Turbotax Form 3520

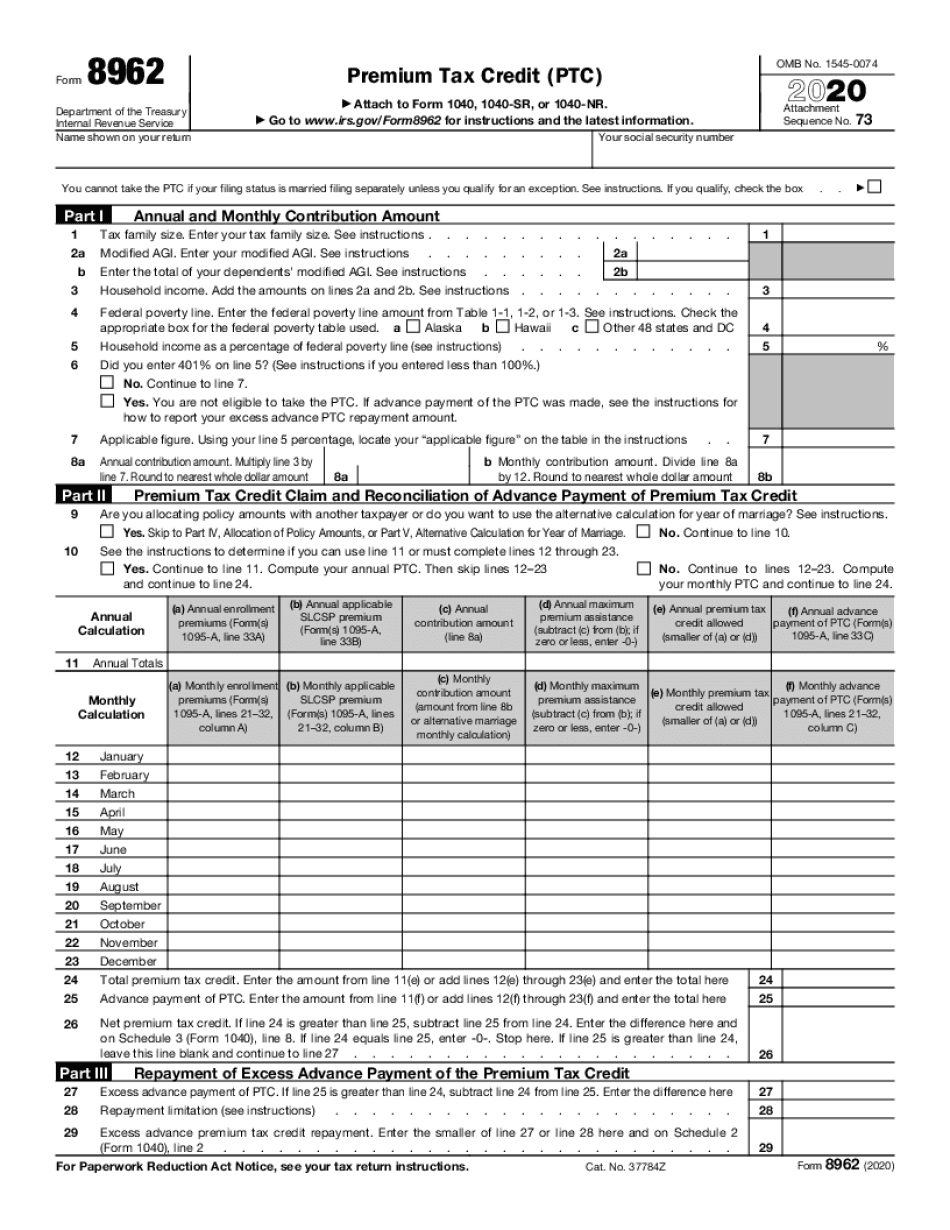

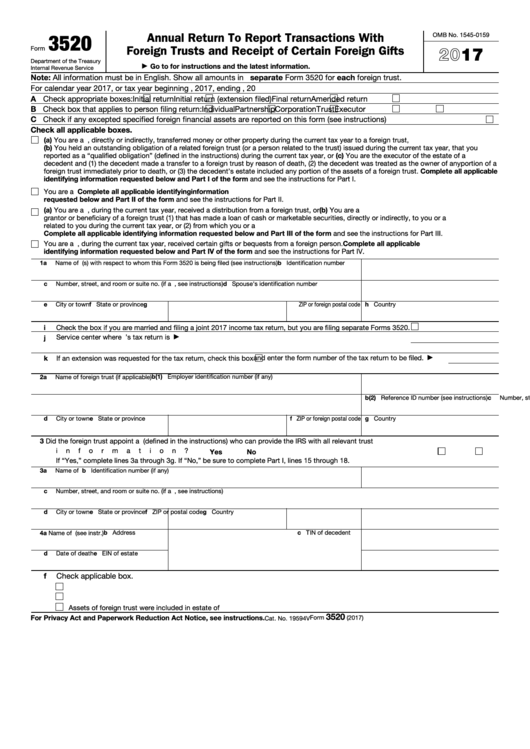

Turbotax Form 3520 - Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web cannot file return online after indicating i will file a 3520 form on my form 8938 in turbotax? The 3520 is most often filed when you receive a gift from a foreign person in the amount over $100,000. For the latest information about developments related to form 3520 and its instructions, such as. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. This information includes its u.s. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, and instructions. If this is you, you have this requirement. Form 3520 is a tax form used to report certain transactions involving foreign trusts. For the latest information about developments related to form 3520 and its instructions, such as. Web understanding irs form 3520. Ad save time and money with professional tax planning & preparation services. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Web in particular,. The 3520 is most often filed when you receive a gift from a foreign person in the amount over $100,000. Taxpayers who receive foreign gifts, inheritances, or distributions from. I am doing my 2022 tax returns in turbo tax (have an extension). Owner files this form annually to provide information. Annual return to report transactions with foreign trusts and receipt. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Many americans who interact with a foreign trust are required to file form. Web cannot file return online after indicating i will file. Web form 3520 is an informational return in which u.s. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, and instructions. A foreign trust with at least one u.s. Web there is a fbar reporting that requires you to report all foreign accounts that exceed $10,000 during a tax year. Web otherwise,. In general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Web cannot file return online after indicating i will file a 3520 form on my. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web there is a fbar reporting that requires you to report all foreign accounts that exceed $10,000 during a tax year. Web form 3520 is an informational return in which u.s. Minimize potential audit risks and save. The 3520 is most often filed when you receive a gift from a foreign person in the amount over $100,000. In general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is. If this is you, you have this requirement. Irs form 3520 is a reporting requirement imposed on u.s. Web there. Guidance regarding the imposition of tax on. Web form 3520 is an informational return in which u.s. This information includes its u.s. I am doing my 2022 tax returns in turbo tax (have an extension). Web understanding irs form 3520. A foreign trust with at least one u.s. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Guidance regarding the imposition of tax on. This information includes its u.s. Web cannot file return online after indicating i will file a 3520 form on my form 8938. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Department of the treasury internal revenue service. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. A. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Many americans who interact with a foreign trust are required to file form. Minimize potential audit risks and save time when filing taxes each year Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, and instructions. Form 3520 is a tax form used to report certain transactions involving foreign trusts. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Taxpayers who receive foreign gifts, inheritances, or distributions from. The 3520 is most often filed when you receive a gift from a foreign person in the amount over $100,000. Web understanding irs form 3520. Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and receipts of large. For the latest information about developments related to form 3520 and its instructions, such as. If this is you, you have this requirement. Irs form 3520 is a reporting requirement imposed on u.s. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web there is a fbar reporting that requires you to report all foreign accounts that exceed $10,000 during a tax year. In general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is. A foreign trust with at least one u.s. Department of the treasury internal revenue service. Web a form 3520 is filed separately from your tax return.1040 Form 3520 New Form

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

1040 Form 3520 New Form

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Fillable Form 3520 Annual Return To Report Transactions With Foreign

1040 Form 3520 New Form

form 8949 turbotax 2022 Fill Online, Printable, Fillable Blank form

IRS Creates “International Practice Units” for their IRS Revenue Agents

Related Post: