Tax Form K 40

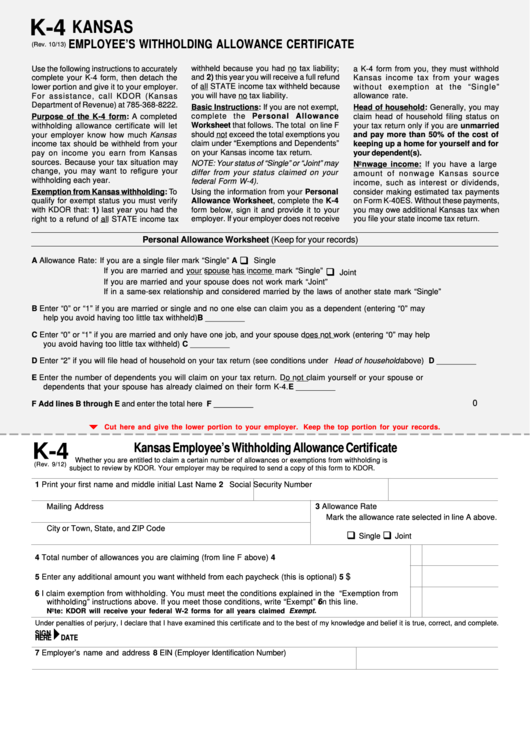

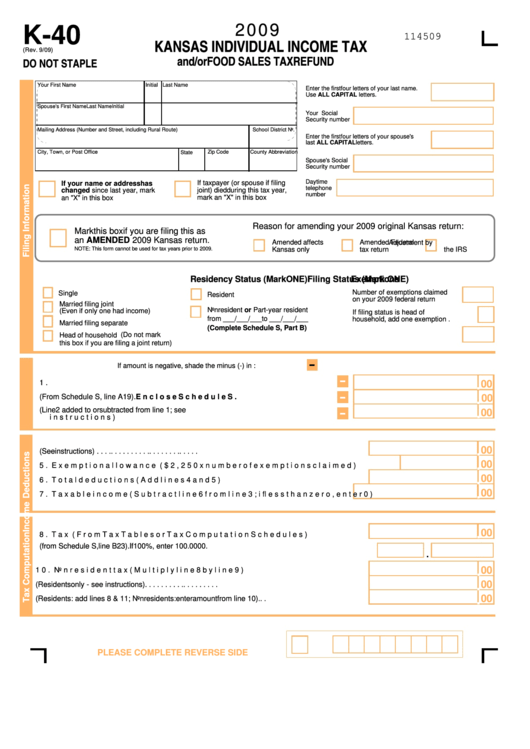

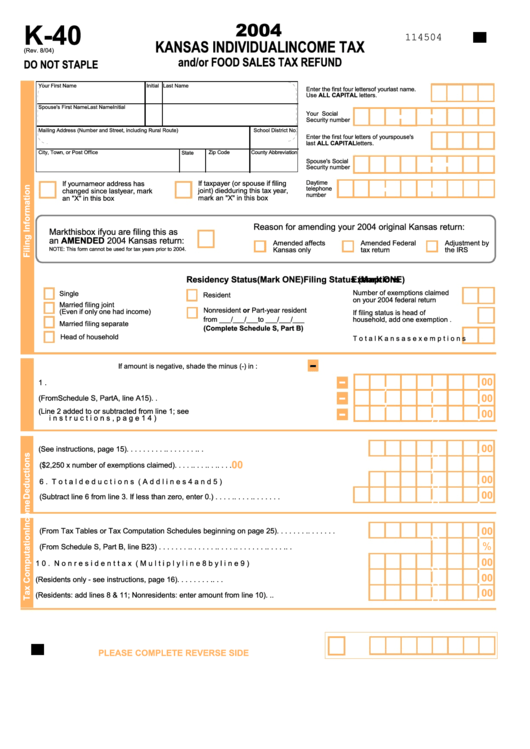

Tax Form K 40 - Web tax type tax year (select) current 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 clear filters Kansas income tax, kansas dept. Call us for a free consultation. City, town, or post office. Arizona has a state income tax that ranges between 2.55% and 3.34% , which is administered by the arizona department of revenue. Individual estimated tax payment booklet. Taxformfinder provides printable pdf copies of. Tax credit consulting, syndication legal & financial structuring. What is a k40 tax form. _____ 7) add lines 5 and 6c. Ad helping make your project a reality. Why does the schedule s not display in webfile? Individual estimated tax payment booklet. What is a k40 tax form. Every tax problem has a solution. Taxformfinder provides printable pdf copies of. Web for tax years ending on or before december 31, 2019, individuals with an adjusted gross income of at least $5,500 must file taxes, and an arizona resident is subject to tax on all income, including from other states. Who can use webfile for a homestead refund claim? How many exemptions can i claim?. What is a k40 tax form. The code of alabama 1975. Amended returns must be filed within three years of when the original return was filed. Taxformfinder provides printable pdf copies of. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into. Get a free consultation today & move towards resolution. The code of alabama 1975. What is a k40 tax form. Web tax type tax year (select) current 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 clear filters Ad tax levy attorney & cpa. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Mailing address (number and street, including rural route) school district no. Arizona has a state income tax that ranges between 2.55% and 3.34% , which is administered by the arizona department of revenue. Taxformfinder provides printable pdf copies of.. What is a k40 tax form. City, town, or post office. Get a free consultation today & move towards resolution. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: What do i need to file? Resident shareholder's information schedule form with instructions. Get a free consultation today & move towards resolution. Food sales tax credit (multiply line g by $125). Taxformfinder provides printable pdf copies of. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Every tax problem has a solution. If claiming a foreign tax credit, and you were required to complete federal form 1116, enclose a. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Who can use webfile for a. City, town, or post office state zip code county abbreviation enter the first four letters of your last name. Who can use webfile for a homestead refund claim? Web tax type tax year (select) current 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999. City, town, or post office. Arizona has a state income tax that ranges between 2.55% and 3.34% , which is administered by the arizona department of revenue. Web adjusted gross income chart for use tax computation. Ad tax levy attorney & cpa helping resolve back tax issues no matter how complex. Web webfile is an online application for filing kansas. Mailing address (number and street, including rural route) school district no. Free, fast, full version (2023) available! Web adjusted gross income chart for use tax computation. _____ 7) add lines 5 and 6c. Every tax problem has a solution. Web total qualifying exemptions (subtract line f from line e) h. Individual estimated tax payment booklet. Why does the schedule s not display in webfile? Who can use webfile for an income tax return? Get a free consultation today & move towards resolution. Food sales tax credit (multiply line g by $125). Ad tax levy attorney & cpa helping resolve back tax issues no matter how complex. Every tax problem has a solution. Total number of boxes checked _____ c. Enter the first four letters of your last name. Ad what is a k40 tax form. Get a free consultation today & move towards resolution. Multiply 6b by $850 ($700 if married filing joint or separate) 6c. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank accountFillable Form K4 Kansas Employee'S Withholding Allowance Certificate

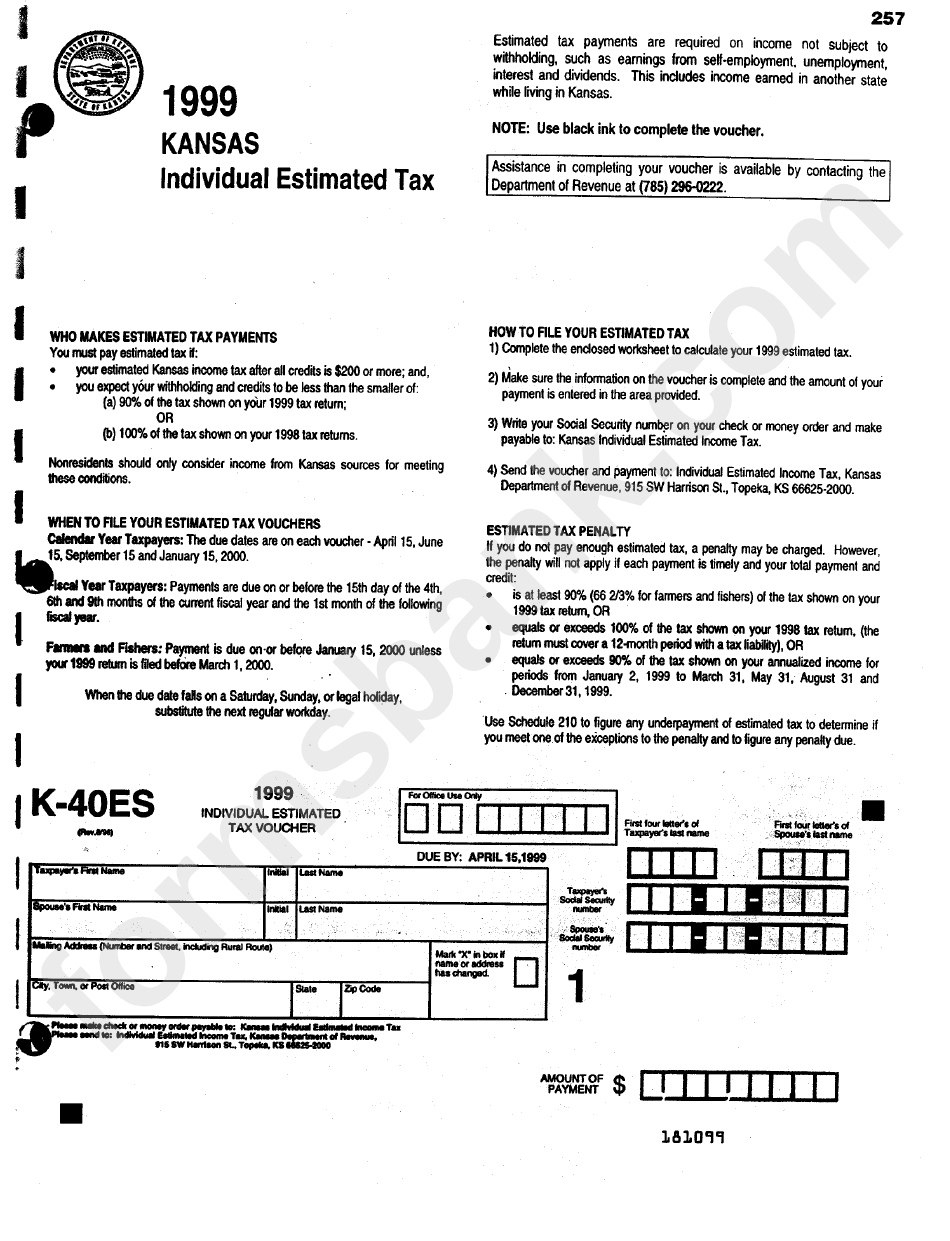

Fillable Form K40es Individual Estimated Tax Kansas Department Of

Form K 40 Kansas Individual Tax YouTube

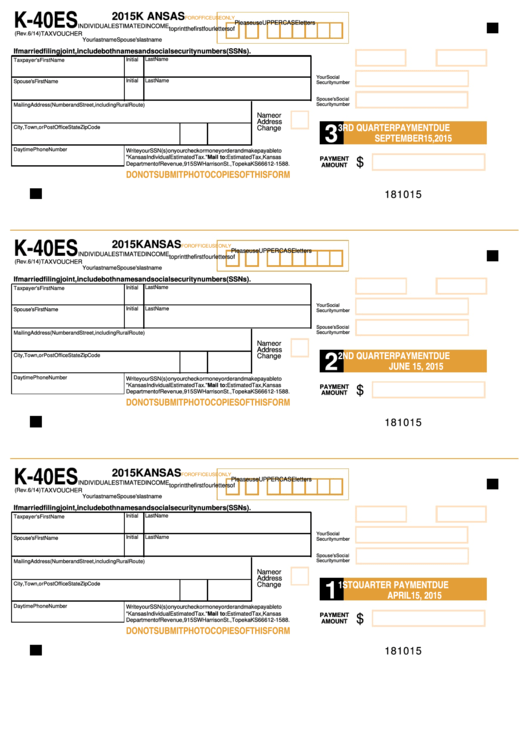

Fillable Form K40es Individual Estimated Tax Voucher

2015 Form KS DoR K40Fill Online, Printable, Fillable, Blank pdfFiller

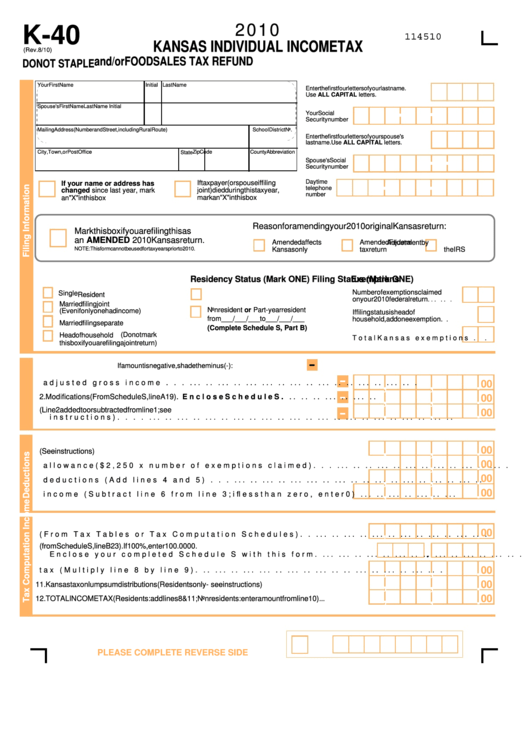

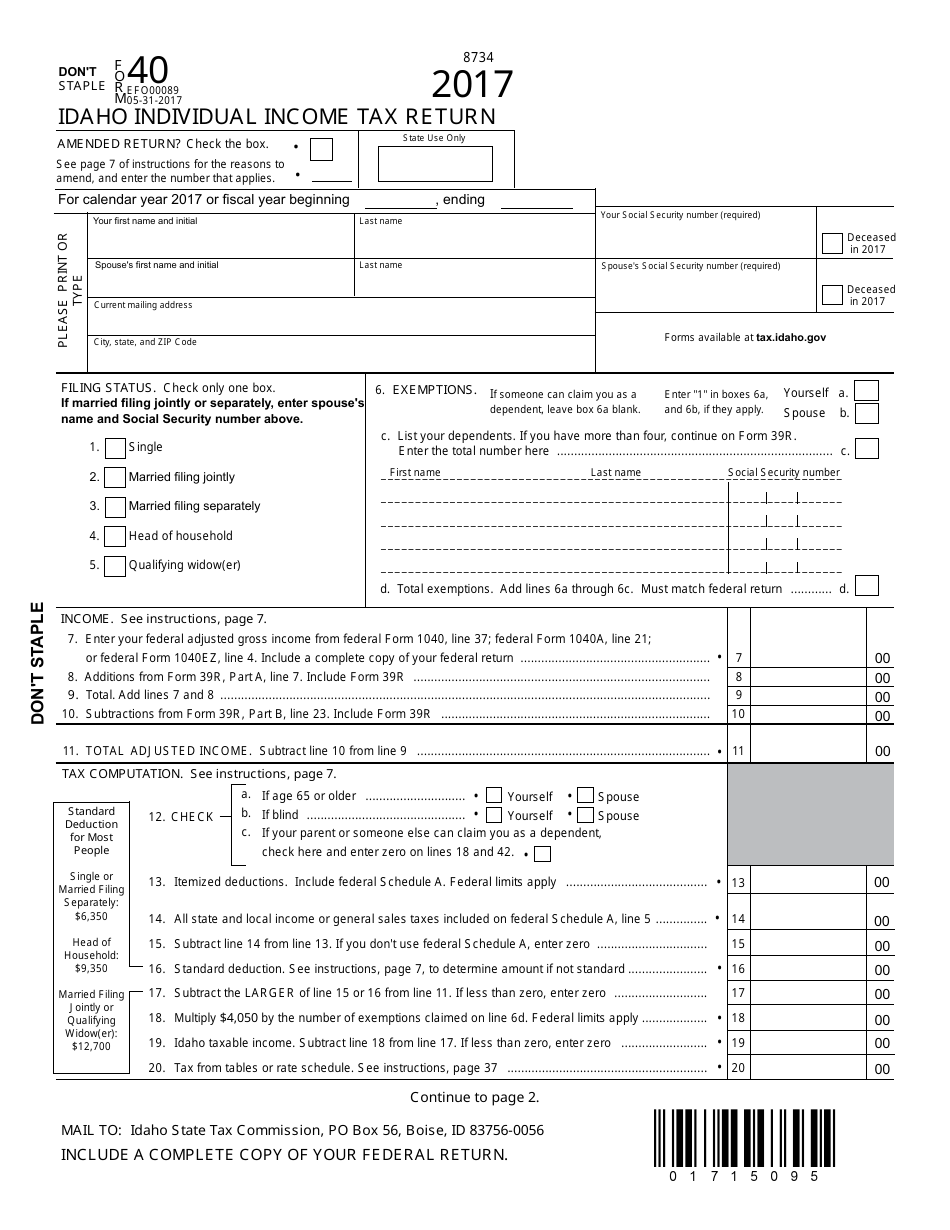

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Form 40 Download Fillable PDF or Fill Online Idaho Individual

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

Form K40 Kansas Individual Tax 2004 printable pdf download

2014 k 40 form Fill out & sign online DocHub

Related Post: