Injured Spouse Form Instructions

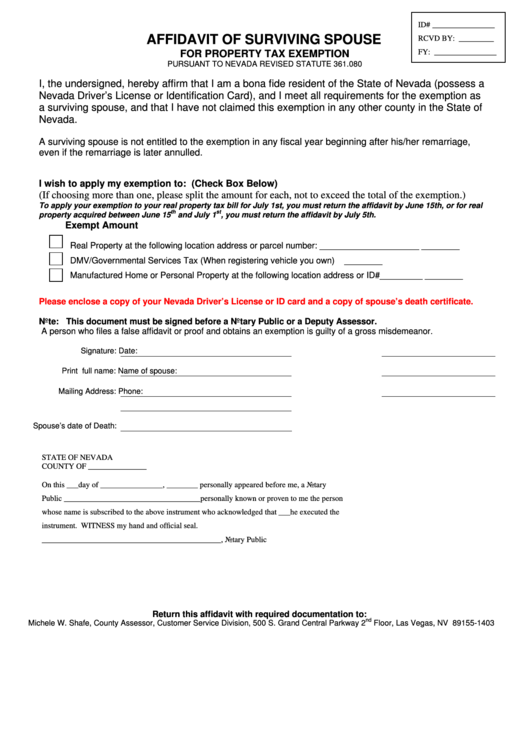

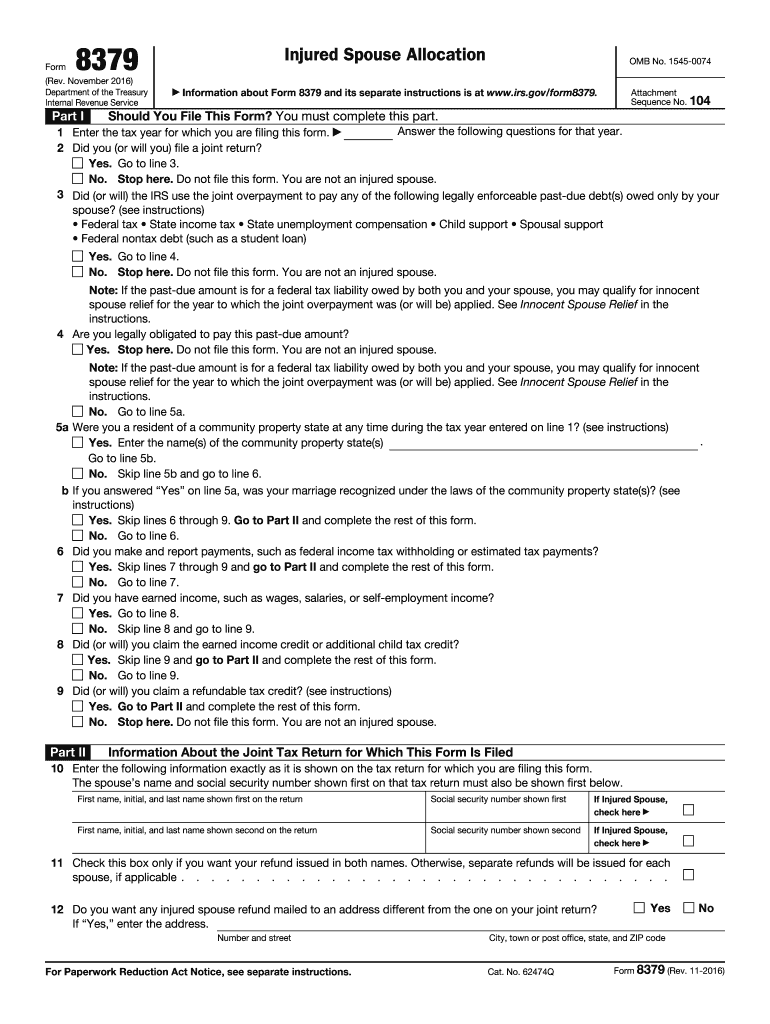

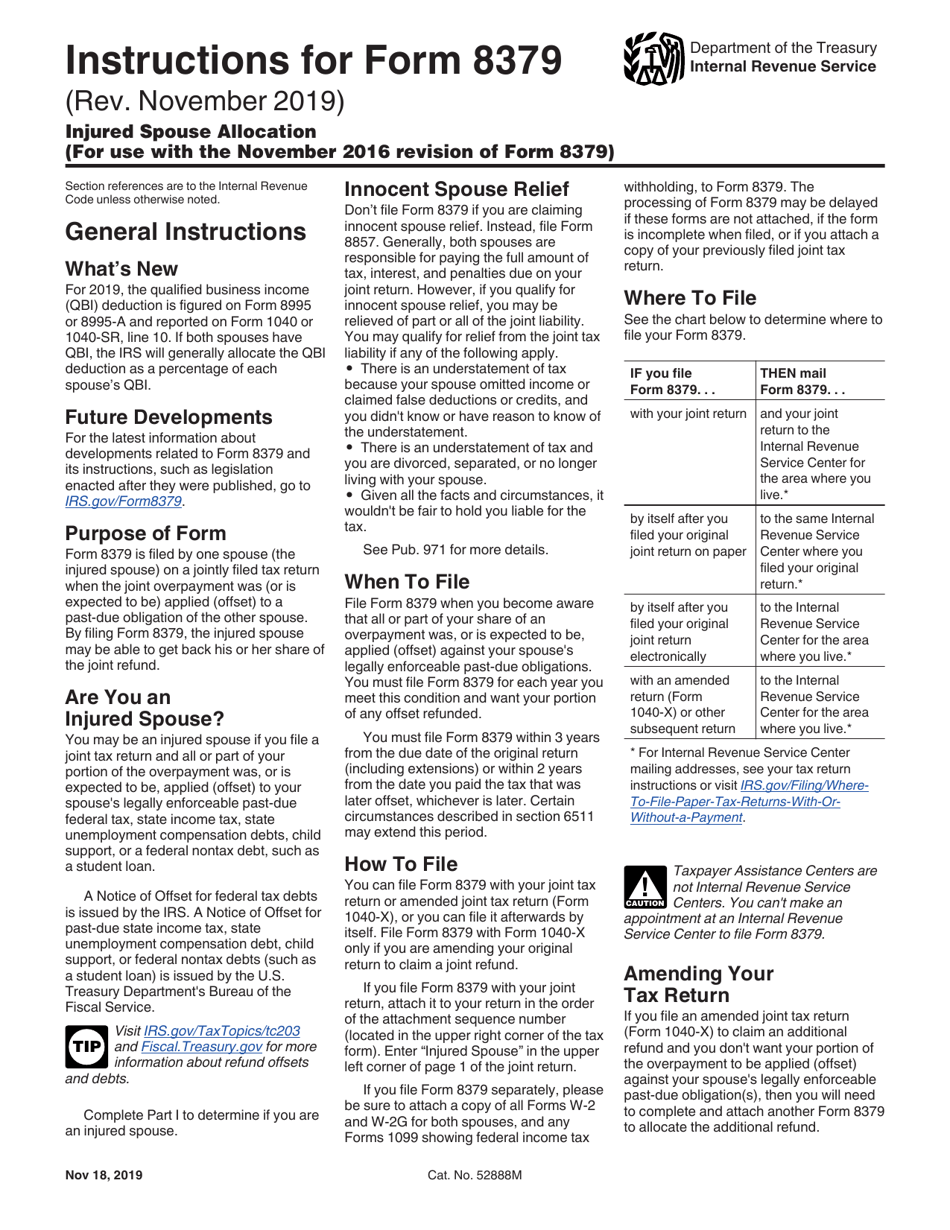

Injured Spouse Form Instructions - If you believe that this page should be taken down, please follow our dmca take down processhere. Web to file as an injured spouse, you’ll need to complete form 8379: This tax form might help you get. Ad access irs tax forms. The irs will use the information. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a. If you’re filing with h&r block, you won’t need to complete this form on. Ensure the security of your data. Web while you won’t be able to get your entire refund back, you can use irs form 8379 to ask the irs for injured spouse relief. By filing form 8379, the injured spouse may be able to. Web form 8379 is required oo claim or request your injured spouse tax refund allocation. Here's how to go about it. If you’re filing with h&r block, you won’t need to complete this form on. This tax form might help you get. By filing form 8379, the injured spouse may be able to. Web to file as an injured spouse, you’ll need to complete form 8379: Web there are two different forms relating to injured/innocent spouses, form 8379 injured spouse allocation and form 8857 request for innocent spouse relief. Here's how to go about it. Web you may be an injured spouse if you file a joint tax return and all or part. Web solved • by turbotax • 8212 • updated january 13, 2023. The irs will use the information. You can file this form before or after the offset occurs,. Web the terms injured spouse and innocent spouse are so frequently confused that the first page of the form 8379 instructions specifically address the matter. Web to request relief, file form. Web irs injured spouse form 8379 instructions; Yes, you can file form 8379 electronically with your tax return. Web you may be an injured spouse if you file a joint tax return and all or part of your portion of the overpayment was, or is expected to be, applied (offset) to your spouse’s legally. If you file form 8379 with. Web there are two different forms relating to injured/innocent spouses, form 8379 injured spouse allocation and form 8857 request for innocent spouse relief. Ensure the security of your data. Go to www.irs.gov/form8379 for instructions and the latest. By filing form 8379, the injured spouse may be able to. Web to file as an injured spouse, you’ll need to complete form. Web the terms injured spouse and innocent spouse are so frequently confused that the first page of the form 8379 instructions specifically address the matter. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. Yes, you can file form 8379 electronically with your tax return. Go to www.irs.gov/form8379. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a. Web there are two different forms relating to injured/innocent spouses, form 8379 injured spouse allocation and form 8857 request for innocent spouse relief. Web you need to file form 8379. Get ready for tax season deadlines by completing any required tax forms today. Web by filling out form 8379, the injured spouse is requesting that the internal revenue service (irs) release their share of a joint tax refund. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. If. Web by filling out form 8379, the injured spouse is requesting that the internal revenue service (irs) release their share of a joint tax refund. If you file form 8379 with a joint return electronically, the time needed to. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was. Web to file as an injured spouse, you’ll need to complete form 8379: Yes, you can file form 8379 electronically with your tax return. Web solved • by turbotax • 8212 • updated january 13, 2023. Web irs injured spouse form 8379 instructions; Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when. Web by filling out form 8379, the injured spouse is requesting that the internal revenue service (irs) release their share of a joint tax refund. Web there are two different forms relating to injured/innocent spouses, form 8379 injured spouse allocation and form 8857 request for innocent spouse relief. Web you can file irs form 8379 for injured spouse relief if your joint tax refund is intercepted to pay for your spouse's debt. Yes, you can file form 8379 electronically with your tax return. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a. By filing form 8379, the injured spouse may be able to. Here's how to go about it. Web while you won’t be able to get your entire refund back, you can use irs form 8379 to ask the irs for injured spouse relief. Complete, edit or print tax forms instantly. Ad access irs tax forms. This tax form might help you get. Web form 8379 is required oo claim or request your injured spouse tax refund allocation. You can file this form before or after the offset occurs,. Web solved • by turbotax • 8212 • updated january 13, 2023. Web page last reviewed or updated: November 2021) department of the treasury internal revenue service. Ensure the security of your data. See detailed instructions on how to claim your refund. If you file form 8379 with a joint return on paper, the time. Injured spouse claim and allocation.Affidavit Of Surviving Spouse Form printable pdf download

FREE 7+ Sample Injured Spouse Forms in PDF

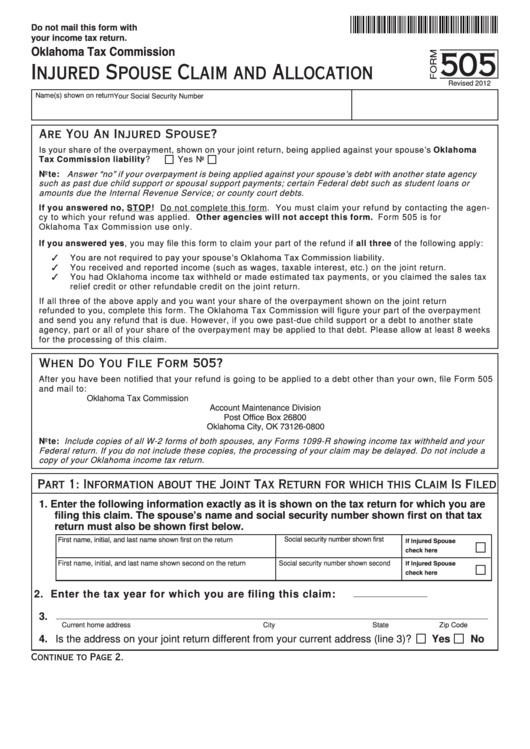

Fillable Form 505 Injured Spouse Claim And Allocation Oklahoma Tax

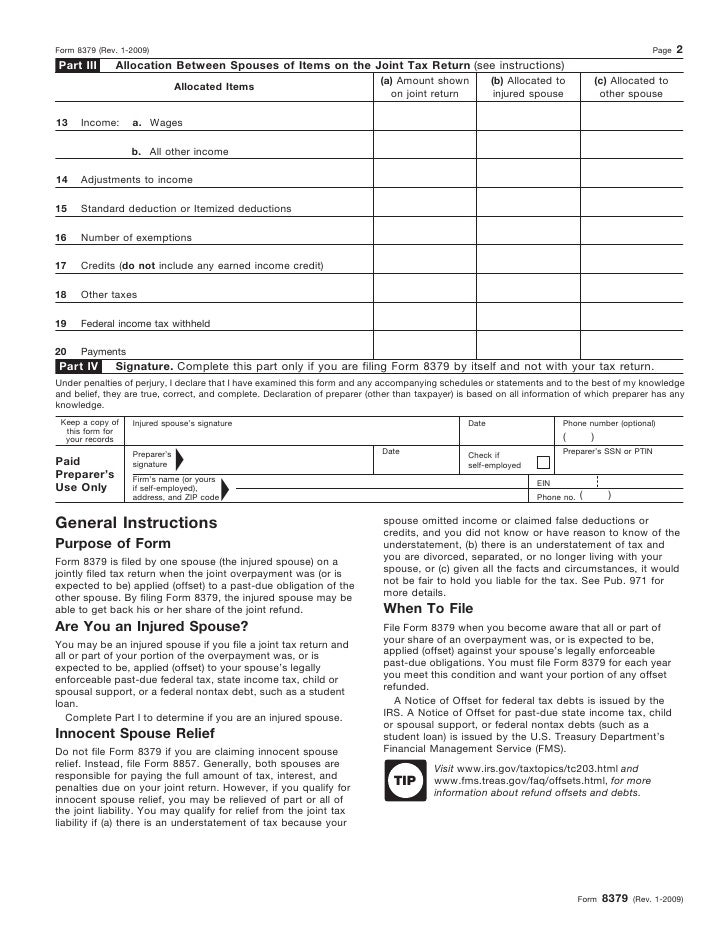

Form 8379Injured Spouse Claim and Allocation

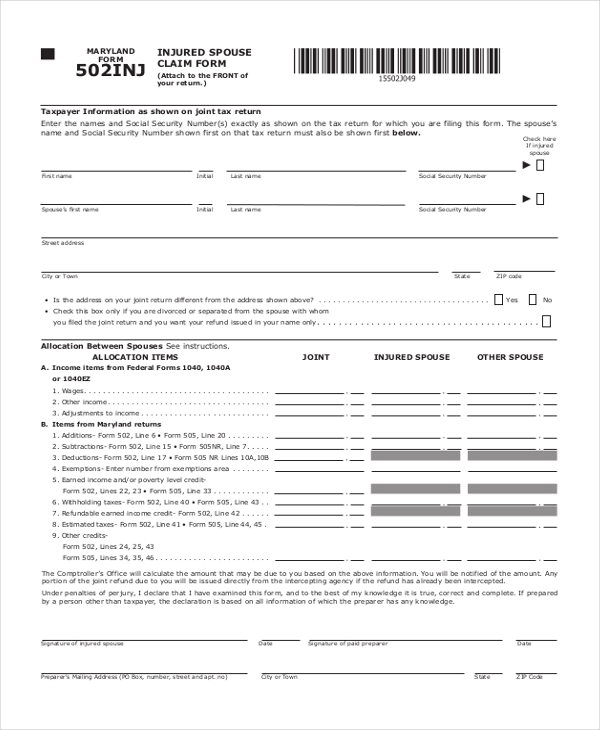

Injured Spouse Allocation Free Download

FREE 9+ Sample Injured Spouse Forms in PDF

Free Fillable Injured Spouse Form Printable Forms Free Online

FREE 7+ Sample Injured Spouse Forms in PDF

FREE 7+ Sample Injured Spouse Forms in PDF

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

Related Post: