Tax Form 8814 Instructions

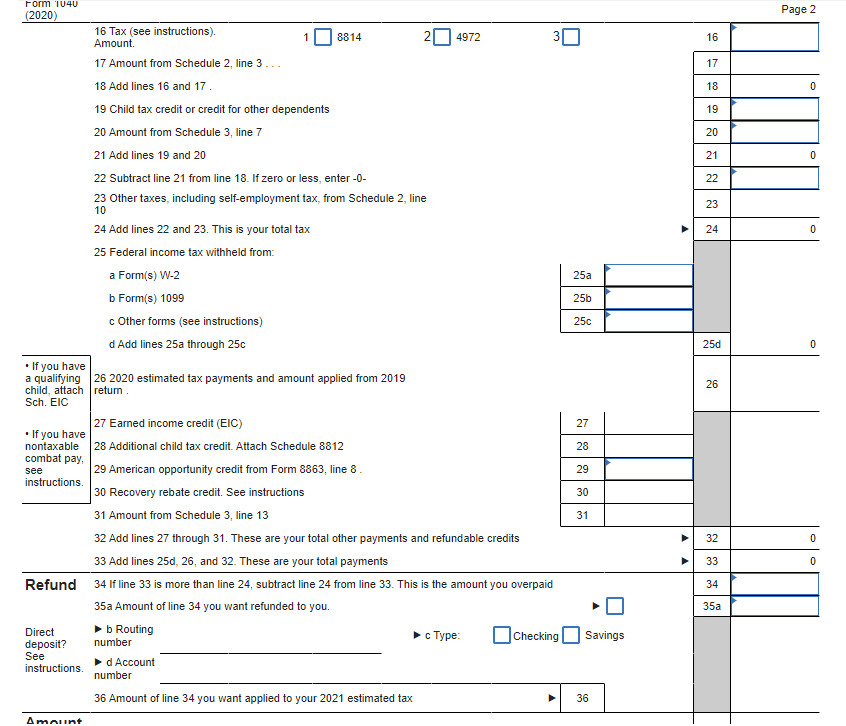

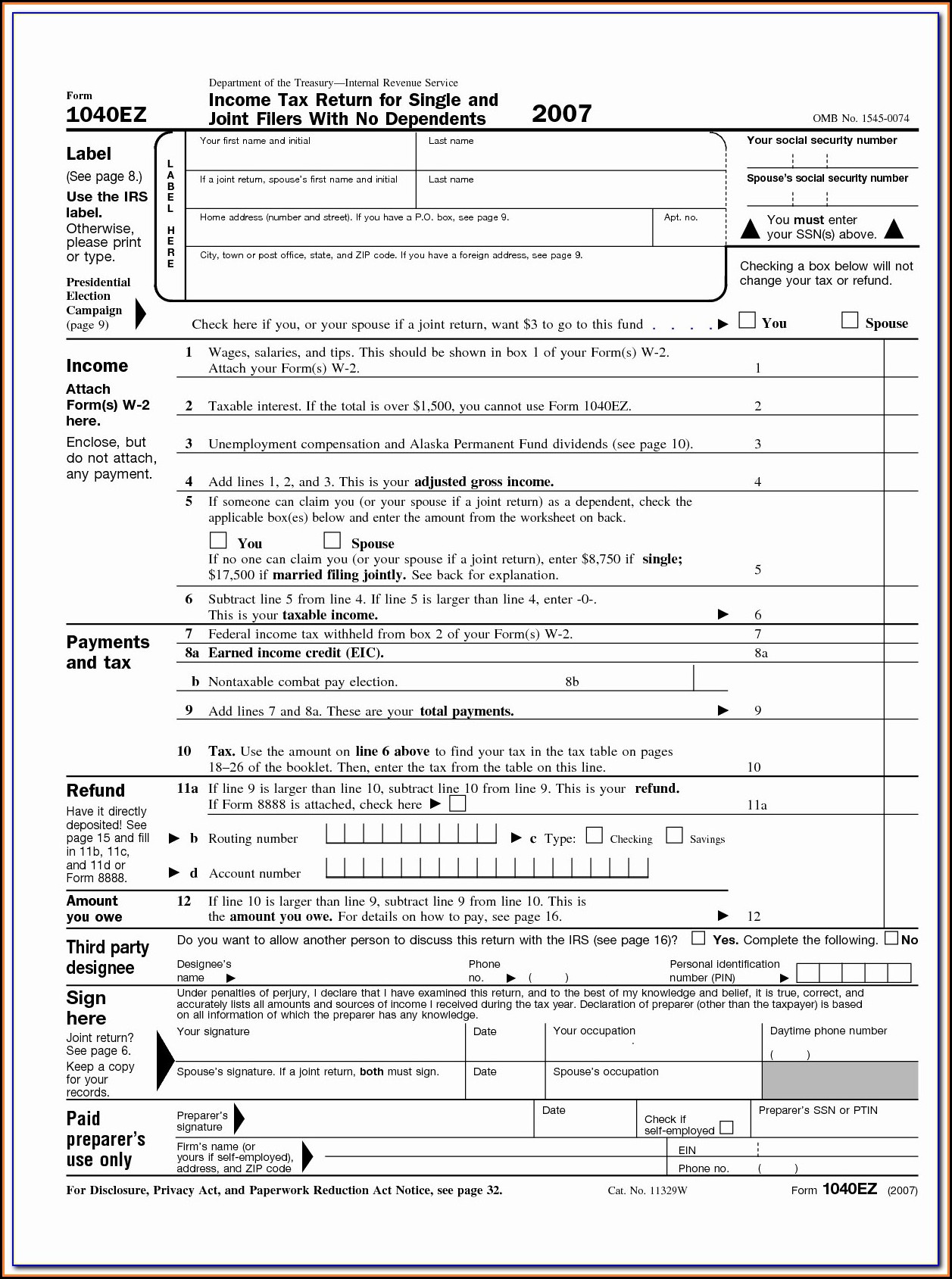

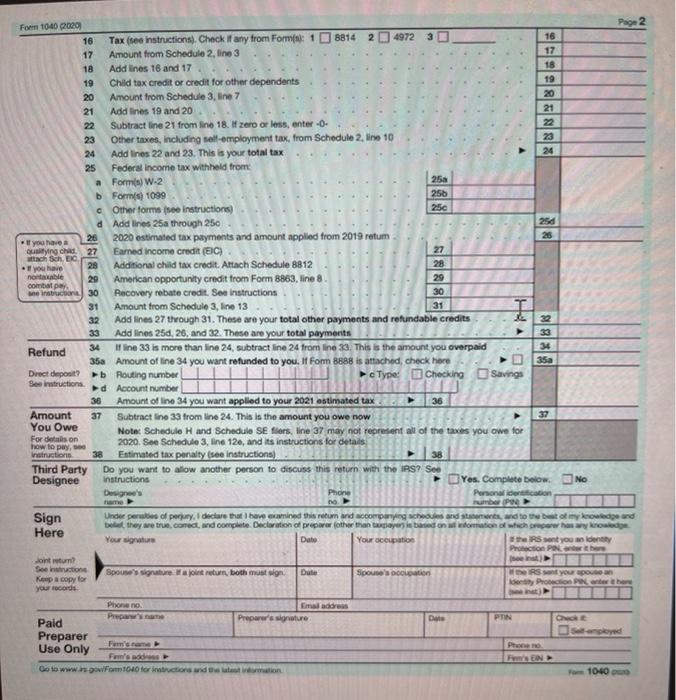

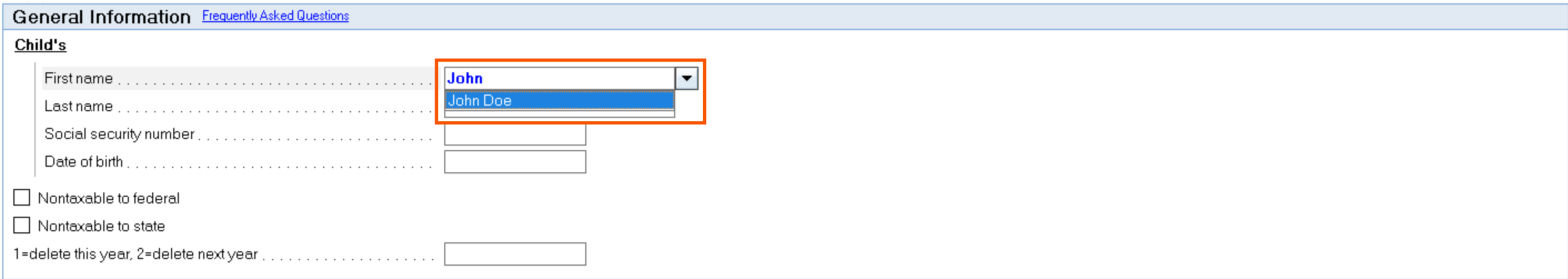

Tax Form 8814 Instructions - Web we have reproduced key portions of the 8814 instructions, with our own summary below. Ad outgrow.us has been visited by 10k+ users in the past month It is part of a group of forms that are. To include the child's income in the parent's return in taxslayer pro, from the main menu of the tax return (form 1040) select: Web for the latest information about developments related to form 8814 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8814. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. If you file form 8814 with your income tax return to report. If you choose this election, your child may not have to file a return. This form is for income earned in tax year 2022, with tax returns due in april. By forrest baumhover august 12, 2023 reading time: Department of the treasury internal revenue service. For the latest information about developments related to form 8814 and. Be sure to check box 1 on form. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Parents use 8814 form to report dividend income on their child’s tax return. If the child's interest and dividend income (including capital gain distributions) total less than $11,000, the child's. Parents’ election to report child’s interest and dividends. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web subtract line 11 from line 6. Be sure to check box 1 on form. Web see the form 8814 instructions for details. Complete, edit or print tax forms instantly. Parents’ election to report child’s interest and dividends. Parents use 8814 form to report dividend income on their child’s tax return. If you file form 8814 with your income tax return to report. Use this screen to complete form 8814 if the taxpayer has elected to report his or her child's income, thus eliminating the need for the child to file a return using form. Complete, edit or print tax forms instantly. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Web see the form 8814. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web for the latest information about developments related to form 8814 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8814. Ad outgrow.us has been visited by 10k+ users in the past month Who must file form 8814? Form. Parents use 8814 form to report dividend income on their child’s tax return. If you file form 8814 with your income tax return to report. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Use this form if you. Web subtract line 11 from line 6. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. If you choose this election, your child may not have to file a return. Parents’ election to report child’s interest and dividends. Web we have reproduced key portions of the 8814 instructions, with our own summary below. Web form 8814 department of the treasury. Who must file form 8814? If you file form 8814 with your income tax return to report. Complete, edit or print tax forms instantly. Fill out all necessary lines in your document making use of our powerful and. This form is for income earned in tax year 2022, with tax returns due in april. Fill out all necessary lines in your document making use of our powerful and. Who must file form 8814? Ad outgrow.us has been visited by 10k+ users in the past month Web subtract line 11 from line 6. This form is for income earned in tax year 2022, with tax returns due in april. For the latest information about developments related to form 8814 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8814. Click on the button get form to open it and start editing. In the space next to line 21, enter. Web for the latest information about developments related to form 8814 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8814. Web see the form 8814 instructions for details. Complete, edit or print tax forms instantly. For the latest information about developments related to form 8814 and. Use this screen to complete form 8814 if the taxpayer has elected to report his or her child's income, thus eliminating the need for the child to file a return using form. Who must file form 8814? To include the child's income in the parent's return in taxslayer pro, from the main menu of the tax return (form 1040) select: Include this amount in the total on form 1040, line 21, or form 1040nr, line 21. In the space next to line 21, enter “form 8814” and show the amount. Click on the button get form to open it and start editing. Web federal form 8814 instructions. By forrest baumhover august 12, 2023 reading time: If the child's interest and dividend income (including capital gain distributions) total less than $11,000, the child's. Use this form if you elect to report your child’s income on your. Web we have reproduced key portions of the 8814 instructions, with our own summary below. Department of the treasury internal revenue service. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web subtract line 11 from line 6. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income.Reba Dixon is a fifthgrade school teacher who earned

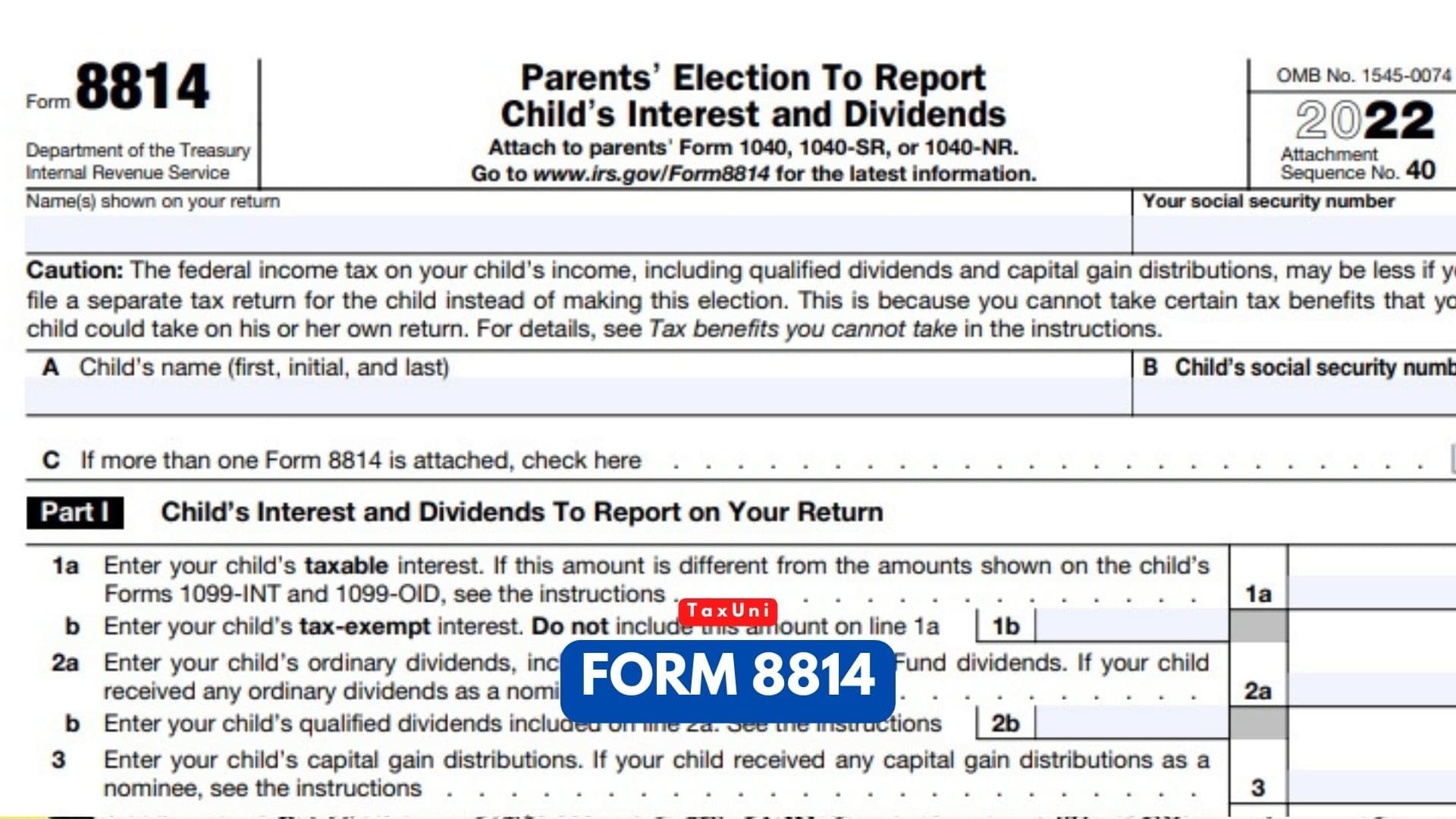

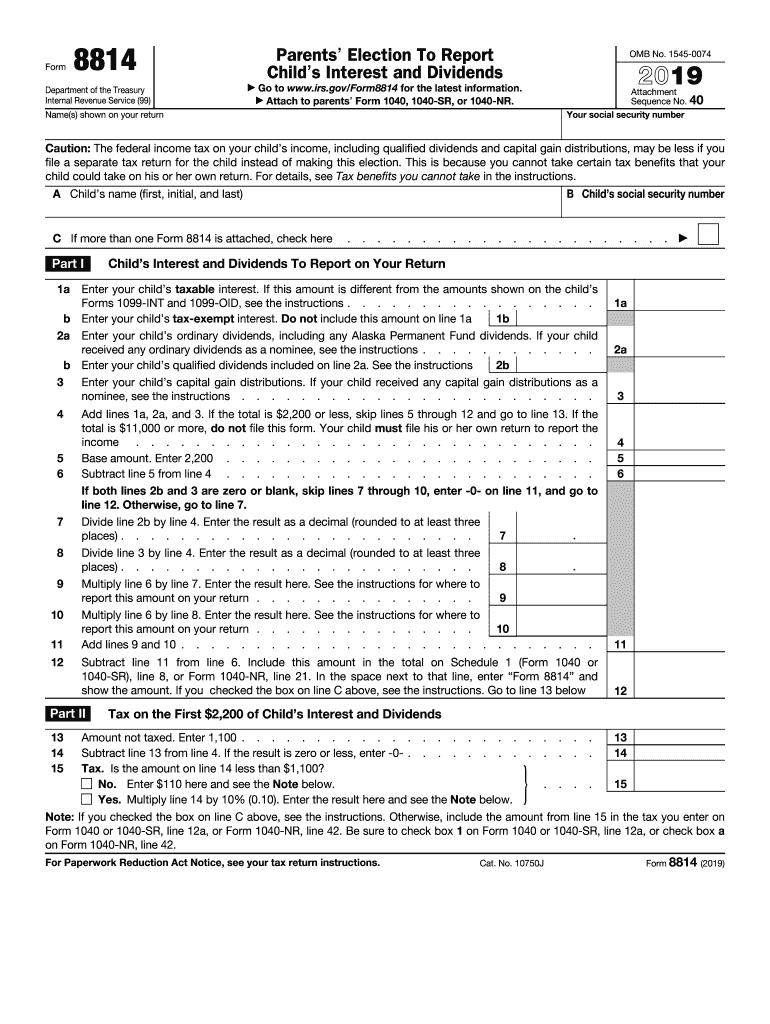

Form 8814 Parent's Election to Report Child's Interest and Dividends

IRS Form 8814 Reporting Your Child's Interest and Dividends

Form 8814 Parent's Election to Report Child's Interest and Dividends

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Fill Free fillable IRS PDF forms

Individual Return (Linda and Kyle Smith) Linda and

Generating Form 8814 in Lacerte

8814 Form 2023

8814 2019 Form Fill Out and Sign Printable PDF Template signNow

Related Post: