Turbo Tax Form 8606

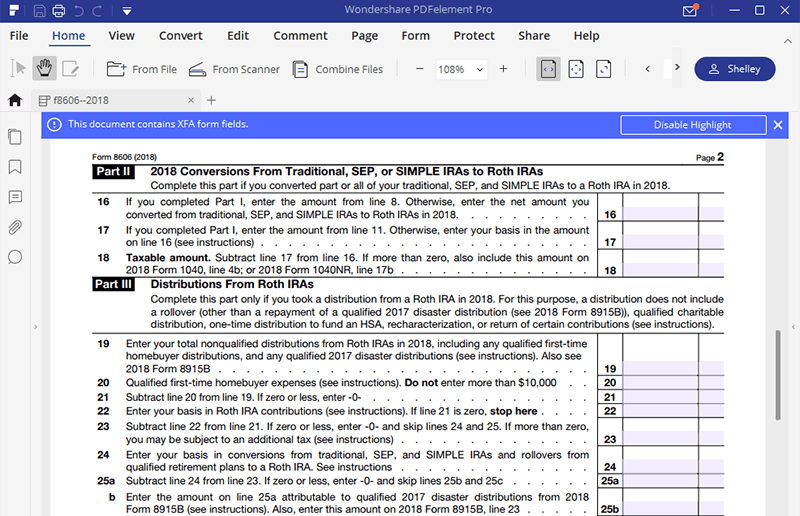

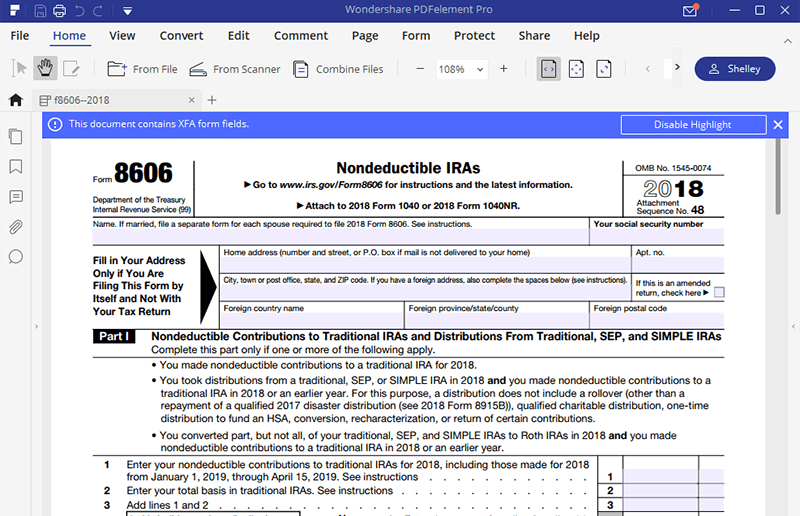

Turbo Tax Form 8606 - Department of the treasury internal revenue service (99) nondeductible iras. Web except for distributions from inherited iras, if form 8606 is required and you've made all of the correct entries, yes, turbotax will automatically generate form. Keep a copy of the last form 8606 you filed for your records. You might not be able to deduct your traditional ira contribution. Web 1 best answer. Sign into your account and select your current return. I hope this helps you understand the. Web it is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a main home in the area of a disaster, and repayments of. However, if only part of the contribution or conversion is. However now that i want to do a roth. Web form 8606 does not have to be filed if the entire contribution or conversion is recharacterized. Department of the treasury internal revenue service. Keep a copy of the last form 8606 you filed for your records. Where do i find form 8606? Web i have been making non deductible contributions to a traditional ira for years. You might not be able to deduct your traditional ira contribution. Department of the treasury internal revenue service. Per irs instructions, the form 8606, nondeductible iras isn't needed if there is no distribution or. Web form 8606 does not have to be filed if the entire contribution or conversion is recharacterized. Select tax tools and then tools (see attached tax. Web except for distributions from inherited iras, if form 8606 is required and you've made all of the correct entries, yes, turbotax will automatically generate form. Web i have been making non deductible contributions to a traditional ira for years. Department of the treasury internal revenue service. Web form 8606 does not have to be filed if the entire contribution. Information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to. Tax forms included with turbotax cd/download products. Web apparently turbotax will not generate a form 8606 for an inherited ira. However now that i want to do a roth. Select tax tools on the left and then print. Web to enter a 8606 follow these steps. Web apparently turbotax will not generate a form 8606 for an inherited ira. Web 1 best answer. Web form 8606, nondeductible iras isn't generating in lacerte. Web form 8606 is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an individual retirement. Web use irs form 8606 to deduct ira contributions. Web page last reviewed or updated: Web internal revenue service (irs) form 8606, nondeductible iras, is used by filers who make nondeductible contributions to an individual retirement account (ira). Web to enter a 8606 follow these steps. Answer simple questions about your life, and we’ll fill out the. If you aren’t required to file an income tax return but. I hope this helps you understand the. Department of the treasury internal revenue service. Web internal revenue service (irs) form 8606, nondeductible iras, is used by filers who make nondeductible contributions to an individual retirement account (ira). However now that i want to do a roth. For instructions and the latest. Tax forms included with turbotax cd/download products. You might not be able to deduct your traditional ira contribution. Solved • by turbotax • 2913 • updated 2 weeks ago. Web page last reviewed or updated: Solved • by turbotax • 2913 • updated 2 weeks ago. If you aren’t required to file an income tax return but. I hope this helps you understand the. Web internal revenue service (irs) form 8606, nondeductible iras, is used by filers who make nondeductible contributions to an individual retirement account (ira). Department of the treasury internal revenue service. Web internal revenue service (irs) form 8606, nondeductible iras, is used by filers who make nondeductible contributions to an individual retirement account (ira). Web use irs form 8606 to deduct ira contributions. However now that i want to do a roth. Keep a copy of the last form 8606 you filed for your records. The form has to be manually. We'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on your tax return: Department of the treasury internal revenue service. Web form 8606 is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an individual retirement. If you aren’t required to file an income tax return but. Per irs instructions, the form 8606, nondeductible iras isn't needed if there is no distribution or. Sign into your account and select your current return. Web use irs form 8606 to deduct ira contributions. Where do i find form 8606? Web to enter a 8606 follow these steps. Web please be aware that turbotax sometimes uses the taxable ira distribution worksheet to calculate the nontaxable distribution on line 13 of form 8606. However now that i want to do a roth. Web apparently turbotax will not generate a form 8606 for an inherited ira. However, you can make nondeductible ira. Web except for distributions from inherited iras, if form 8606 is required and you've made all of the correct entries, yes, turbotax will automatically generate form. I hope this helps you understand the. Keep a copy of the last form 8606 you filed for your records. Web it is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a main home in the area of a disaster, and repayments of. Web form 8606, nondeductible iras isn't generating in lacerte. You might not be able to deduct your traditional ira contribution. If you aren’t required to file an income tax return but.Irs form 8606 2016 Fill out & sign online DocHub

How to report a backdoor Roth IRA contribution on your taxes Merriman

Form 8606 Nondeductible IRAs Fill Out and Report Your Retirement Savings

united states How to file form 8606 when doing a recharacterization

IRS Form 8606 Printable

for How to Fill in IRS Form 8606

Backdoor Roth A Complete HowTo

LATE Backdoor ROTH IRA Tax Tutorial TurboTax & Form 8606 walkthrough

IRS Form 8606 LinebyLine Instructions 2023 How to File Form 8606

BACKDOOR ROTH IRA TurboTax Tutorial How to report BACKDOOR ROTH IRA

Related Post: