The W-4 Tax Form Is Used To Everfi

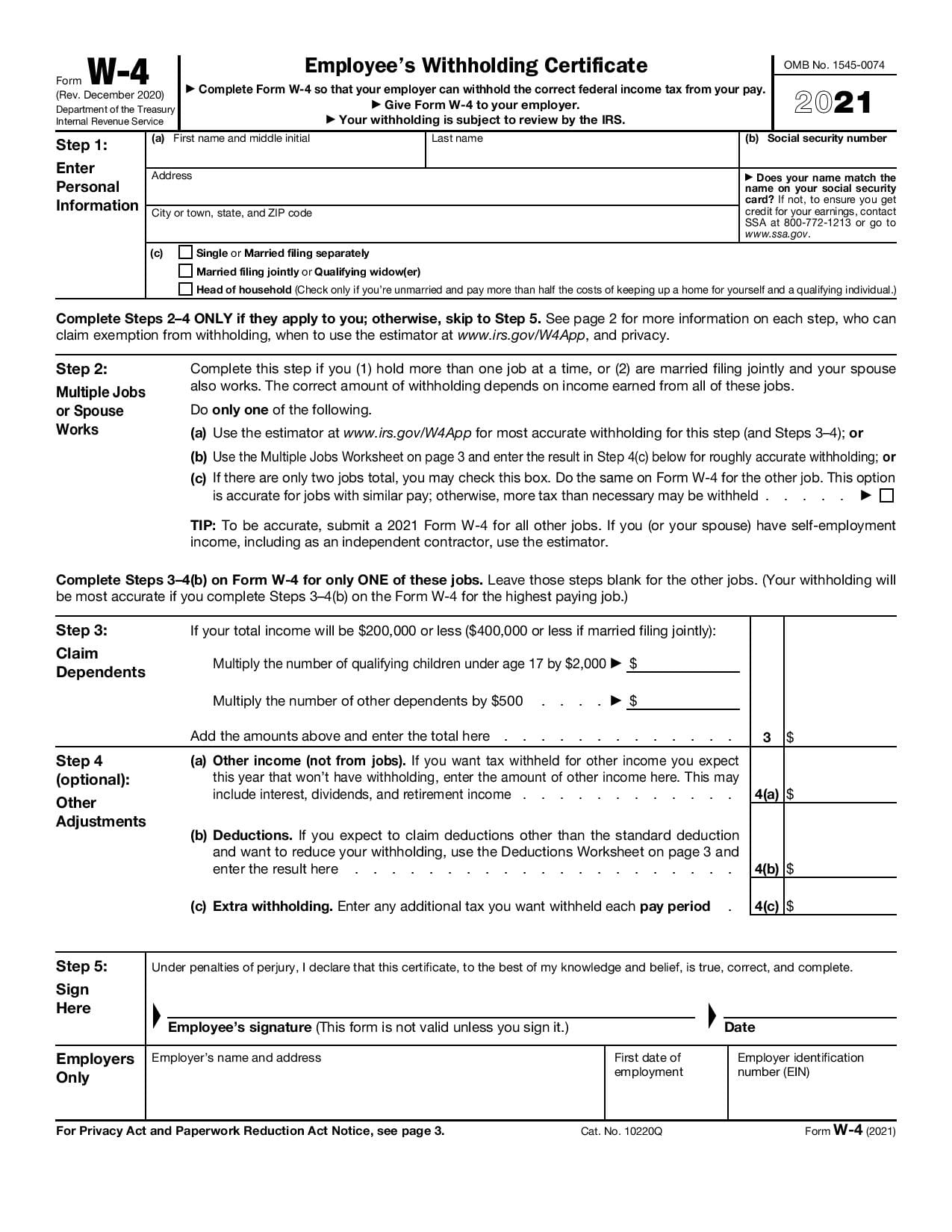

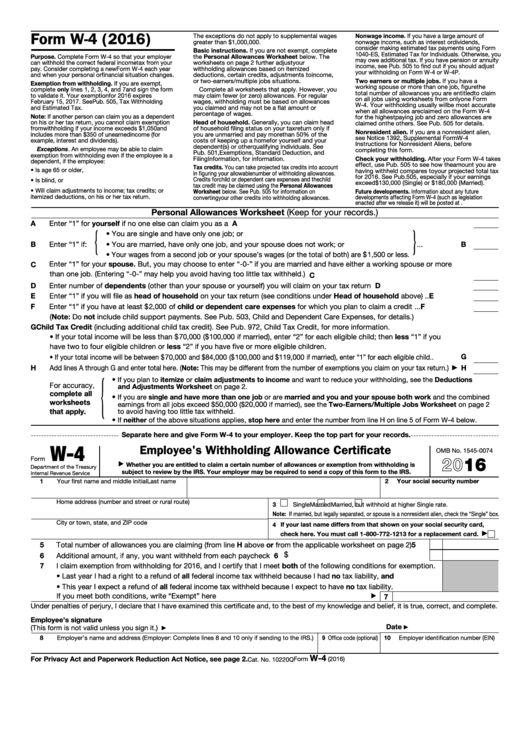

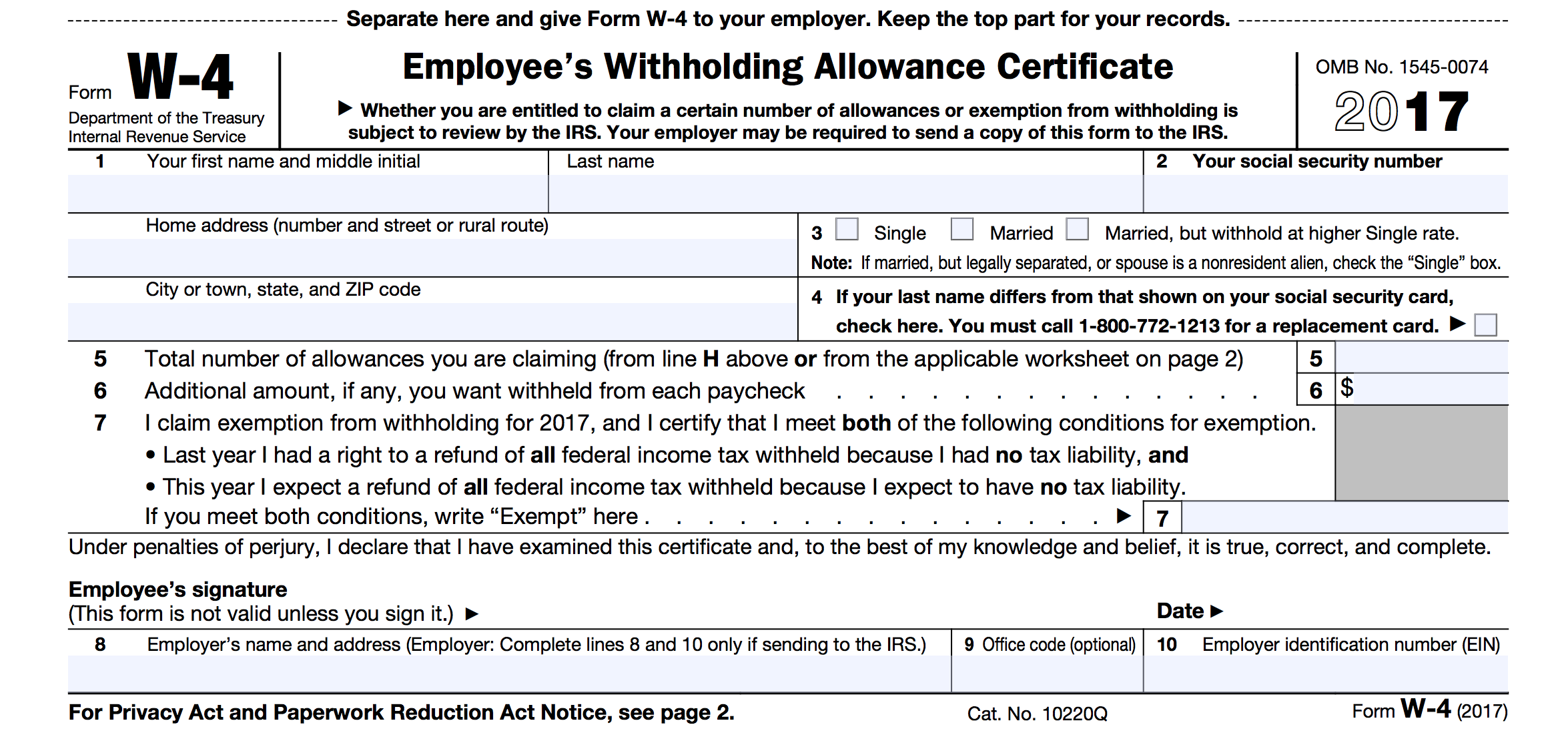

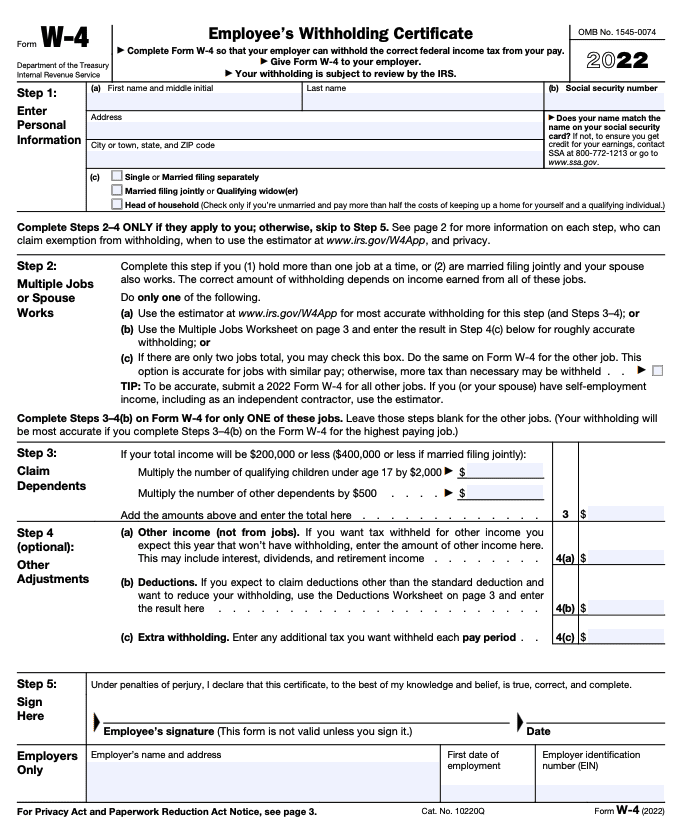

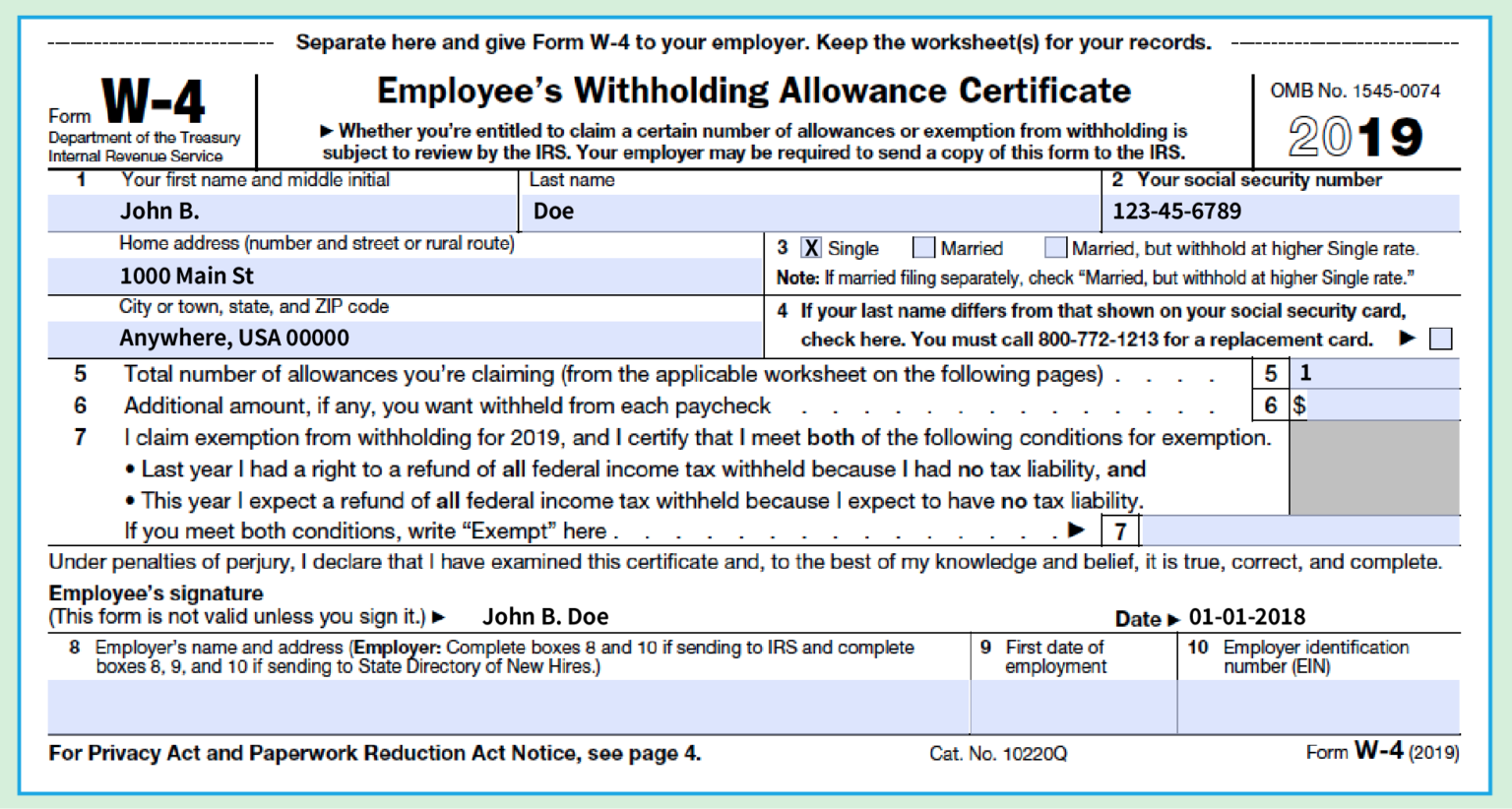

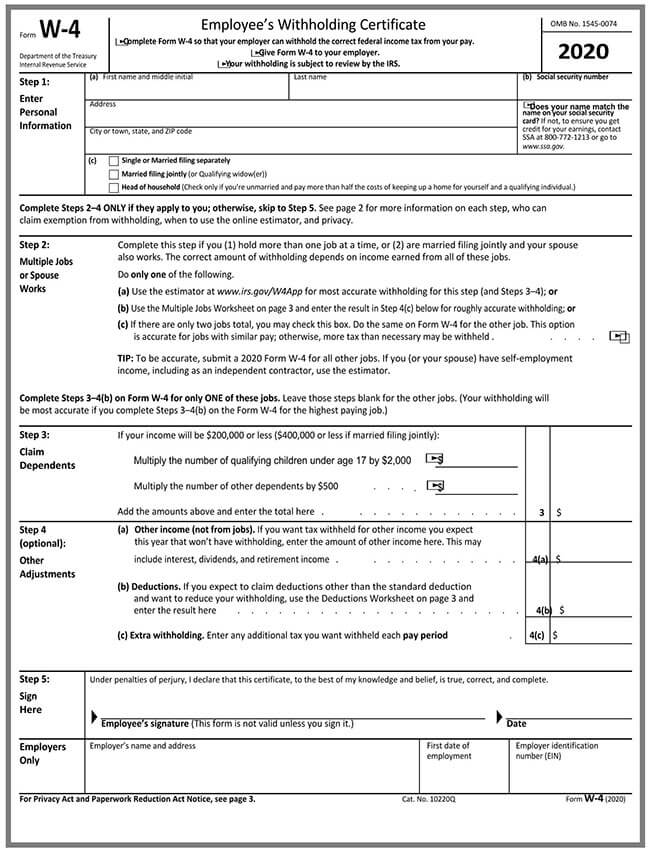

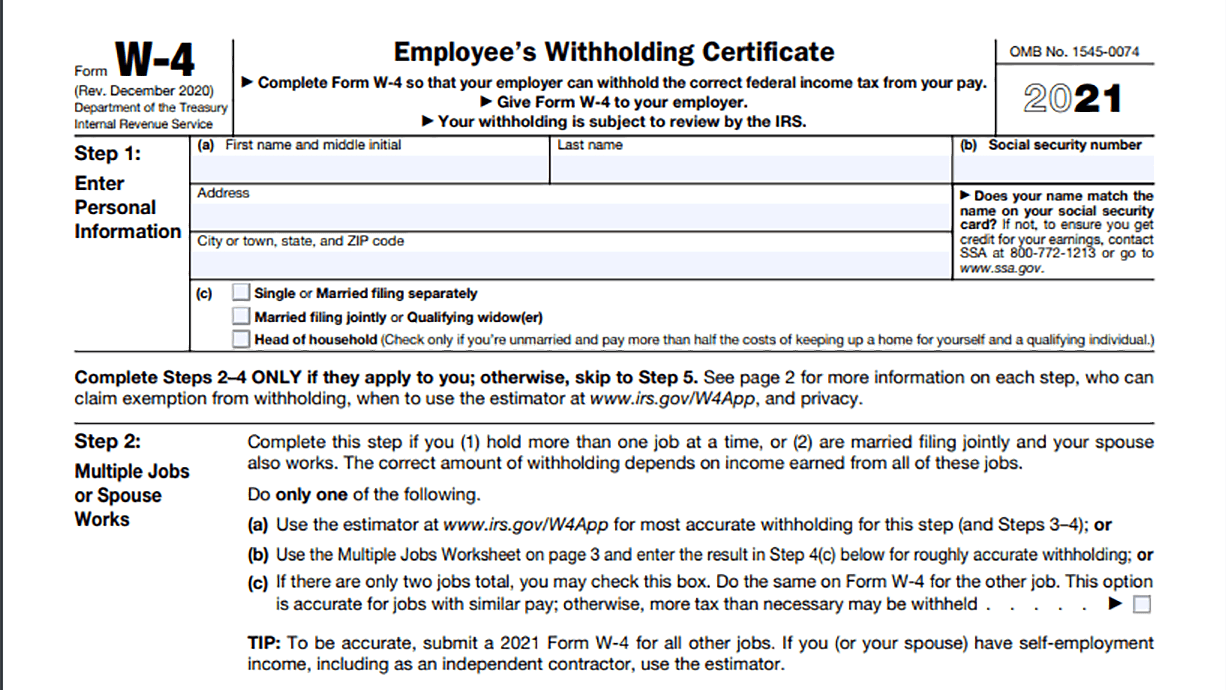

The W-4 Tax Form Is Used To Everfi - 100 n 15th ave, #301. To determine how much federal income. If too little is withheld, you will generally owe tax when you file your tax return. A federal tax form filled out by an employee to indicate the amount that should be. Payroll taxes and federal income tax withholding. If too little is withheld, you will generally owe tax when you file your tax return. Web which of the following is a possible tax or deductions that they may show up on your paycheck? Determine how much your gross pay. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. Web adoa human resources. An employer whose previous 4 quarter arizona withholding average. Payroll taxes and federal income tax withholding. A federal tax form filled out by an employee to indicate the amount that should be. If too little is withheld, you will generally owe tax when you file your tax return. Web the schedule an employer must use will depend on the amount. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. If too little is withheld, you will generally owe tax when you file your tax return. This form determines how much money withheld from your wages for tax purposes. At the end of the year, your employer. If too little is withheld, you. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Web in this video you’ll learn: This form determines how much money withheld from your wages for tax purposes. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Payroll taxes and federal income. A federal tax form filled out by an employee to indicate the amount that should be. 100 n 15th ave, #301. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. Web in this video you’ll learn: Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. In may you will take. If too little is withheld, you will generally owe tax when you file your tax return. Web which of the following is a possible tax or deductions that they may show up on your paycheck? Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Payroll taxes. Determine how much your gross pay. At the end of the year, your employer. Web 2k views streamed 7 days ago. An employer whose previous 4 quarter arizona withholding average. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. If too little is withheld, you will generally owe tax when you file your tax return. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. To determine how much federal income tax your employer should withhold from your paychecks. A federal tax form filled out by an employee to indicate the. Web 2k views streamed 7 days ago. Web in this video you’ll learn: Learn how to calculate and fill in the amounts required on form 1040 from everfi module two: If too little is withheld, you will generally owe tax when you file your tax return. Web adoa human resources. To determine how much federal income. If too little is withheld, you will generally owe tax when you file your tax return. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. Click the card to flip 👆. If too little is withheld, you will generally owe tax when you file your tax return. Click the card to flip 👆. If too little is withheld, you will generally owe tax when you file your tax return. This form determines how much money withheld from your wages for tax purposes. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. In may you will take. Click the card to flip 👆. At the end of the year, your employer. Web students discover how their level of education or job training affects total income over a lifetime. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. Web in this video you’ll learn: Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Learn how to calculate and fill in the amounts required on form 1040 from everfi module two: This form determines how much money withheld from your wages for tax purposes. Payroll taxes and federal income tax withholding. Web adoa human resources. Determine how much your gross pay. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. An employer whose previous 4 quarter arizona withholding average. To determine how much federal income. A federal tax form filled out by an employee to indicate the amount that should be. 100 n 15th ave, #301. In may you will take.How To Fill Out a W4 Form for 2021 Millennial Money

Fillable Form W4 2022 W4 Form

W4 Form 2022 Printable, FAQ, How to Fill Out Ultimate Guide

Employee Tax Form W 4 2022 W4 Form

W4 Form (What It Is & How to Fill It Out) Millennial Money

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

How to Fill a W4 Form (with Guide)

What you should know about the new Form W4 Atlantic Payroll Partners

Did the W4 Form Just Get More Complicated? GoCo.io

W4 Form How to Fill It Out in 2023

Related Post:

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)