Trd-41413 Form

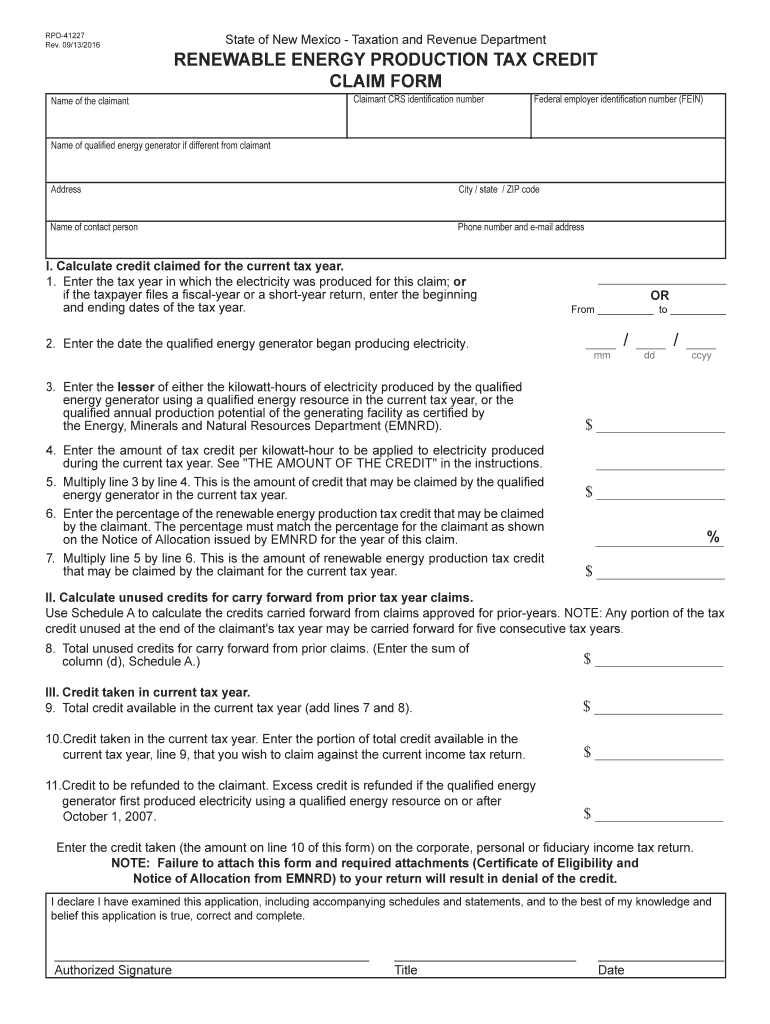

Trd-41413 Form - Web the gross receipts tax rate varies throughout the state from 5% to 9.3125%. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. To calculate the amount you may claim for any tax year, refer to the claim form for the credit, or if no claim form, refer to the instructions. You also need to file an annual withholding. When claiming the affordable housing tax credit, this form must accompany the applicable tax return, see instructions for applicable tax programs. In deductible transactions, the seller or lessor incurs no. Welcome to the taxation and revenue department’s forms & publications page. However, going forward these taxes will need to be filed on different forms, see below: It is used for reporting financial interests and potential conflicts. It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Superior court of arizona in maricopa county Web new mexico cannabis excise tax return. It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Welcome to the taxation and revenue department’s forms & publications page. The folders on this page contain everything from returns and. If all receipts of the marketplace seller are deductible, the result will be that. Web purpose of this form: Web new mexico cannabis excise tax return. Web purpose of this form: It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Web purpose of this form: If all receipts of the marketplace seller are deductible, the result will be that. To calculate the amount you may claim for any tax year, refer to the claim form for the credit, or if no claim form, refer to the instructions. Welcome to the taxation and revenue department’s forms & publications page. In deductible. It is used for reporting financial interests and potential conflicts. Web purpose of this form: However, going forward these taxes will need to be filed on different forms, see below: Web the gross receipts tax rate varies throughout the state from 5% to 9.3125%. Superior court of arizona in maricopa county Tax day has passed, and refunds are being processed! Web up to $40 cash back form 14 313 is a financial disclosure form used by the united states department of defense (dod). Web new mexico cannabis excise tax return. The folders on this page contain everything from returns and. You also need to file an annual withholding. It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Web new mexico cannabis excise tax return. Web purpose of this form: However, going forward these taxes will need to be filed on different forms, see below: Web up to $40 cash back form 14 313 is a financial disclosure form used by the. Web the gross receipts tax rate varies throughout the state from 5% to 9.3125%. Welcome to the taxation and revenue department’s forms & publications page. Web new mexico has released two new withholding forms and related instructions. The feature saves you the time. When claiming the affordable housing tax credit, this form must accompany the applicable tax return, see instructions. Web the gross receipts tax rate varies throughout the state from 5% to 9.3125%. It is used for reporting financial interests and potential conflicts. The folders on this page contain everything from returns and. Web up to $40 cash back form 14 313 is a financial disclosure form used by the united states department of defense (dod). Web new mexico. It is used for reporting financial interests and potential conflicts. Web up to $40 cash back form 14 313 is a financial disclosure form used by the united states department of defense (dod). Web new mexico has released two new withholding forms and related instructions. The feature saves you the time. To calculate the amount you may claim for any. Web purpose of this form: When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands. Web up to $40 cash back form 14 313 is a financial disclosure form used by the united states department of defense (dod). Superior court of arizona in maricopa. If all receipts of the marketplace seller are deductible, the result will be that. Superior court of arizona in maricopa county The folders on this page contain everything from returns and. The feature saves you the time. Web purpose of this form: However, going forward these taxes will need to be filed on different forms, see below: Web purpose of this form: In deductible transactions, the seller or lessor incurs no. When claiming the affordable housing tax credit, this form must accompany the applicable tax return, see instructions for applicable tax programs. You also need to file an annual withholding. To calculate the amount you may claim for any tax year, refer to the claim form for the credit, or if no claim form, refer to the instructions. It is used for reporting financial interests and potential conflicts. Tax day has passed, and refunds are being processed! It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Welcome to the taxation and revenue department’s forms & publications page. Web the gross receipts tax rate varies throughout the state from 5% to 9.3125%. Web new mexico cannabis excise tax return. Web up to $40 cash back form 14 313 is a financial disclosure form used by the united states department of defense (dod). Web new mexico has released two new withholding forms and related instructions. When you use our print, fill and go forms, you can walk into any of our district offices with a completed tax form in your hands.2014 Form NM TRD PTE Fill Online, Printable, Fillable, Blank pdfFiller

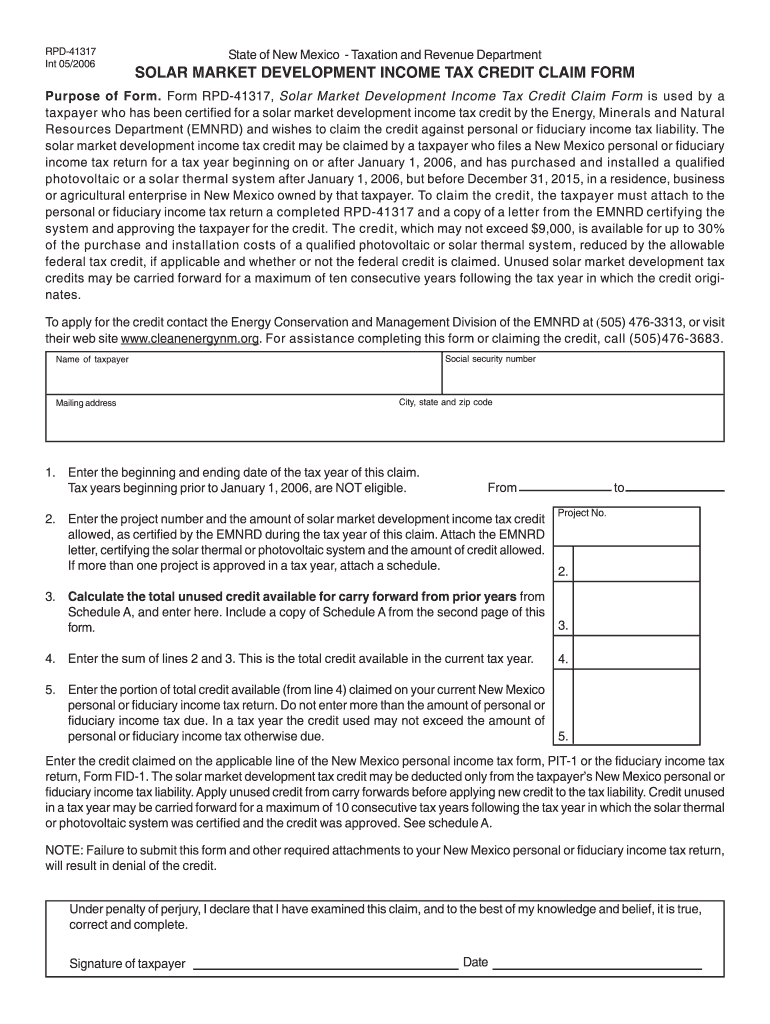

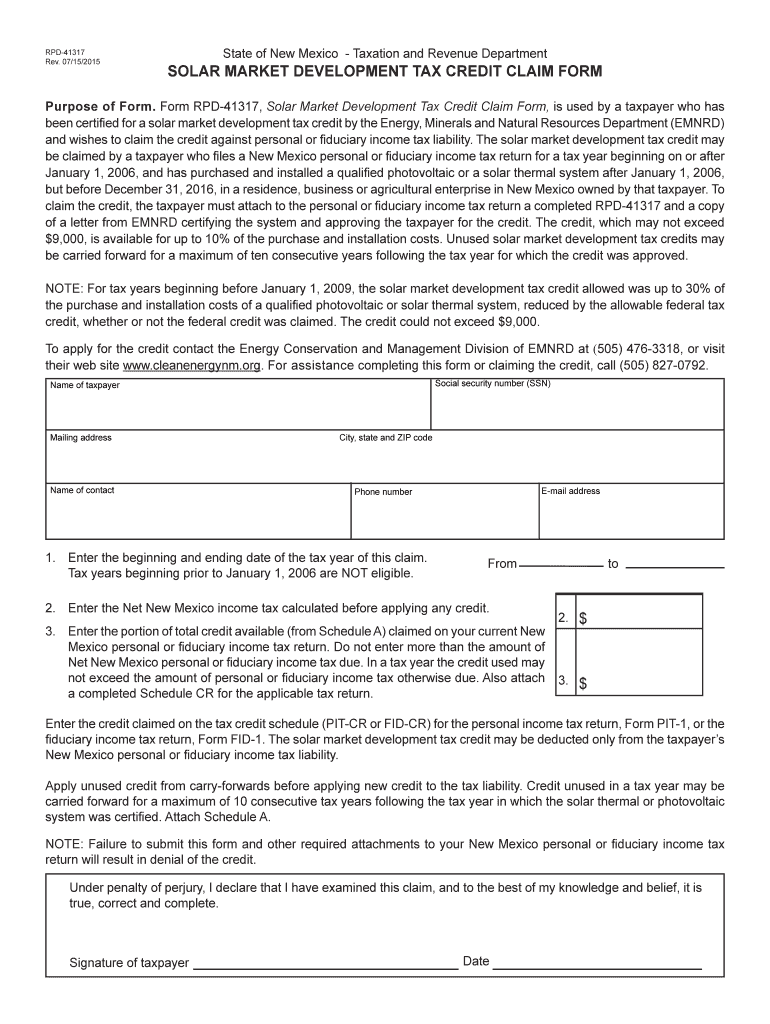

NM TRD RPD41317 2006 Fill out Tax Template Online US Legal Forms

Form Nm Revenue Fill Online, Printable, Fillable, Blank pdfFiller

NM TRD RPD41367 2013 Fill out Tax Template Online US Legal Forms

Trd 41406 Fill Out and Sign Printable PDF Template signNow

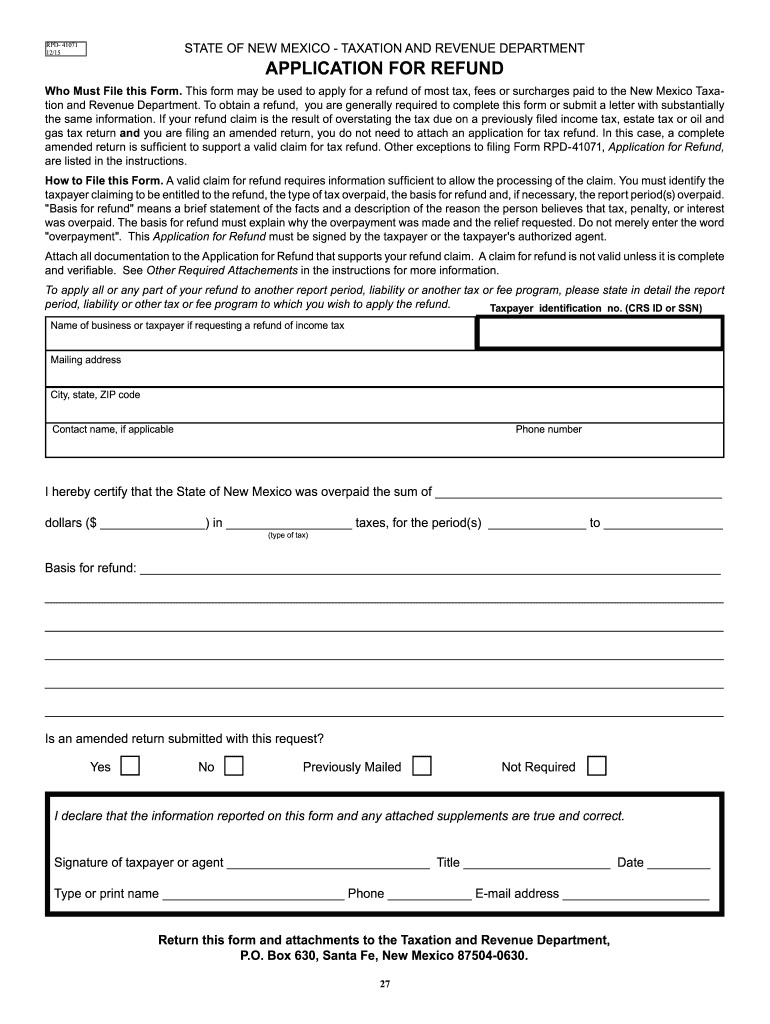

2015 Form NM TRD RPD41071 Fill Online, Printable, Fillable, Blank

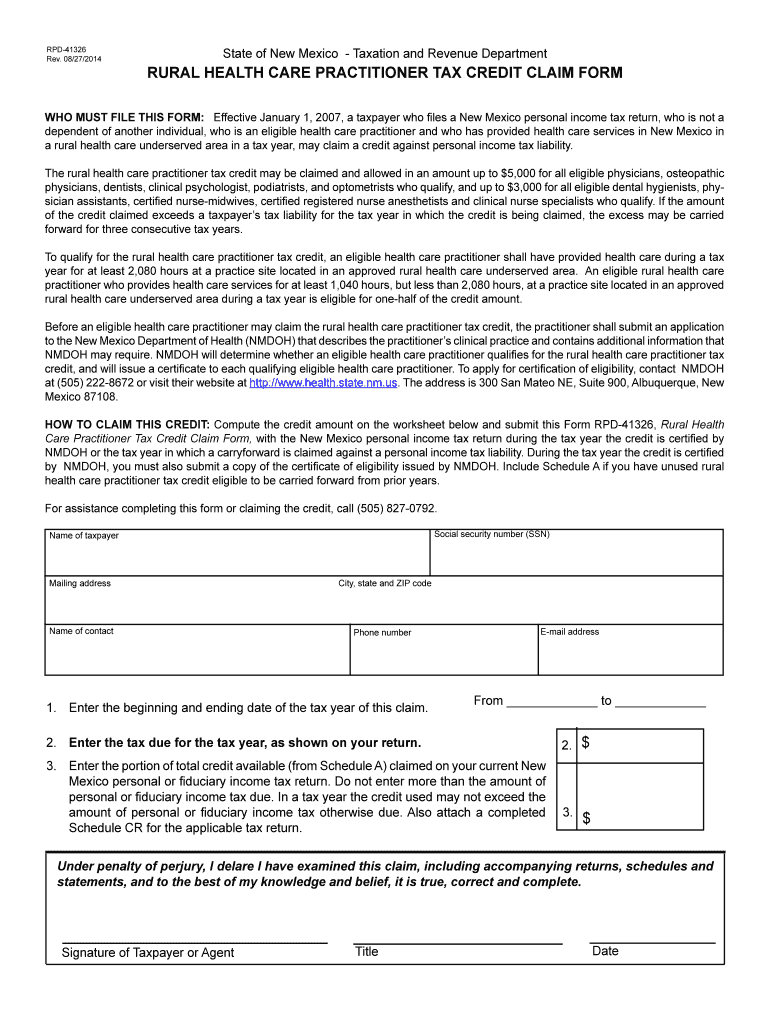

Form NM TRY RPD 41326 Fill Online, Printable, Fillable Fill Out and

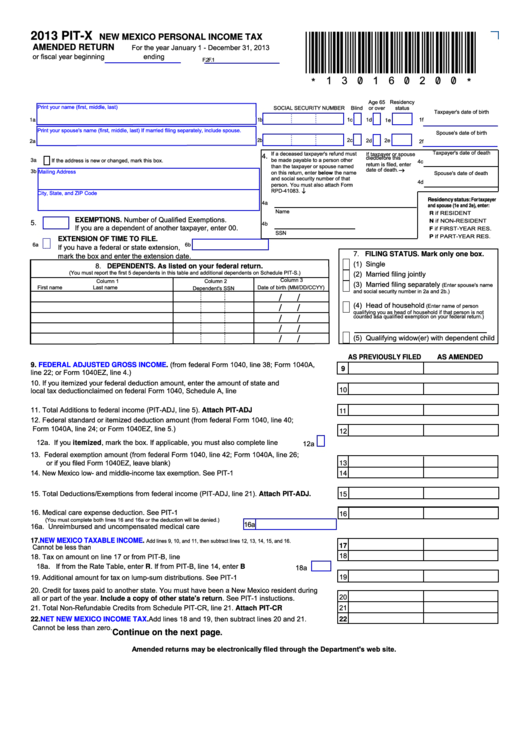

Fillable Form PitX New Mexico Personal Tax Amended Return

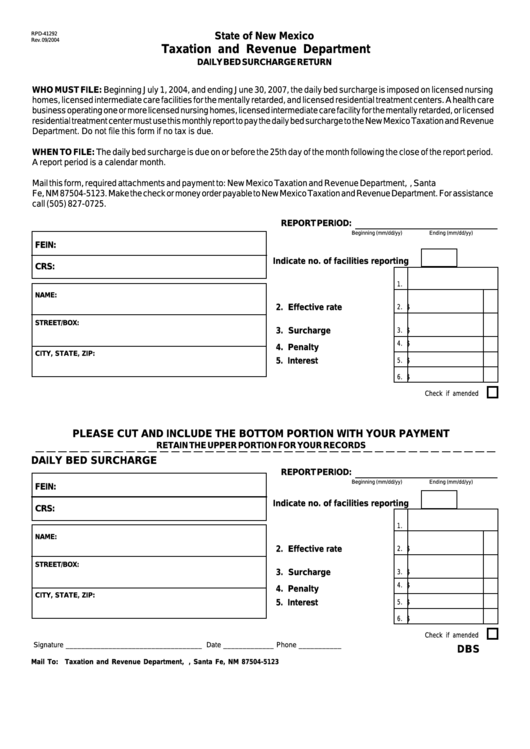

Fillable Form Rpd41292 Daily Bed Surcharge Return New Mexico

NM TRD RPD41227 20162022 Fill out Tax Template Online

Related Post: