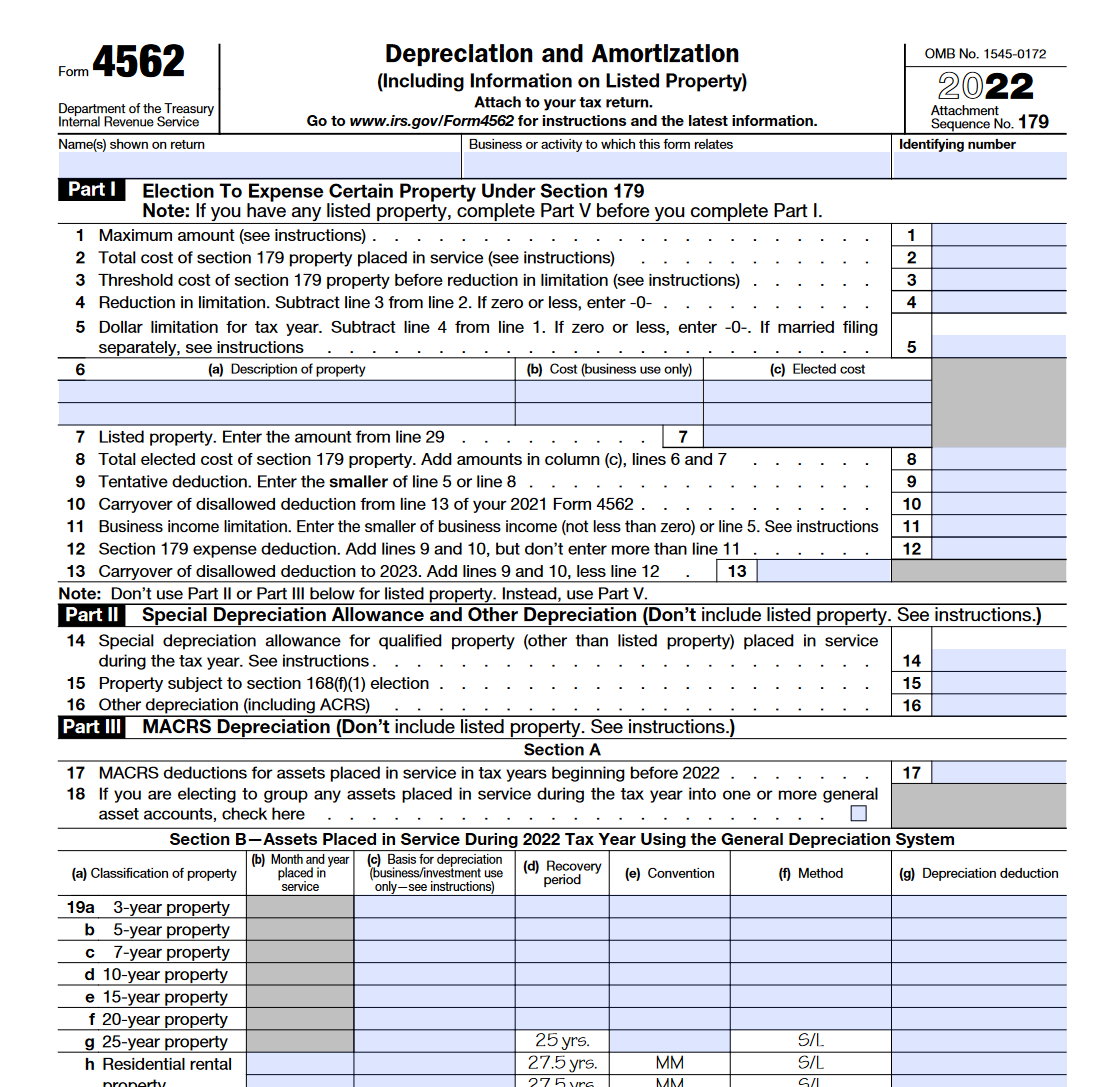

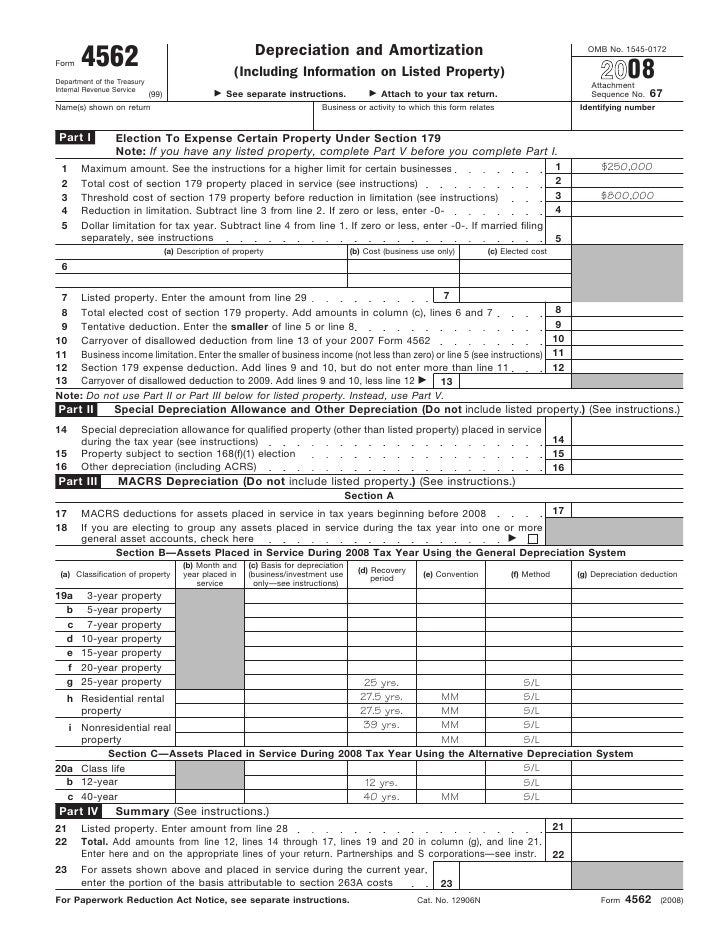

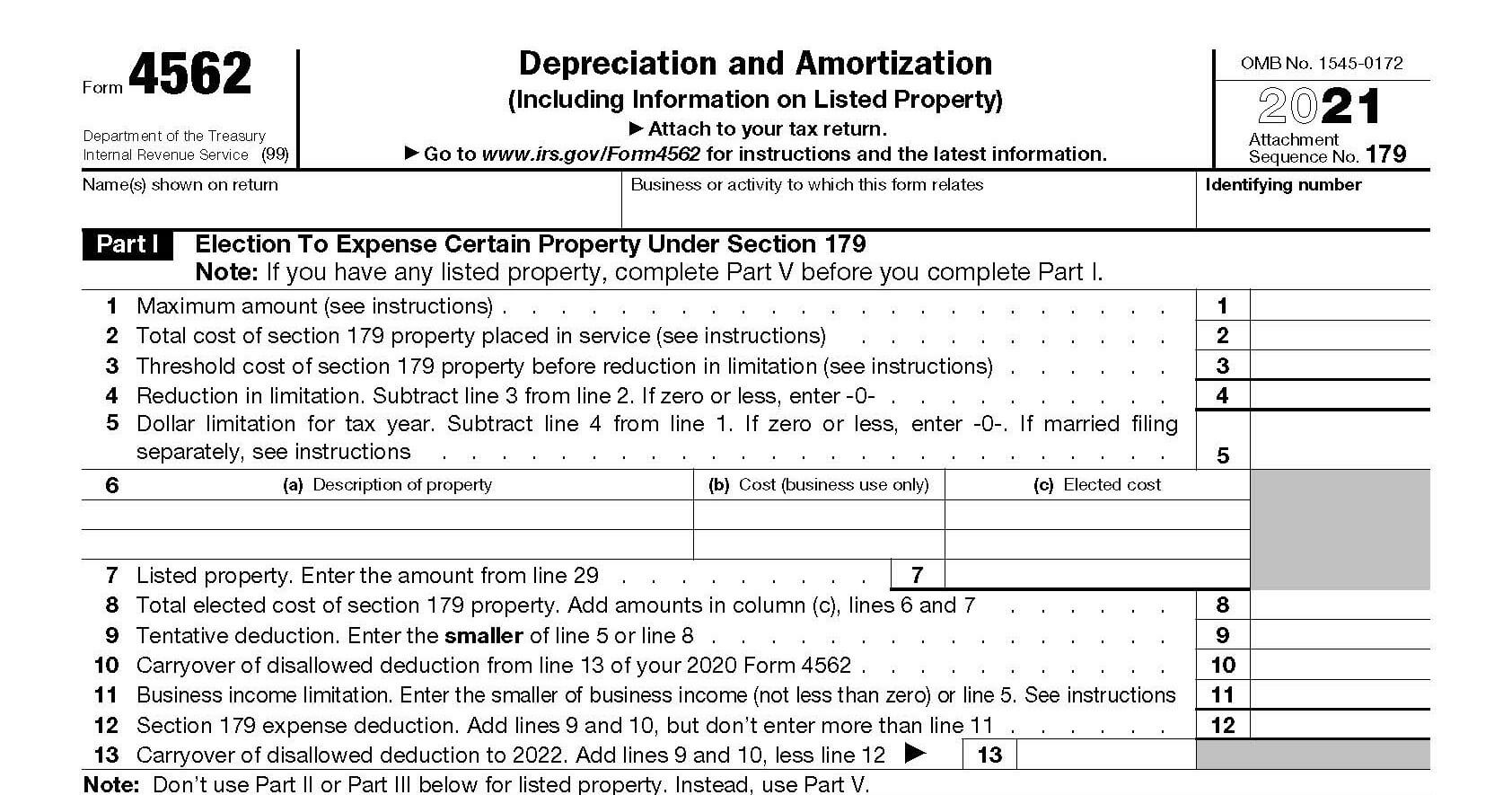

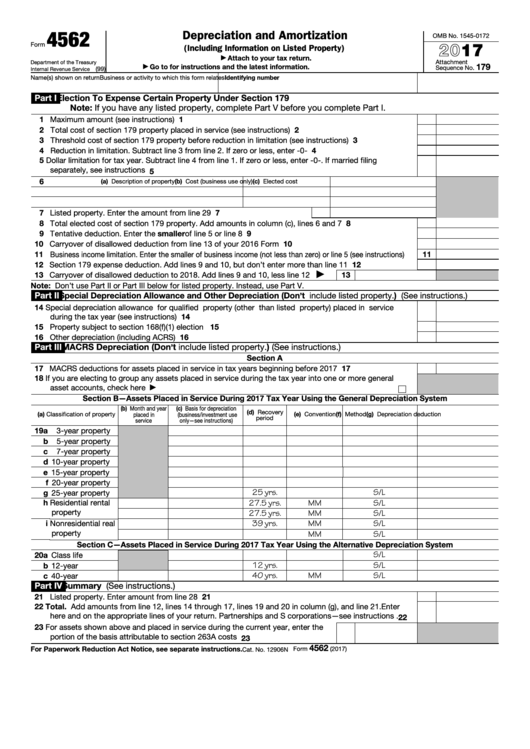

Form 4562 Depreciation

Form 4562 Depreciation - Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Irs form 4562 is used to claim depreciation and amortization. Web irs form 4562 amortization and depreciation is the form companies must file to deduct a part or the entire value of assets and property they use in their trade. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web enter any other applicable information such as cost or basis, depreciation deduction, etc. This form is for income earned in tax year 2022, with tax returns due in april. Ad signnow.com has been visited by 100k+ users in the past month Web 4562 depreciation and amortization omb no. Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form. To properly fill out form 4562, you’ll need the following information: Web learn what assets should be included on form 4562, as well as how often this form should be filed. Web irs form 4562 amortization and depreciation is the form companies must file to deduct a part or the entire value of assets and property they use in their trade. Web we last updated the depreciation and amortization (including information. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web irs form 4562: Web learn what assets should be included on form 4562, as well as how often this form should be filed. Depreciation and amortization is the name of this form, but it has additional. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web as a general rule, a taxpayer will add back the accelerated depreciation expense in year 1, and then take a deduction in the subsequent years until all of the ohio depreciation add. Web form 4562 is. Irs form 4562 is used to claim depreciation and amortization. Web claiming the special depreciation allowance. Ad pdffiller.com has been visited by 1m+ users in the past month Price of the asset being. Web common questions about depreciation form 4562 in lacerte solved • by intuit • 8 • updated april 19, 2023 depreciate or amortize assets related to a. Web up to 10% cash back in most cases, your depreciation deductions will be entered on irs form 4562, depreciation and amortization, and then the total amount will be. Use the special depreciation allowance input to enter the special. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or. Web irs form 4562 amortization and depreciation is the form companies must file to deduct a part or the entire value of assets and property they use in their trade. Price of the asset being. Ad pdffiller.com has been visited by 1m+ users in the past month Ad signnow.com has been visited by 100k+ users in the past month Depreciation. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web learn what assets should be included on form 4562, as well as how often this form should be filed. Depreciation and amortization is the name of this form, but it has. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. Web enter any other applicable information such as cost or basis, depreciation deduction, etc. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Web the irs allows businesses to claim a. Web irs form 4562: Web 4562 depreciation and amortization omb no. Web common questions about depreciation form 4562 in lacerte solved • by intuit • 8 • updated april 19, 2023 depreciate or amortize assets related to a specific. Web do you have to file form 4562? Irs form 4562 is used to claim depreciation and amortization. Ad signnow.com has been visited by 100k+ users in the past month Web 4562 depreciation and amortization omb no. Web claiming the special depreciation allowance. Web enter any other applicable information such as cost or basis, depreciation deduction, etc. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Web common questions about depreciation form 4562 in lacerte solved • by intuit • 8 • updated april 19, 2023 depreciate or amortize assets related to a specific. Ad signnow.com has been visited by 100k+ users in the past month Web form 4562 is primarily required for business owners who plan to claim inevitable depreciation and amortization deductions, such as section 179 expense. Use the special depreciation allowance input to enter the special. Electing the section 179 deduction. How do you correct depreciation deductions? Irs form 4562 is used to claim depreciation and amortization. Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form. Ad pdffiller.com has been visited by 1m+ users in the past month Web first, you’ll need to gather all the financial records regarding your asset. This form is for income earned in tax year 2022, with tax returns due in april. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web do you have to file form 4562? You can take a special depreciation allowance to recover part of the cost of qualified property (defined next),. Web enter any other applicable information such as cost or basis, depreciation deduction, etc. Irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web 4562 depreciation and amortization omb no. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. To properly fill out form 4562, you’ll need the following information:IRS Form 4562. Depreciation and Amortization Forms Docs 2023

Formulario 4562 Definición de depreciación y amortización Traders Studio

About Form 4562, Depreciation and Amortization IRS tax forms

Learn How to Fill the Form 4562 Depreciation and Amortization YouTube

Form 4562 Depreciation and Amortization YouTube

Form 4562Depreciation and Amortization

Cómo completar el formulario 4562 del IRS

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Form 4562Depreciation and Amortization

Fillable Form 4562 Depreciation And Amortization 2017 printable pdf

Related Post: