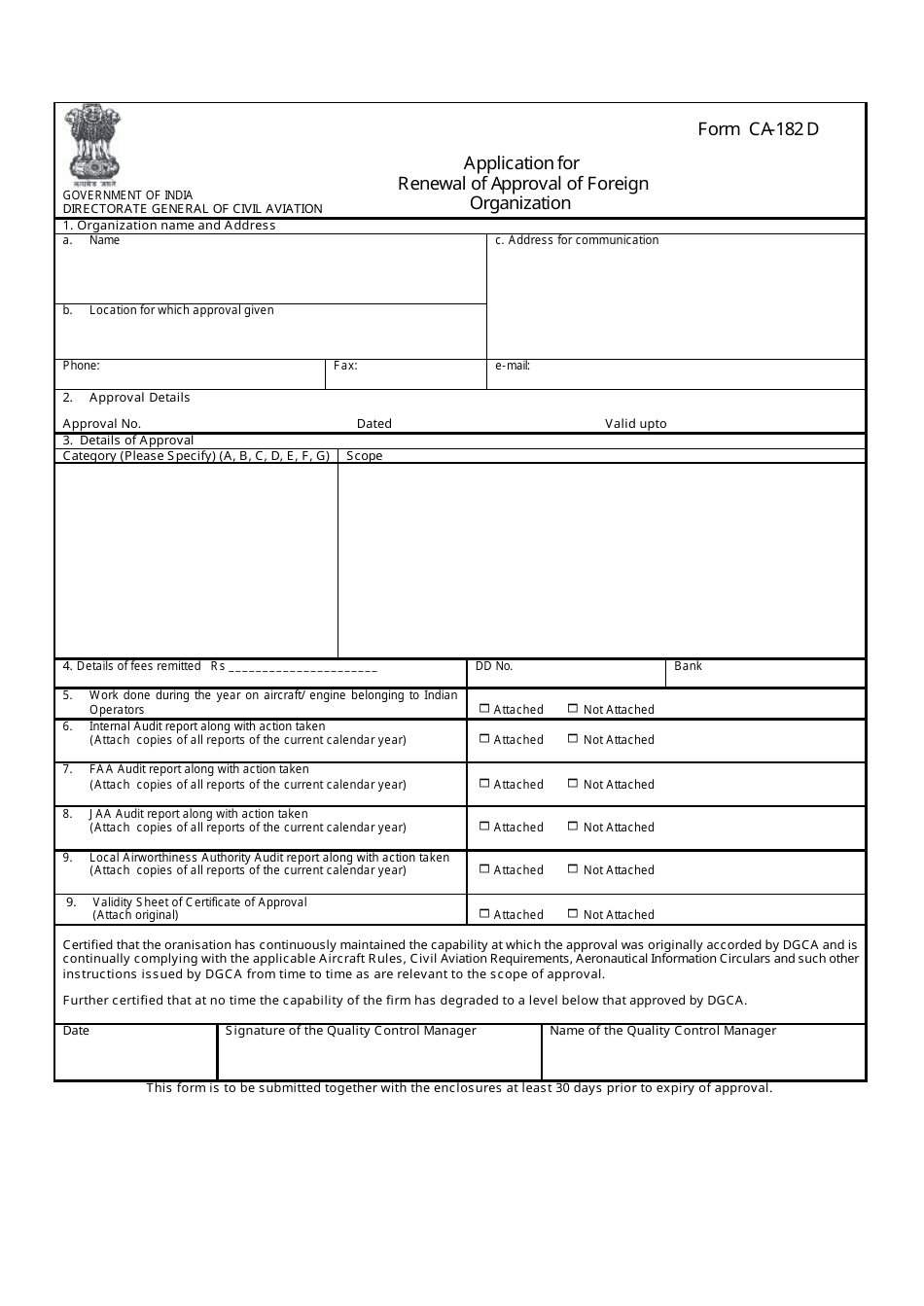

CA Form CA182 D Download Printable PDF or Fill Online Application for

Desktop Form 3514 California Earned Tax Credit Fill Out and

California State Tax Forms By Mail Form Resume Examples EY39y4d32V

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

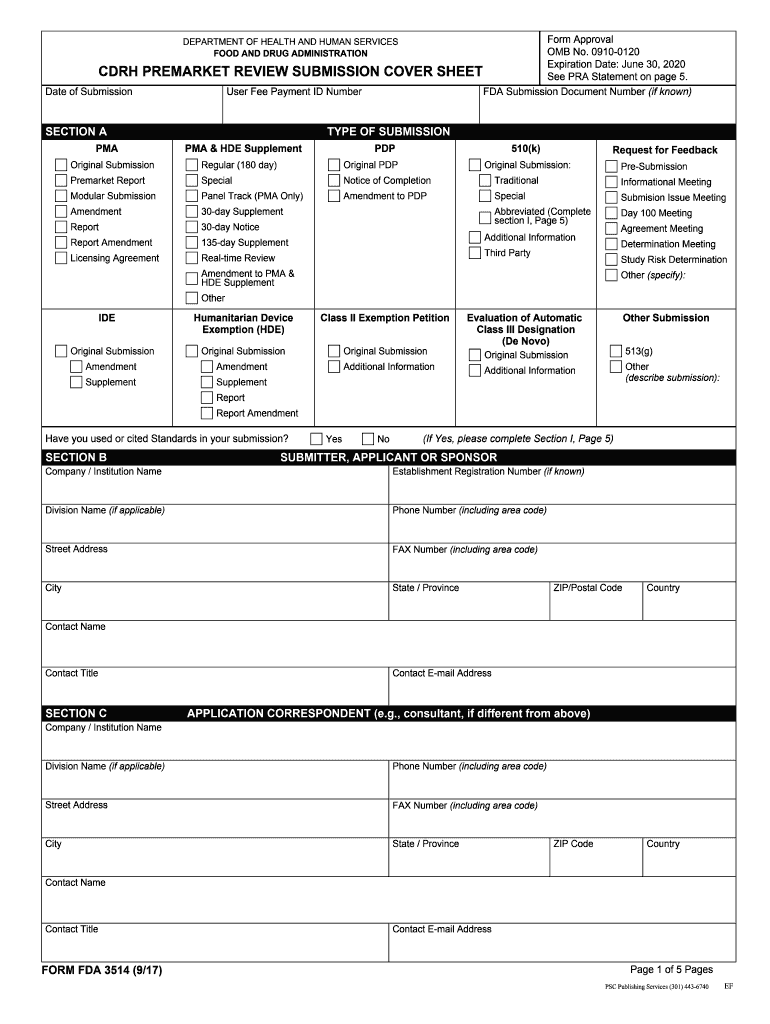

Fda Form 3514 Fill Out and Sign Printable PDF Template signNow

Form 3514 California Earned Tax Credit 2015 printable pdf

Related Post: