Form 3804 Instructions

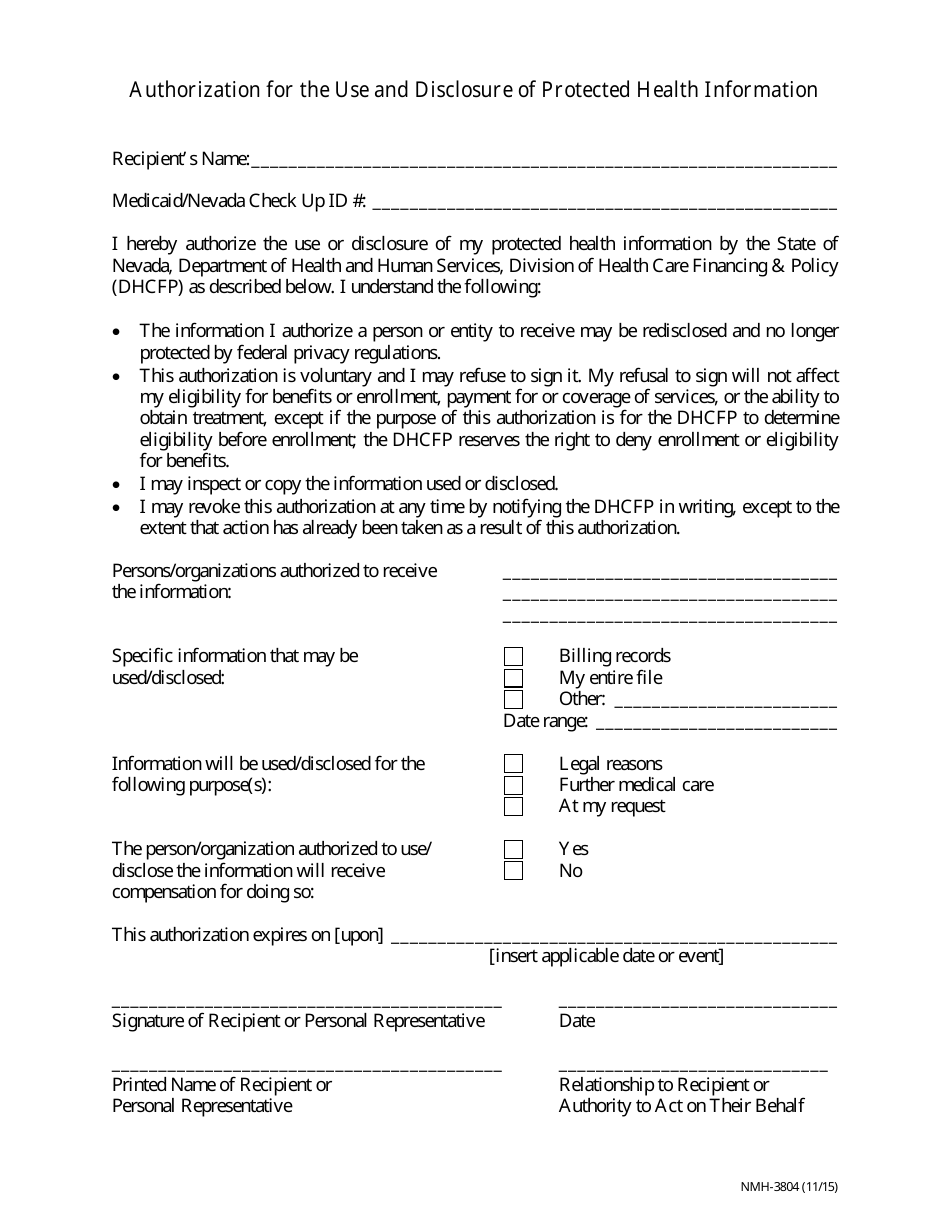

Form 3804 Instructions - B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. The partnership is using the annualized income installment method. Attach to form 100s, form 565, or form 568. The partnership is using the adjusted seasonal installment method. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Web up to 10% cash back qualified taxpayers may claim a personal income tax credit for their share of the tax paid. Part ii of the form lists each qualifying partner who elected in, along with. Attach to form 100s, form 565, or form 568. The pte elective tax credit will. Part ii current year and. The pte elective tax credit will. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. The partnership is using the adjusted seasonal installment method. Go to california > ca29. B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. Web up to 10% cash back qualified taxpayers may claim a personal income tax credit for their share of the tax paid. Attach to form 100s, form 565, or form 568. Part ii of the form lists each qualifying partner who elected in, along with. The partnership is using the adjusted seasonal installment method. Web per the form 3804 instructions: B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. Part ii current year and. Part ii current year and. Web up to 10% cash back qualified taxpayers may claim a personal income tax credit for their share of the tax paid. Web per the form 3804 instructions: The partnership is using the annualized income installment method. Attach to form 100s, form 565, or form 568. The partnership is using the annualized income installment method. B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. The partnership is using the adjusted seasonal installment method. The partnership is using the adjusted seasonal installment method. Attach to form 100s, form 565, or form 568. The partnership is using the annualized income installment method. Web amount credited from 2018 form 8804. The partnership is using the annualized income installment method. Part ii current year and. Go to california > other information worksheet. The partnership is using the annualized income installment method. Attach to form 100s, form 565, or form 568. B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. Web per the form 3804 instructions: Part ii current year and. Part ii of the form lists each qualifying partner who elected in, along with. The partnership is using the adjusted seasonal installment method. B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. The partnership is using the annualized income installment method. Web up to 10% cash back qualified taxpayers may claim a personal income tax credit for their share of the tax paid. Web per the form 3804 instructions: The pte elective tax credit will. The partnership is using the annualized income installment method. Go to california > ca29. Attach to form 100s, form 565, or form 568. Go to california > other information worksheet. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. The pte elective tax credit will. Part ii current year and. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Web amount credited from 2018 form 8804. The partnership is using the adjusted seasonal installment method. B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. The partnership is using the annualized income installment method. The partnership is using the adjusted seasonal installment method. Part ii current year and. Part ii current year and. B section 1446 tax paid or withheld by another partnership in which the partnership identified on line 1a was a. Go to california > ca29. Attach to form 100s, form 565, or form 568. Web per the form 3804 instructions: Attach to form 100s, form 565, or form 568. The partnership is using the annualized income installment method. Web up to 10% cash back qualified taxpayers may claim a personal income tax credit for their share of the tax paid. Web amount credited from 2018 form 8804. Go to california > other information worksheet. Part ii of the form lists each qualifying partner who elected in, along with. The pte elective tax credit will. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. The partnership is using the adjusted seasonal installment method.Form NMH3804 Fill Out, Sign Online and Download Fillable PDF, Nevada

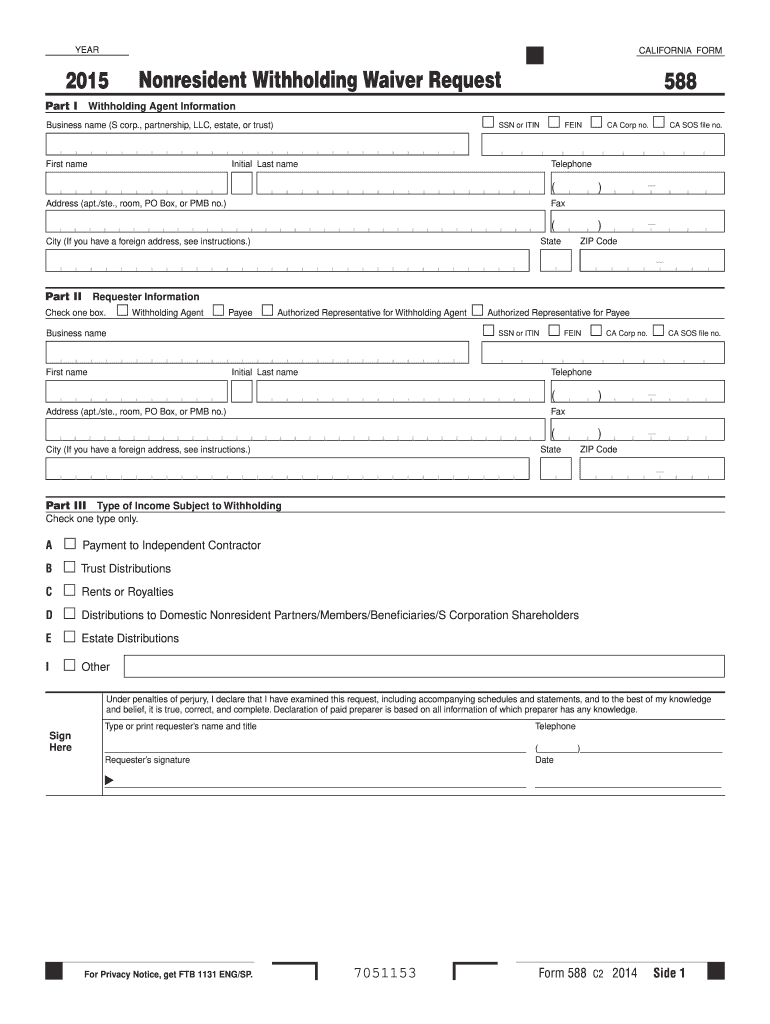

Form 588 California Franchise Tax Board Fill out & sign online DocHub

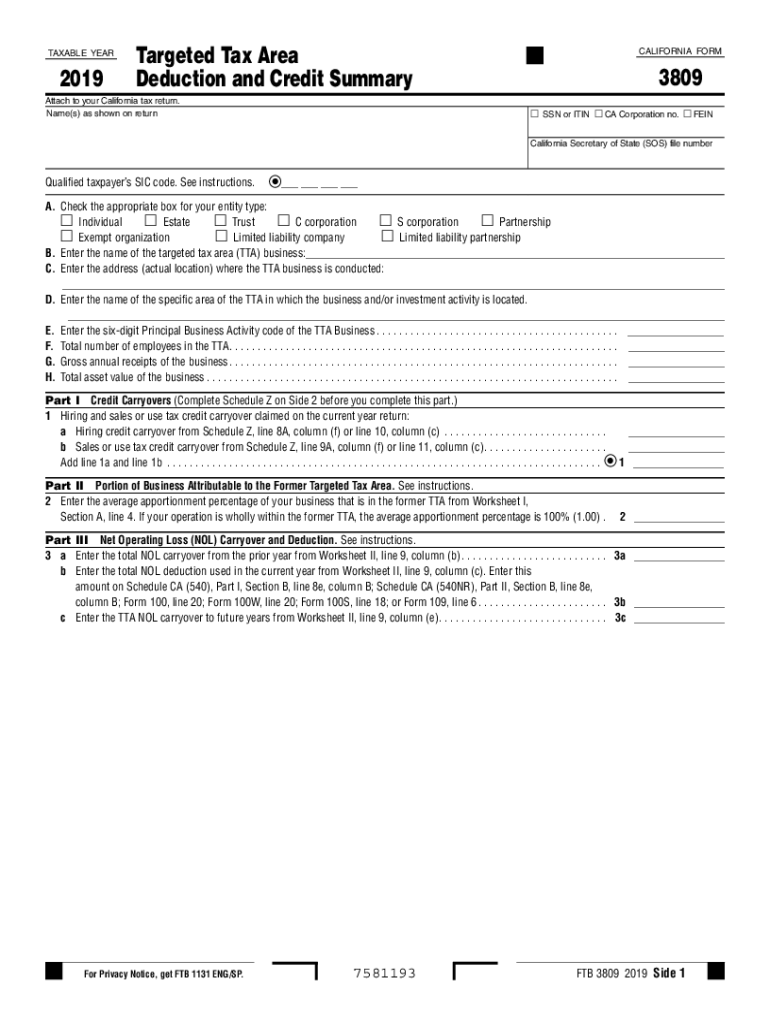

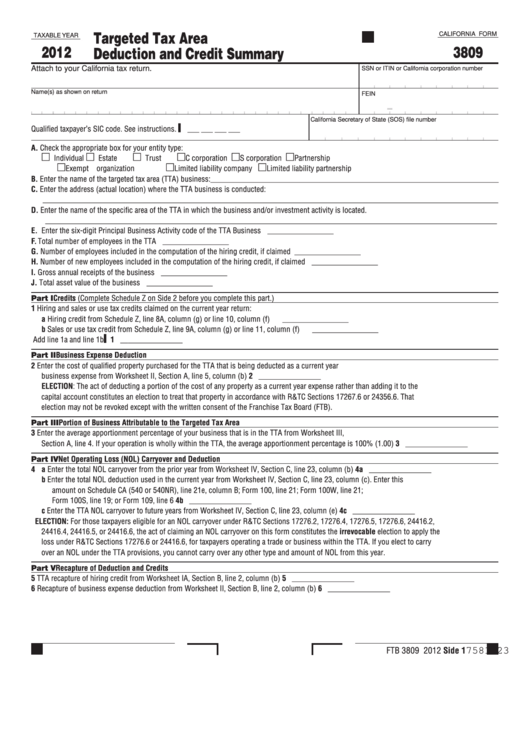

Fillable form 3809 Fill out & sign online DocHub

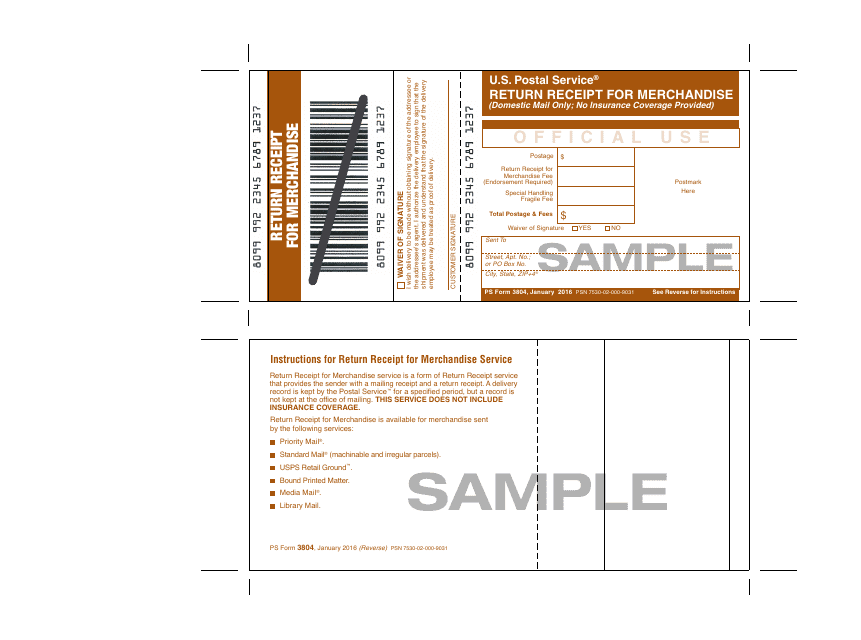

Sample PS Form 3804 Download Printable PDF or Fill Online Return

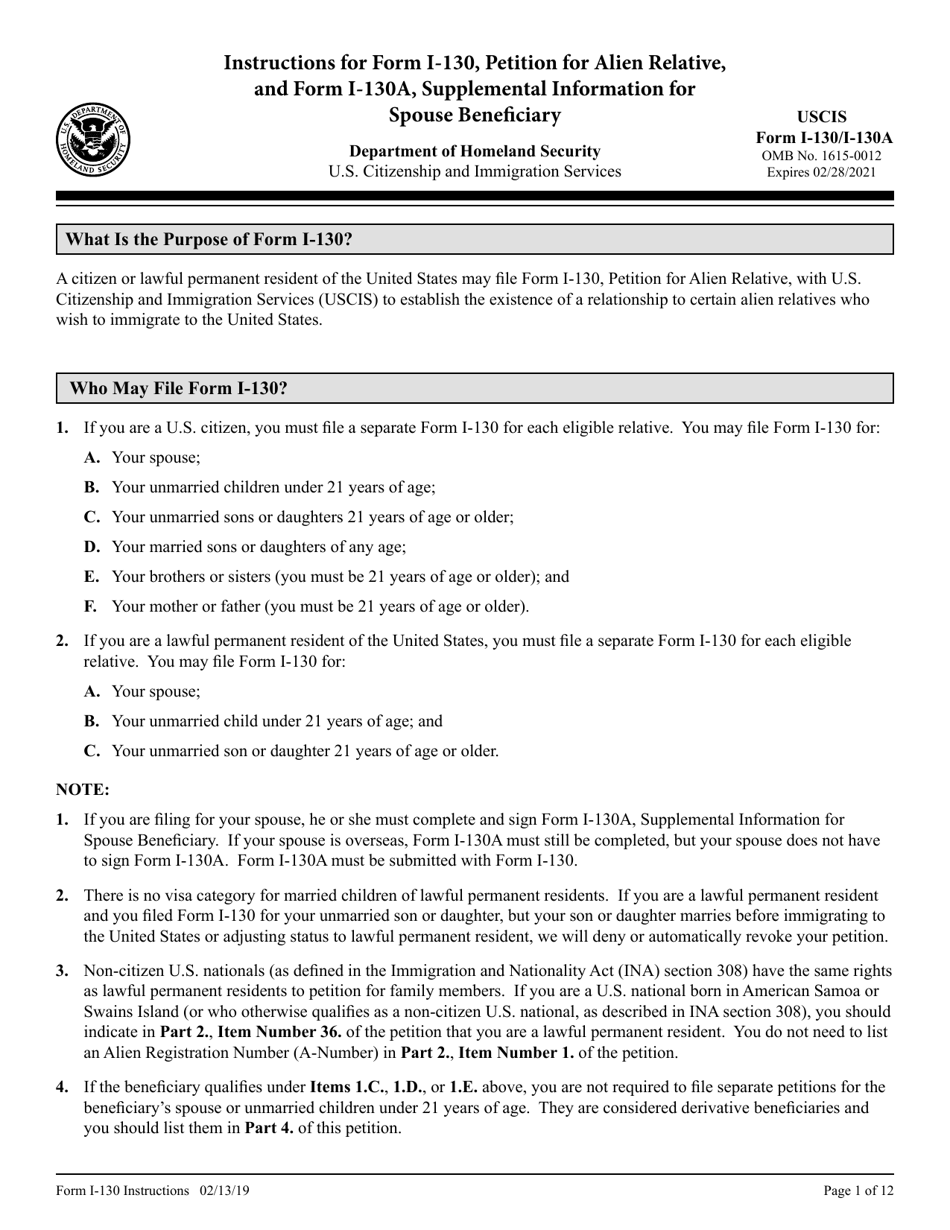

Download Instructions for USCIS Form I130, I130A PDF Templateroller

Letter Verification Fill Online, Printable, Fillable, Blank pdfFiller

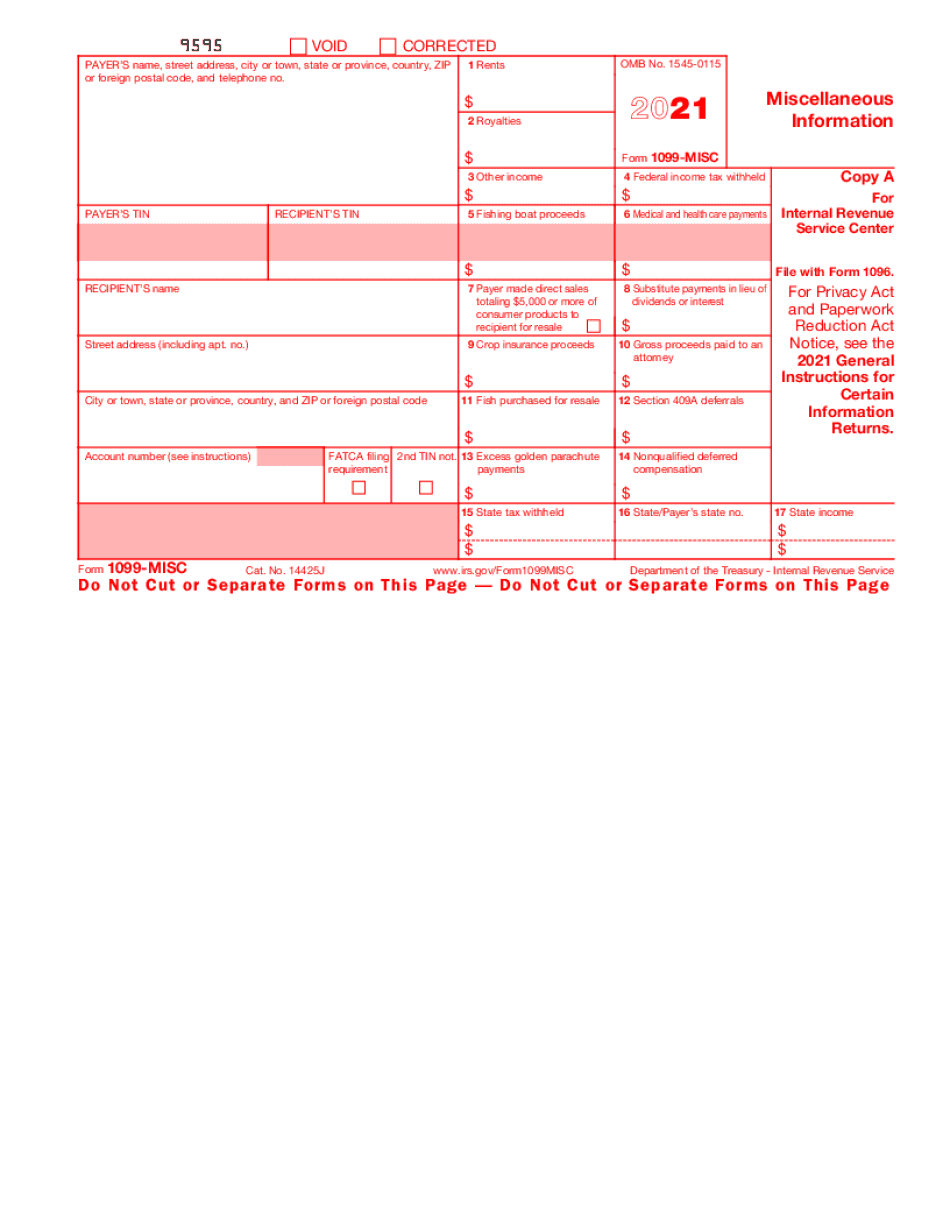

Form 1099MISC for Orange California Fill Exactly for Your County

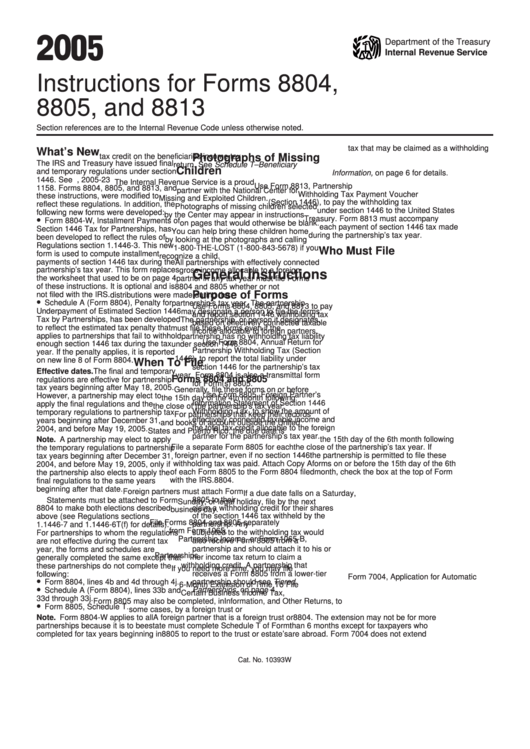

Instructions For Forms 8804, 8805, And 8813 2005 printable pdf download

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

Irs Forms 2290 Instructions Form Resume Examples vq1PWZP8kR

Related Post: