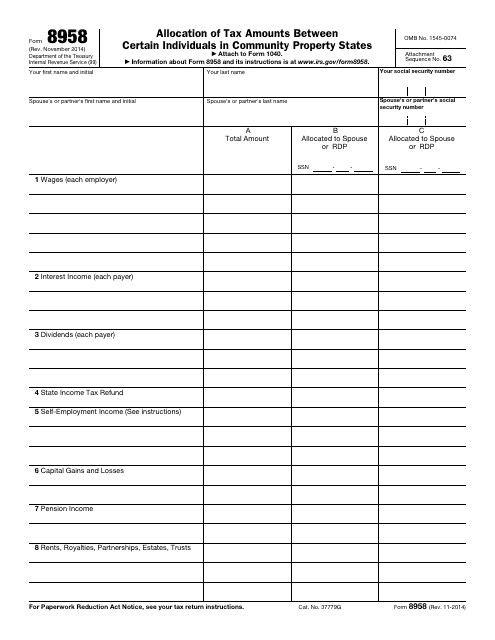

Irs Form 8958

Irs Form 8958 - Use this section to enter information necessary to complete form 8958, allocation of tax amounts between certain individuals in. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Selecting and entering the correct filing status is a critical. Web introduction this lesson will help you determine the most advantageous (and allowable) filing status for the taxpayer. Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community. Access irs forms, instructions and publications in electronic and print media. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web you must attach form 8958 to your tax form showing how. Maximize your tax return by working with experts in the field Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Complete, edit or print tax forms instantly. Ad save time and money with professional tax planning & preparation services. Web this article will help you to generate form 8958, allocation of tax amount between certain. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Yes, loved it could be better no one. Ad save time and money with professional tax planning & preparation services. Web you must attach form 8958 to your tax form showing. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web use this form to determine the allocation of tax amounts between married filing separate spouses. Yes, loved it could be better no one. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web generally, any u.s. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Complete, edit or print tax forms instantly. Access. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Web generally, any u.s. Complete, edit or print tax forms instantly. Use this section to enter information necessary to complete form 8958, allocation of tax amounts between certain individuals in. Access irs forms, instructions and publications in electronic and. Gather all documents received from employers, financial institutions, etc. Web introduction this lesson will help you determine the most advantageous (and allowable) filing status for the taxpayer. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual. Ad save time and money with professional tax planning. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Complete, edit or print tax forms instantly. Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. Web you must attach. Ad save time and money with professional tax planning & preparation services. Gather all documents received from employers, financial institutions, etc. Web introduction this lesson will help you determine the most advantageous (and allowable) filing status for the taxpayer. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. Yes, loved it could be better no one. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Selecting and entering the correct filing status is a critical. Access irs forms, instructions and publications in electronic and print media. That report income or deductions for either spouse. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual. Web generally, any u.s. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Use this section to enter information necessary to complete form 8958, allocation of tax amounts between certain individuals in. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully.Americans forprosperity2007

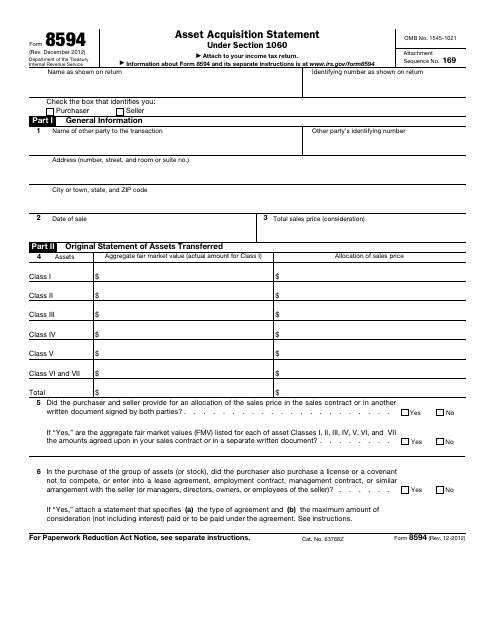

3.24.3 Individual Tax Returns Internal Revenue Service

3.11.3 Individual Tax Returns Internal Revenue Service

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

3.21.3 Individual Tax Returns Internal Revenue Service

IRS Form 8594 Download Fillable PDF or Fill Online Asset Acquisition

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Related Post: