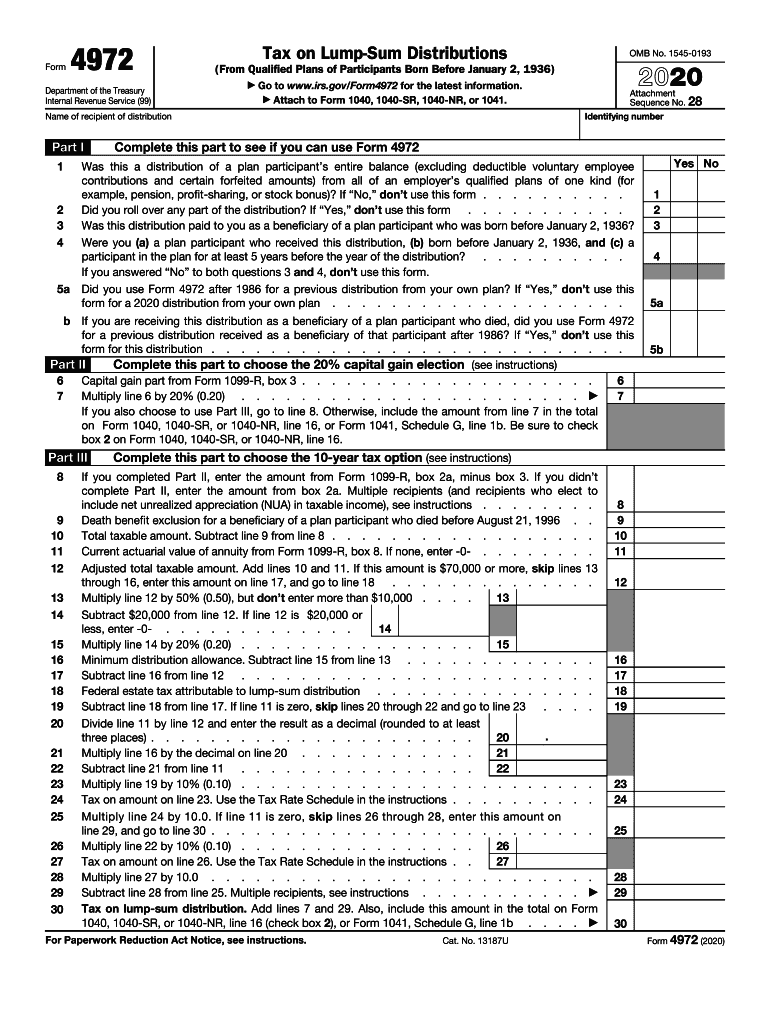

Taxpayer Form 4972

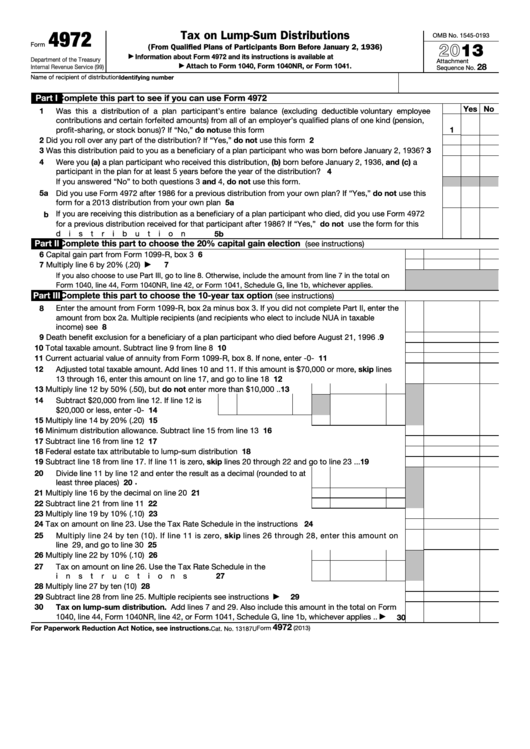

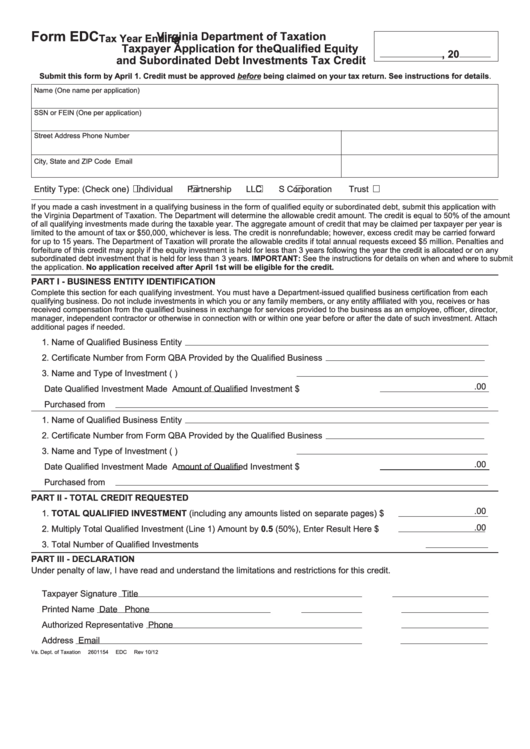

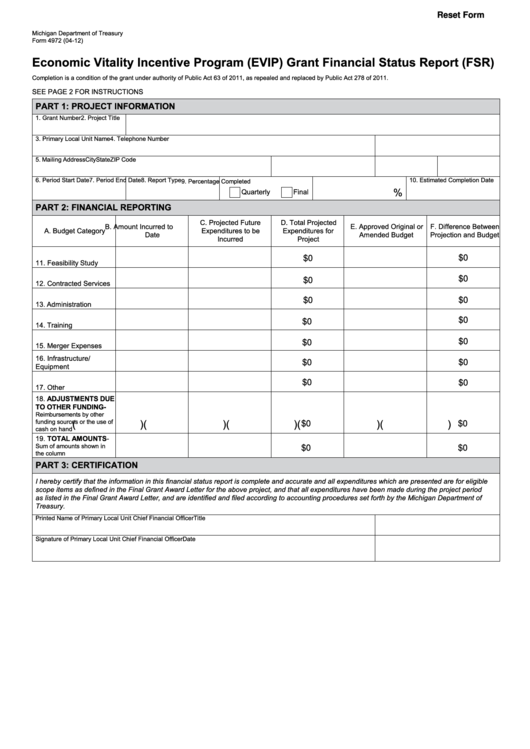

Taxpayer Form 4972 - Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Ad download or email irs 4972 & more fillable forms, register and subscribe now! To claim these benefits, you must file irs. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Web 1 was this a distribution of a plan participant’s entire balance (excluding deductible voluntary employee contributions and certain forfeited amounts) from all of an employer’s qualified. See capital gain election, later. If you were older than. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. It allows beneficiaries to receive their entire benefit in. Click add to create a new copy of the form or click review to review a form already created. Web 3️⃣ once form 4972 has been completed, the taxpayer is ready to file their tax return. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. If you were older than. Use this form to figure the.. Ad living outside the usa? It allows beneficiaries to receive their entire benefit in. You can download or print current. If you were older than. See capital gain election, later. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Use this form to figure the. The following choices are available. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Use distribution code a and answer. We'll find the right solution for you whether it's restructuring, liquidation, or filing. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. Click. Web up to 10% cash back do not use any form without first having an attorney review the form and determine that it is suitable for the purpose for which you intend it. It allows beneficiaries to receive their entire benefit in. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Use screen 1099r in. Use distribution code a and answer. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. Ad living outside the usa? Web 3️⃣ once form 4972 has been completed, the taxpayer is ready to file their tax return.. You can download or print current. Ad living outside the usa? Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. Ad living outside the usa? We'll find the right solution for you whether it's restructuring, liquidation, or. The following choices are available. Use this form to figure the. You can download or print current. We'll find the right solution for you whether it's restructuring, liquidation, or filing. Web what is irs form 4972 used for? See capital gain election, later. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. The following. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Need to file your taxes? It allows beneficiaries to receive their entire benefit in. If you were older than. Web what is irs form 4972 used for? Ad living outside the usa? Web up to 10% cash back do not use any form without first having an attorney review the form and determine that it is suitable for the purpose for which you intend it. See capital gain election, later. You can download or print current. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. To claim these benefits, you must file irs. Use distribution code a and answer. Use screen 1099r in the income folder to complete form 4972. We'll find the right solution for you whether it's restructuring, liquidation, or filing. Online navigation instructions sign in to your taxact online return click tools to. Web 3️⃣ once form 4972 has been completed, the taxpayer is ready to file their tax return. Click + add to create a new copy of the form or click form to review a form. Ad living outside the usa? If you were older than. Web what is irs form 4972 used for? Click add to create a new copy of the form or click review to review a form already created. Need to file your taxes? Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported.Fillable Form W7 Application For Irs Individual Taxpayer

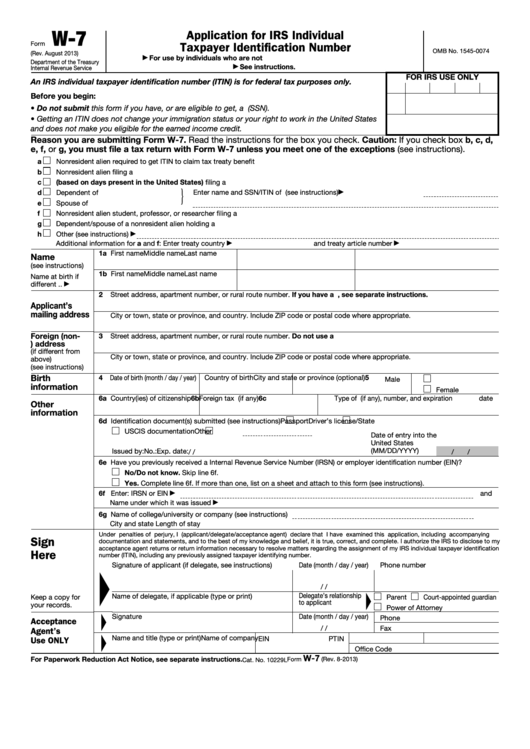

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

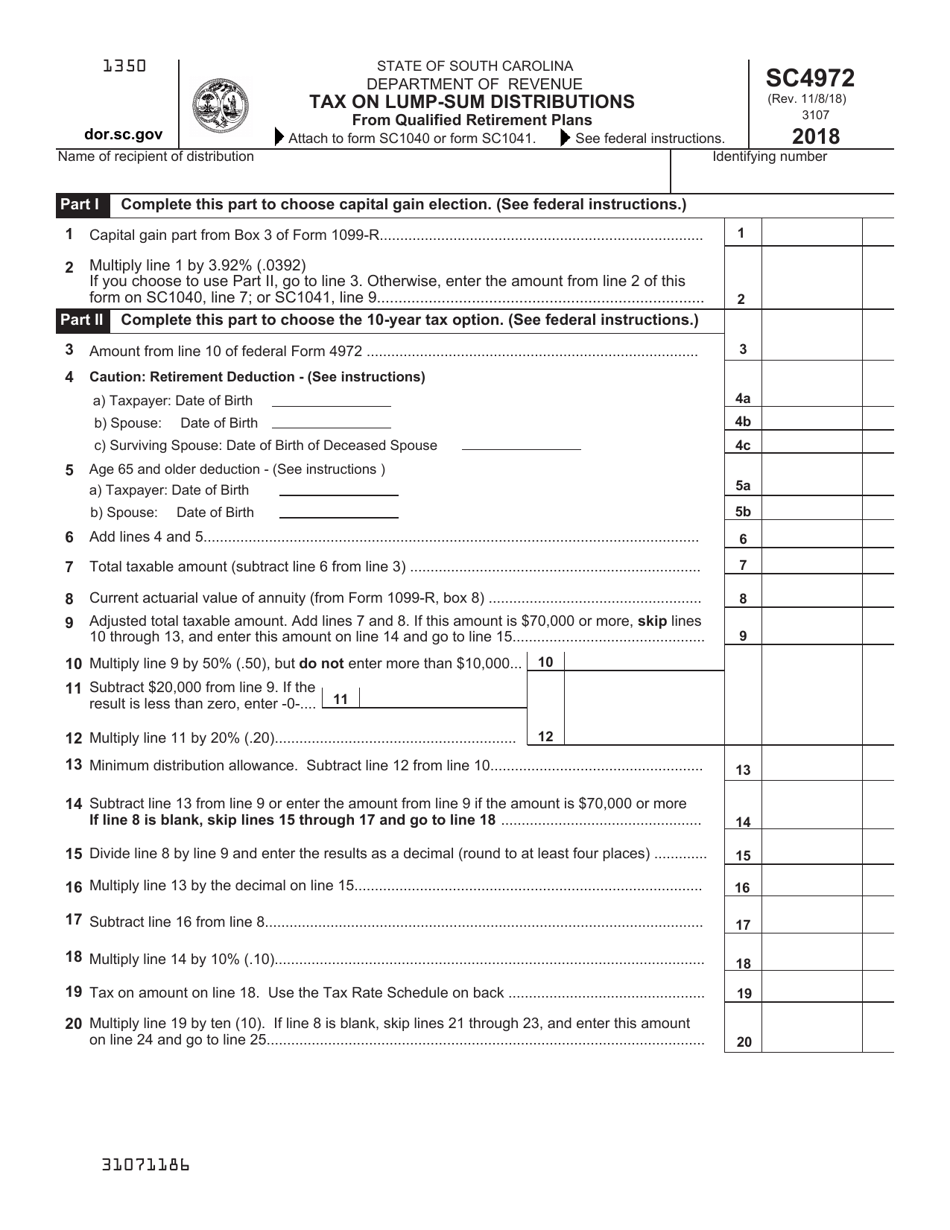

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

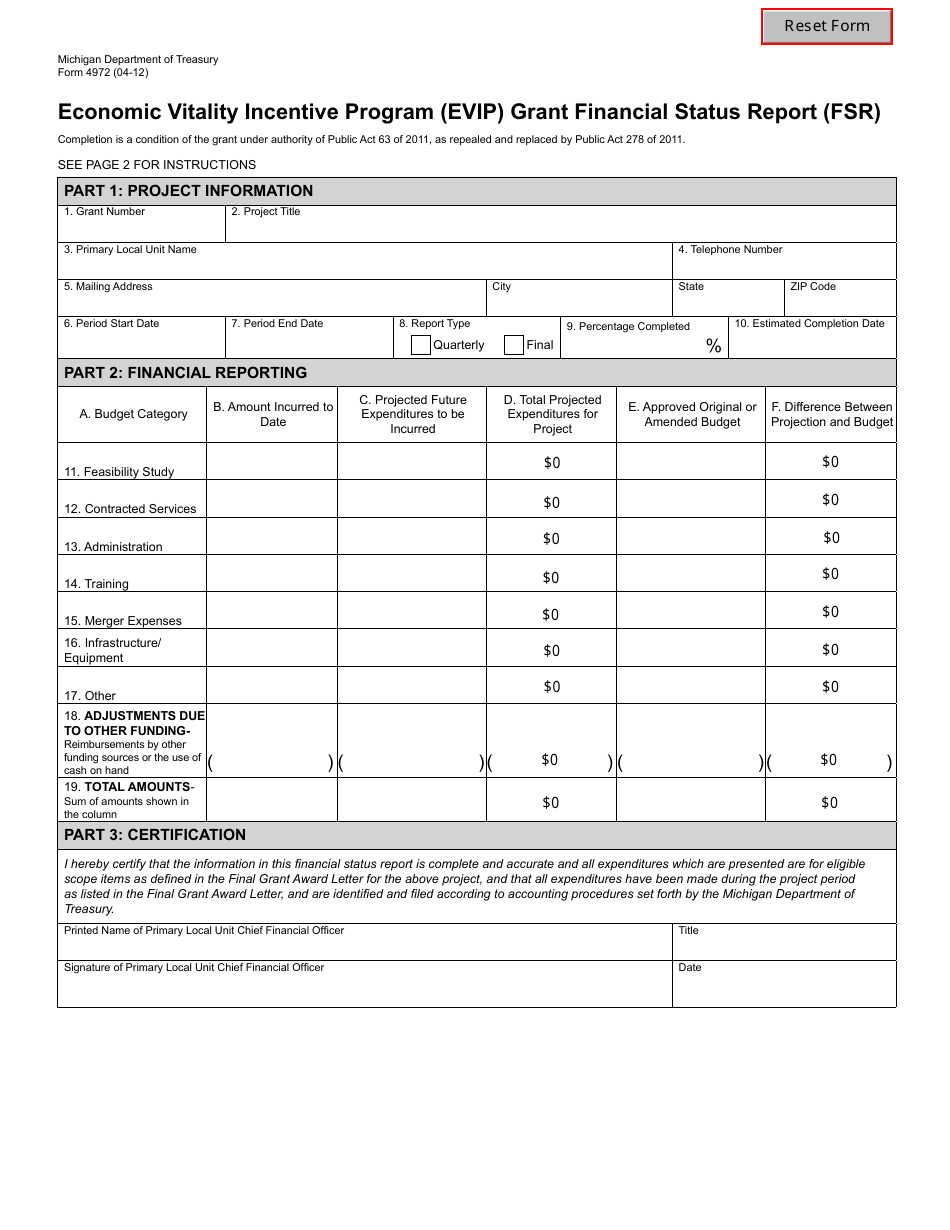

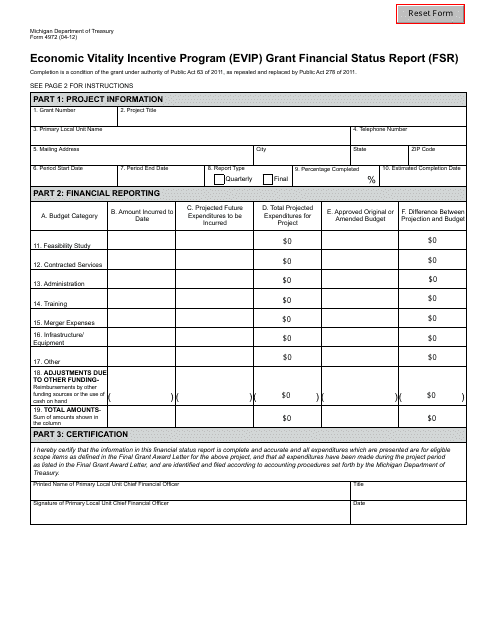

Form 4972 Fill Out, Sign Online and Download Fillable PDF, Michigan

IRS 4972 20202022 Fill out Tax Template Online US Legal Forms

Fillable Form 4972 Tax On LumpSum Distributions 2013 printable pdf

Fillable Form Edc Taxpayer Application For The Qualified Equity And

Fillable Form 4972 Economic Vitality Incentive Program (Evip) Grant

Form 4972 2022 2023

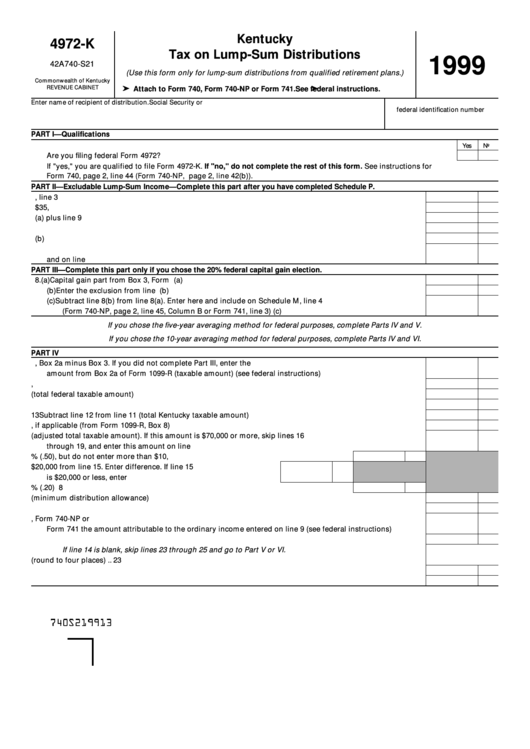

Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

Related Post: