Code Eh On Form 8949

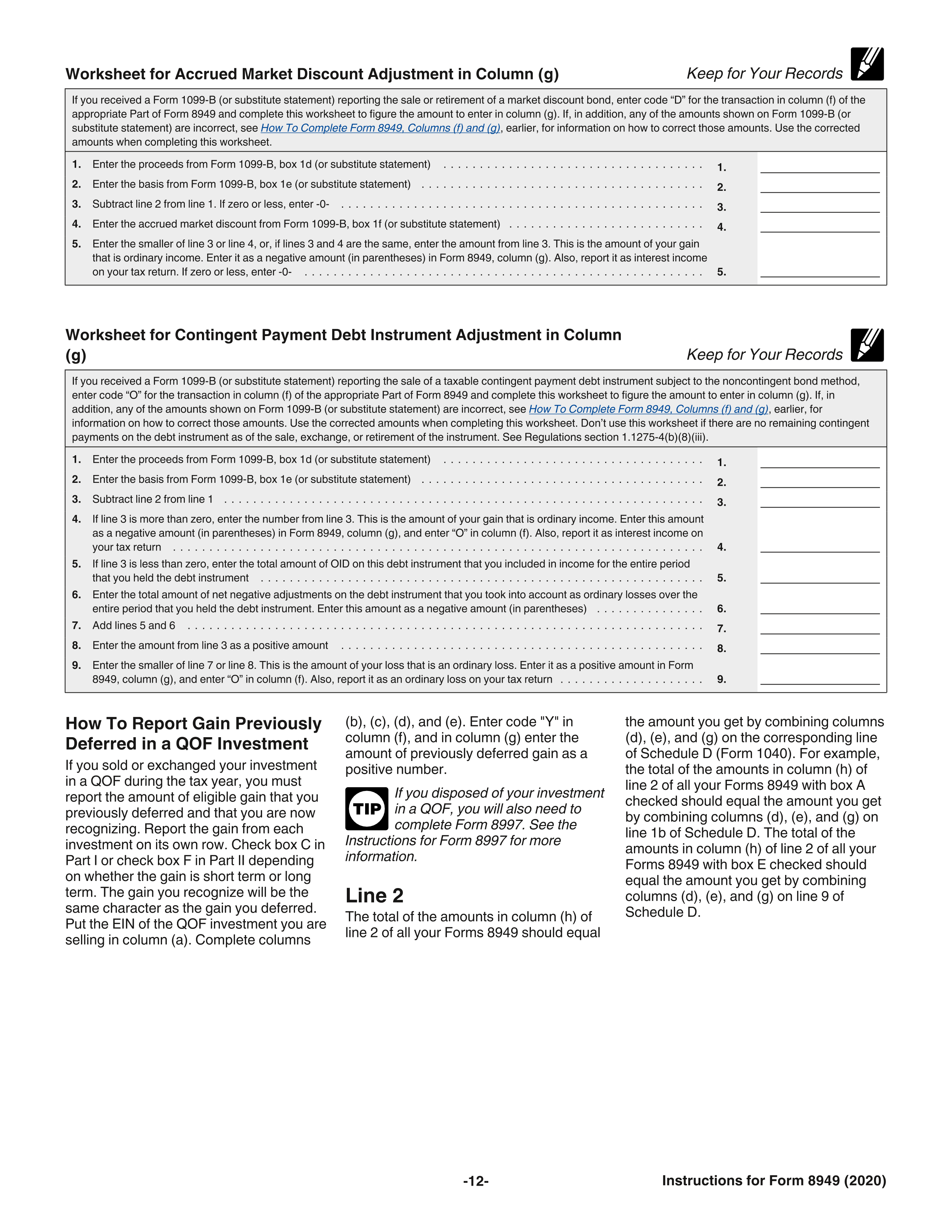

Code Eh On Form 8949 - Web 12 rows report the sale or exchange on form 8949 as you would if you were not making the election. Web solved•by intuit•239•updated 1 year ago. Web to enter form 8949 adjustment codes: Web overview of form 8949: Web 17 rows you sold or exchanged your main home at a gain, must report the sale or. Then enter the amount of postponed gain as a negative number (in. Solved•by intuit•73•updated 1 year ago. If form 8949 isn't required, lacerte. Go to the income input folder. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8949, sales and other dispositions of capital assets isn't generating in lacerte. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Click the b&d or broker screen. Sales and other dispositions of capital assets. Web 8949 box, code 1: If form 8949 isn't required, lacerte. Solved•by intuit•73•updated 1 year ago. Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 8949 to report sales and exchanges of capital assets. Web solved•by intuit•239•updated 1 year ago. The adjustment amount will also be listed on. The adjustment amount will also be listed on form 8949 and will transfer. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Web use form 8949 to report sales and exchanges of capital assets. Web these adjustment codes will be included on form 8949, which. Web solved•by intuit•239•updated 1 year ago. Solved•by intuit•73•updated 1 year ago. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Sales and other dispositions of capital assets. Go to the income input folder. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web 8949 box, code 1: Web 12 rows report the sale or exchange on form 8949 as you would if you were not making the election. Web overview of form 8949: Web use form 8949 to report sales and exchanges of capital assets. Web introduction these instructions explain how to complete schedule d (form 1040). Web use form 8949 to report sales and exchanges of capital assets. Go to the income input folder. The adjustment amount will also be listed on form 8949 and will transfer. Web 17 rows you sold or exchanged your main home at a gain, must report the sale or. Sales and other dispositions of capital assets. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax. Solved•by intuit•73•updated 1 year ago. Complete, edit or print tax forms instantly. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Sales and other dispositions of capital assets. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Complete, edit or print tax forms instantly. Web use form 8949 to report sales and exchanges of capital assets. The adjustment amount will also be listed on. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. This article. Go to the income input folder. Web form 8949, sales and other dispositions of capital assets isn't generating in lacerte. Web use form 8949 to report sales and exchanges of capital assets. Complete, edit or print tax forms instantly. Web 8949 box, code 1: If form 8949 isn't required, lacerte. For the main home sale exclusion, the code is h. Web to enter form 8949 adjustment codes: Web 12 rows report the sale or exchange on form 8949 as you would if you were not making the election. Go to the income input folder. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Then enter the amount of postponed gain as a negative number (in. Sales and other dispositions of capital assets. It is possible to attach multiple pdf files to represent summary totals for form 8949 sales and other dispositions of capital. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web solved•by intuit•239•updated 1 year ago. The adjustment amount will also be listed on. The adjustment amount will also be listed on form 8949 and will transfer. Web form 8949, sales and other dispositions of capital assets isn't generating in lacerte. Web use form 8949 to report sales and exchanges of capital assets. Click the b&d or broker screen. Solved•by intuit•73•updated 1 year ago. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Code(s) from amount of instructions adjustment (h) gain or (loss) subtract column (e) from column (d) and combine the result with column (g).Free Fillable Form 8949 Printable Forms Free Online

Fill Out Form 8949 For Bitcoin Taxes YouTube

Online Generation Of Schedule D And Form 8949 For 10 00 2021 Tax

IRS Form 8949 instructions.

Printable Form 8949 Printable Forms Free Online

O que é o Formulário 8949 do IRS? Economia e Negocios

IRS Form 8949 Instructions Sales & Dispositions of Capital Assets

Irs Form 8949 Printable Printable Forms Free Online

Form 8949 Fillable Printable Forms Free Online

IRS Form 8949 instructions.

Related Post:

:max_bytes(150000):strip_icc()/2020Form8949-0791c2d868bc4a418fd342bb64d0ae91.jpg)