Form 5405 Turbotax

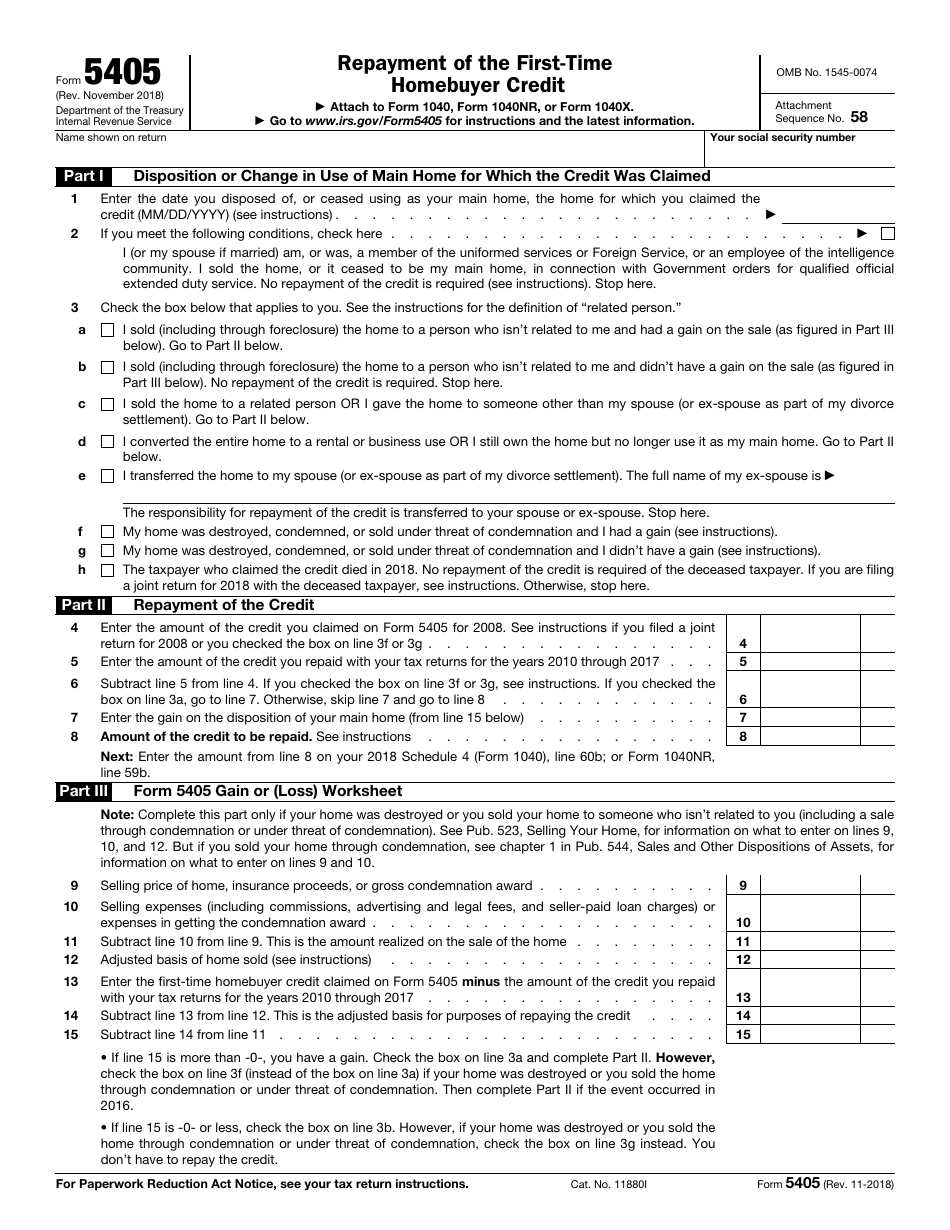

Form 5405 Turbotax - Web form 5405 does not need to be completed if the home is still the taxpayer's main home. Answer simple questions about your life, and we’ll fill out the. Notify the irs that the home for which you claimed the credit was disposed of or. Ad save time and money with professional tax planning & preparation services. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Tax forms included with turbotax cd/download products. You are responsible for repayment of homebuyer credit. Web if you dispose of the home or if you (and your spouse if married) stopped using it as your principal residence in 2022, you must attach a completed form 5405 for you (and your. Forms, deductions, tax filing and more. The exceptions to repayment of. Forms, deductions, tax filing and more. In that case, only enter the annual credit repayment in the tax return. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. You disposed of it in 2022. Ad. Tax forms included with turbotax cd/download products. Ad thousands of highly rated, verified tax professionals. Web if you dispose of the home or if you (and your spouse if married) stopped using it as your principal residence in 2022, you must attach a completed form 5405 for you (and your. Web you must file form 5405 with your 2022 tax. Web if you dispose of the home or if you (and your spouse if married) stopped using it as your principal residence in 2022, you must attach a completed form 5405 for you (and your. You may need to report this on form 1040, schedule 2. Web you must file form 5405 with your 2022 tax return if you purchased. Ad thousands of highly rated, verified tax professionals. Web quicken products provided by quicken inc., quicken import subject to change. Minimize potential audit risks and save time when filing taxes each year You disposed of it in 2022. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Answer simple questions about your life, and we’ll fill out the. Easily sign the form with your finger. Open form follow the instructions. The form is used for the credit received if you bought a. Web if you dispose of the home or if you (and your spouse if married) stopped using it as your principal residence in 2022, you. You disposed of it in 2022. Ad thousands of highly rated, verified tax professionals. Minimize potential audit risks and save time when filing taxes each year Open form follow the instructions. You disposed of it in 2021. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Repay the credit on form 5405 and attach it to your form 1040. You ceased using it as your. All features, services, support, prices, offers, terms and conditions are subject to. Web if you. Repay the credit on form 5405 and attach it to your form 1040. Ad save time and money with professional tax planning & preparation services. Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: All features, services, support, prices, offers, terms and conditions are subject. Repay the credit on form 5405 and attach it to your form 1040. You disposed of it in 2022. Taxpayers used it to claim a. November 2022) department of the treasury internal revenue service. Easily sign the form with your finger. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Ask a tax professional anything right now. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Notify the irs that the home for which you claimed the. You disposed of it in 2022. Easily sign the form with your finger. Web quicken products provided by quicken inc., quicken import subject to change. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Taxpayers used it to claim a. All features, services, support, prices, offers, terms and conditions are subject to. Forms, deductions, tax filing and more. Web form 5405 does not need to be completed if the home is still the taxpayer's main home. You are responsible for repayment of homebuyer credit. Tax forms included with turbotax cd/download products. Web if you dispose of the home or if you (and your spouse if married) stopped using it as your principal residence in 2022, you must attach a completed form 5405 for you (and your. You ceased using it as your. ★ ★ ★ ★ ★. The exceptions to repayment of. Ad save time and money with professional tax planning & preparation services. Ad thousands of highly rated, verified tax professionals. Ask a tax professional anything right now. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. In that case, only enter the annual credit repayment in the tax return. Web the irs requires you to prepare irs form 5405 before you can claim the credit.form 2555 turbotax Fill Online, Printable, Fillable Blank irsform

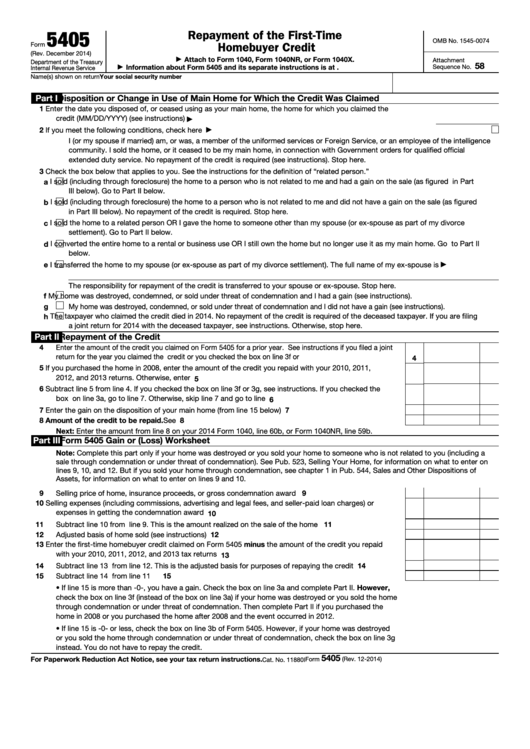

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

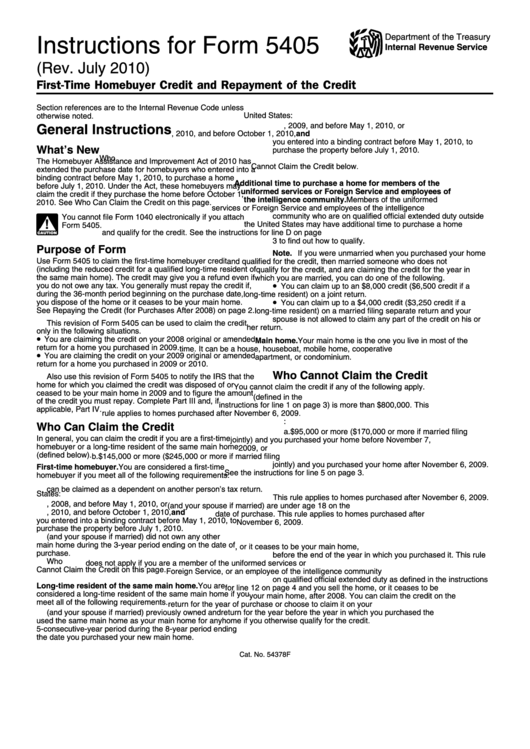

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

form 8949 turbotax 2022 Fill Online, Printable, Fillable Blank form

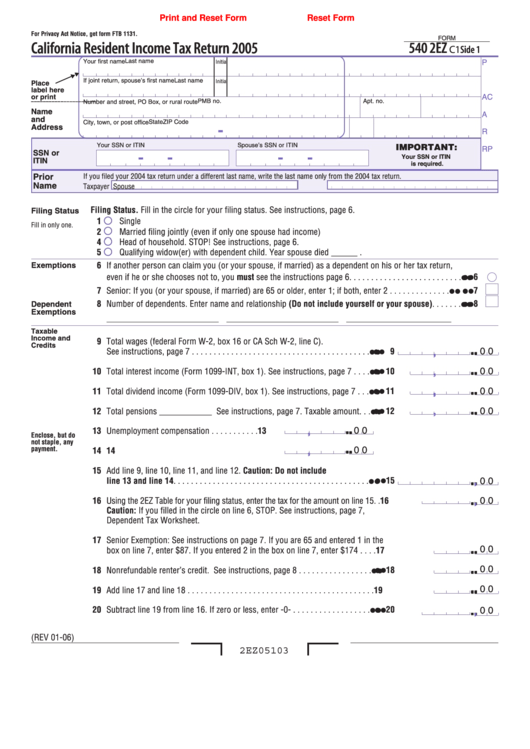

Fillable Form 540 Printable Forms Free Online

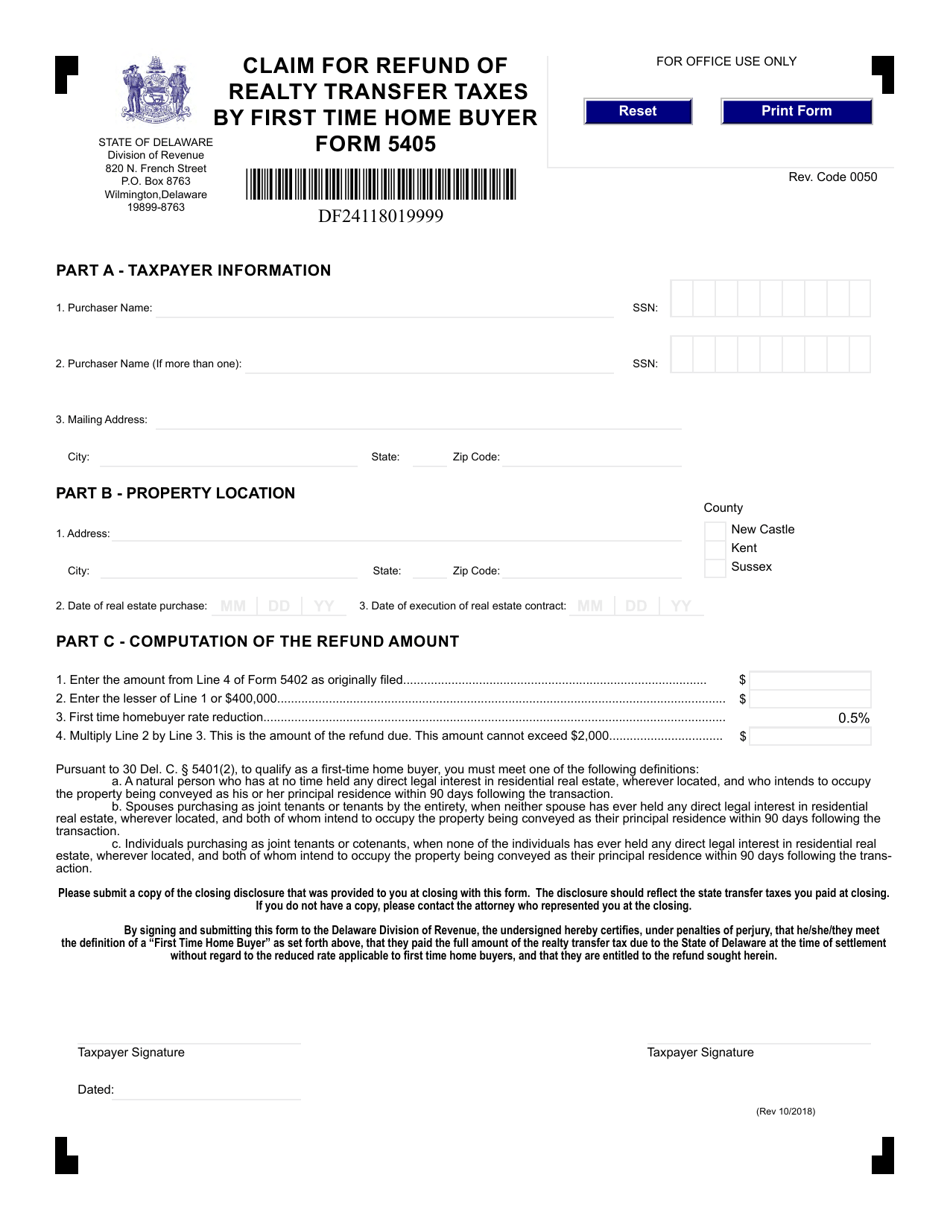

Form 5405 Fill Out, Sign Online and Download Fillable PDF, Delaware

Instructions For Form 5405 (Rev. July 2010) printable pdf download

Form 5405 Sale of Primary Residence YouTube

form 8915 e instructions turbotax Renita Wimberly

IRS Form 5405 Download Fillable PDF or Fill Online Repayment of the

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)