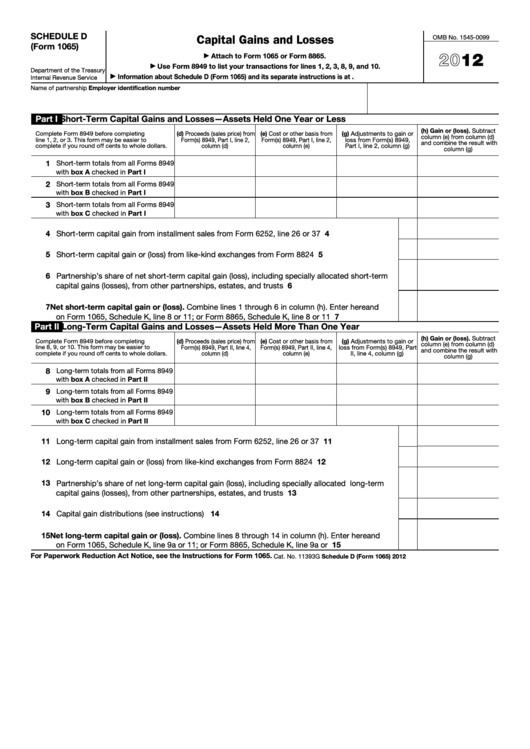

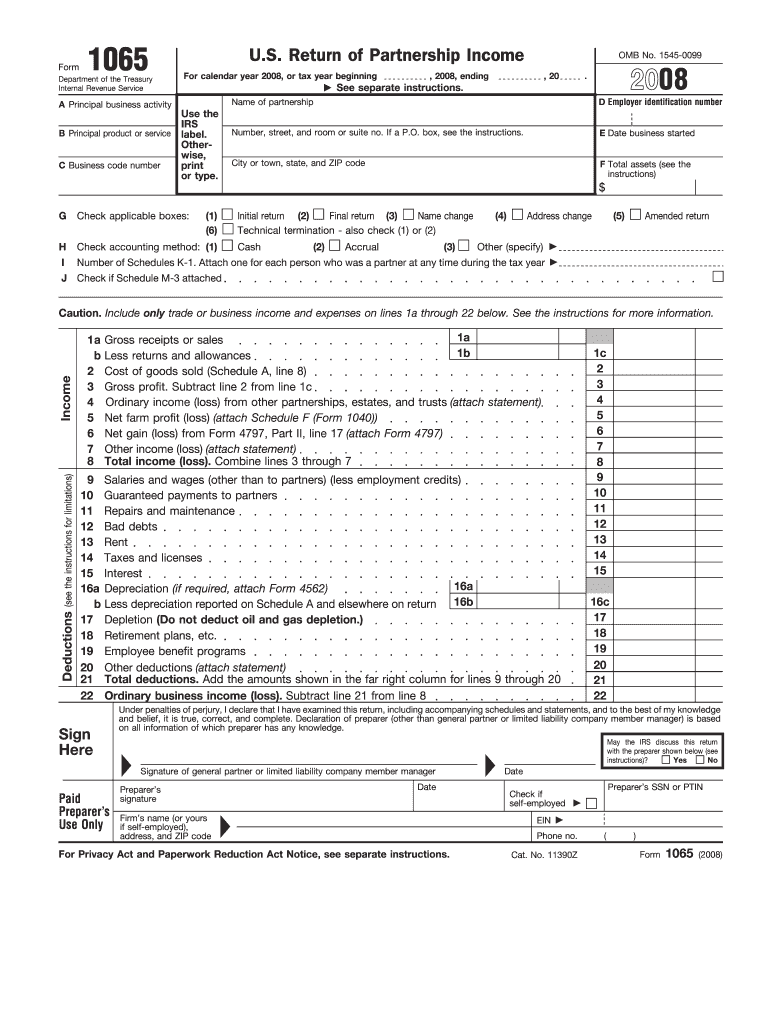

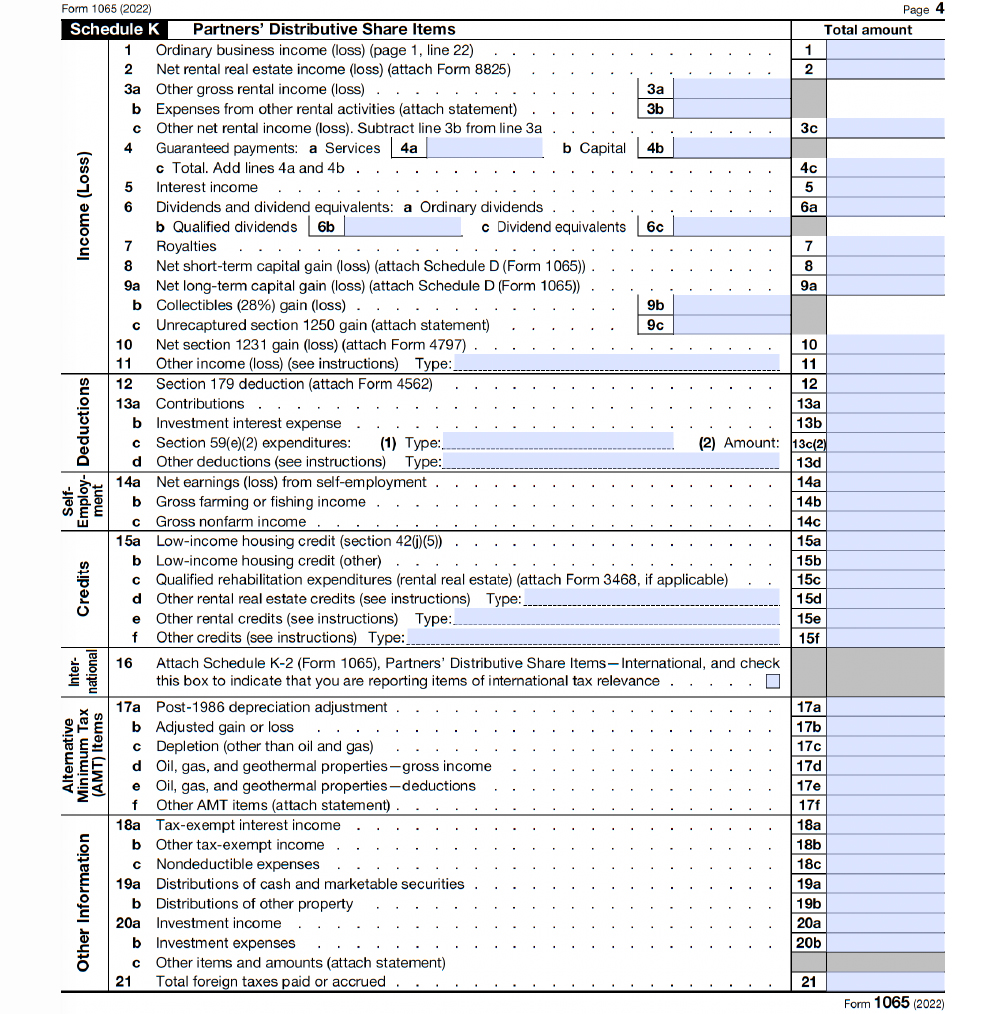

Form 1065 Schedule D

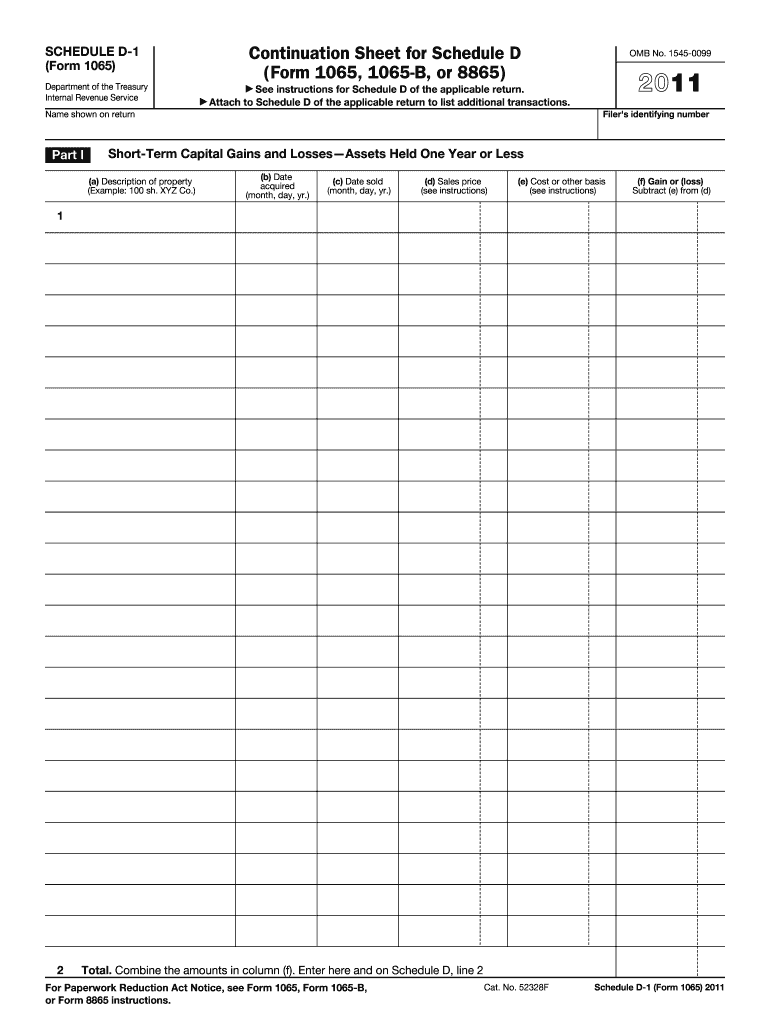

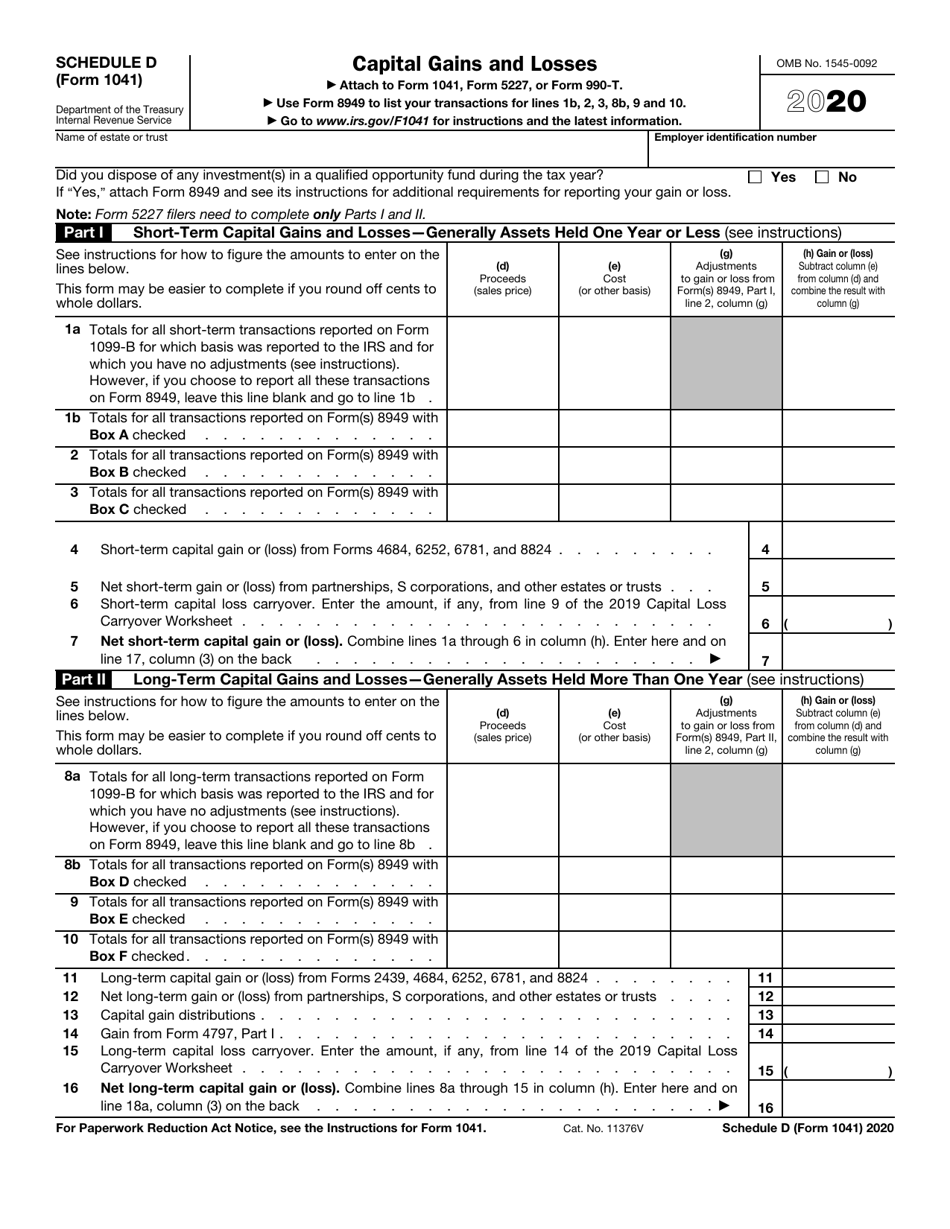

Form 1065 Schedule D - Web use schedule d (form 1065) to report the following. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The sale or exchange of a capital asset not reported on another form or schedule. Complete, edit or print tax forms instantly. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs. Web form 1065, u.s. For calendar year 2021, or tax year beginning. Web overview of form 1065 (schedule d): Form 8949, sales and other dispositions of capital. Web purpose of schedule use schedule d (form 1065) to report the following. For instructions and the latest information. Web schedule d (form 1065) department of the treasury internal revenue service capital gains and losses attach to form 1065 or form 8865. Web purpose of schedule use schedule d (form 1065) to report the following. The schedule d form is what. Return of partnership income where the partnership reports to the irs their. Web written by a turbotax expert • reviewed by a turbotax cpa. Web schedule d (form 1065) department of the treasury internal revenue service capital gains and losses attach to form 1065 or form 8865. Web we last updated the capital gains and losses in january 2023, so this is the latest version of 1065 (schedule d), fully updated for. Web schedule d (form 1065), capital gains and losses (if required). Web use schedule d (form 1040) to report the following: Use form 8949 to list your transactions for lines 1b,. Web purpose of schedule use schedule d (form 1065) to report the following. • form 8949 reports a detailed schedule of sales and exchanges. Updated for tax year 2022 • june 2, 2023 8:43 am. Get ready for tax season deadlines by completing any required tax forms today. Web written by a turbotax expert • reviewed by a turbotax cpa. • form 8949 reports a detailed schedule of sales and exchanges. Return of partnership income, is a tax form used by partnerships to provide. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital. For instructions and the latest information. You can download or print current. Web use schedule d (form 1040) to report the following: Updated for tax year 2022 • june 2, 2023 8:43 am. You can file for an extension using. • form 8949 reports a detailed schedule of sales and exchanges. Web do not file august 31, 2021 draft as of schedule d (form 1065) department of the treasury internal revenue service capital gains and losses attach. Web schedule d (form 1065), capital gains and losses use this schedule to report: Web purpose. Web up to $40 cash back schedule d (form 1065) capital gains and losses omb no. Use form 8949 to list your transactions for lines 1b,. • the total capital gains and losses from transactions reported on form 8949, sales and other. The schedule d form is what. Web use schedule d (form 1065) to report the following. Complete, edit or print tax forms instantly. Use form 8949 to list your. Following is a list of lines that are filled in on the tax forms, and where those entries. Form 4797, sales of business property (if required). Web schedule d (form 1065), capital gains and losses (if required). Return of partnership income where the partnership reports to the irs their balance sheet as. • the total capital gains and losses from transactions reported on form 8949, sales and other. Web schedule d (form 1065), capital gains and losses use this schedule to report: The schedule d form is what. You can download or print current. Web we last updated the capital gains and losses in january 2023, so this is the latest version of 1065 (schedule d), fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. Use form 8949 to list your. Web purpose of schedule use schedule d (form 1065) to report the following.. You can file for an extension using. Web written by a turbotax expert • reviewed by a turbotax cpa. Web schedule d (form 1065) department of the treasury internal revenue service capital gains and losses attach to form 1065 or form 8865. The overall capital gains and losses from transactions reported on form 8949, sales and. The sale or exchange of a capital asset not reported on another form or schedule. Web overview of form 1065 (schedule d): Use form 8949 to list your. Updated for tax year 2022 • june 2, 2023 8:43 am. For calendar year 2021, or tax year beginning. • form 8949 reports a detailed schedule of sales and exchanges. Use form 8949 to list your transactions for lines 1b,. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital. Form 8949, sales and other dispositions of capital. Web on form 1065, schedule k, line 8 or 11; Web do not file august 31, 2021 draft as of schedule d (form 1065) department of the treasury internal revenue service capital gains and losses attach. Web use schedule d (form 1040) to report the following: , 2021, ending , 20. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs. Return of partnership income where the partnership reports to the irs their balance sheet as. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.20112021 Form IRS 1065 Schedule D1 Fill Online, Printable, Fillable

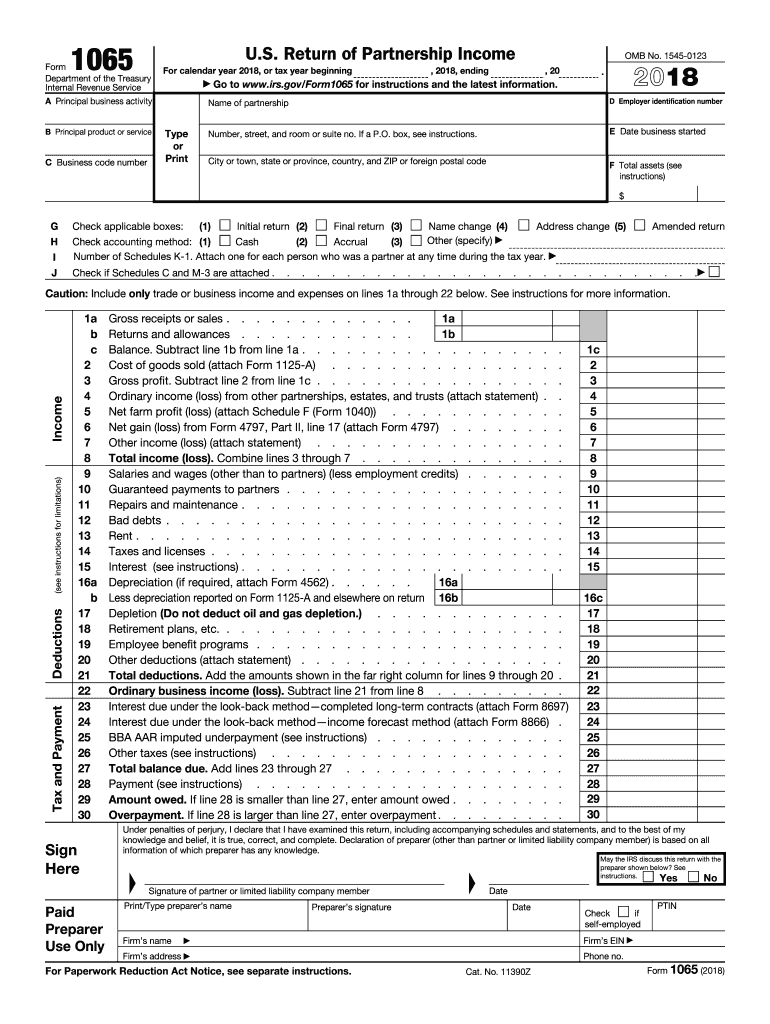

2018 Form IRS 1065Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 1065 (2020) U.S. Return of Partnership

Form 1065 (Schedule D) Capital Gains and Losses (2014) Free Download

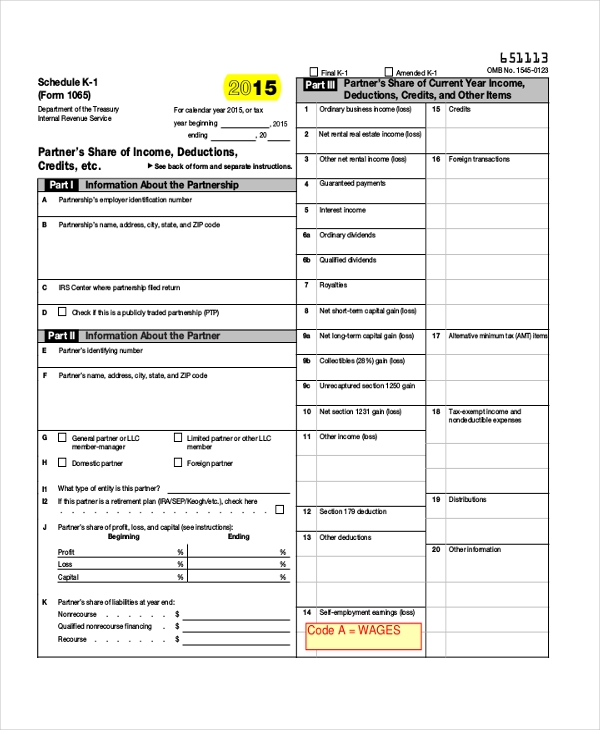

Schedule K1 Form 1065 Self Employment Tax Employment Form

Free Fillable Form 1065 Printable Forms Free Online

Fillable Schedule D (Form 1065) Capital Gains And Losses 2012

20222023 Form 1065 Schedule D instructions Fill online, Printable

Irs 1065 2008 form Fill out & sign online DocHub

2023 Form 1065 Printable Forms Free Online

Related Post: