Form Cift 620

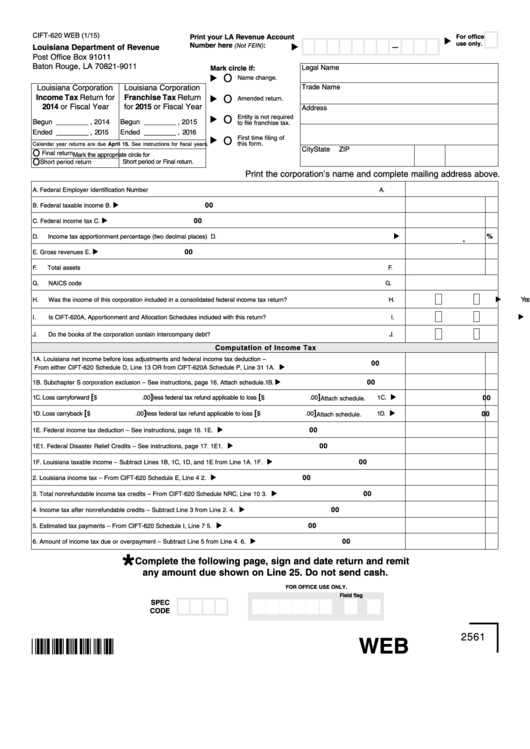

Form Cift 620 - Federal employer identification number a. 2023 estimated tax voucher for corporations. *complete the following page, sign and date return and remit any. Print the amount from schedule d, line 13 or schedule p, line 31. O first time filing of this form. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed. Short period filers mark this box and see the instructions. Enter the amount of line 1 or $300,000,. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below:. O entity is not required to file franchise tax. *complete the following page, sign and date return and remit any. O first time filing of this form. Enter the amount of line 1 or $300,000, whichever is less. Short period filers mark this box and see the instructions. When to file a 2020 calendar year return is due on or before may 15, 2021. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below:. Returns for fiscal years are. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed. 2023 estimated. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: O entity is not required to file franchise tax. *complete the following page, sign and date return and remit any. When to file a 2020 calendar year return is due on or before may 15, 2021. A foreign corporation is subject. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed. Enter the amount of line 1 or $300,000, whichever is less. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: A foreign corporation is subject to the franchise tax if it meets. Short period filers mark this box and see the instructions. O first time filing of this form. Print the amount from schedule d, line 13 or schedule p, line 31. When to file a 2020 calendar year return is due on or before may 15, 2021. O entity is not required to file franchise tax. Returns for fiscal years are. *complete the following page, sign and date return and remit any. O entity is not required to file franchise tax. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below:. A foreign corporation is subject to the franchise tax if it meets any one of the. 2023 estimated tax voucher for corporations. Enter the amount of line 1 or $300,000, whichever is less. Enter the amount of line 1 or $300,000,. *complete the following page, sign and date return and remit any. O entity is not required to file franchise tax. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed. Short period filers mark this box and see the instructions. Federal employer identification number a. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: Returns for fiscal years are. O first time filing of this form. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: Returns for fiscal years are. 2023 estimated tax voucher for corporations. Enter the amount of line 1 or $300,000, whichever is less. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below:. O first time filing of this form. 2023 estimated tax voucher for corporations. Print the amount from schedule d, line 13 or schedule p, line 31. Enter the amount of line 1 or $300,000, whichever is less. Enter the amount of line 1 or $300,000, whichever is less. Returns for fiscal years are. Enter the amount of line 1 or $300,000,. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: Federal employer identification number a. When to file a 2020 calendar year return is due on or before may 15, 2021. O first time filing of this form. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below:. Short period filers mark this box and see the instructions. 2023 estimated tax voucher for corporations. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed below: Print the amount from schedule d, line 13 or schedule p, line 31. A foreign corporation is subject to the franchise tax if it meets any one of the criteria listed. O entity is not required to file franchise tax. *complete the following page, sign and date return and remit any.Form Cift 620 ≡ Fill Out Printable PDF Forms Online

Louisiana form cift 620 2016 Fill out & sign online DocHub

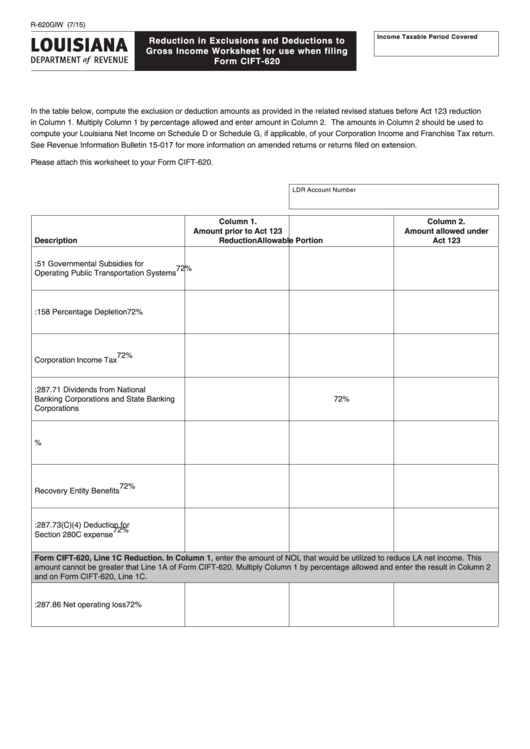

Fillable Form Cift620 Reduction In Exclusions And Deductions To

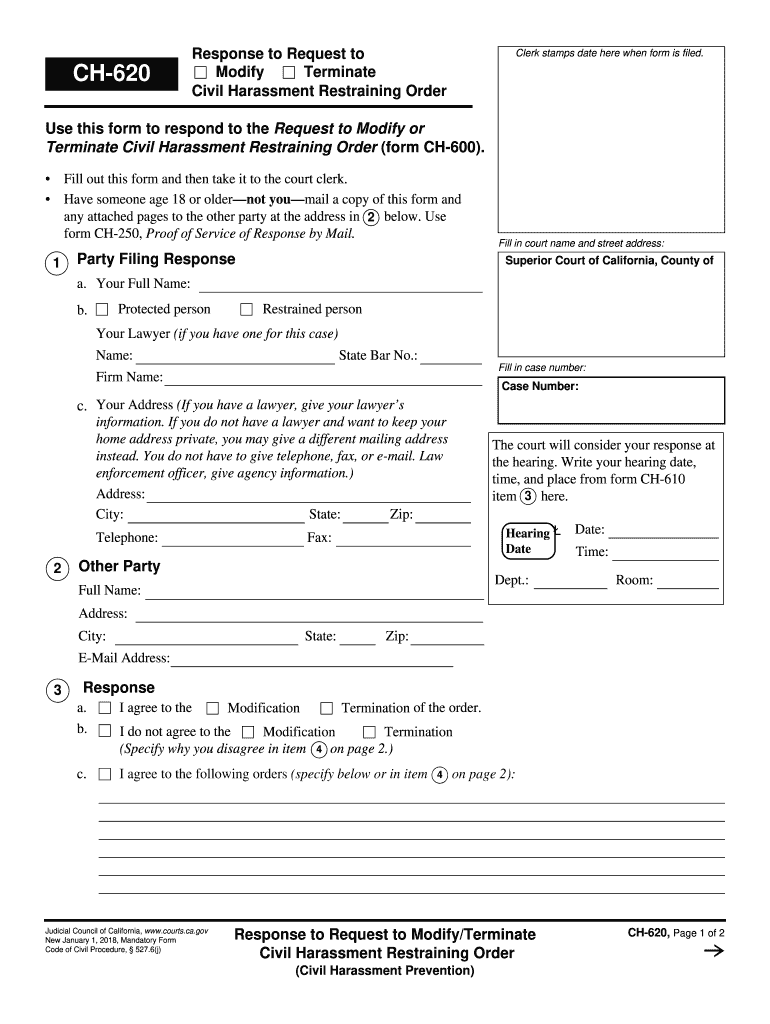

Ch 620 Fill Online, Printable, Fillable, Blank pdfFiller

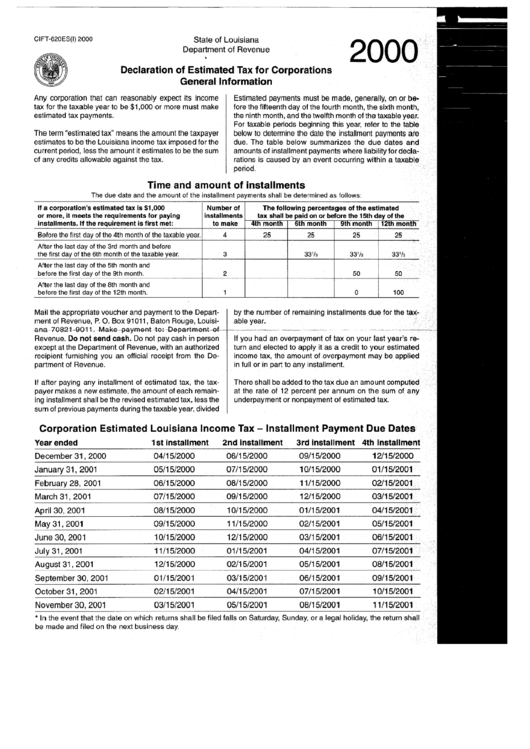

Form Cift620es(I) Worksheet For Estimating Corporation Tax

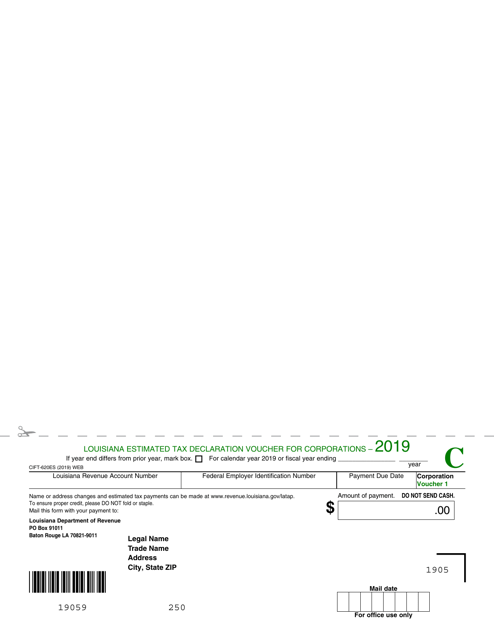

Form CIFT620ES 2019 Fill Out, Sign Online and Download Fillable

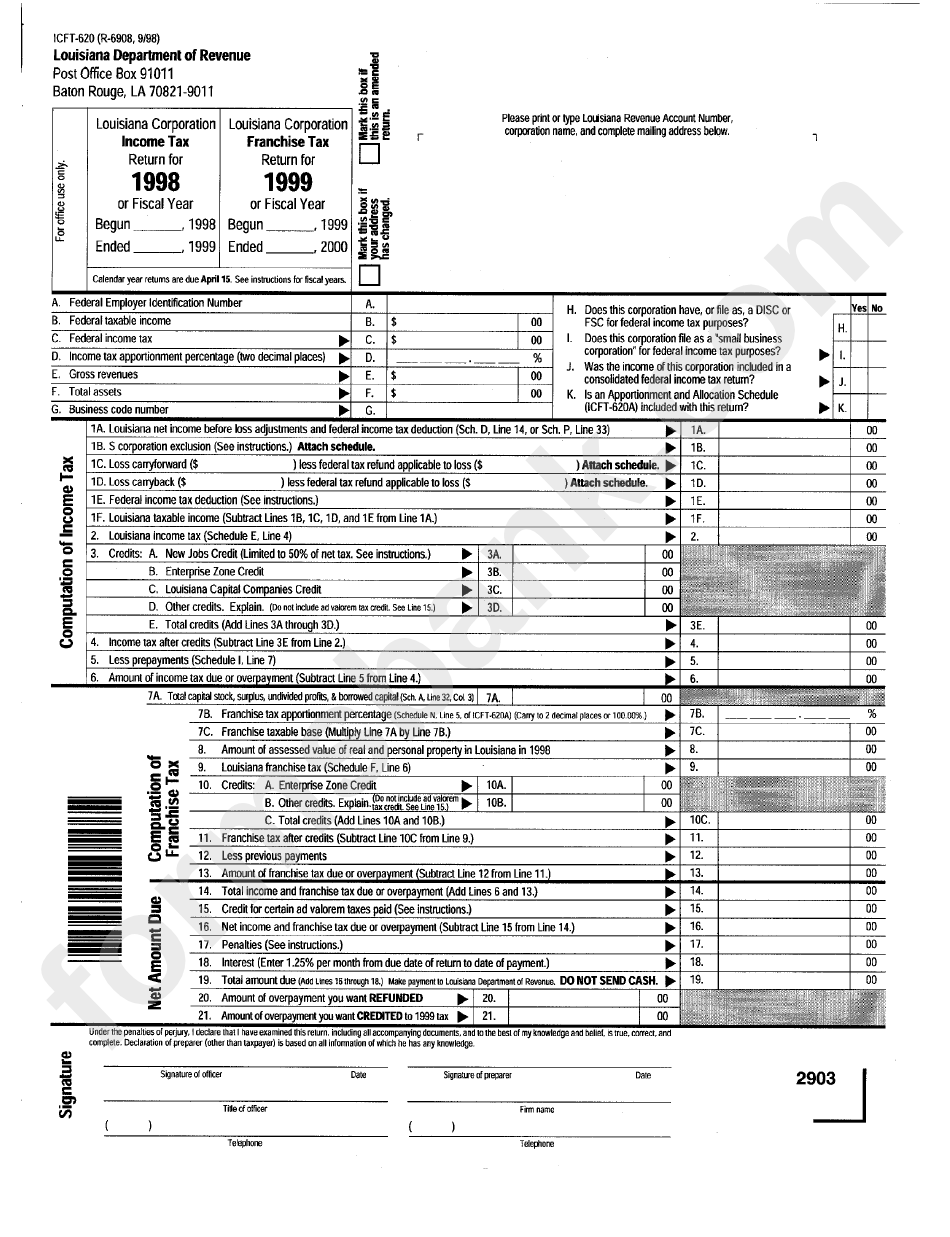

Fillable Form Icft620 Louisiana Corporation And Franchise Tax

Fillable Form Cift620 Louisiana Corporation Tax Return

Louisiana Form Cift 620 ≡ Fill Out Printable PDF Forms Online

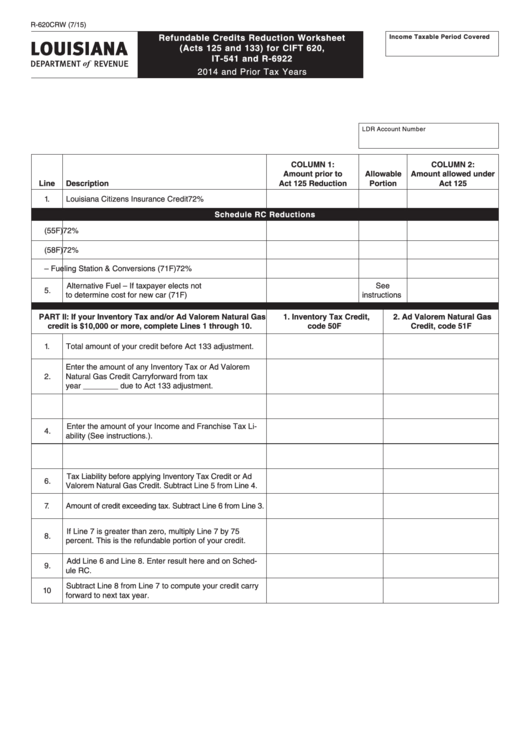

Fillable Form R620crw Refundable Credits Reduction Worksheet (Acts

Related Post: