Turbo Tax Form 3520

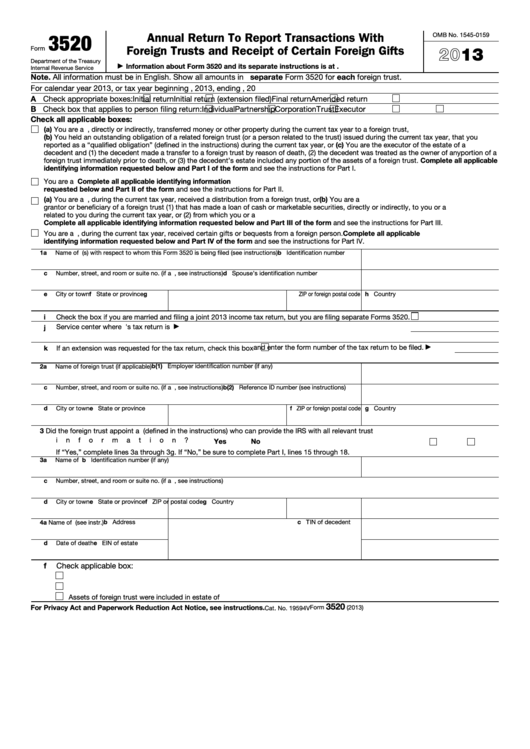

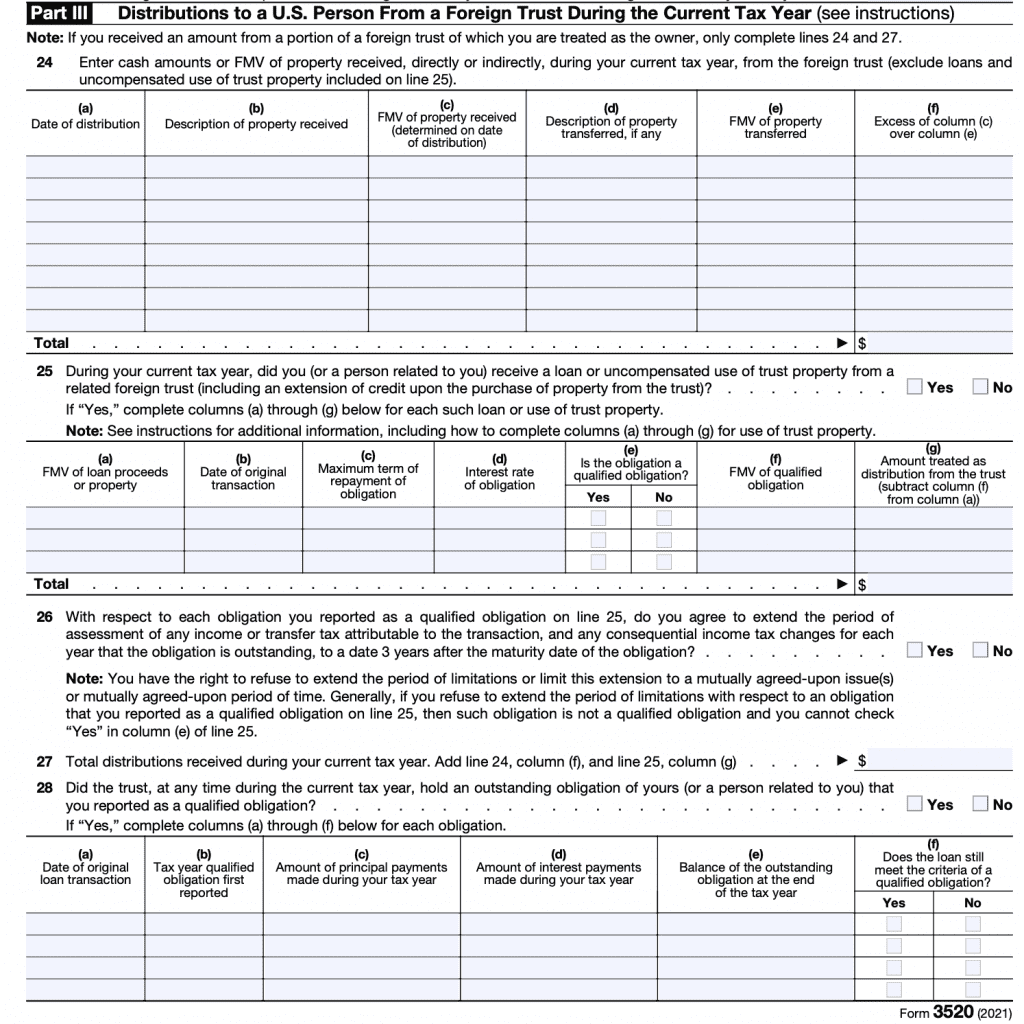

Turbo Tax Form 3520 - Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Persons (and executors of estates of u.s. Web form 3520 for u.s. Decedents) file form 3520 with the irs to report: Get ready for tax season deadlines by completing any required tax forms today. Person to file a form. Cannot file return online after indicating i will file a 3520 form on my form 8938 in turbotax? Web understanding form 3520. All information must be in english. Owner a foreign trust with at least one u.s. Web understanding form 3520. Talk to our skilled attorneys by scheduling a free consultation today. The form provides information about the foreign trust, its u.s. Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to report: In year 2021, i inherited money over us$100k from my mother who had passed away in a foreign country. Web understanding form 3520. There are three main types of transactions with a foreign trust you need to report on: All information must be in english. Web form 3520 department of the treasury internal revenue service annual return to report transactions. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Web understanding form 3520. As the title suggests, form 3520 is used by u.s. In general, the due date for a u.s. Ad find deals on turbo tax online in software on amazon. Owner files this form annually to provide information. There are three main types of transactions with a foreign trust you need to report on: Persons (and executors of estates of u.s. Certain transactions with foreign trusts, ownership of foreign trusts under. Ad find deals on turbo tax online in software on amazon. Web form 3520 for u.s. Person to file a form. Certain transactions with foreign trusts, ownership of foreign trusts under. As the title suggests, form 3520 is used by u.s. The form provides information about the foreign trust, its u.s. Estimate how much you could potentially save in just a matter of minutes. Decedents) file form 3520 with the irs to report: Web understanding form 3520. Web 1 best answer fangxial expert alumni if you are not the beneficiary, you don't need to file a joint 3520 even if you are filing a joint tax return. Person to file a. Persons (and executors of estates of u.s. Ad find deals on turbo tax online in software on amazon. Cannot file return online after indicating i will file a 3520 form on my form 8938 in turbotax? Web a form 3520 is filed separately from your tax return. Web file form 3520 separately from your income tax return by following the. There are three main types of transactions with a foreign trust you need to report on: At its core, form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an irs. Web form 3520 is typically filed by individuals who are responsible for reporting a significant event that occurred in the current tax. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Certain transactions with foreign trusts, ownership of foreign trusts under. Web level 1 what 's next with form3520 in turbotax? Web form 3520 is typically filed by individuals who are responsible for reporting a significant event that occurred in the current tax. Owner files this form annually to provide information. Persons (and executors of estates of u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad don’t. Owner files this form annually to provide information. Web form 3520 for u.s. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. Certain transactions with foreign trusts, ownership of foreign trusts under. Owner a foreign trust with at least one u.s. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. Talk to our skilled attorneys by scheduling a free consultation today. Estimate how much you could potentially save in just a matter of minutes. Cannot file return online after indicating i will file a 3520 form on my form 8938 in turbotax? Taxpayer transactions with a foreign trust. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad find deals on turbo tax online in software on amazon. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Person to file a form. Persons (and executors of estates of u.s. Get ready for tax season deadlines by completing any required tax forms today. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. In general, the due date for a u.s. Talk to our skilled attorneys by scheduling a free consultation today. Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520.Fillable Form 3520 Annual Return To Report Transactions With Foreign

Form 3520 Annual Return to Report Transactions with Foreign Trusts

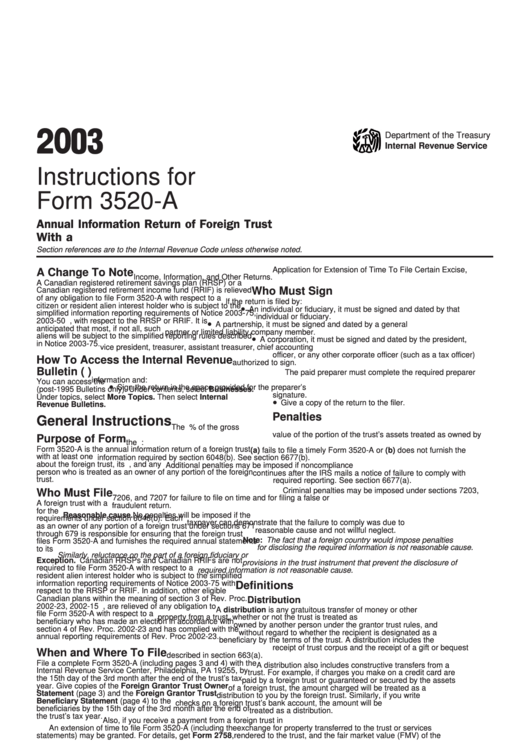

Form 3520A Annual Information Return of Foreign Trust with a U.S

Irs form 3520 Fill out & sign online DocHub

Form 3520 Blank Sample to Fill out Online in PDF

Instructions For Form 3520A Annual Information Return Of Foreign

IRS Form 3520Reporting Transactions With Foreign Trusts

Form FDA 3520 Release Record and Agreement Permission to Publish in

Form 3520 Edit, Fill, Sign Online Handypdf

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Related Post: