Tamu Tax Exempt Form

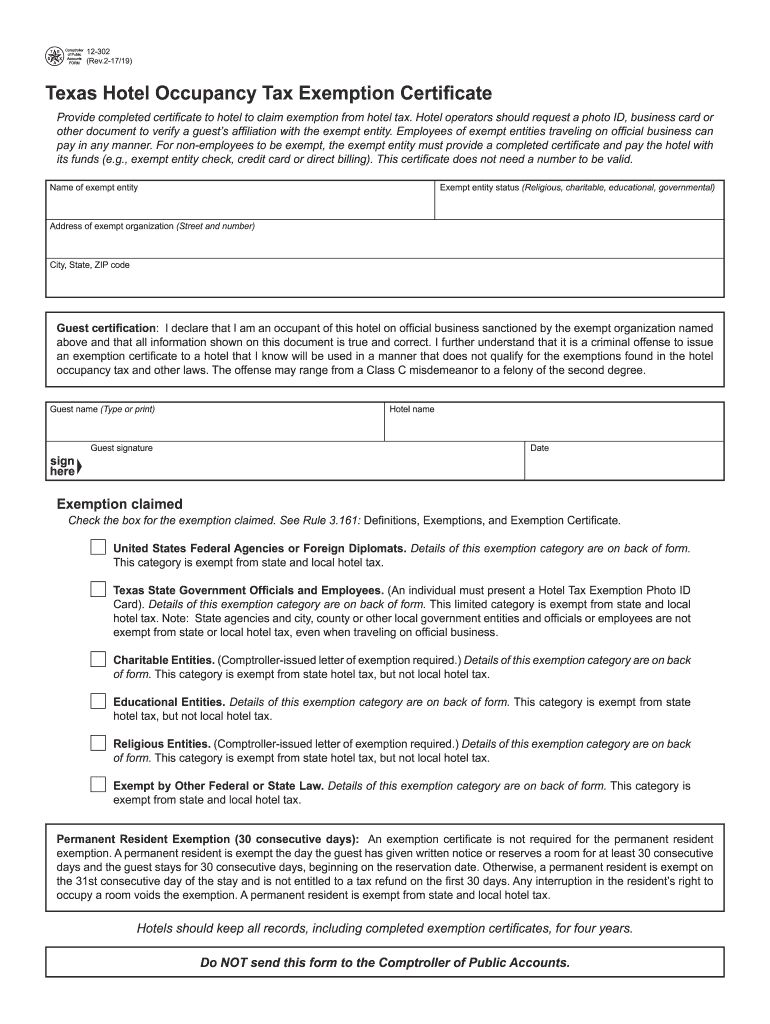

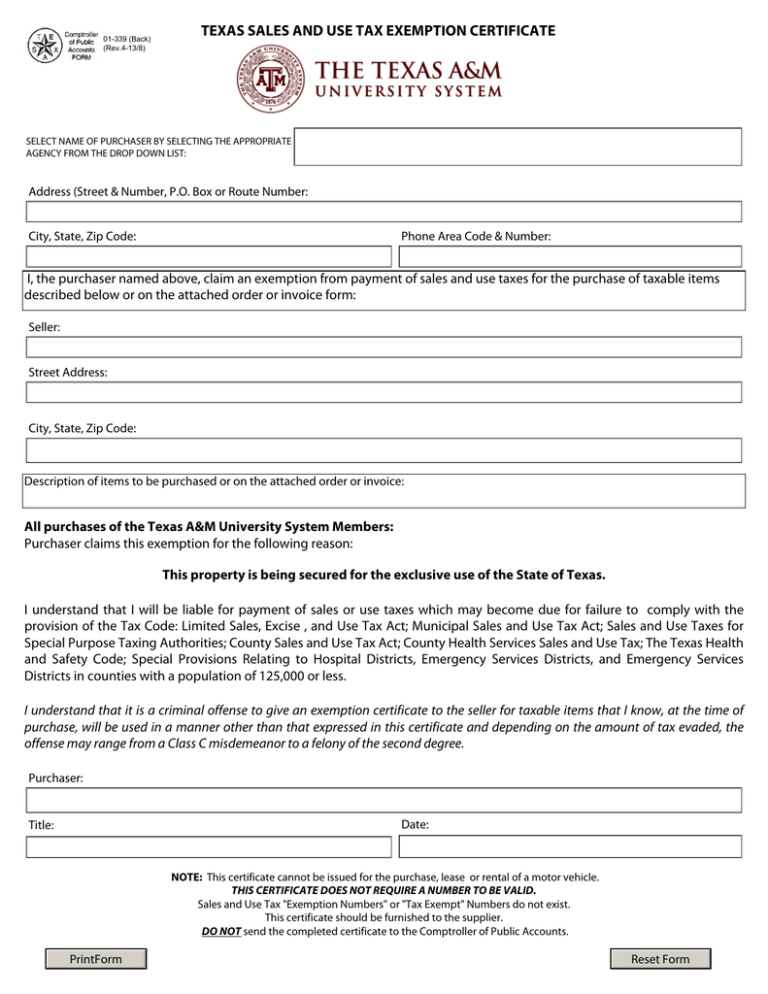

Tamu Tax Exempt Form - Web federal tax compliance and reporting for: Web do not pay texas sales tax! Texas motor vehicle rental tax exemption form. And name of the qualifying. The purpose of the certificate is. Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. Fly america act exemption form. 17421252251 city, state, zip code: Texas sales & use tax exemption form. Web federal tax compliance and reporting for: Texas motor vehicle rental tax exemption form. Reduction to expenditure instructions and form. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. This certificate should be kept on file by the selling. And name of the qualifying. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Fly america act exemption form. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web a qualifying charity is a charity that is exempt from federal. Web federal tax compliance and reporting for: Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. This certificate should be kept on file by the selling. International travel export controls certification. Other information about texas tax exemptions, including applications, is online at:. The purpose of the certificate is. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. United states tax exemption form; 17421252251 city, state, zip code: Phone area code & number: Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Texas sales & use tax exemption form. Web do not pay texas sales tax! Web united states tax exemption form. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes. Texas sales & use tax exemption form. This certificate should be kept on file by the selling. Web do not pay texas sales tax! Web a qualifying charity is a charity that is exempt from federal income tax under internal revenue code (irc) § 501(c)(3). Web united states tax exemption form. Web the texas university system t e comptroller of public x accounts form. Web federal tax compliance and reporting for: Web a qualifying charity is a charity that is exempt from federal income tax under internal revenue code (irc) § 501(c)(3). Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase. The purpose of the certificate is. International travel export controls certification. Web federal tax compliance and reporting for: United states tax exemption form; Fly america act exemption form. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice form:. 17421252251 city, state, zip code: Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice form:. Web the texas university system t e comptroller of public x accounts form. Web united states tax exemption form. Web some states will offer sales tax, and/or state. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice form:. Reduction to expenditure instructions and form. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. The texas a&m university system is always exempt from texas state sales tax and can be exempt from federal taxes and other state taxes. Web federal tax compliance and reporting for: United states tax exemption form; Phone area code & number: I, the purchaser named above, claim an exemption from payment of sales and use taxes for. Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Fly america act exemption form. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web the texas university system t e comptroller of public x accounts form. 17421252251 city, state, zip code: And name of the qualifying. Texas motor vehicle rental tax exemption form. Other information about texas tax exemptions, including applications, is online at:. Texas sales & use tax exemption form. Web a qualifying charity is a charity that is exempt from federal income tax under internal revenue code (irc) § 501(c)(3). International travel export controls certification. The purpose of the certificate is.Texas hotel exemption certificate Fill out & sign online DocHub

Forms Texas Crushed Stone Co.

2023 Sales Tax Exemption Form Texas

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

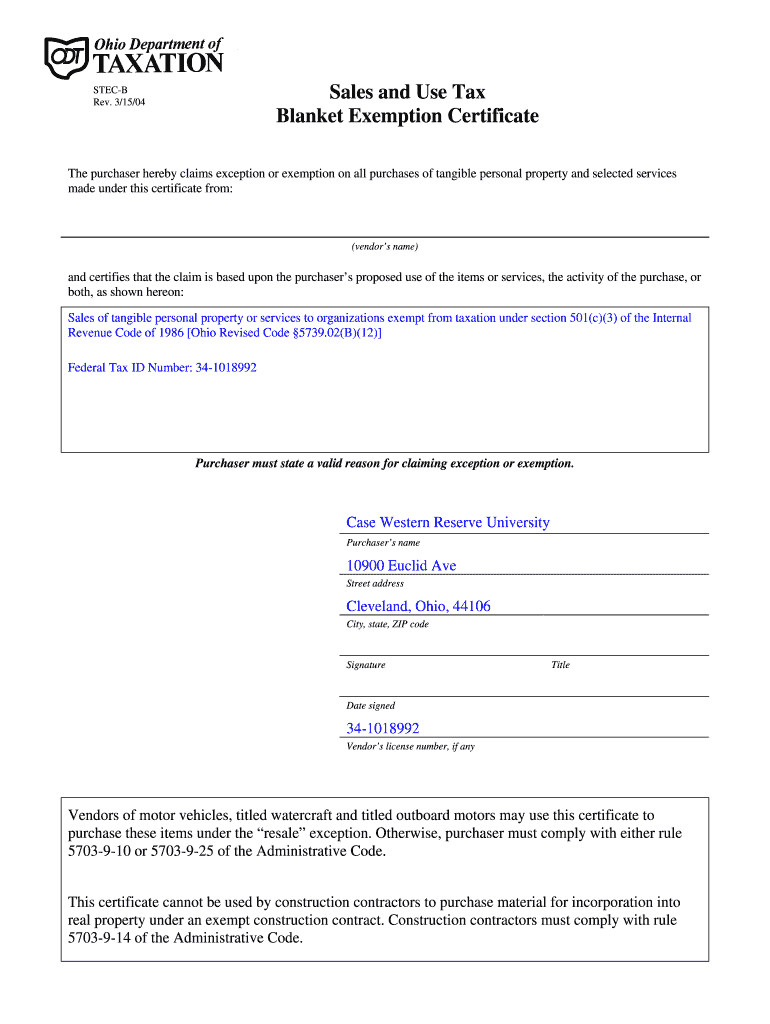

Ohio Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Texas Homestead Tax Exemption Form

Case Western Tax Exempt Certificate Fill Online, Printable, Fillable

Fillable Online Employee State Tax Texas A&M University Fax

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Printable Texas Tax Exempt Form Fill Online, Printable, Fillable

Related Post: