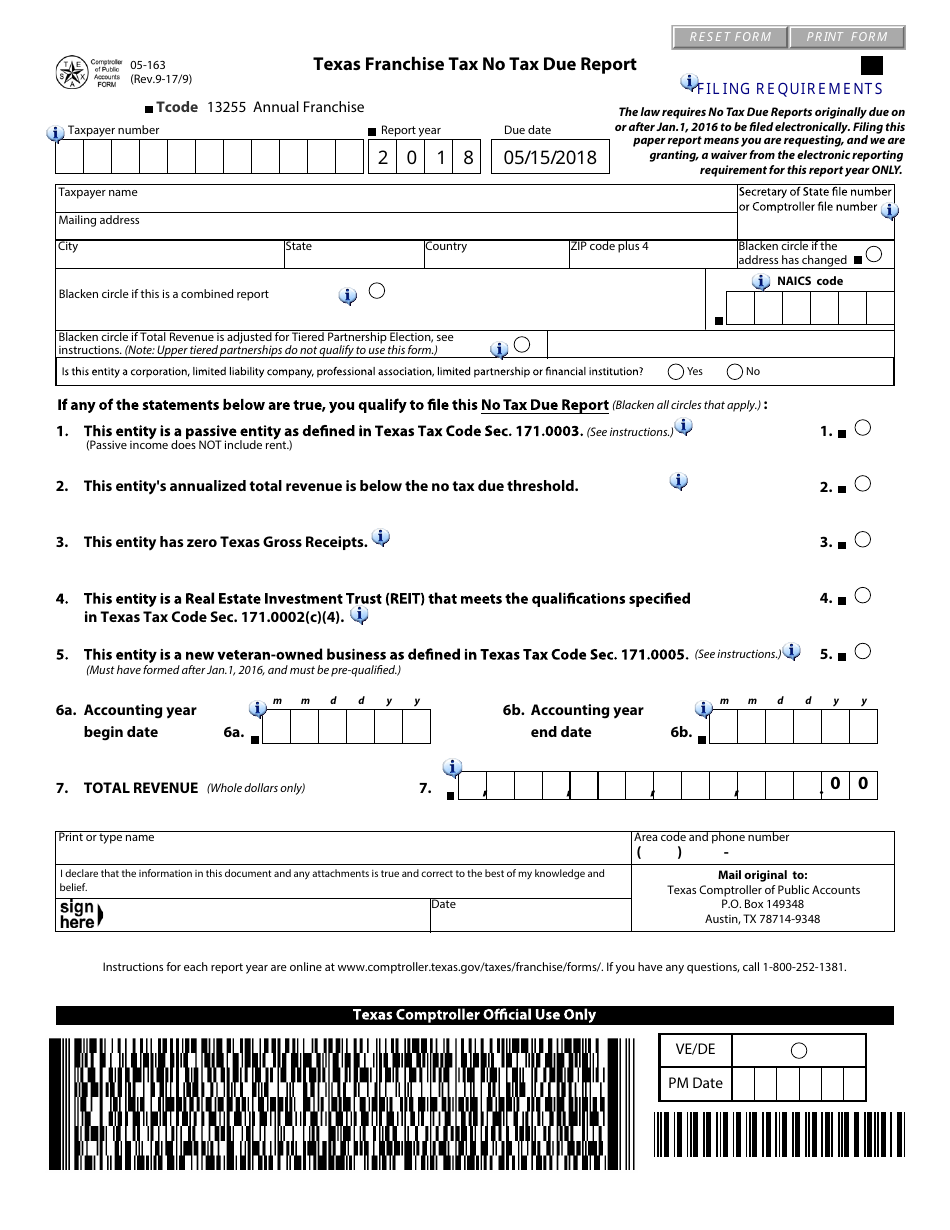

Tax Form 05-163

Tax Form 05-163 - Filing this paper report means you are requesting, and we are granting, a. Web (for contributions that exceed the maximum allowable credit on arizona form 323) 348 for information or help, call one of the numbers listed: The entity has $300,000 or less in total revenue. There is no minimum tax requirement under the franchise tax provisions. Open form follow the instructions. The law requires no tax due reports originally due on or after jan.1, 2016 to be led electronically. To begin the form, use the fill camp; Print or type name area code and phone. Web coupled with the increased individual income tax rates that take effect after december 31, 2025, taxpayers will see an increase in their effective tax rate of 10%, going from 30% to 39.6%. Paper report means you are requesting, and we are granting, a waiver from the electronic reporting requirement for. Ad a tax advisor will answer you now! Web arizona department of revenue. Any entity that calculates tax due that is less than $1,000 or that has total. The advanced tools of the editor will guide you through the editable pdf template. Ad tax planning software for accounting firms from corvee. The law requires no tax due reports originally due on. The increase in effective tax rate does not include the increased. Taxpayer is a real estate investment trust that meets the. The mailing address for your arizona state income tax return, if you are not enclosing a payment with your return: Paper report means you are requesting, and we are. Taxpayer is a passive entity. The increase in effective tax rate does not include the increased. Any entity that calculates tax due that is less than $1,000 or that has total. Open form follow the instructions. There is no minimum tax requirement under the franchise tax provisions. Any entity that calculates tax due that is less than $1,000 or that has total. Paper report means you are requesting, and we are granting, a waiver from the electronic reporting requirement for. Blacken circle if this is a. Ad tax planning software for accounting firms from corvee. Taxpayer is a real estate investment trust that meets the. The law requires no tax due reports originally due on or after jan.1, 2016 to be led electronically. The advanced tools of the editor will guide you through the editable pdf template. Web (for contributions that exceed the maximum allowable credit on arizona form 323) 348 for information or help, call one of the numbers listed: Privilege period covered by. The law requires no tax due reports originally due on. Any entity that calculates tax due that is less than $1,000 or that has total. Print or type name area code and phone. Get all your questions answered. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on. The advanced tools of the editor will guide you through the editable pdf template. Web the 2017 tax return. Easily sign the form with your finger. Web coupled with the increased individual income tax rates that take effect after december 31, 2025, taxpayers will see an increase in their effective tax rate of 10%, going from 30% to 39.6%. In. The following are the revenue thresholds outlined in the texas franchise tax report. Web september 28, 2023. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. To begin the form, use the fill camp; Save or instantly send your ready documents. Print or type name area code and phone. Privilege period covered by this report. Tax forms, instructions, and other tax. The following are the revenue thresholds outlined in the texas franchise tax report. Taxpayer is a passive entity. Filing this paper report means you are requesting, and we are granting, a. Web (for contributions that exceed the maximum allowable credit on arizona form 323) 348 for information or help, call one of the numbers listed: Web the 2017 tax return. If a fund is designated, the umbrella charitable organization fund. Open form follow the instructions. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. Get all your questions answered. This form will produce automatically when: Filing this paper report means you are requesting, and we are granting, a. Open form follow the instructions. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on the tax form. If a fund is designated, the umbrella charitable organization fund. Web the 2017 tax return. Web what is texas form 05 163? Open form follow the instructions. The entity has $300,000 or less in total revenue. Print or type name area code and phone. Save or instantly send your ready documents. Privilege period covered by this report. The entity is passive as defined in chapter 171 of the texas tax code. The law requires no tax due reports originally due on. Sign online button or tick the preview image of the form. The following are the revenue thresholds outlined in the texas franchise tax report. Taxpayer is a real estate investment trust that meets the. The mailing address for your arizona state income tax return, if you are not enclosing a payment with your return:Texas Franchise Tax Instructions 2021 20192021 Form TX Comptroller

Blank Nv Sales And Use Tax Form / Form MBTFI Fillable Modified

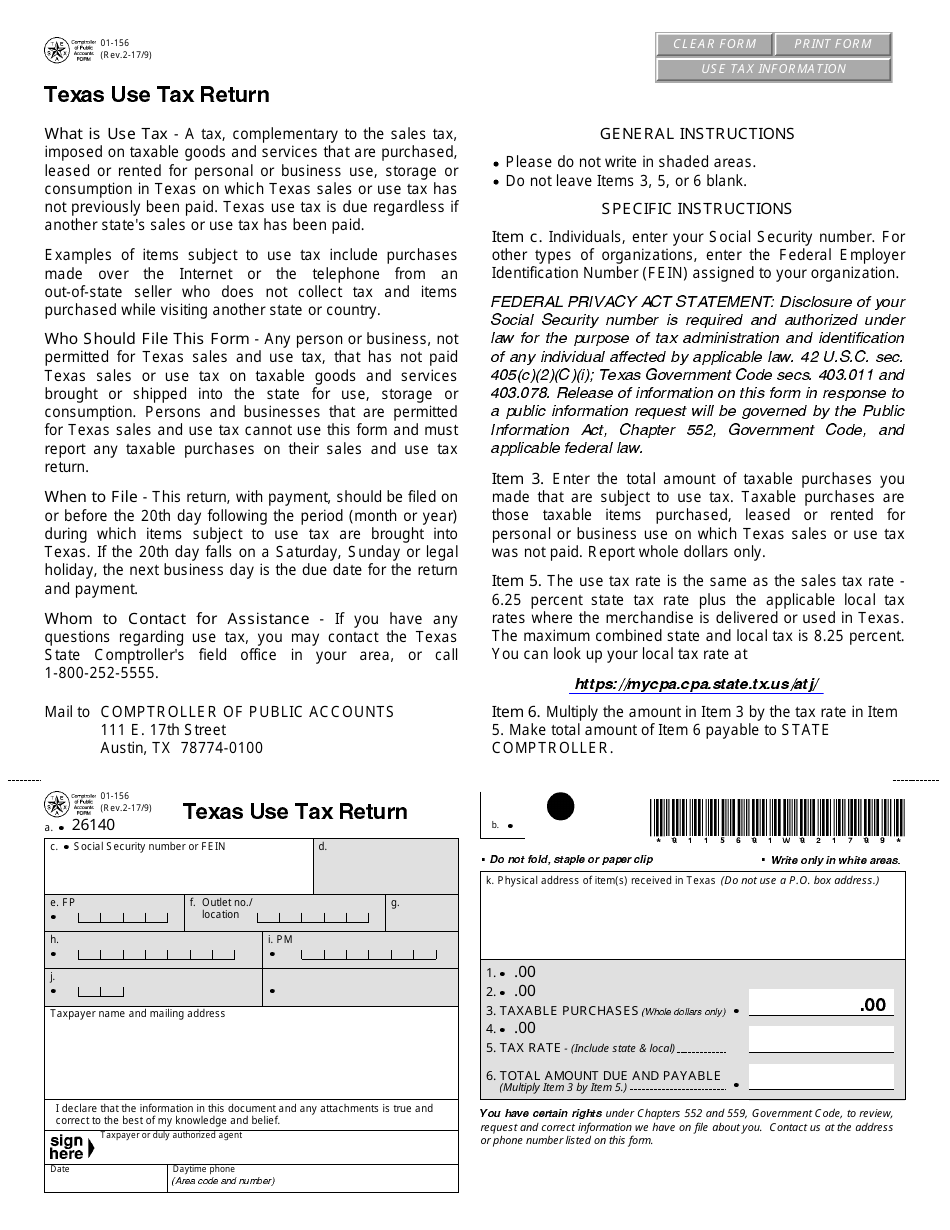

Form 01156 Fill Out, Sign Online and Download Fillable PDF, Texas

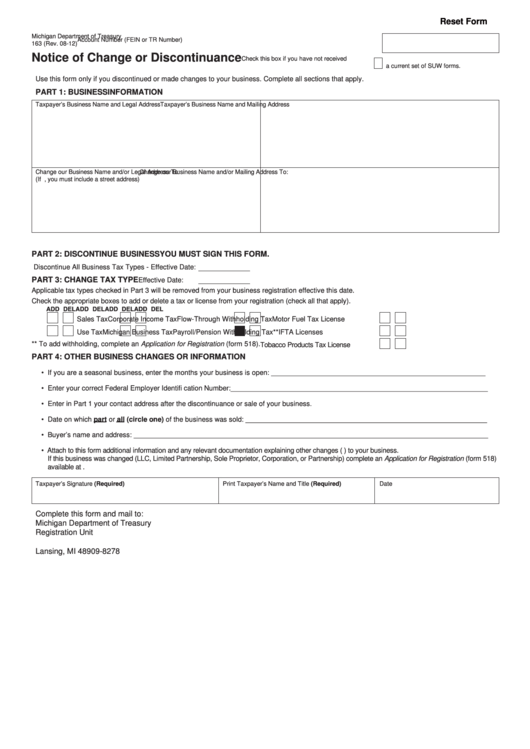

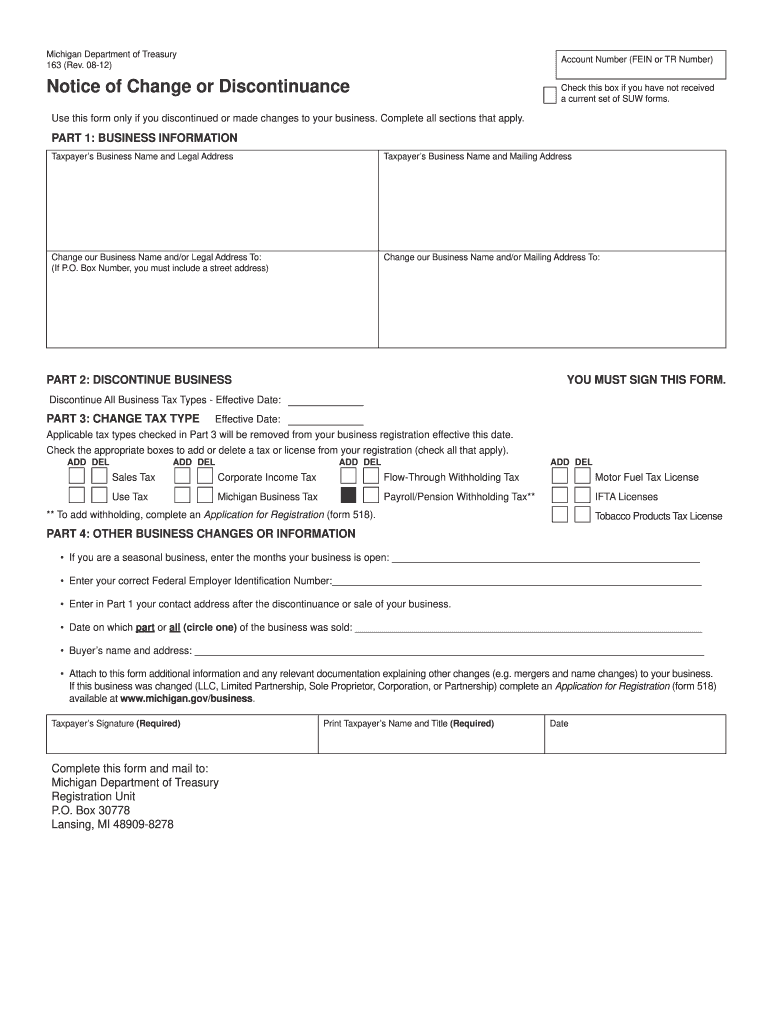

Fillable Form 163 Notice Of Change Or Discontinuance printable pdf

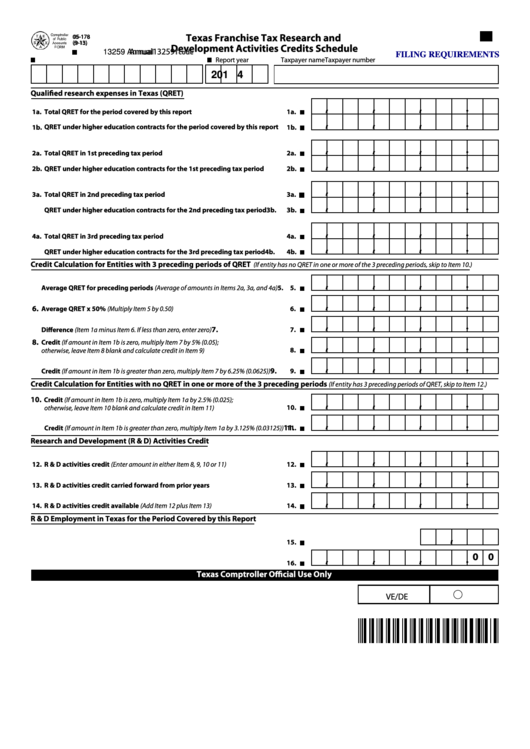

Fillable Form 05178 Texas Franchise Tax Research And Development

Texas form 05 163 2016 Fill out & sign online DocHub

Form 163 Fill Out and Sign Printable PDF Template signNow

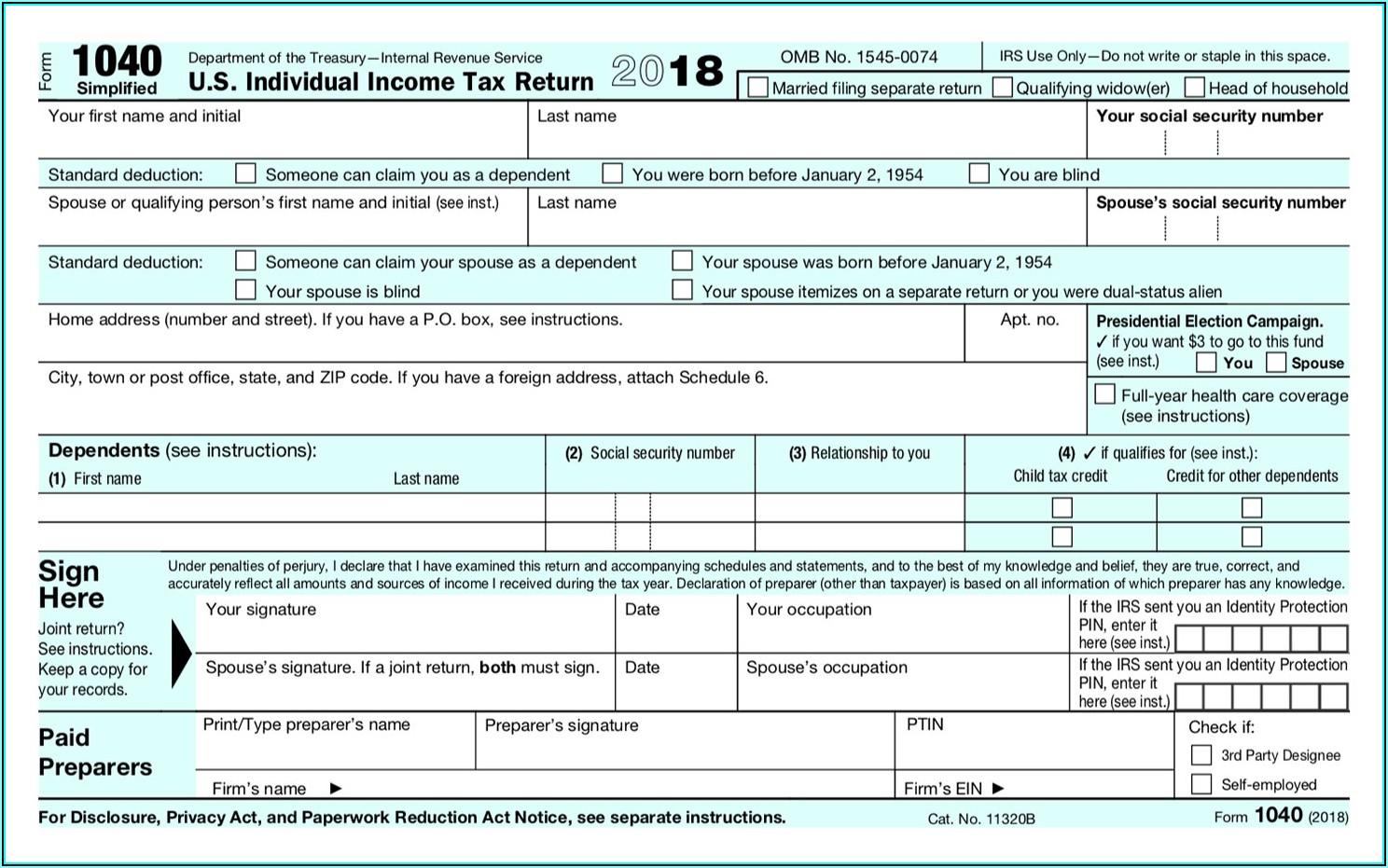

Federal Tax Forms 1040ez Form Resume Examples a6YnA8P9Bg

Form 05163 2018 Fill Out, Sign Online and Download Fillable PDF

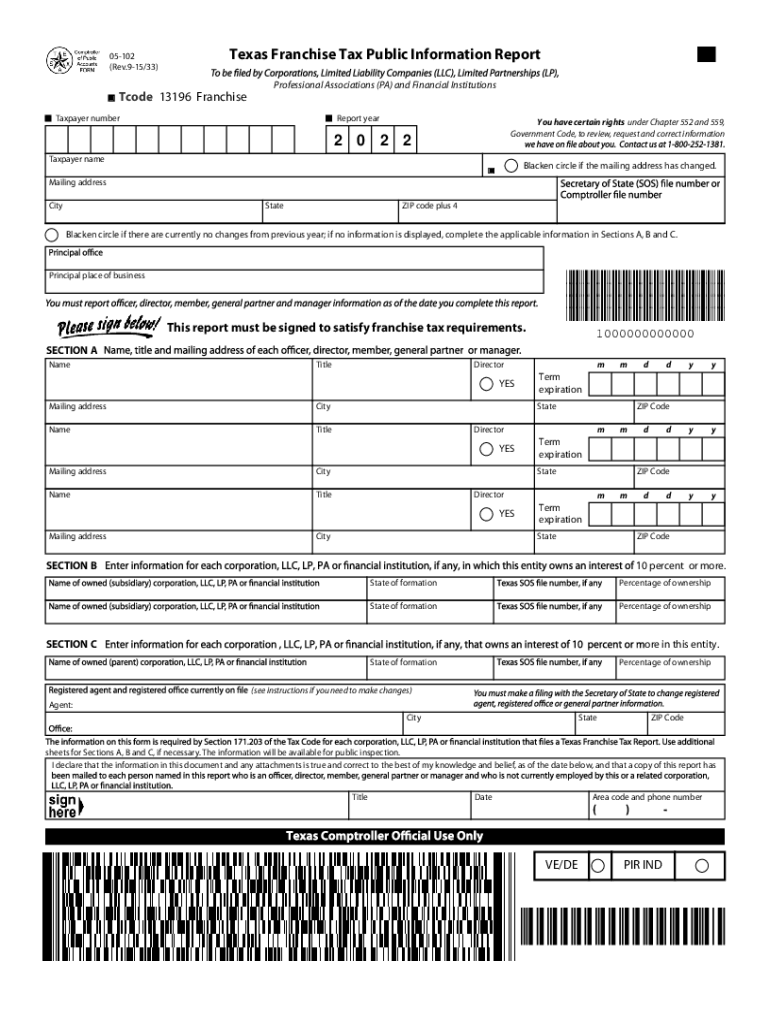

Form 05 102 Fill out & sign online DocHub

Related Post: