Texas A&M Tax Exempt Form

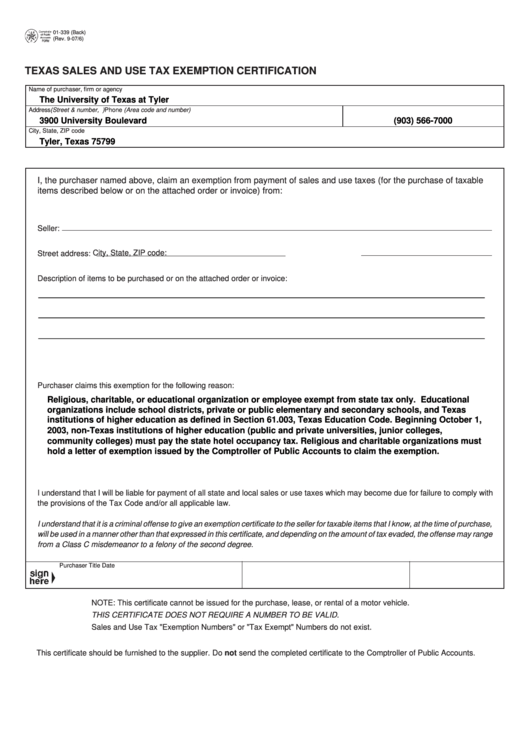

Texas A&M Tax Exempt Form - Ad collect and report on exemption certificates quickly to save your company time and money. Web texas sales and use tax exemption certificate. 151.310 and 171.063) the texas tax code provides an exemption from franchise tax. Web texas sales and use tax exemption certificate. Web the texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. We are exempt from paying texas. Texas sales and use tax exemption. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Sample texas a&m university invoice (reimburse texas a&m) stipend. Learn more about states' sales, property & locality taxes. Web the texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. We are exempt from paying texas. Name of purchaser, firm or agency: Since colorado allows the use of other state sales. Web the forms listed below are pdf files. Web please click on the link to review the states offering these exemptions and what forms to provide for that exemption. Items described below or on the attached order or invoice form:. Employee vs independent contractor questionnaire. Address (street & number, p. University departments must obtain sales. Name of purchaser, firm or agency: Documentation in lieu of receipt. This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items). 151.310 and 171.063) the texas tax code provides an exemption from franchise tax. Web the texas university system t e comptroller of public x accounts form. 151.310 and 171.063) the texas tax code provides an exemption from franchise tax. Streamline the entire lifecycle of exemption certificate management. Qualified tuition and related expenses. Learn more about states' sales, property & locality taxes. Since colorado allows the use of other state sales. Streamline the entire lifecycle of exemption certificate management. Hotel operators should request a photo id, business card or other document to verify a guest's affiliation. Items described below or on the attached order or invoice form:. Web the forms listed below are pdf files. Tamu and tamug travel forms. Other taxes may fill the void. Ad collect and report on exemption certificates quickly to save your company time and money. Explore these zero income tax states. Documentation in lieu of receipt. 151.310 and 171.063) the texas tax code provides an exemption from franchise tax. We are exempt from paying texas. Web the texas university system t e comptroller of public x accounts form. Documentation in lieu of receipt. Select name of purchaser by checking the box below the appropriate agency: Web federal exemption under internal revenue code (irc) section 501 (c) (tax code secs. Hotel operators should request a photo id, business card or other document to verify a guest's affiliation. Texas hotel occupancy tax exempt form. Ad collect and report on exemption certificates quickly to save your company time and money. Web provide completed certificate to hotel to claim exemption from hotel tax. Qualified tuition and related expenses. Web provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo id, business card or other document to verify a guest's affiliation. Web texas sales and use tax exemption certificate. Select name of purchaser by checking the box below the appropriate agency: Other taxes may fill the void. Streamline the entire lifecycle of exemption certificate management. Address (street & number, p. Web the texas university system t e comptroller of public x accounts form. Name of purchaser, firm or agency: Since colorado allows the use of other state sales. Other taxes may fill the void. Web all purchases of texas a&m university, texas a&m university galveston or texas a&m system offices: Web please click on the link to review the states offering these exemptions and what forms to provide for that exemption. Web texas sales and use tax exemption certificate. Since colorado allows the use of other state sales. Hotel operators should request a photo id, business card or other document to verify a guest's affiliation. Web provide completed certificate to hotel to claim exemption from hotel tax. Texas motor vehicle rental tax exemption form. Tamu and tamug travel forms. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. We are exempt from paying texas. Texas sales and use tax exemption. Explore these zero income tax states. Qualified tuition and related expenses. Sample texas a&m university invoice (reimburse texas a&m) stipend. Web the texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. 151.310 and 171.063) the texas tax code provides an exemption from franchise tax. Web federal exemption under internal revenue code (irc) section 501 (c) (tax code secs. This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items). Web texas sales & use tax exemption form.Texas Homestead Tax Exemption Form

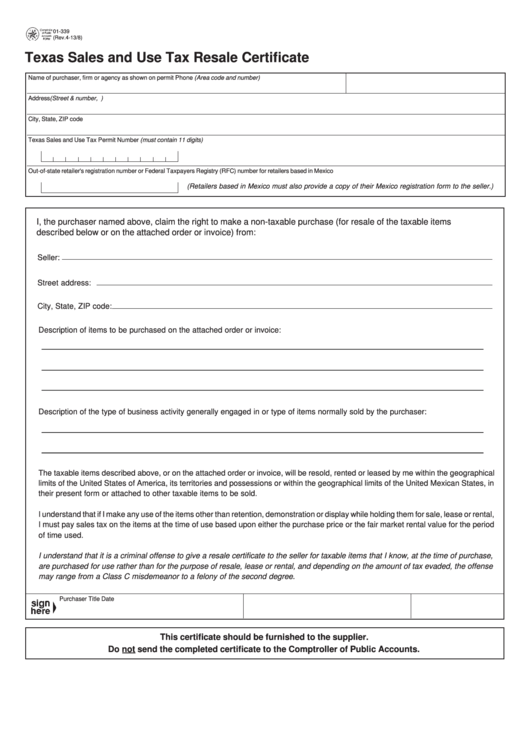

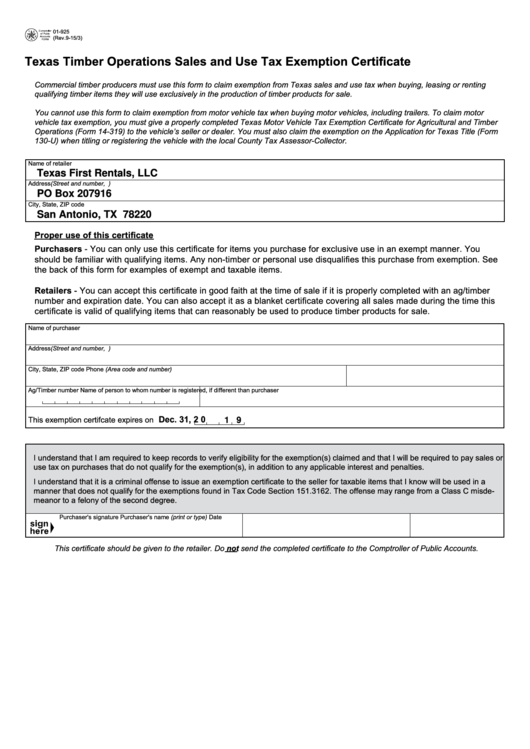

Texas Sales And Use Tax Exemption Form 01339

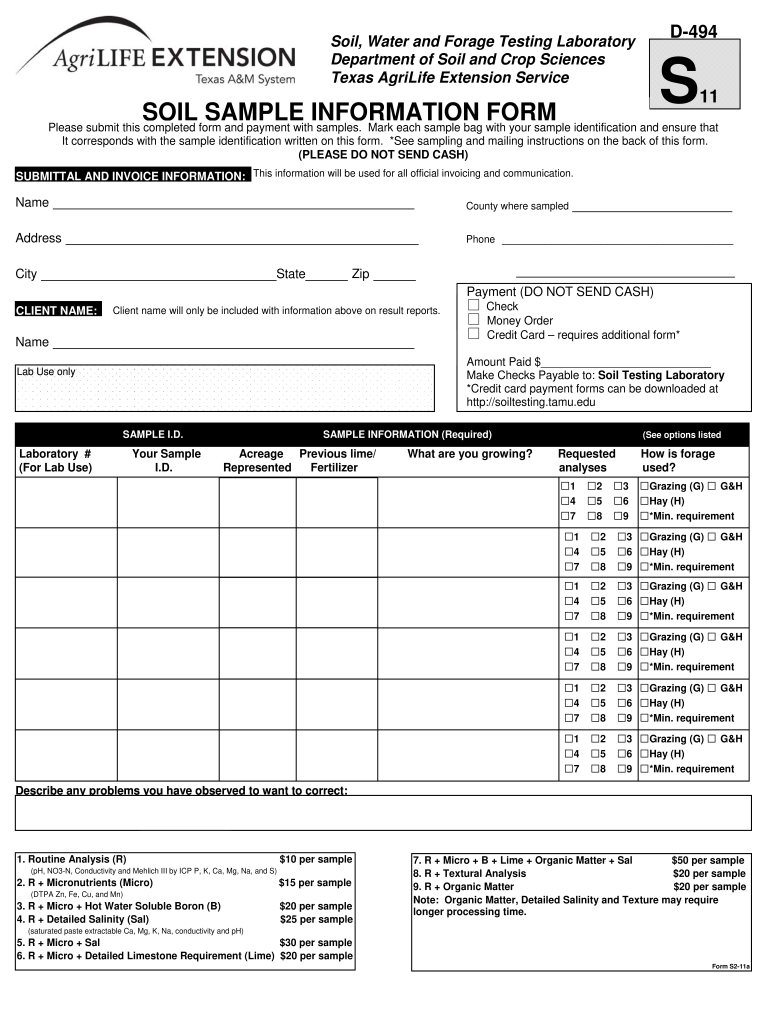

TX Texas A&M System Form S211A Fill and Sign Printable Template

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Texas sales tax exemption form Fill out & sign online DocHub

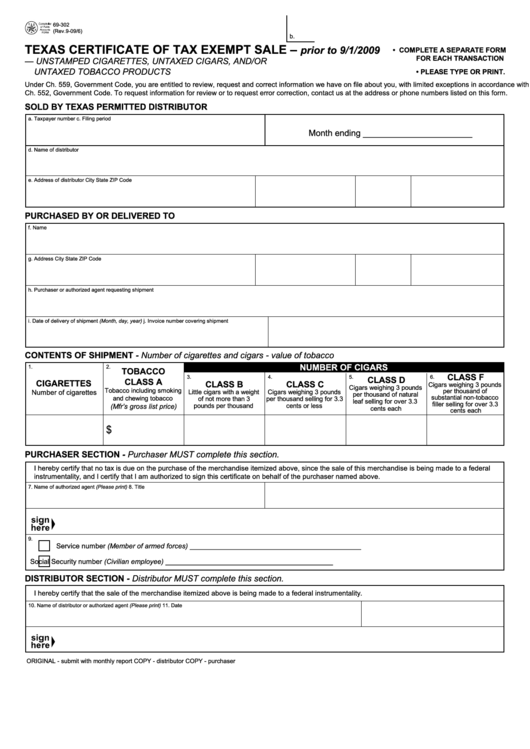

Fillable Form 69302 Texas Certificate Of Tax Exempt Sale 2009

Fillable Form 01339 (Back) Texas Sales And Use Tax Exemption

Texas Sales And Use Tax Exemption Blank Form

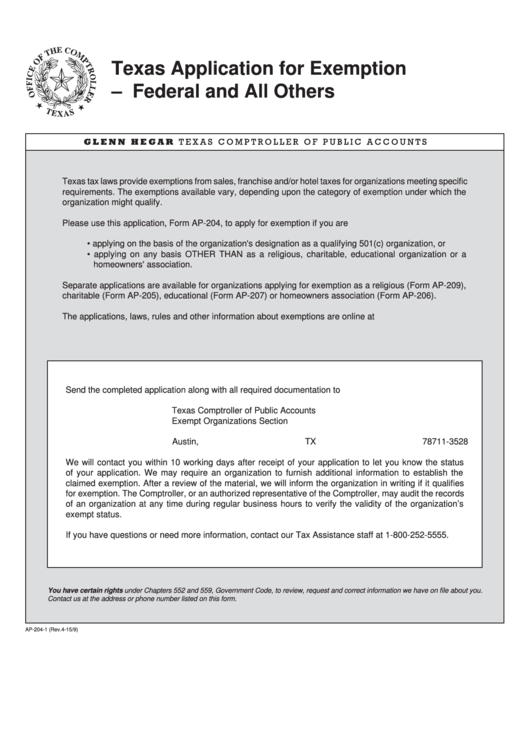

Fillable Texas Application For Exemption printable pdf download

Texas Fillable Tax Exemption Form Fill Out and Sign Printable PDF

Related Post: