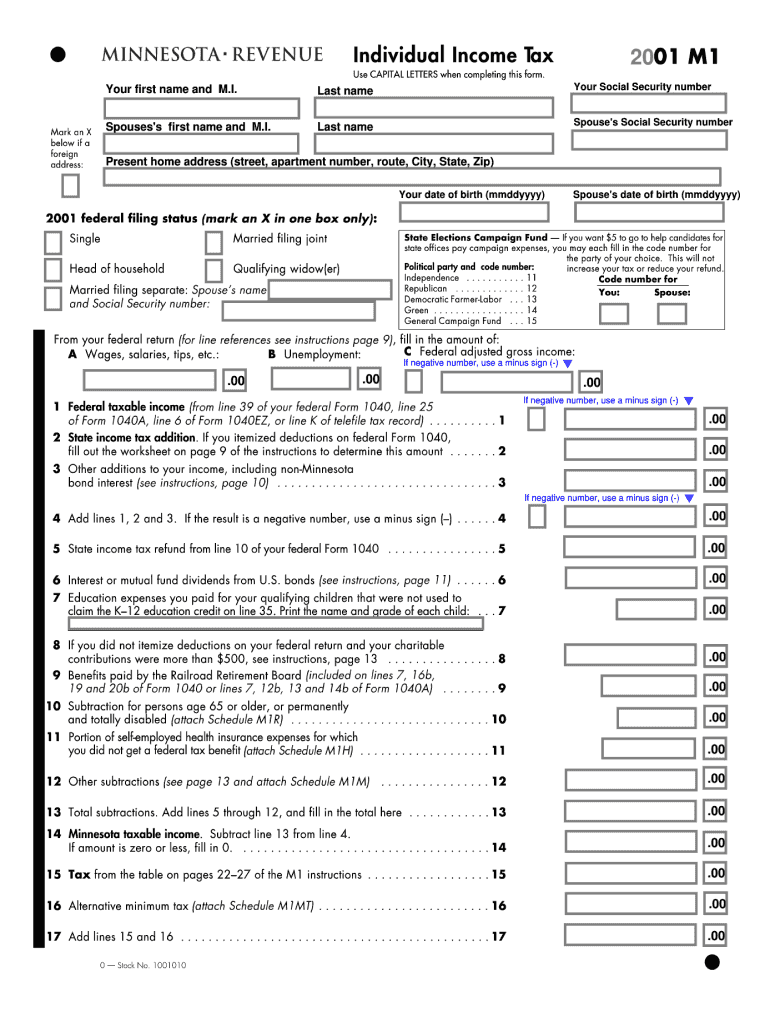

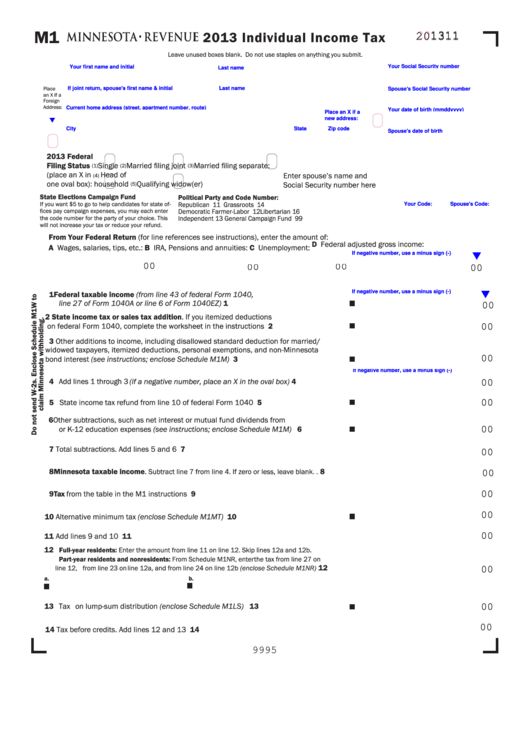

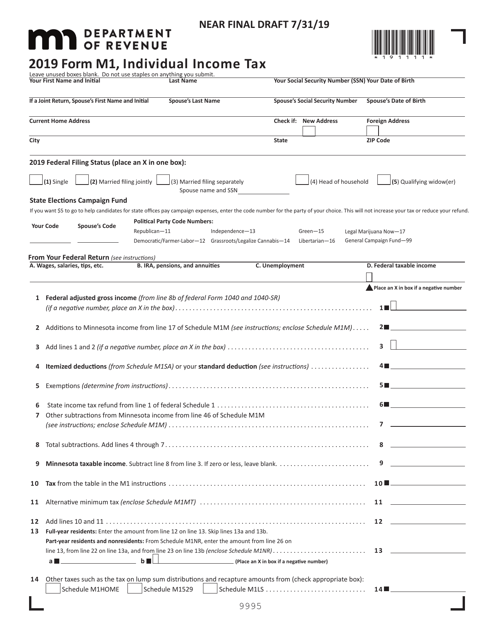

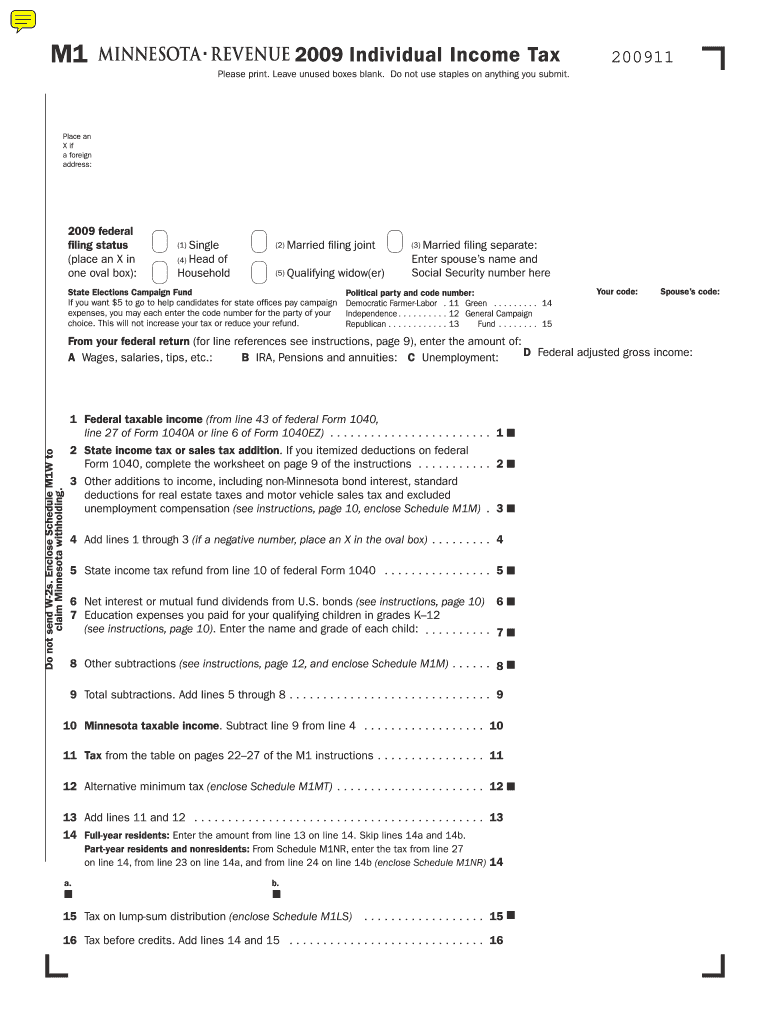

Tax Form M1

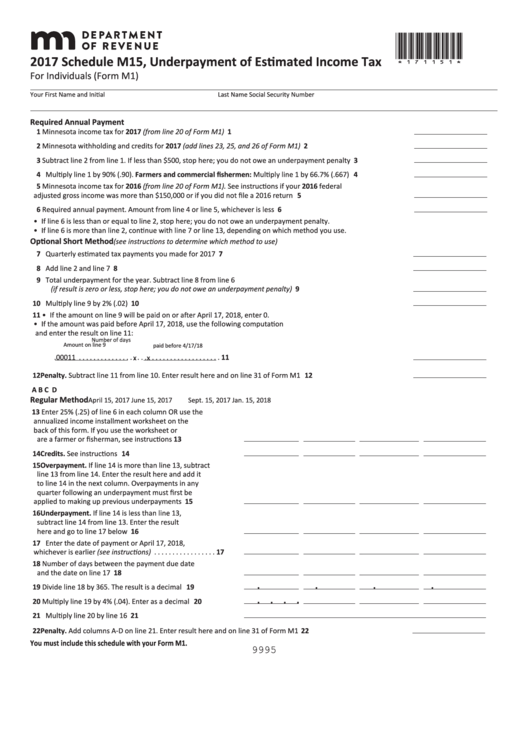

Tax Form M1 - Web form m1 is the most common individual income tax return filed for minnesota residents. Federal taxable income your first name and initial last name your social security number your date. 16 published a draft booklet on 2023 individual income tax forms and instructions, including form m1, minnesota. 26, uscis automatically extended the validity of permanent resident cards. Web 2019 form m1, individual income tax. 21 22 amount from line 11 of schedule m1ref, refundable credits (see instructions; Do not use staples on anything you submit. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web up to $40 cash back all returns are available for 2016 and for previous fiscal years. These are the necessary steps you should take to apply an m1 visa: Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Get ready for this year\'s tax. Easily complete a printable irs mn dor m1 form 2022 online. A state other than minnesota. Find out which product is right for you. It will help candidates for state offices. Web in the cbam transitional period starting october 1, 2023, there are requirements for quarterly reporting of embedded greenhouse gas (ghg) emissions of. Web minnesota state income tax form m1 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Do not use staples on anything you submit.. Web form m1 is the most common individual income tax return filed for minnesota residents. Web in the cbam transitional period starting october 1, 2023, there are requirements for quarterly reporting of embedded greenhouse gas (ghg) emissions of. 21 22 amount from line 11 of schedule m1ref, refundable credits (see instructions; You must file yearly by april 17. From the. Ira, pensions, and annuities c. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. From the table in the form m1. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Ira, pensions, and annuities c. From the table in the form m1 instructions. Printable minnesota state tax forms for the. Web in the cbam transitional period starting october 1, 2023, there are requirements for quarterly reporting of embedded greenhouse gas (ghg) emissions of. Your first name and initial last name. You must file yearly by april 15. Find free tax preparation help. This form is for income earned in tax year 2022, with tax. File an income tax return. Web form number title; A state other than minnesota. Web form m1 is the most common individual income tax return filed for minnesota residents. 26, uscis automatically extended the validity of permanent resident cards. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. This form is for income earned in tax year 2022, with tax. Web 21 minnesota estimated tax and extension payments made for 2023. Web if you received a state income tax refund in 2022 and you itemized deductions on your 2021 federal form 1040, you may need to report an amount on line 1 of your 2022 federal. Web form. Find free tax preparation help. From the table or schedules in the form m1 instructions. Web 21 minnesota estimated tax and extension payments made for 2023. It will help candidates for state offices. If line 9 of form m1 is less than $90,000, you must use the tax table on pages 28 through. If line 9 of form m1 is less than $90,000, you must use the tax table on pages 28 through. Ira, pensions, and annuities c. A state other than minnesota. 21 22 amount from line 11 of schedule m1ref, refundable credits (see instructions; Web 21 minnesota estimated tax and extension payments made for 2023. We last updated the individual income tax return in. Web form m1 is the most common individual income tax return filed for minnesota residents. Your first name and initial last name. Web in form 1065, u.s. A state other than minnesota. Web of the amount you included (or should have included) on line 2a of federal form 1040, add the interest you received from municipal bonds issued by: Web if you received a state income tax refund in 2021 and you itemized deductions on federal form 1040 in 2020, you may need to report. 16 published a draft booklet on 2023 individual income tax forms and instructions, including form m1, minnesota. Printable minnesota state tax forms for the. Web filing status to determine the tax amount to enter on line 10 of form m1. 26, uscis automatically extended the validity of permanent resident cards. Web the minnesota department of revenue oct. Find free tax preparation help. Web form number title; 21 22 amount from line 11 of schedule m1ref, refundable credits (see instructions; Web minnesota state income tax form m1 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. From the table in the form m1 instructions. Get ready for this year\'s tax. Web up to $40 cash back all returns are available for 2016 and for previous fiscal years. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice.Form M1 Individual Tax Printable YouTube

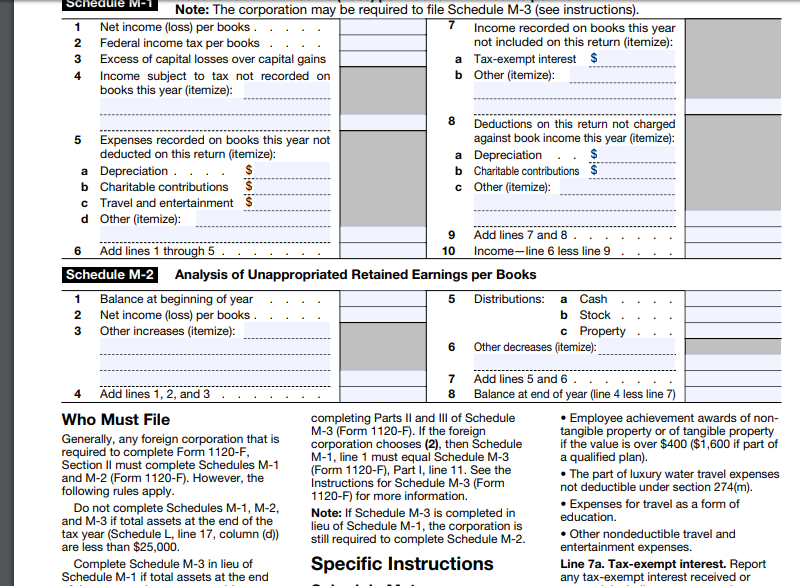

Tax Table M1 Instructions

Top 5 M1 Form Templates free to download in PDF format

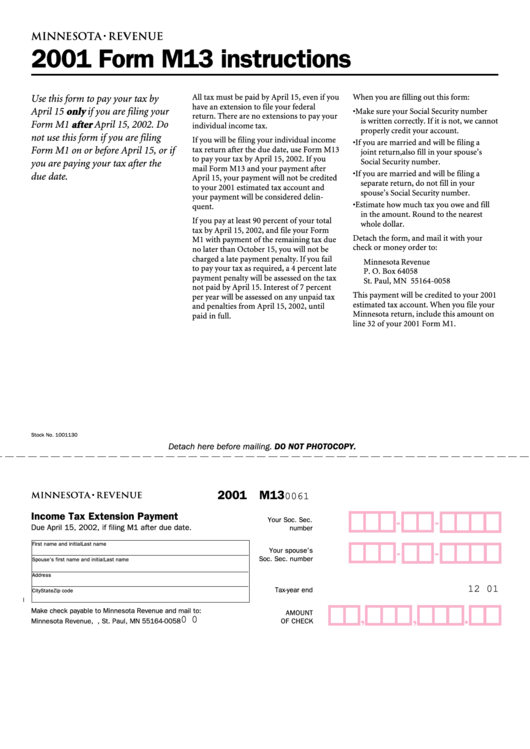

Form M13 Tax Extension Payment printable pdf download

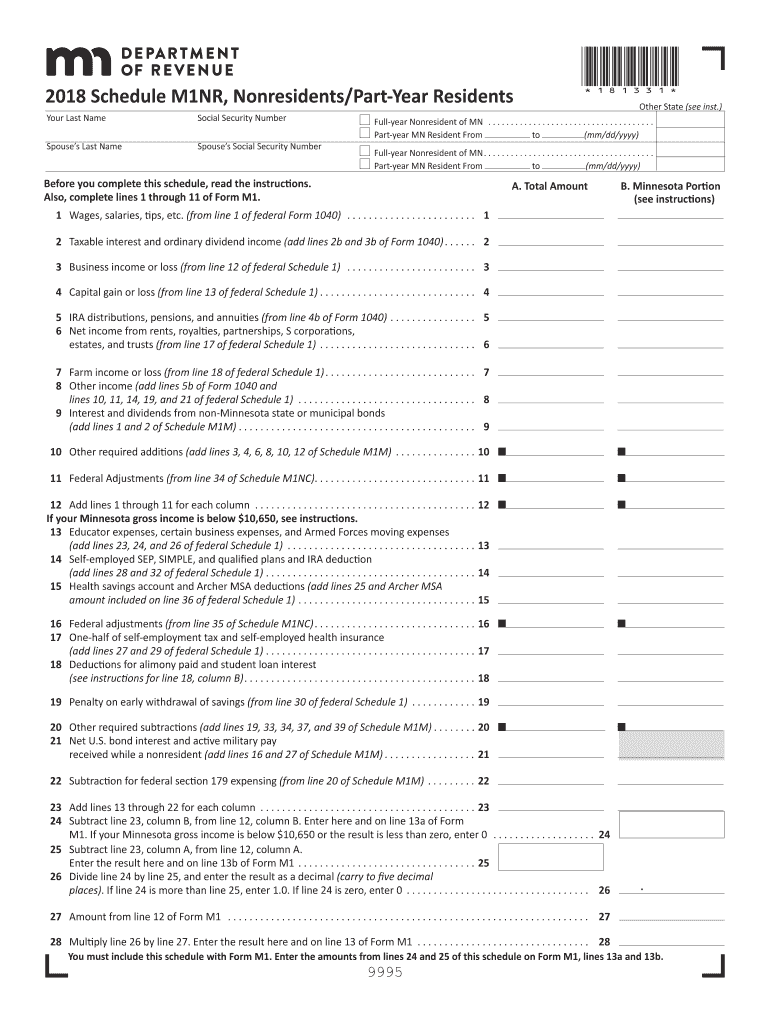

Schedule M1Nr Fill Out and Sign Printable PDF Template signNow

M1 Tax Documents Form Fill Out and Sign Printable PDF Template signNow

M1 taxes.state.mn.us

Fillable Form M1 Individual Tax 2013 printable pdf download

Form M1 2019 Fill Out, Sign Online and Download Printable PDF

2009 M1, Individual Tax Return revenue state mn Fill out

Related Post: