Form 709 Instructions

Form 709 Instructions - Instructions for form 720 (06/2023) instructions for form 720. Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million. Upon audit, it is discovered that the gift. Web the gift tax return exists to keep u.s. 15 reflects inflation adjustments for gifts. Web you’ll enter amounts from schedules a, b, c, and d back on the first page of form 709. An individual makes one or more gifts to any. Web execute 2021 instructions for form 709. If you gave gifts to. Ad get ready for tax season deadlines by completing any required tax forms today. Web all taxable gifts should be adequately disclosed, including all information required by form 709 and its instructions, such as information pertaining to the donee. Instructions for form 720 (06/2023) instructions for form 720. The instructions for form 709 direct you to mail it to the applicable address. Web you’ll enter amounts from schedules a, b, c, and d back. Ad explore the collection of software at amazon & take your skills to the next level. Web read the instructions before attempting to complete the form. You may also find additional information in publication 559 or some of the other. Ad get ready for tax season deadlines by completing any required tax forms today. Web execute 2021 instructions for form. Form 709 cannot be electronically filed. You may also find additional information in publication 559 or some of the other. Try it for free now! Web if you make a taxable gift (one in excess of the annual exclusion), you are required to file form 709: Upon audit, it is discovered that the gift. Web execute 2021 instructions for form 709. Web below are some of the more common questions and answers about gift tax issues. (this is an irs limitation.) to create form 709 in. Web if you make a taxable gift (one in excess of the annual exclusion), you are required to file form 709: Department of the treasury internal revenue service. This is because all us persons have a lifetime gift tax exemption of $12.92. The instructions for form 709 direct you to mail it to the applicable address. Instructions for form 709, united states gift (and within several moments by following the guidelines listed below: If you are a citizen or resident of the united states, you must file a. Try it for free now! If you are a citizen or resident of the united states, you must file a gift tax return (whether or not any tax is ultimately due) in the following situations. Web below are some of the more common questions and answers about gift tax issues. Upload, modify or create forms. Web you’ll enter amounts from. Web the form 709 instructions should be clarified to allow, as provided in the adequate disclosure regulations, either providing a trust summary or attaching the trust document,. Department of the treasury internal revenue service. Web all taxable gifts should be adequately disclosed, including all information required by form 709 and its instructions, such as information pertaining to the donee. Your. Try it for free now! Instructions for form 720 (06/2023) instructions for form 720. Web execute 2021 instructions for form 709. Instructions for form 709, united states gift (and within several moments by following the guidelines listed below: If you are a citizen or resident of the united states, you must file a gift tax return (whether or not any. Ad get ready for tax season deadlines by completing any required tax forms today. Instructions for form 709, united states gift (and within several moments by following the guidelines listed below: Form 709 cannot be electronically filed. 15 reflects inflation adjustments for gifts. If you gave gifts to. Web the form 709 instructions should be clarified to allow, as provided in the adequate disclosure regulations, either providing a trust summary or attaching the trust document,. We offer a variety of software related to various fields at great prices. Web read the instructions before attempting to complete the form. Upon audit, it is discovered that the gift. The instructions. The instructions for form 709 direct you to mail it to the applicable address. If you are a citizen or resident of the united states, you must file a gift tax return (whether or not any tax is ultimately due) in the following situations. This is because all us persons have a lifetime gift tax exemption of $12.92. Web read the instructions before attempting to complete the form. Web for most taxpayers, form 709 is a purely informational tax form and does not create a tax liability. Web you’ll enter amounts from schedules a, b, c, and d back on the first page of form 709. Form 709 cannot be electronically filed. Your tax return preparation software or professional will calculate the amount. Web execute 2021 instructions for form 709. Web 406 rows instructions for form 709 (2022) instructions for form 709 (2022) i709.pdf: Web below are some of the more common questions and answers about gift tax issues. Web if you make a taxable gift (one in excess of the annual exclusion), you are required to file form 709: Web the gift tax return exists to keep u.s. You may also find additional information in publication 559 or some of the other. Web all taxable gifts should be adequately disclosed, including all information required by form 709 and its instructions, such as information pertaining to the donee. Instructions for form 720 (06/2023) instructions for form 720. (this is an irs limitation.) to create form 709 in. Try it for free now! Ad explore the collection of software at amazon & take your skills to the next level. If you gave gifts to.IRS Instructions 709 2018 2019 Printable & Fillable Sample in PDF

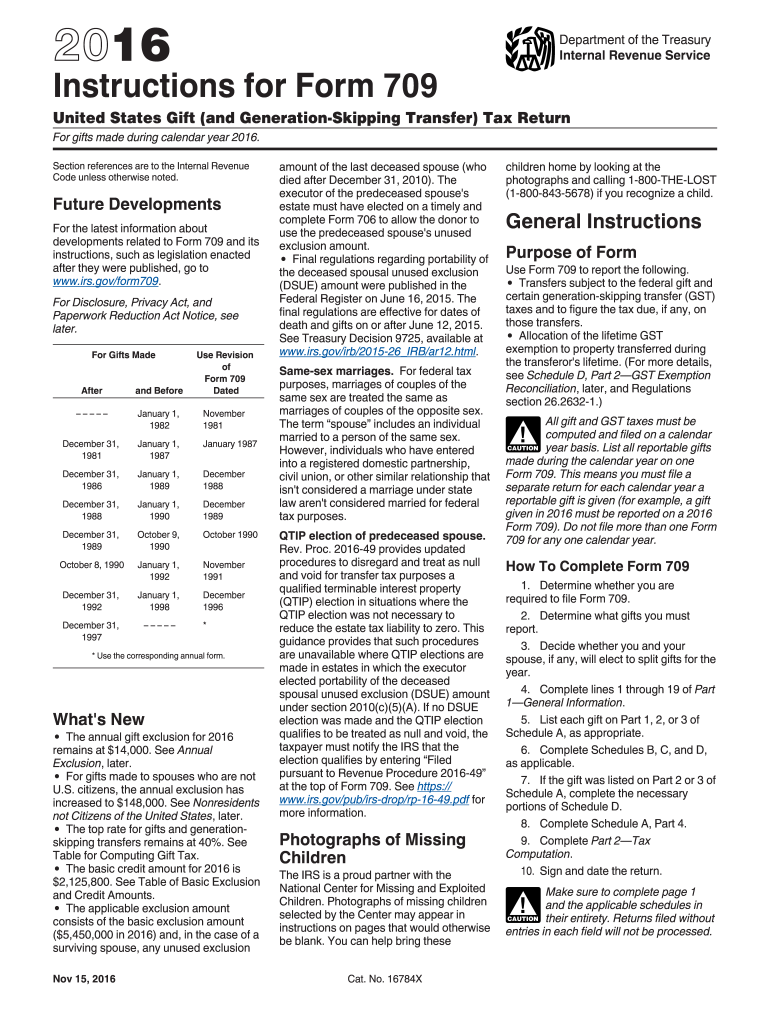

2016 irs form 709 instructions Fill out & sign online DocHub

Instructions For Form 709 United States Gift (And GenerationSkipping

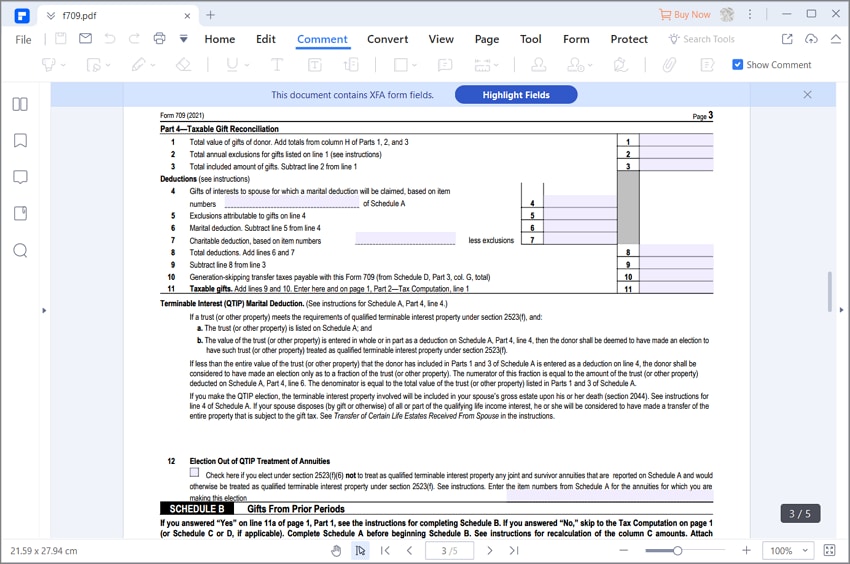

for How to Fill in IRS Form 709

709 gift tax return instructions

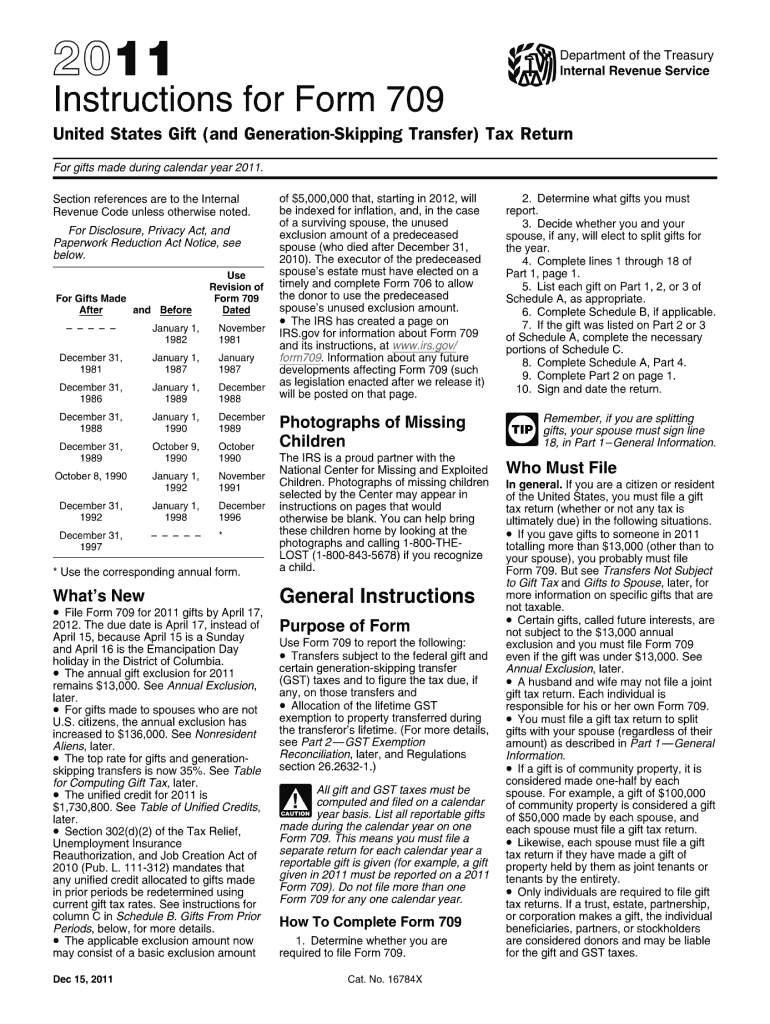

IRS 709 Instructions 2011 Fill out Tax Template Online US Legal Forms

Gift Tax Return Form 709 Instructions YouTube

Instructions For Form 709 United States Gift (And GenerationSkipping

709 gift tax return instructions

Instructions For Form 709 United States Gift (And GenerationSkipping

Related Post: