Tax Form 6198

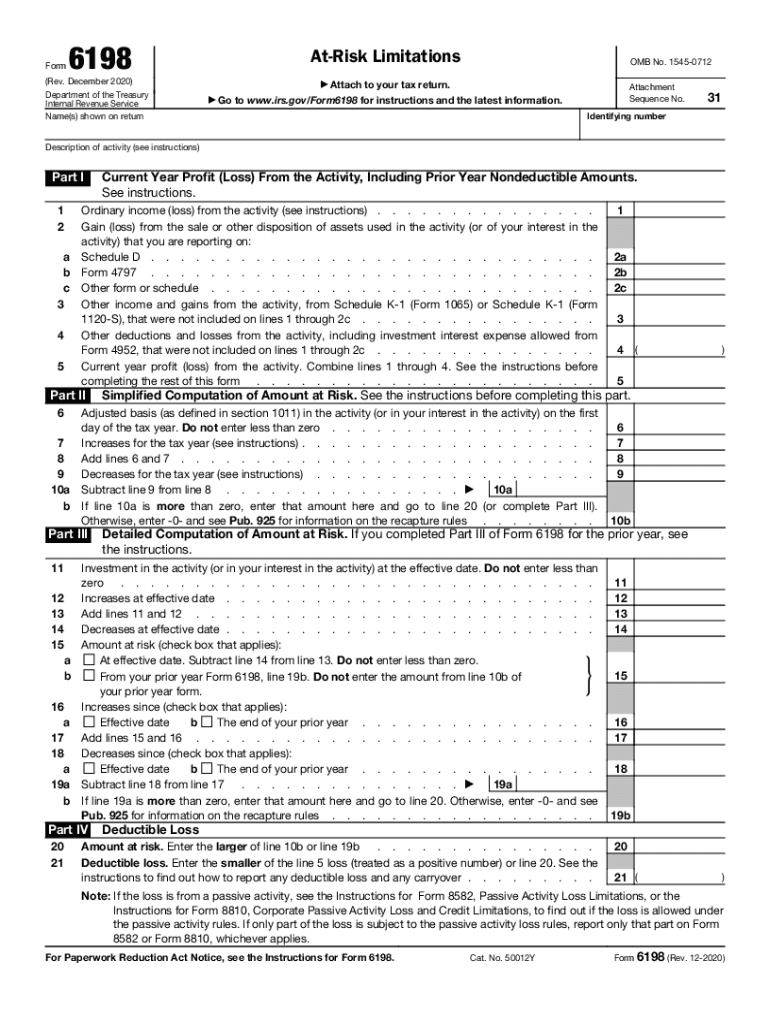

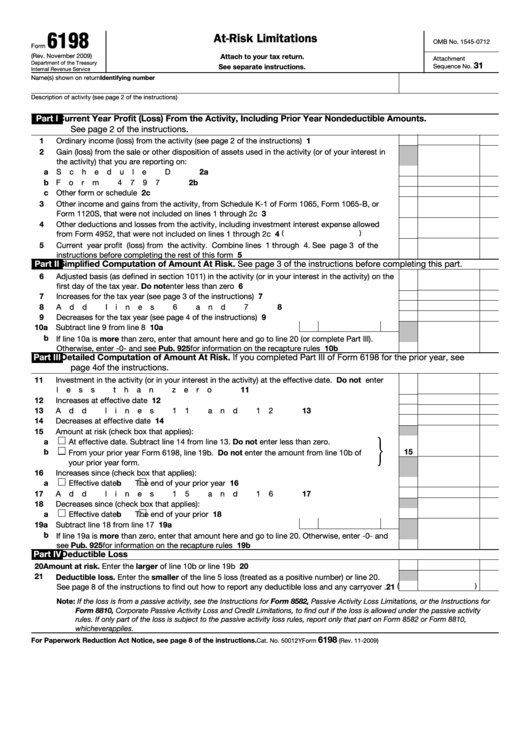

Tax Form 6198 - Web use form 6198 to figure: Form 6198 should be filed when a taxpayer has a loss in a business. Log on to uaccess student center. Web as a general rule, being able to take a tax deduction largely depends on whether the owner is actually taking an entrepreneurial risk. Do not enter the amount from line 10b of the 2007 form. In this article, we’ll cover the. Generally, any loss from an activity (such as a rental). B increases since (check box that applies): Ad justanswer.com has been visited by 100k+ users in the past month You can download or print current or past. Log on to uaccess student center. Attach to your tax return. We have no way of. Tpt filers are reminded of the following september tpt filing deadlines: Generally, any loss from an activity (such as a rental). Ad justanswer.com has been visited by 100k+ users in the past month Tpt filers are reminded of the following september tpt filing deadlines: Web as a general rule, being able to take a tax deduction largely depends on whether the owner is actually taking an entrepreneurial risk. Do not enter the amount from line 10b of the 2007 form. Attach. Web from 2007 form 6198, line 19b. Web as a general rule, being able to take a tax deduction largely depends on whether the owner is actually taking an entrepreneurial risk. Attach to your tax return. Form 6198 must be completed if there is an entry on line 19 above. For contributions made to an umbrella charitable organization, the qualifying. Web the 2017 tax return. Web individual income tax forms. In this article, we’ll cover the. Tpt forms, corporate tax forms, withholding forms : Tpt filers are reminded of the following september tpt filing deadlines: Web using form 6198, you can figure out the maximum amount you can deduct after you have suffered a loss in your business in the tax year. B increases since (check box that applies): In this article, we’ll cover the. Web from 2007 form 6198, line 19b. December 2020) department of the treasury internal revenue service. Ad outgrow.us has been visited by 10k+ users in the past month Web form number title; For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Everything you need to know. Log on to uaccess student center. Everything you need to know. Web as a general rule, being able to take a tax deduction largely depends on whether the owner is actually taking an entrepreneurial risk. Tpt forms, corporate tax forms, withholding forms : Form 6198 should be filed when a taxpayer has a loss in a business. Log on to uaccess student center. Web the 2017 tax return. Web using form 6198, you can figure out the maximum amount you can deduct after you have suffered a loss in your business in the tax year. Form 6198 should be filed when a taxpayer has a loss in a business. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding. Everything you need to know. Tpt filers are reminded of the following september tpt filing deadlines: Ad outgrow.us has been visited by 10k+ users in the past month You can download or print current or past. In this article, we’ll cover the. You can download or print current or past. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Ad outgrow.us has been visited by 10k+ users in the past month Do not enter the amount from line 10b of the 2007 form. Web form number title; Log on to uaccess student center. Form 6198 should be filed when a taxpayer has a loss in a business. You can download or print current or past. B increases since (check box that applies): Web the 2017 tax return. Web individual income tax forms. Form 6198 must be completed if there is an entry on line 19 above. Web form number title; Tpt filers are reminded of the following september tpt filing deadlines: In this article, we’ll cover the. Do not enter the amount from line 10b of the 2007 form. Tpt forms, corporate tax forms, withholding forms : Generally, any loss from an activity (such as a rental). Web from 2007 form 6198, line 19b. Attach to your tax return. December 2020) department of the treasury internal revenue service. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Everything you need to know. 16 16 a effective date 17 b the end of your. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are.How To Change Tax Withholding With Unemployment Ny YUNEMPLO

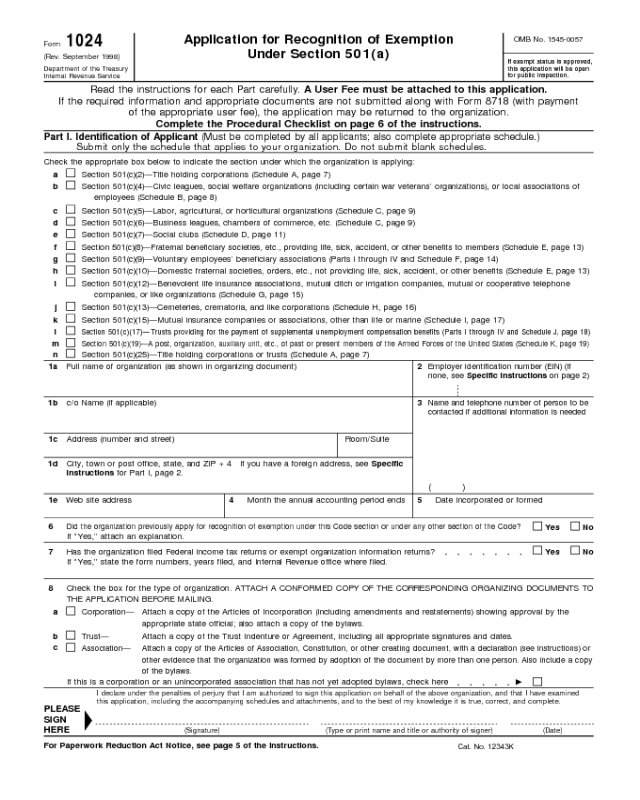

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Simplified Tax Form? NESA

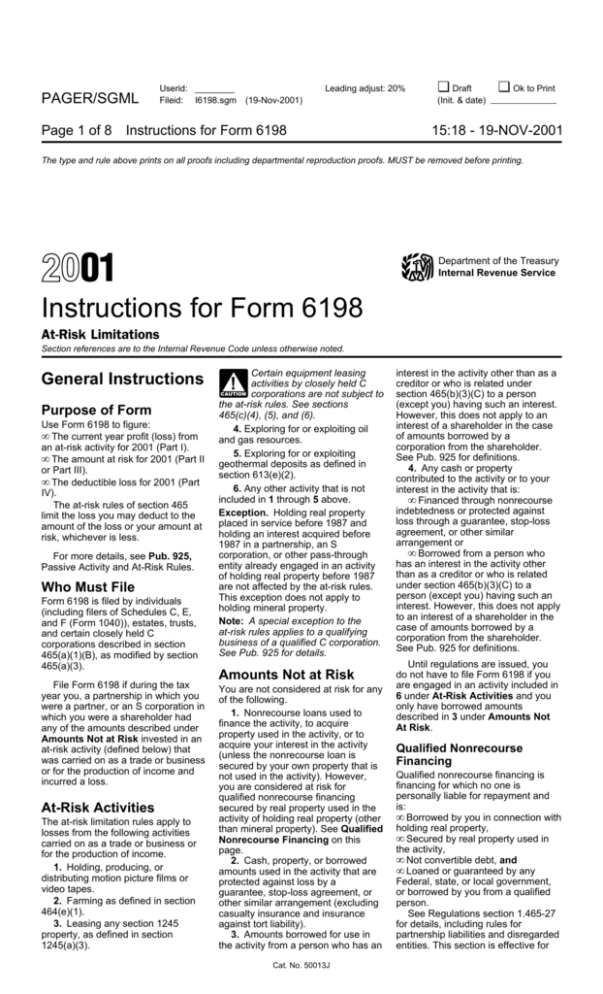

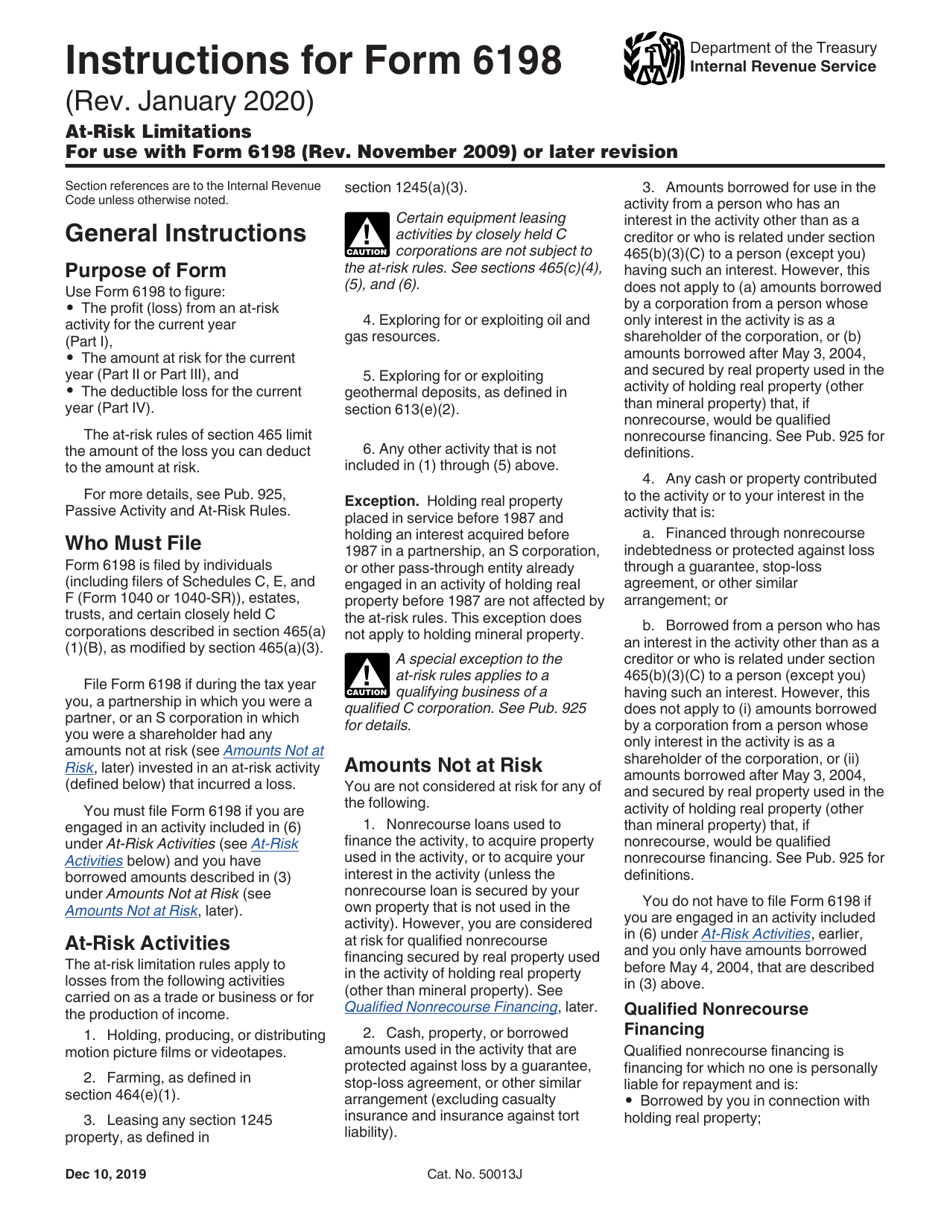

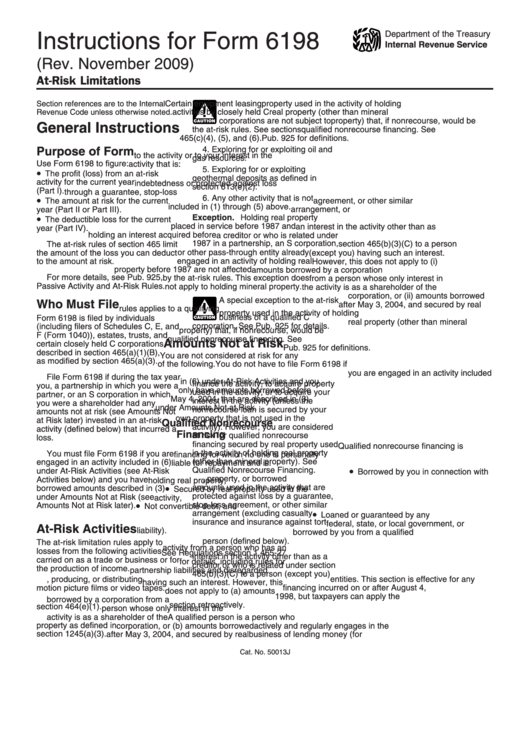

Instructions for Form 6198

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

2020 6198 signNow Form Fill Out and Sign Printable PDF Template signNow

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Instructions For Form 6198 AtRisk Limitations printable pdf download

Fillable Form 6198 AtRisk Limitations printable pdf download

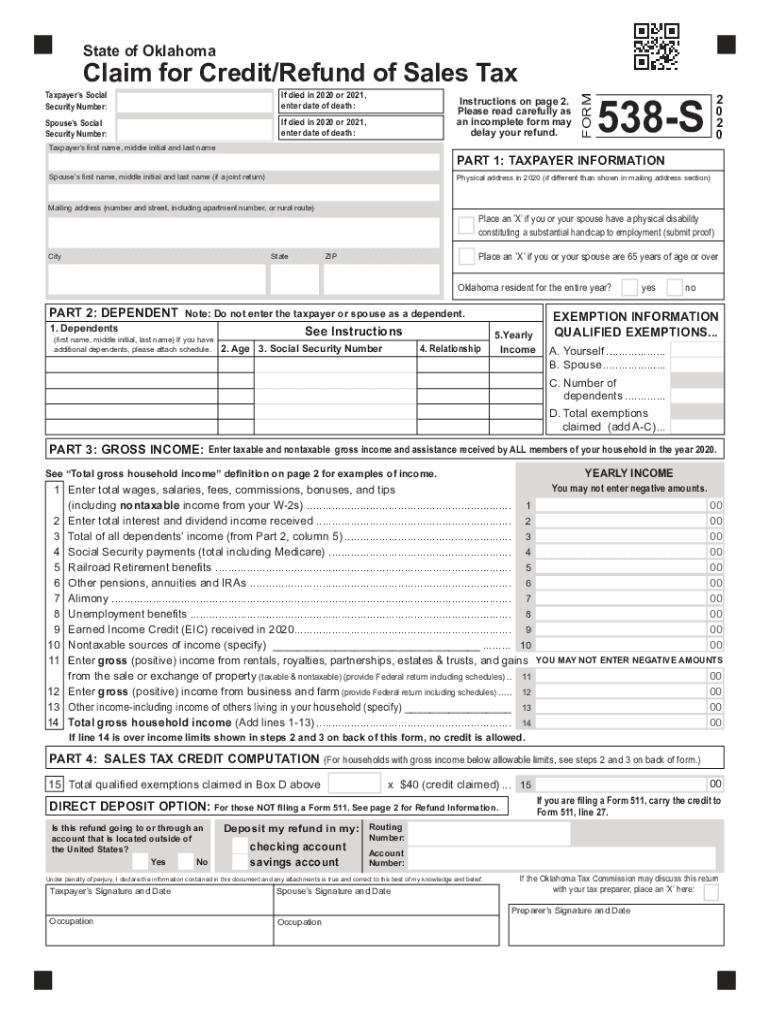

2018 Oklahoma Refund Fill Out and Sign Printable PDF Template signNow

Related Post: