Turbo Tax Form 5329

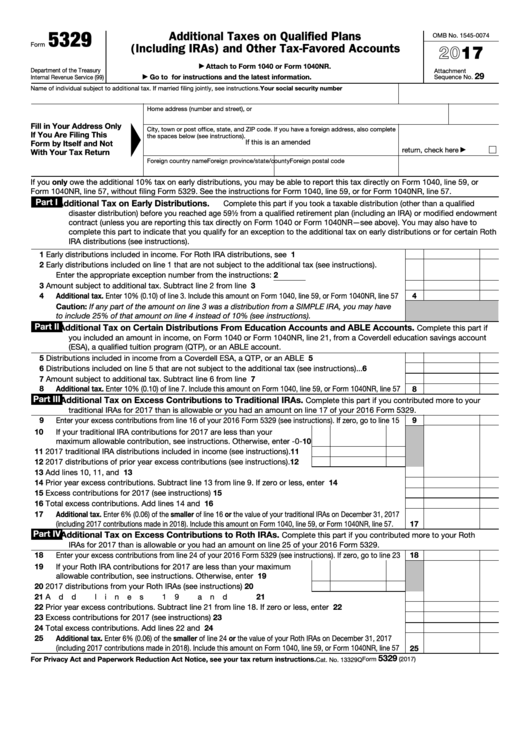

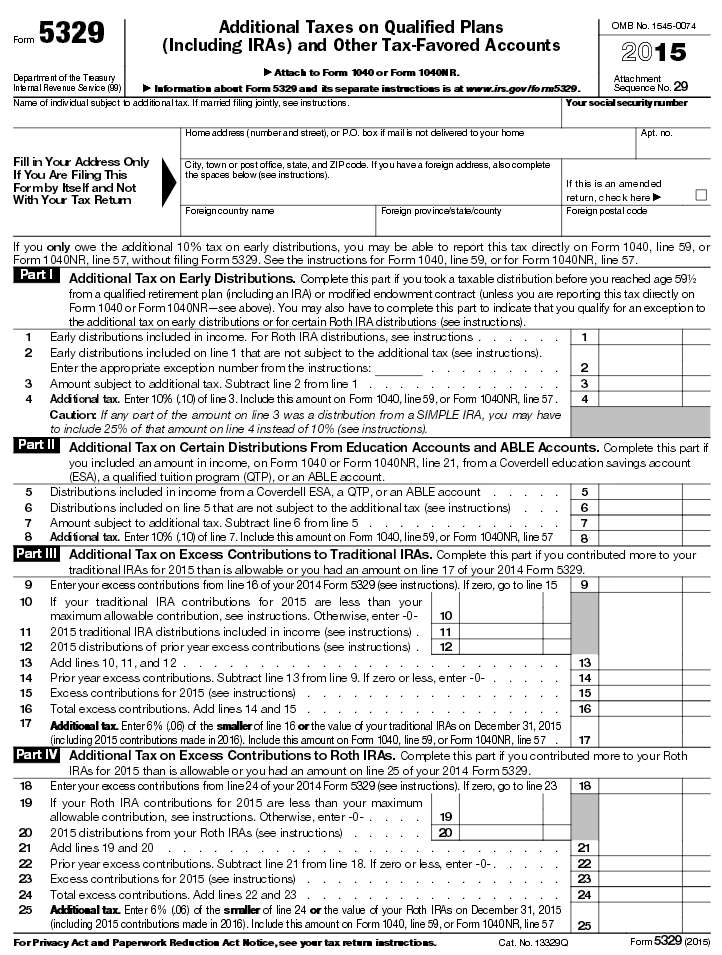

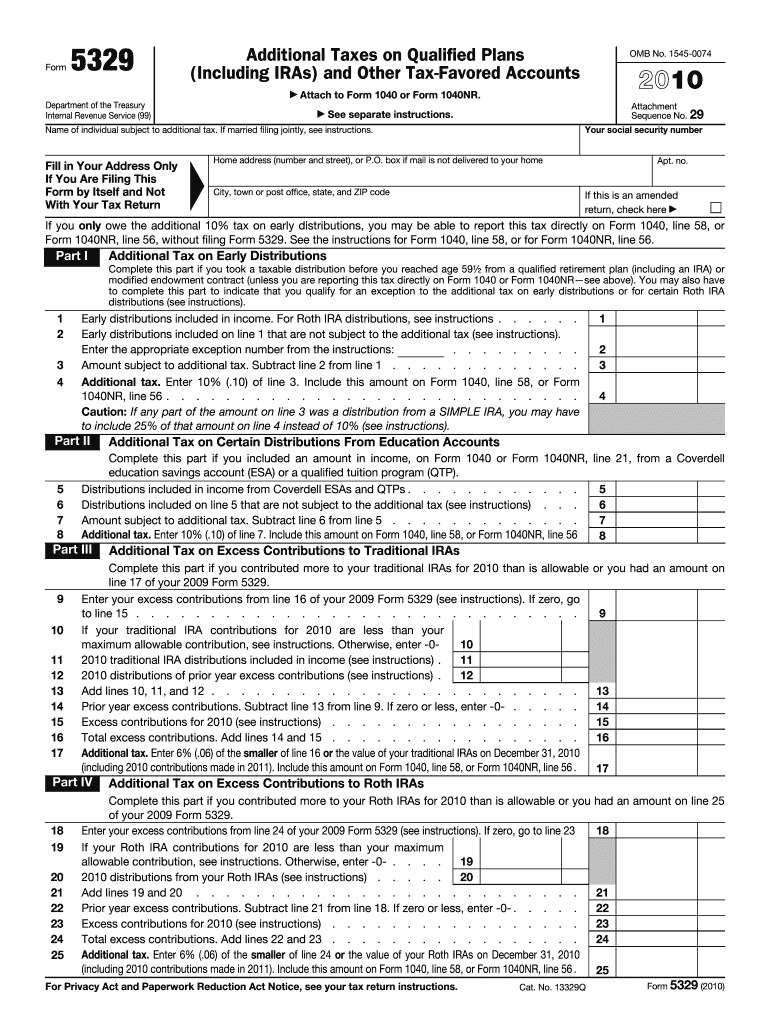

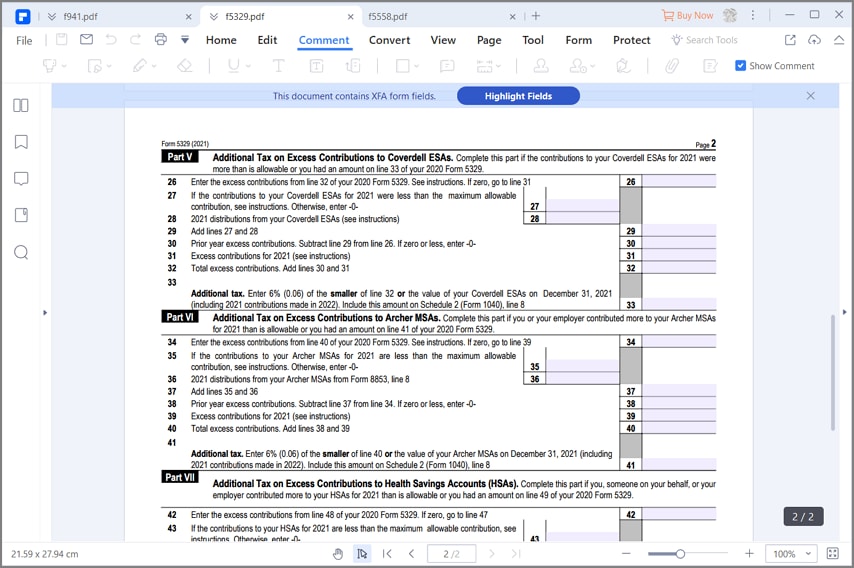

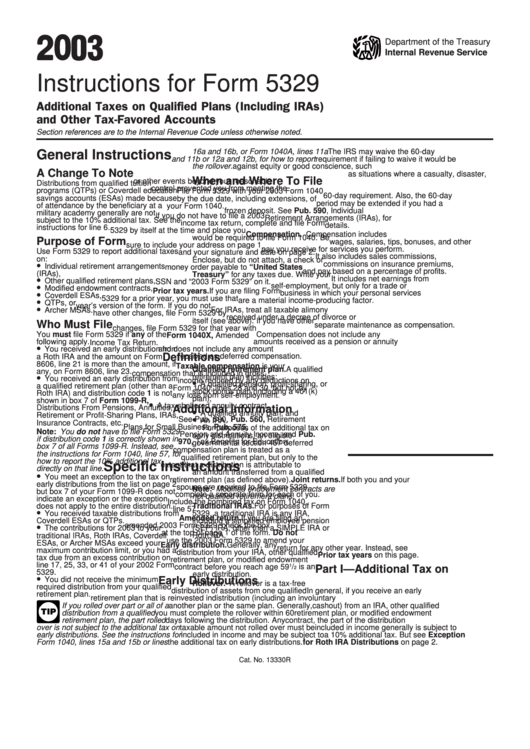

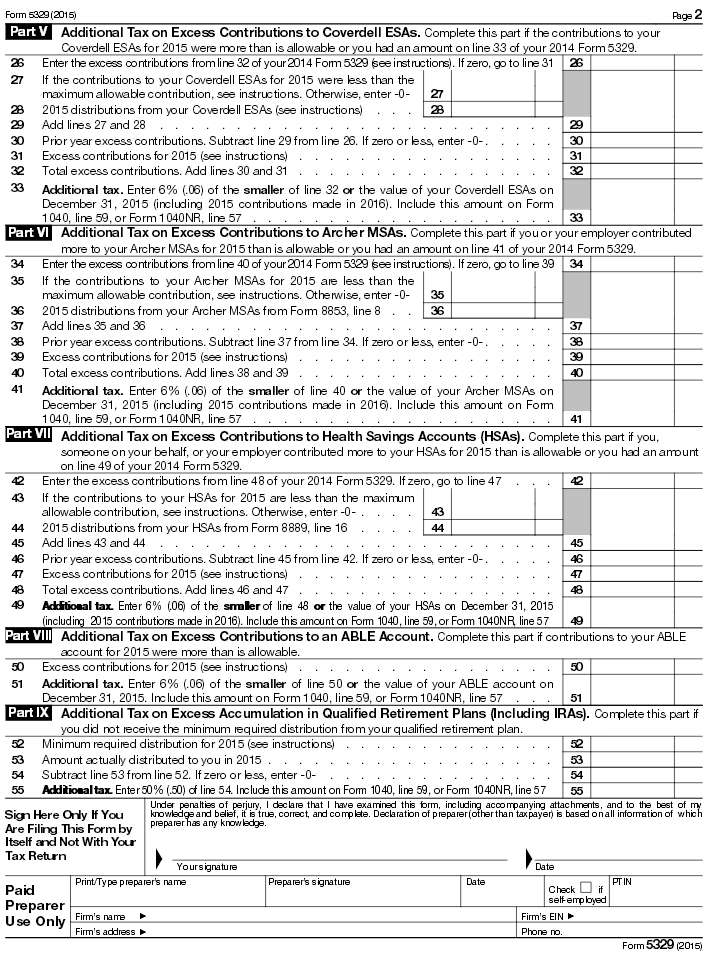

Turbo Tax Form 5329 - Answer simple questions about your life, and we’ll fill out the. Web turbotax / personal taxes / irs forms & schedules. What happens if you need to take the money out of an ira before you reach retirement age, or you take money from a 529 planand don't spend it on. Department of the treasury internal revenue service. The entire early withdrawal amount under line 1. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas,. Get ready for tax season deadlines by completing any required tax forms today. We all know we need to save for the future, but what happens if you contribute more than the annual limit to your retirement or health savings account (hsa)? Once you have the proper form, fill. If you don’t have to file a 2022 income tax return, complete. February 2021) department of the treasury. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas,. What happens if you need to take the money out of an ira before you reach retirement age, or you take money from a 529 planand don't spend it on. Complete, edit or print tax forms instantly. We offer a variety. If you don’t file by the deadline, the irs applies a. The amount eligible for an early withdrawal. Get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Iras, other qualified retirement plans,. For the latest information about developments related to form 5329 and its instructions, such as legislation. Once you have the proper form, fill. We all know we need to save for the future, but what happens if you contribute more than the annual limit to your retirement or health savings account (hsa)? For the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were. Web to calculate this,. Get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. February 2021) department of the treasury. Use form 5329 to report additional taxes on: Department of the treasury internal revenue service. Once you have the proper form, fill. Web instructions for form 5329. Web yes, you can get form 5329 from turbotax. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web to calculate this, irs form 5329 will ask you to enter: We offer a variety of software related to various fields. The entire early withdrawal amount under line 1. If you don’t have to file a 2022 income tax return, complete. Get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Answer simple questions about your life, and we’ll fill out the. However, you may have to print and mail. Once you have the proper form, fill. Iras, other qualified retirement plans,. Web yes, you can get form 5329 from turbotax. Complete, edit or print tax forms instantly. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas,. Ad explore the collection of software at amazon & take your skills to the next level. Once you have the proper form, fill. February 2021) department of the treasury. Answer simple questions about your life, and we’ll fill out the. Web yes, you can get form 5329 from turbotax. Web yes, you can get form 5329 from turbotax. What happens if you need to take the money out of an ira before you reach retirement age, or you take money from a 529 planand don't spend it on. Web for the 2022 tax year (which you’ll file in 2023), the form must filed by the standard deadline of april. The amount eligible for an early withdrawal. Get ready for tax season deadlines by completing any required tax forms today. February 2021) department of the treasury. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. What happens if you need to take the money out. Get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. If you don’t have to file a 2022 income tax return, complete. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas,. The amount eligible for an early withdrawal. Get ready for tax season deadlines by completing any required tax forms today. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web turbotax / personal taxes / irs forms & schedules. February 2021) department of the treasury. We all know we need to save for the future, but what happens if you contribute more than the annual limit to your retirement or health savings account (hsa)? Use form 5329 to report additional taxes on: Iras, other qualified retirement plans,. Complete, edit or print tax forms instantly. Web instructions for form 5329. Answer simple questions about your life, and we’ll fill out the. Web yes, you can get form 5329 from turbotax. Ad explore the collection of software at amazon & take your skills to the next level. Once you have the proper form, fill. Web to calculate this, irs form 5329 will ask you to enter: If you don’t file by the deadline, the irs applies a. The entire early withdrawal amount under line 1.Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Form 5329 Is Used for Which of the Following Purposes

Turbo Tax Return Tax In The United States Tax Deduction

2010 5329 form Fill out & sign online DocHub

Form 5329 Instructions & Exception Information for IRS Form 5329

How to Fill in IRS Form 5329

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Instructions for How to Fill in IRS Form 5329

Who must file the 2015 Form 5329?

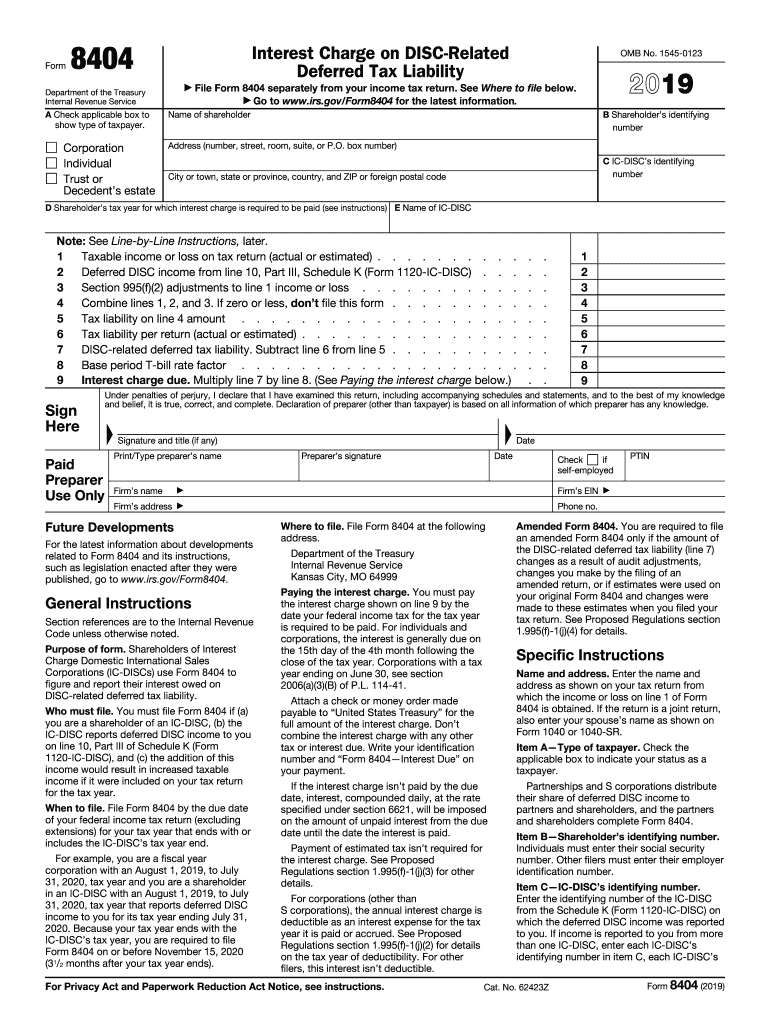

Form 8404 Fill Out and Sign Printable PDF Template signNow

Related Post: