Freetaxusa Form 8606

Freetaxusa Form 8606 - We offer a variety of software related to various fields at great prices. Web 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. Department of the treasury internal revenue service (99) nondeductible iras. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. Web form 8606 (2021) page 2 part ii 2021 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep, and. Web about form 8606, nondeductible iras use form 8606 to report: Web form 8606 department of the treasury internal revenue service (99) nondeductible iras information about form 8606 and its separate instructions is at www.irs.gov/form8606. If you need these forms to complete form 8606, you must mail in the. Solved • by turbotax • 2913 • updated 2 weeks ago we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any. Web form 8606 with freetaxusa. If you aren’t required to file an income tax return but. My 8606 with personal info taken out. I am using freetaxusa to file my taxes and am not sure if form 8606 is filled out correctly. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. Web filing. This is the first year that i am trying freetaxusa.com to file our taxes. If you need these forms to complete form 8606, you must mail in the. Web where do i find form 8606? If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program. Distributions. Complete, edit or print tax forms instantly. Web about form 8606, nondeductible iras use form 8606 to report: Web form 8606 with freetaxusa. If you aren’t required to file an income tax return but. The filing status qualifying widow (er) is now called qualifying surviving spouse. The filing status qualifying widow (er) is now called qualifying surviving spouse. Get ready for tax season deadlines by completing any required tax forms today. Web where do i find form 8606? Web form 8606 for nondeductible contributions any money you contribute to a traditional ira that you do not deduct on your tax return is a “nondeductible contribution.”. Web. Solved • by turbotax • 2913 • updated 2 weeks ago we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any. I am using freetaxusa to file my taxes and am not sure if form 8606 is filled out correctly. Also the final 2017 form 8606 still. If you aren’t required to file an income tax. Web file 2019 form 8606 with your. Ad explore the collection of software at amazon & take your skills to the next level. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras information. Web filing status name changed to qualifying surviving spouse. Web you don’t have to file form 8606 solely to report regular contributions to roth iras. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Web form 8606 department of the treasury internal revenue service nondeductible iras. I have a question regarding form 8606 and our (wife and i) backdoor roth. For instructions and the latest information. Just be sure to preview your forms before filing and ensure the 8606 is present and correctly filled out. Web filing status name changed to qualifying surviving spouse. Web you don’t have to file form 8606 solely to report regular. Web form 8606 for nondeductible contributions any money you contribute to a traditional ira that you do not deduct on your tax return is a “nondeductible contribution.”. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. File 2021 form 8606 with. Web form 8606 department of the treasury. Nondeductible contributions you made to traditional iras. Complete, edit or print tax forms instantly. But see what records must i keep, later. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. File 2021 form 8606 with. Ad access irs tax forms. File 2021 form 8606 with. Web form 8606 with freetaxusa. Web form 8606 for nondeductible contributions any money you contribute to a traditional ira that you do not deduct on your tax return is a “nondeductible contribution.”. Complete, edit or print tax forms instantly. Web where do i find form 8606? The filing status qualifying widow (er) is now called qualifying surviving spouse. Web filing status name changed to qualifying surviving spouse. Web download or print the 2022 federal form 8606 (nondeductible iras) for free from the federal internal revenue service. If you need these forms to complete form 8606, you must mail in the. Web form 8606 (2021) page 2 part ii 2021 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep, and. Solved • by turbotax • 2913 • updated 2 weeks ago we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any. The rules for the filing status have not. Distributions from traditional, sep, or simple. This is the first year that i am trying freetaxusa.com to file our taxes. Nondeductible contributions you made to traditional iras. We offer a variety of software related to various fields at great prices. Department of the treasury internal revenue service (99) nondeductible iras. Web 123 rows form 8606, nondeductible iras: If you aren’t required to file an income tax return but.IRS Form 8606A Comprehensive Guide to Nondeductible IRAs

Irs form 8606 2016 Fill out & sign online DocHub

united states How to file form 8606 when doing a recharacterization

Form 8606 Nondeductible IRAs (2014) Free Download

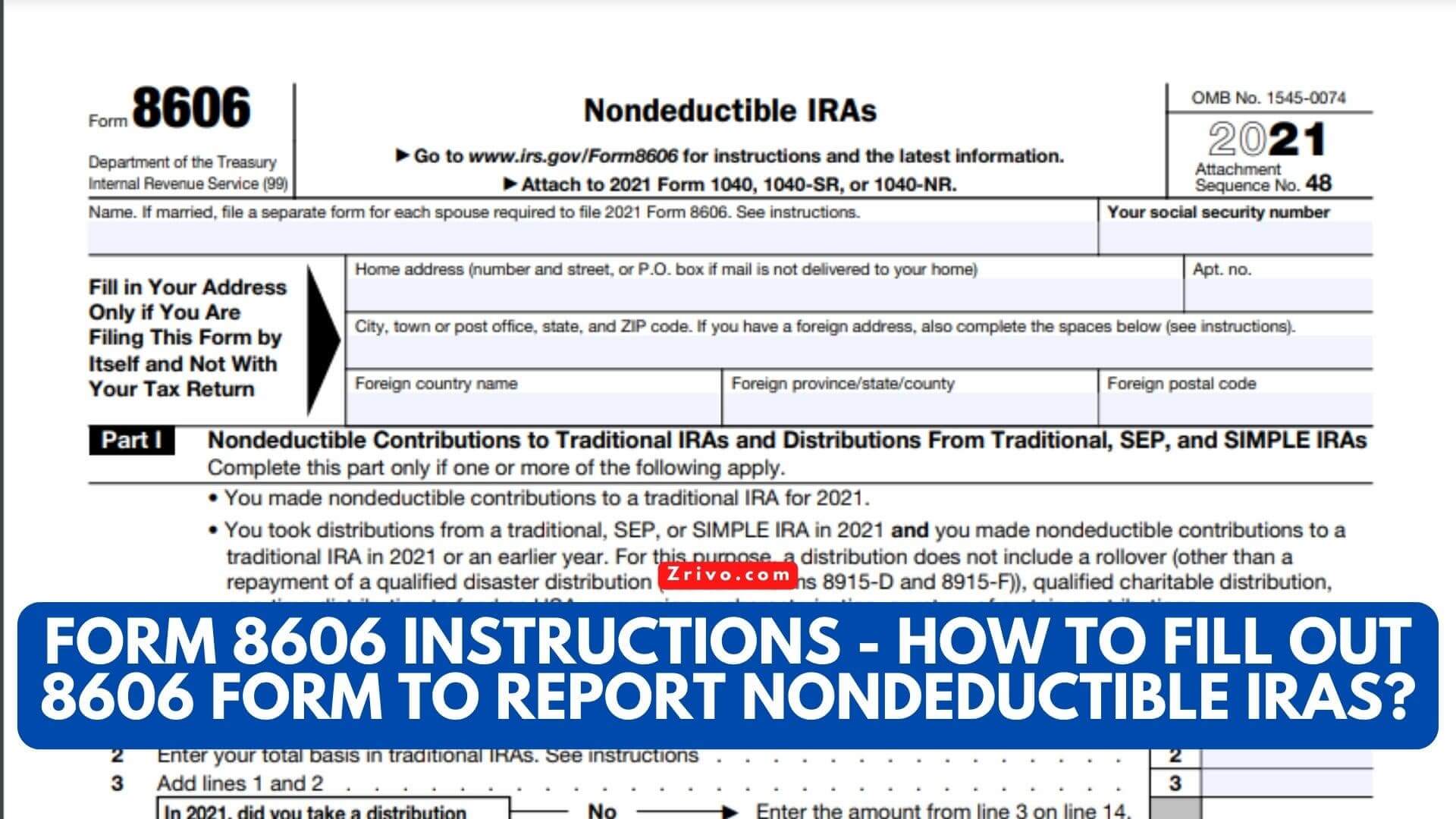

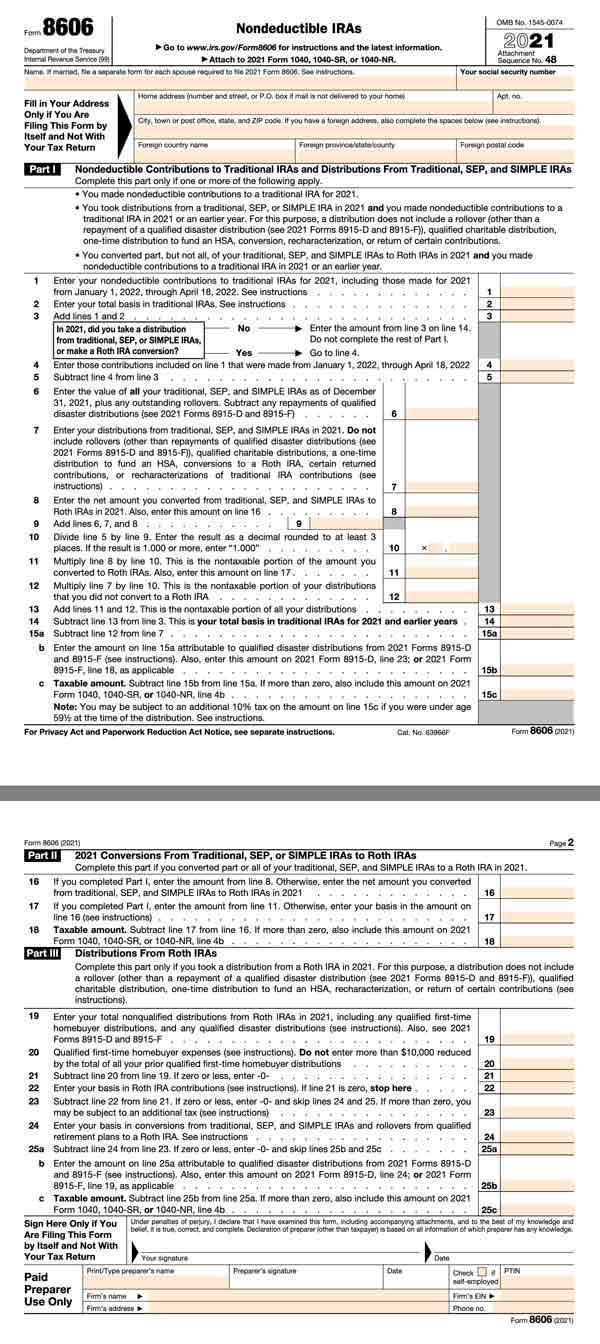

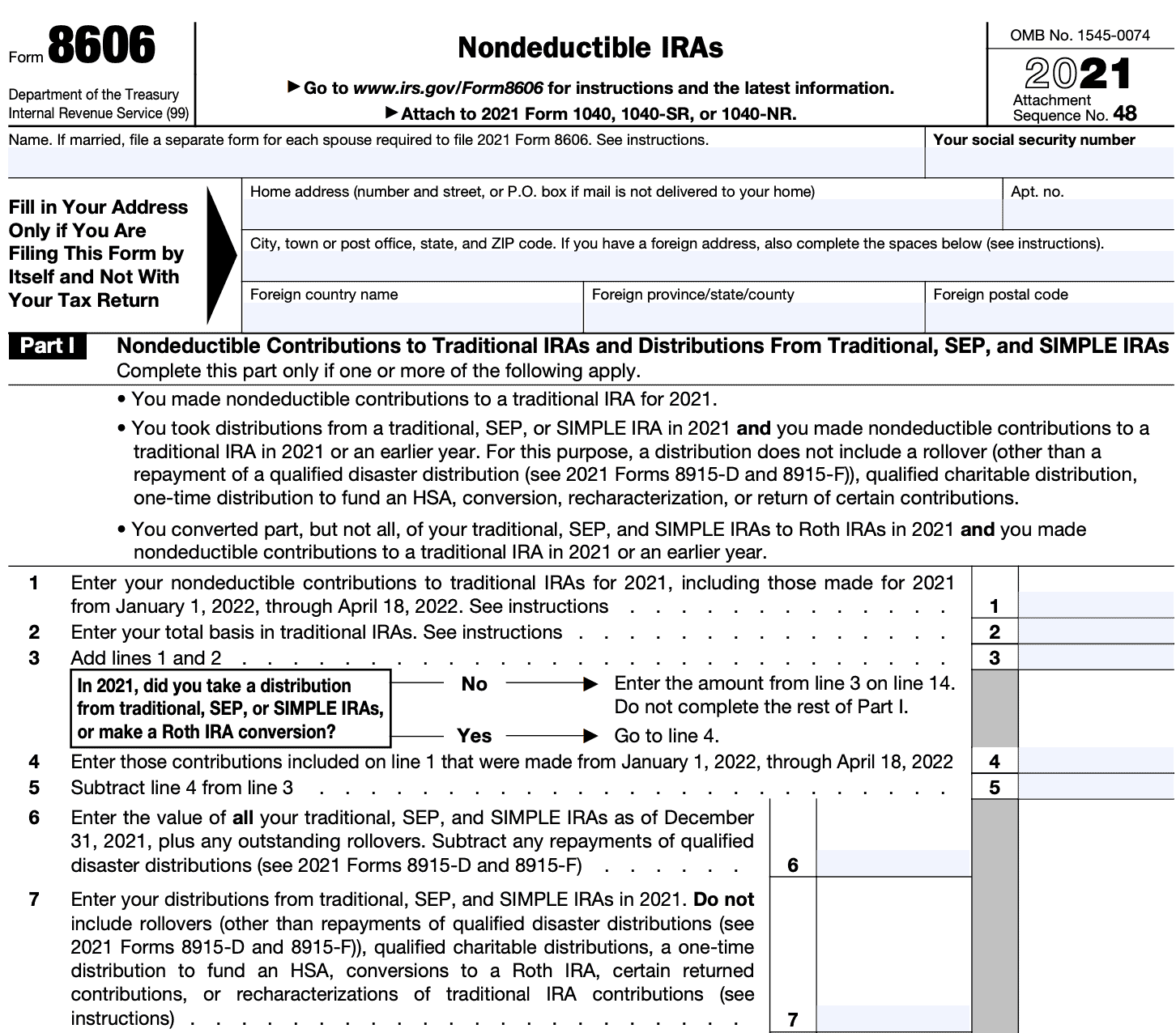

Form 8606 Nondeductible IRAs Fill Out and Report Your Retirement Savings

What Is IRS Form 8606?

2023 Form 8606 Instructions How To Fill Out 8606 Form To Report

IRS Form 8606 What Is It & When To File? SuperMoney

Considering a Backdoor Roth Contribution? Don’t Form 8606!

2008 Form 8606 Fill and Sign Printable Template Online US Legal Forms

Related Post:

:max_bytes(150000):strip_icc()/Form8606pg2-4983aa8619774bbf99bde1e607598d87.jpg)