Stock Block Form 7203

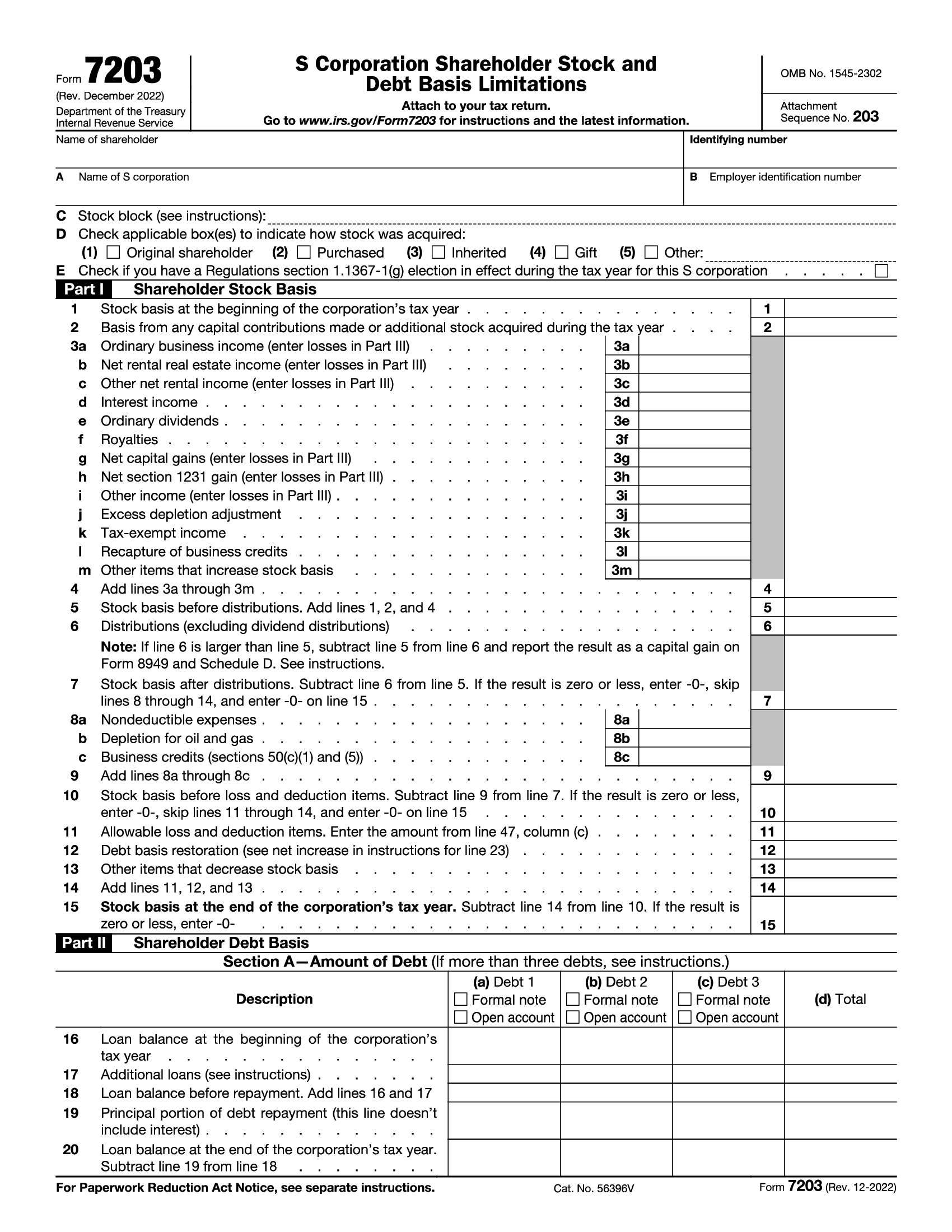

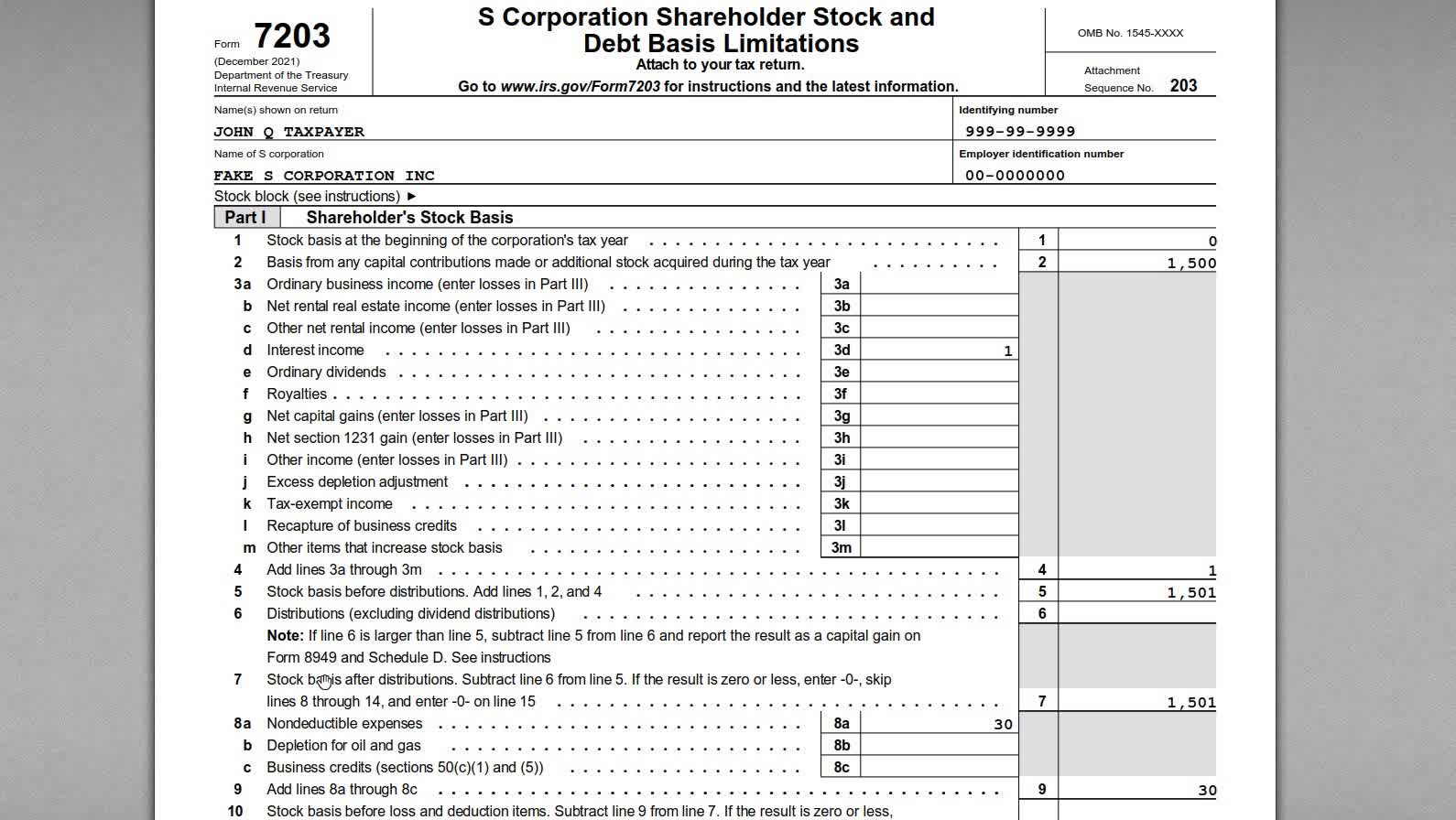

Stock Block Form 7203 - December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web s corporation shareholder stock and debt basis limitations. These limitations and the order in which you must apply them are as follows: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Yes, if you have only invested in or purchased stock 1 time, then your stock block is the first block and should be identified as stock block #1. You use either number or a description such as 100 shares of abc corp. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Ad real estate, family law, estate planning, business forms and power of attorney forms. Form 7203 is filed by shareholders. Get access to the largest online library of legal forms for any state. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. Web s corporation shareholder stock and debt basis limitations. Ad real estate, family law, estate planning, business forms and power of attorney forms. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s. Form 7203 is filed by shareholders. Web form 7203 is generated for a 1040 return when: Web january 19, 2021. Web form 7203 has three parts: Yes, if you have only invested in or purchased stock 1 time, then your stock block is the first block and should be identified as stock block #1. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Form 7203 is filed by shareholders. Get access to the largest online library of legal forms for any state. Web the stock block on form 7203 is to identify your shares so you can keep track. December 2022) s corporation shareholder stock and debt. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. Web january 19, 2021. Web form 7203 has three parts: Web s corporation shareholder stock and debt basis limitations. Web there are potential limitations on corporate losses that you can deduct on your return. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis.. Web the stock block on form 7203 is to identify your shares so you can keep track. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. You use either number or a description such as 100 shares of abc corp. Ad real estate, family law, estate planning, business. Get access to the largest online library of legal forms for any state. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return.. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web s corporation shareholder stock and debt basis limitations. Ad real estate, family law, estate planning, business forms and power of attorney forms. Form 7203 is filed by shareholders. S corporation shareholders use form 7203 to figure the potential. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Ad real estate, family law, estate planning, business forms and power of attorney forms. Web form 7203 is generated for a 1040 return when: Web s corporation shareholder stock and debt basis limitations. The only reason you would have more than one stock block,. Web page last reviewed or updated: Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web purpose of form use form 7203 to figure potential limitations. In 2022, john decides to sell 50 shares of company a stock. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. The only reason you would have more than one stock block, is if you had another. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web january 19, 2021. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. You use either number or a description such as 100 shares of abc corp. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. These limitations and the order in which you must apply them are as follows: Get access to the largest online library of legal forms for any state. Web s corporation shareholder stock and debt basis limitations. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. Web there are potential limitations on corporate losses that you can deduct on your return. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. This form is required to be attached. Web form 7203 is generated for a 1040 return when: Web the stock block on form 7203 is to identify your shares so you can keep track. Go to www.irs.gov/form7203 for instructions and the latest information. Form 7203 is filed by shareholders.Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

SCorporation Shareholders May Need to File Form 7203

IRS Form 7203 Multiple Blocks of S Corporation Stock YouTube

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

How to Complete IRS Form 7203 S Corporation Shareholder Basis

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

More Basis Disclosures This Year for S corporation Shareholders Need

National Association of Tax Professionals Blog

Related Post: