Louisiana Tax Form Schedule E

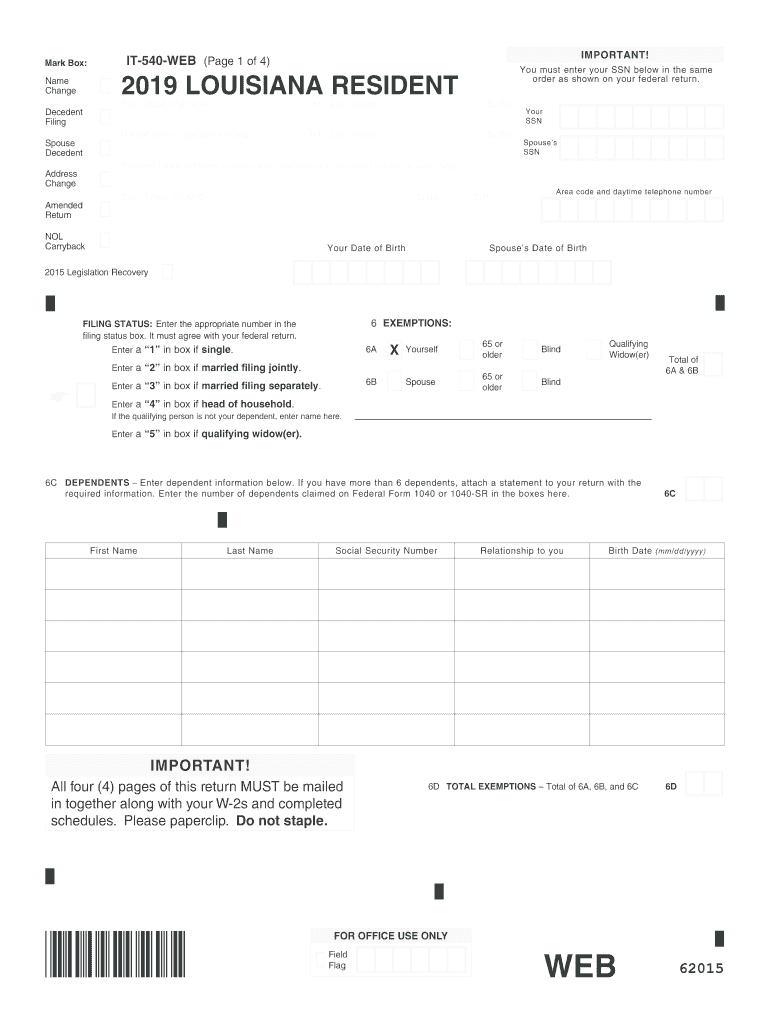

Louisiana Tax Form Schedule E - See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Louisiana has a state income tax that ranges between 1.85% and 4.25% , which is administered by the louisiana department of revenue. Check your louisiana tax refund status. Get ready for tax season deadlines by completing any required tax forms today. (check a box below) incurred no. Enter the appropriate number in the. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Complete, edit or print tax forms instantly. These 2021 forms and more are available: Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in real estate. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in real estate. Get ready for tax season deadlines by completing any required tax forms today. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts,. (check a box below) incurred no. Enter the appropriate number in the ling. These 2021 forms and more are available: Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in. New users for online filing in order to use the online tax filing application, you must. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. Enter the appropriate number in the. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Check your louisiana tax. Get ready for tax season deadlines by completing any required tax forms today. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Web file returns and make payments. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. Enter the appropriate number. We last updated the resident income tax return in january 2023, so this is. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Louisiana has a state income tax that ranges between 1.85% and 4.25% , which. Ad access irs tax forms. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. • free filing • faster refunds • easy, fast, and secure • 24 hours a day • direct deposit • direct debit • confirmation provided • pay. These 2021 forms and more are available: New users for. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in. (check a box below) incurred no. Check your louisiana tax refund status. We last updated the resident income tax return in january 2023, so this is. Sign into your efile.com account and check acceptance by the. (check a box below) incurred no. Web what’s new for louisiana 2022 individual income tax. Web we would like to show you a description here but the site won’t allow us. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Ad access irs tax forms. Louisiana has a state income tax that ranges between 1.85% and 4.25% , which is administered by the louisiana department of revenue. Enter the appropriate number in the ling. Where is your irs refund? Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Web we would like to show you a description here but the site won’t allow us. Check your louisiana tax refund status. Sign into your efile.com account and check acceptance by the tax agency. Web this form package includes the louisiana. Online applications to register a business. Enter the appropriate number in the ling. Complete, edit or print tax forms instantly. Web what’s new for louisiana 2022 individual income tax. Check your louisiana tax refund status. We last updated the resident income tax return in january 2023, so this is. These 2021 forms and more are available: Web this form package includes the louisiana resident income tax return and associated schedules. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in real estate. Find out when all state tax returns are due. Louisiana has a state income tax that ranges between 1.85% and 4.25% , which is administered by the louisiana department of revenue. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. Get ready for tax season deadlines by completing any required tax forms today. New users for online filing in order to use the online tax filing application, you must have already filed a. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Web we would like to show you a description here but the site won’t allow us. Web file returns and make payments. • free filing • faster refunds • easy, fast, and secure • 24 hours a day • direct deposit • direct debit • confirmation provided • pay. Ad access irs tax forms.Form R10606 Fill Out, Sign Online and Download Fillable PDF

Tax Return Louisiana State Tax Return

Louisiana Resale Certificate Fill Out and Sign Printable PDF Template

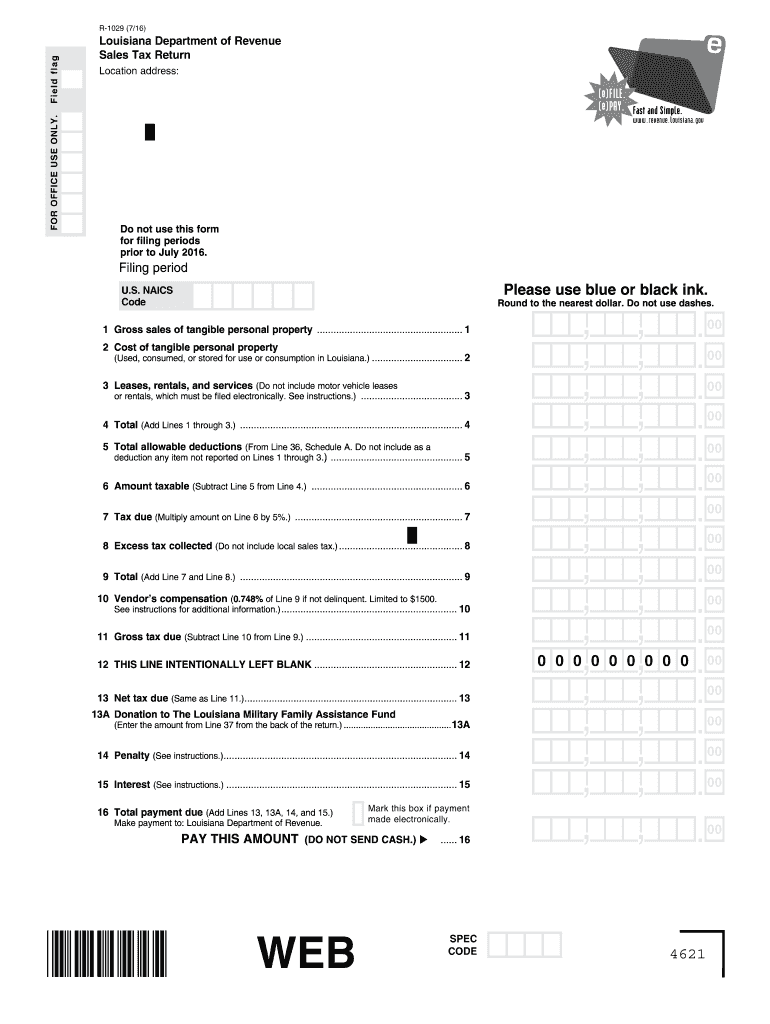

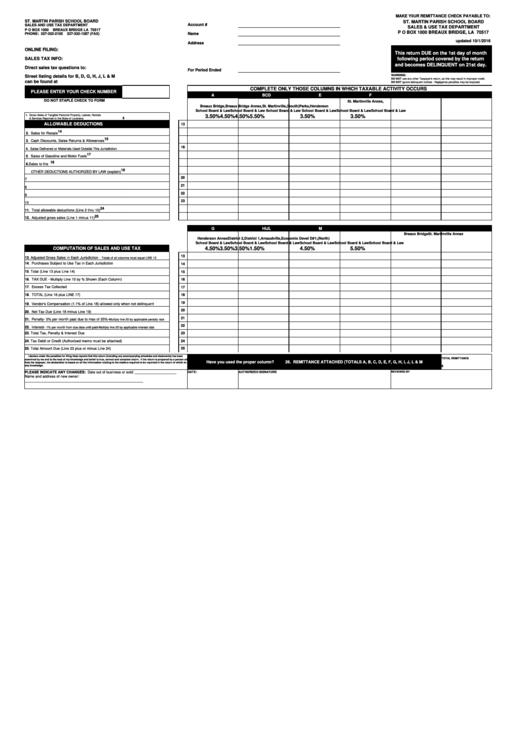

Louisiana R 1029 Form Fill Out and Sign Printable PDF Template signNow

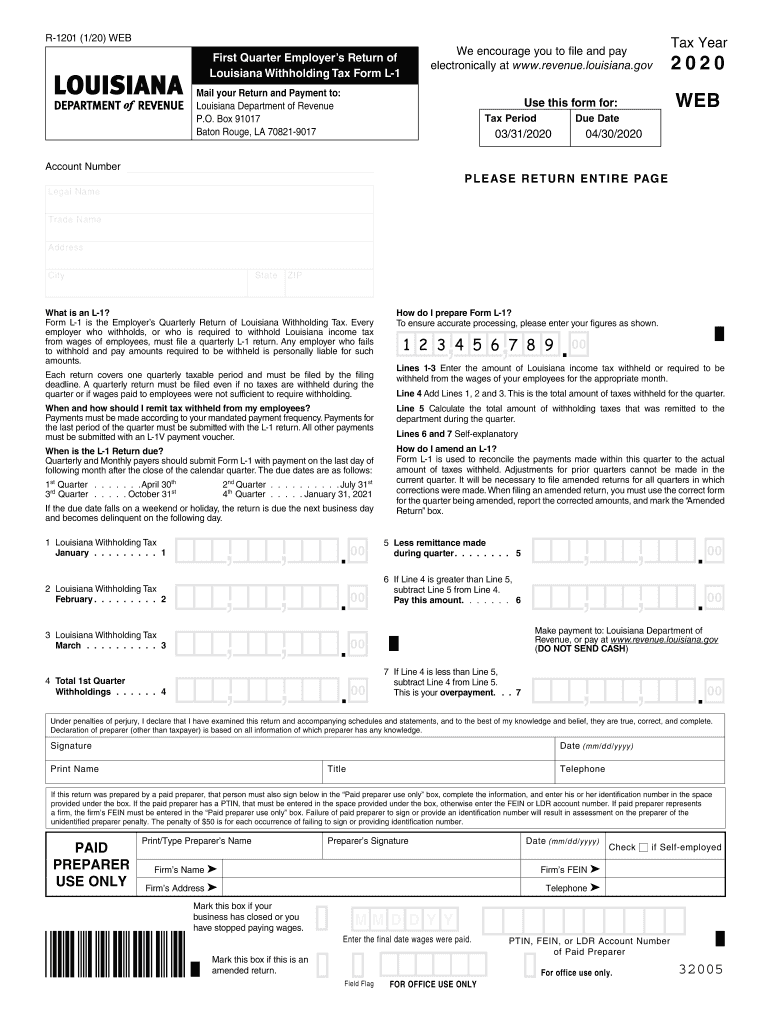

Louisiana L 1 Fourth Quarter Fillable Fill Out and Sign Printable PDF

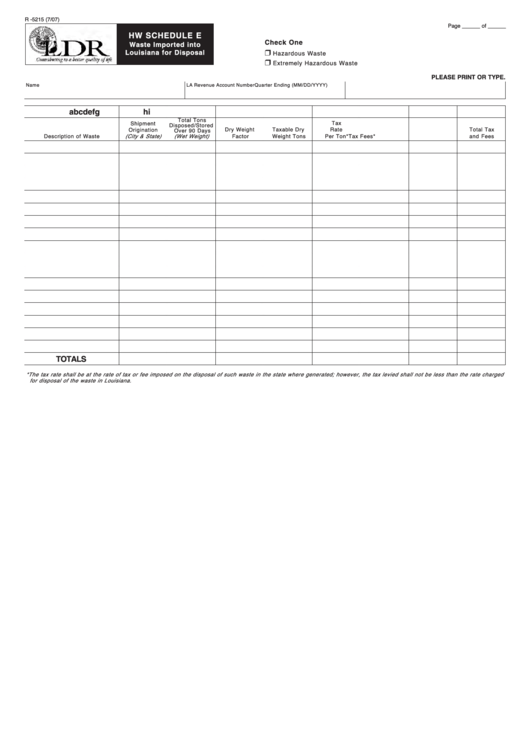

Fillable Form R5215 Hw Schedule E Waste Imported Into Louisiana For

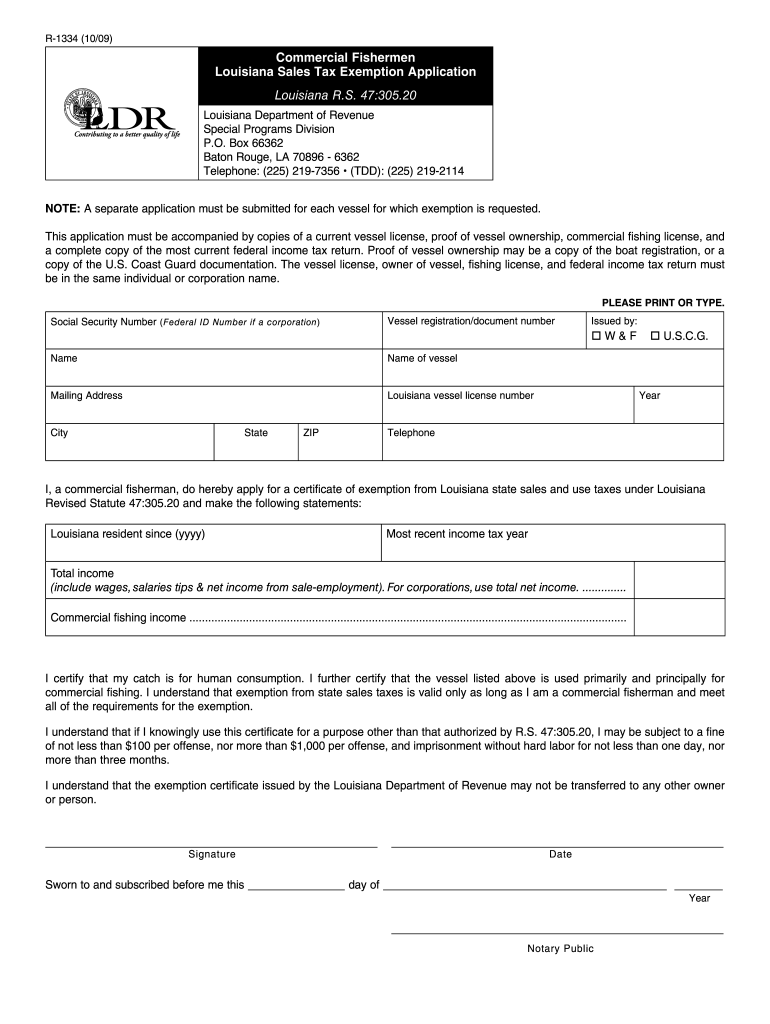

Top 294 Louisiana Sales Tax Form Templates free to download in PDF format

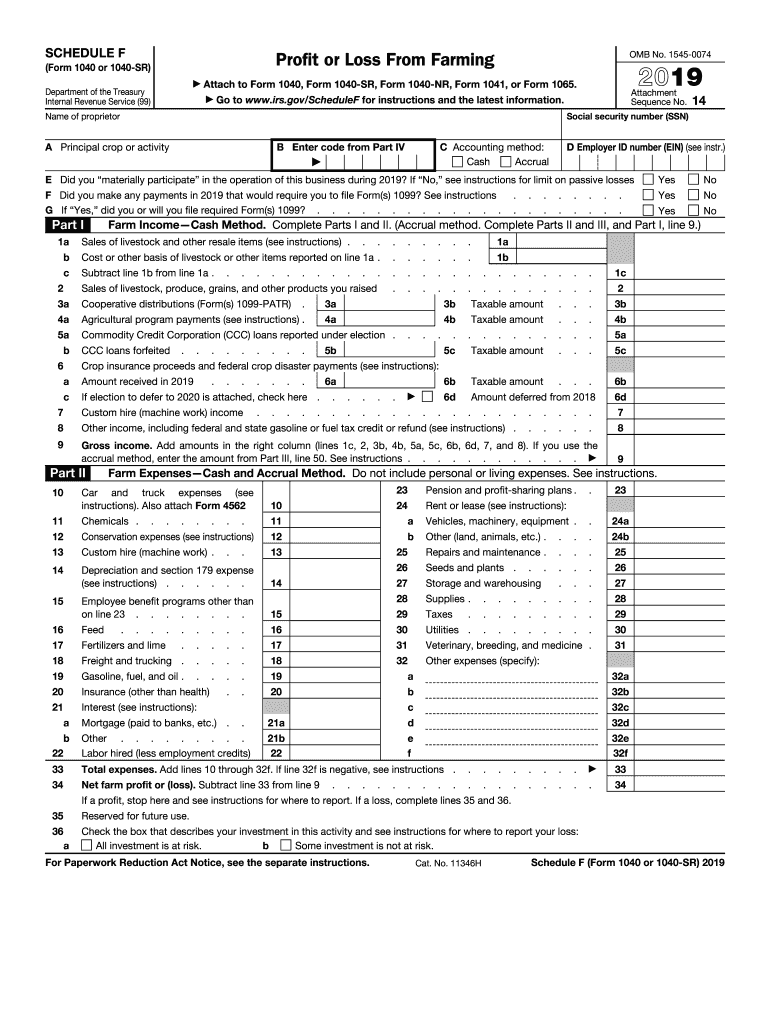

2019 Irs Schedule Form Fill Out and Sign Printable PDF Template signNow

Louisiana State Tax Form Fill Out and Sign Printable PDF Template

Fillable form 540 Fill out & sign online DocHub

Related Post: