Texas Form 50-114 Instructions

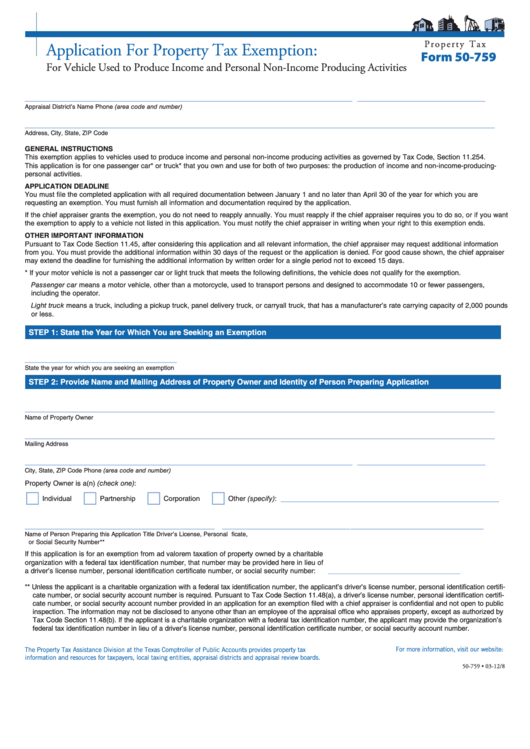

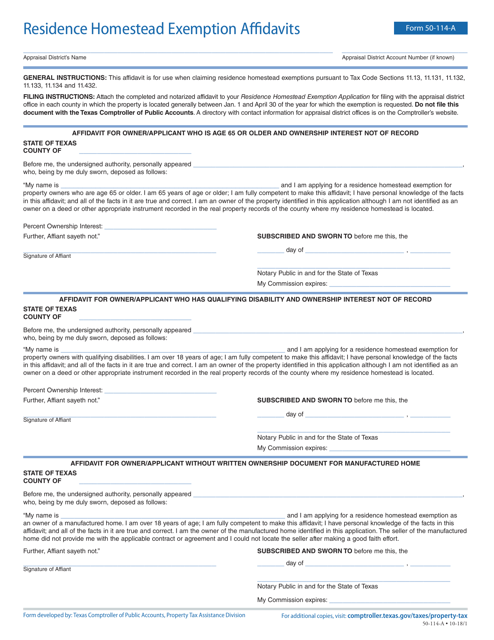

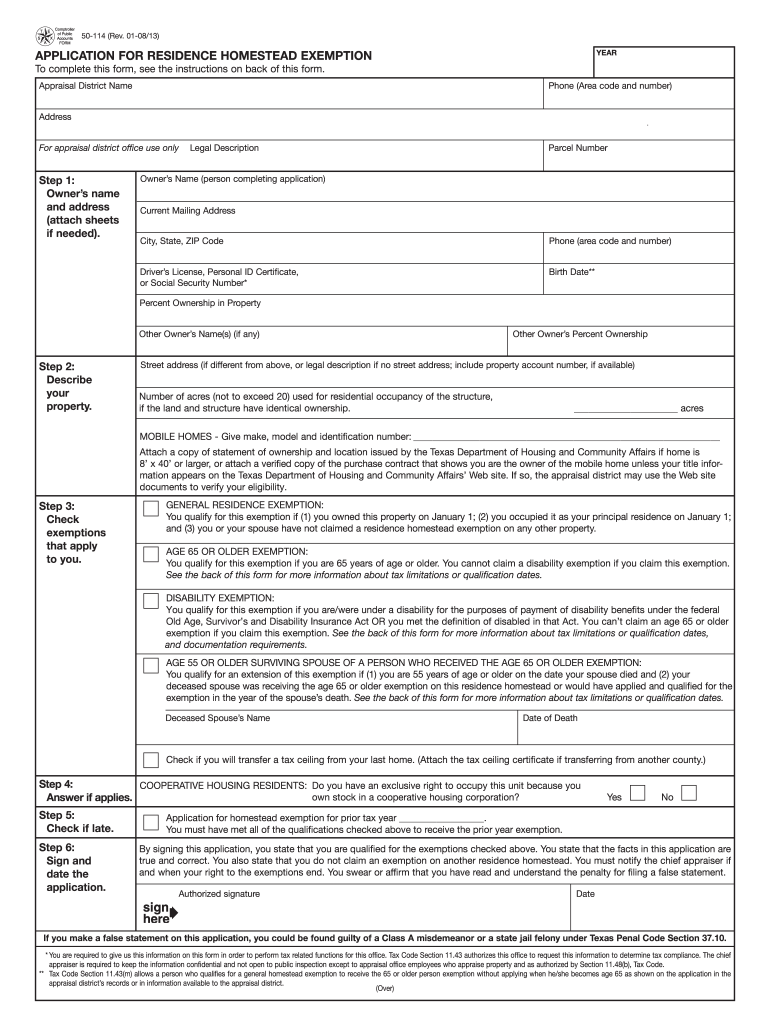

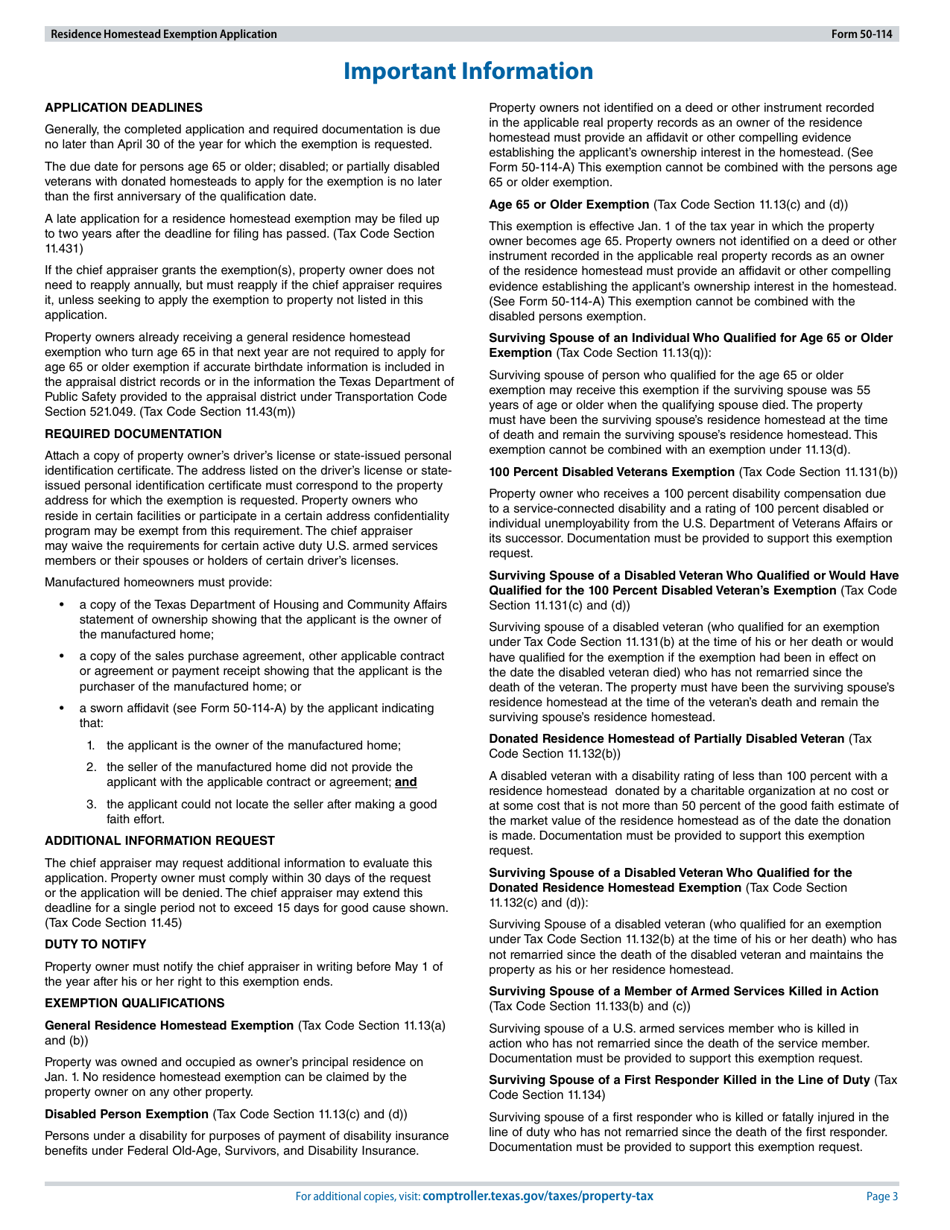

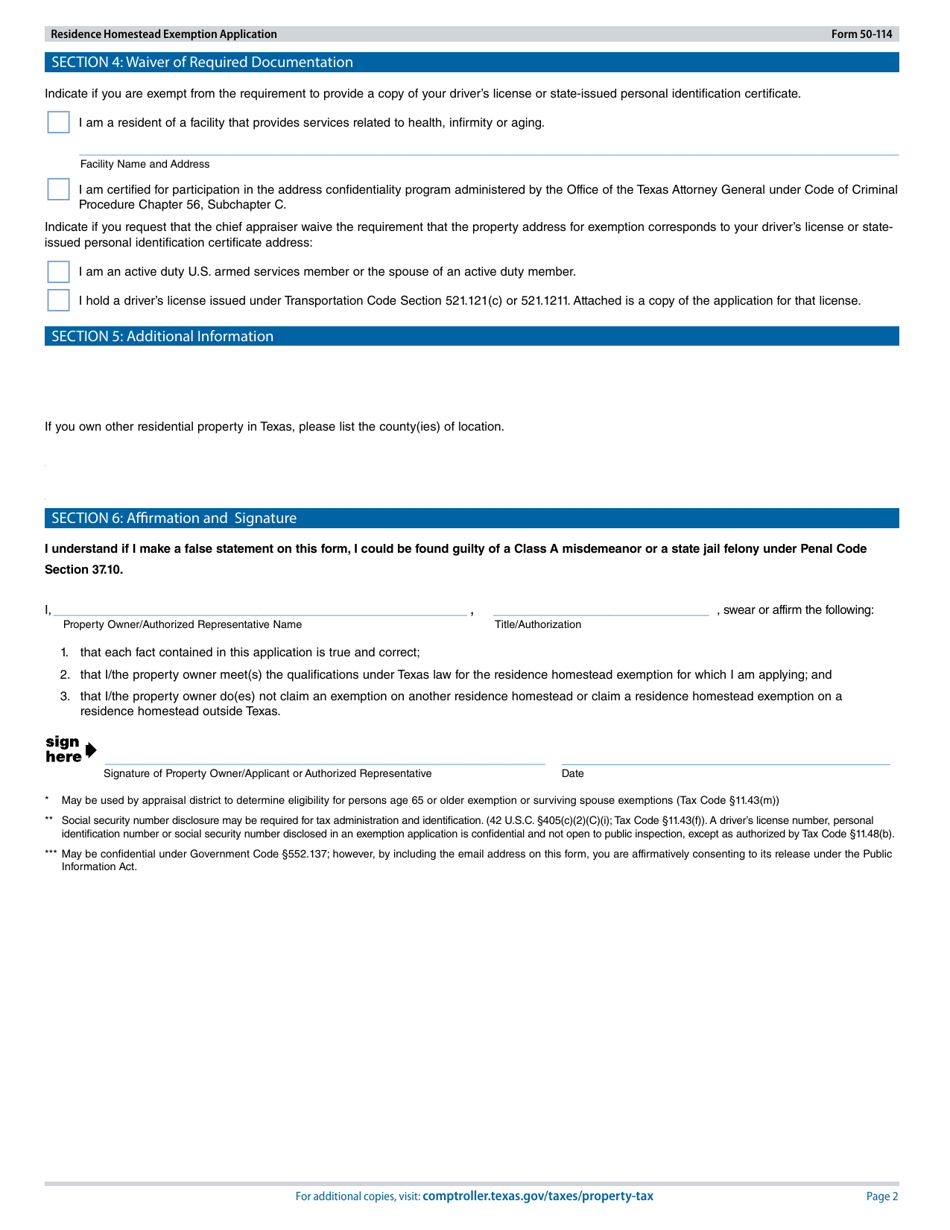

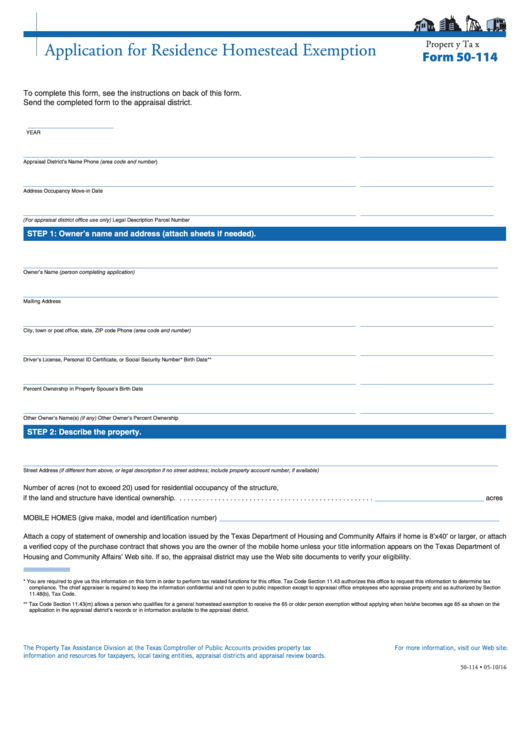

Texas Form 50-114 Instructions - Web as of may 22, 2022, the texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing. Web quick steps to complete and design form 50 114 bexar county online: Web texas or another state, and all information provided in this application is true and correct.. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Get ready for tax season deadlines by completing any required tax forms today. Instructions for filling out the form are provided in the form itself. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. Use get form or simply click on the template preview to open it in the editor. Click on the get form. Web quick steps to complete and design form 50 114 bexar county online: Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. Get ready for tax season deadlines by completing any required tax forms today. Property owners may qualify for a general residence homestead exemption, for the applicable. Click on the get form. Instructions for filling out the form are provided in the form itself. Get ready for tax season deadlines by completing any required tax forms today. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. Texas state comptroller of public accounts keywords;50114a; This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. Web manufactured homes must meet additional requirements for a statement of ownership and location, but if you did not receive the paperwork from the prior owner. Get ready for tax season deadlines by completing any required tax forms today.. Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon. Web texas or another state, and all information provided in this application is true and correct.. Click on the get form. Web quick steps to complete and design form 50 114 bexar county online: Use get form or simply click. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. Instructions for filling out the form are provided in the form itself. Counties, cities, and special taxing. Our guide how to fill a. Web texas or another state, and all information provided in this application is. Do not file this document with the office of the texas. Use get form or simply click on the template preview to open it in the editor. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. Web manufactured homes must meet additional requirements for a statement of ownership. Web quick steps to complete and design form 50 114 bexar county online: Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. Instructions for filling out. Instructions for filling out the form are provided in the form itself. Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon. Web quick steps to complete and design form 50 114 bexar county online: Do not file this document with the office of the texas. Web as of may. Counties, cities, and special taxing. Click on the get form. Web general instructions this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. Web as of. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. Web execute form 50 114 instructions within several clicks following the guidelines listed below: Get ready for tax season deadlines by completing any required tax forms today. Click on the get form. Attach the completed and notarized affidavit to. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in. Get ready for tax season deadlines by completing any required tax forms today. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. Web as of may 22, 2022, the texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Do not file this document with the office of the texas. Get ready for tax season deadlines by completing any required tax forms today. Web manufactured homes must meet additional requirements for a statement of ownership and location, but if you did not receive the paperwork from the prior owner. Texas state comptroller of public accounts keywords;50114a; Our guide how to fill a. Counties, cities, and special taxing. Web quick steps to complete and design form 50 114 bexar county online: Find the template you want in the library of legal form samples. Web texas or another state, and all information provided in this application is true and correct.. Use the tips about how to fill out the tx. Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. Instructions for filling out the form are provided in the form itself. Click on the get form. Web general instructions this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and.Form 50 114 Download Fillable PDF Or Fill Online Residence Homestead

Form 50 114 2017 Fill out & sign online DocHub

Dealers motor vehicle inventory declaration Fill out & sign online

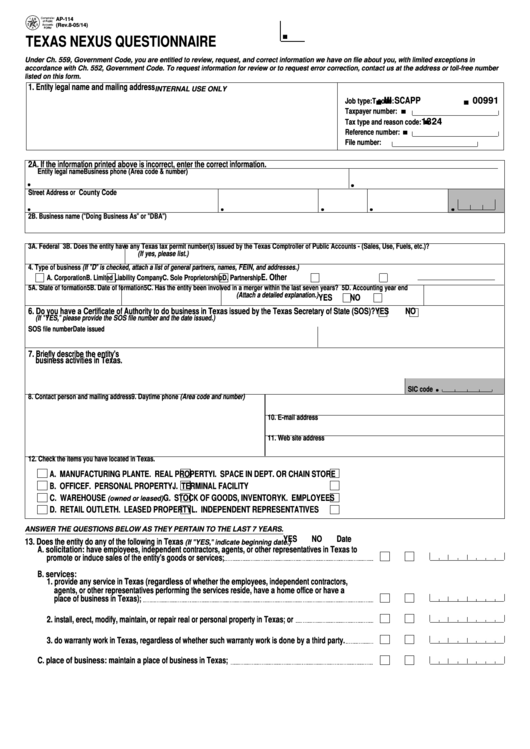

Fillable Form Ap114 Texas Nexus Questionnaire printable pdf download

Form 50114A Fill Out, Sign Online and Download Fillable PDF, Texas

Form 50 114 Example Fill Out and Sign Printable PDF Template signNow

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

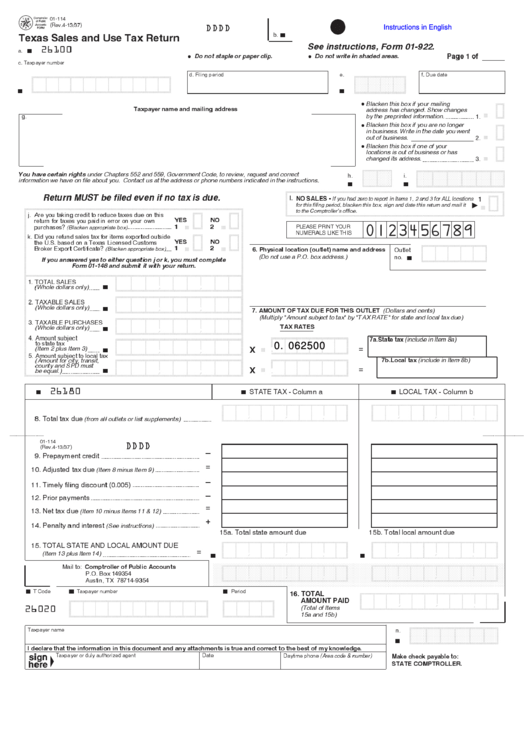

Fillable Form 01114 Texas Sales And Use Tax Return printable pdf

Fillable Form 50114 Application For Residence Homestead Exemption

Related Post: