Stock Basis Form 7203

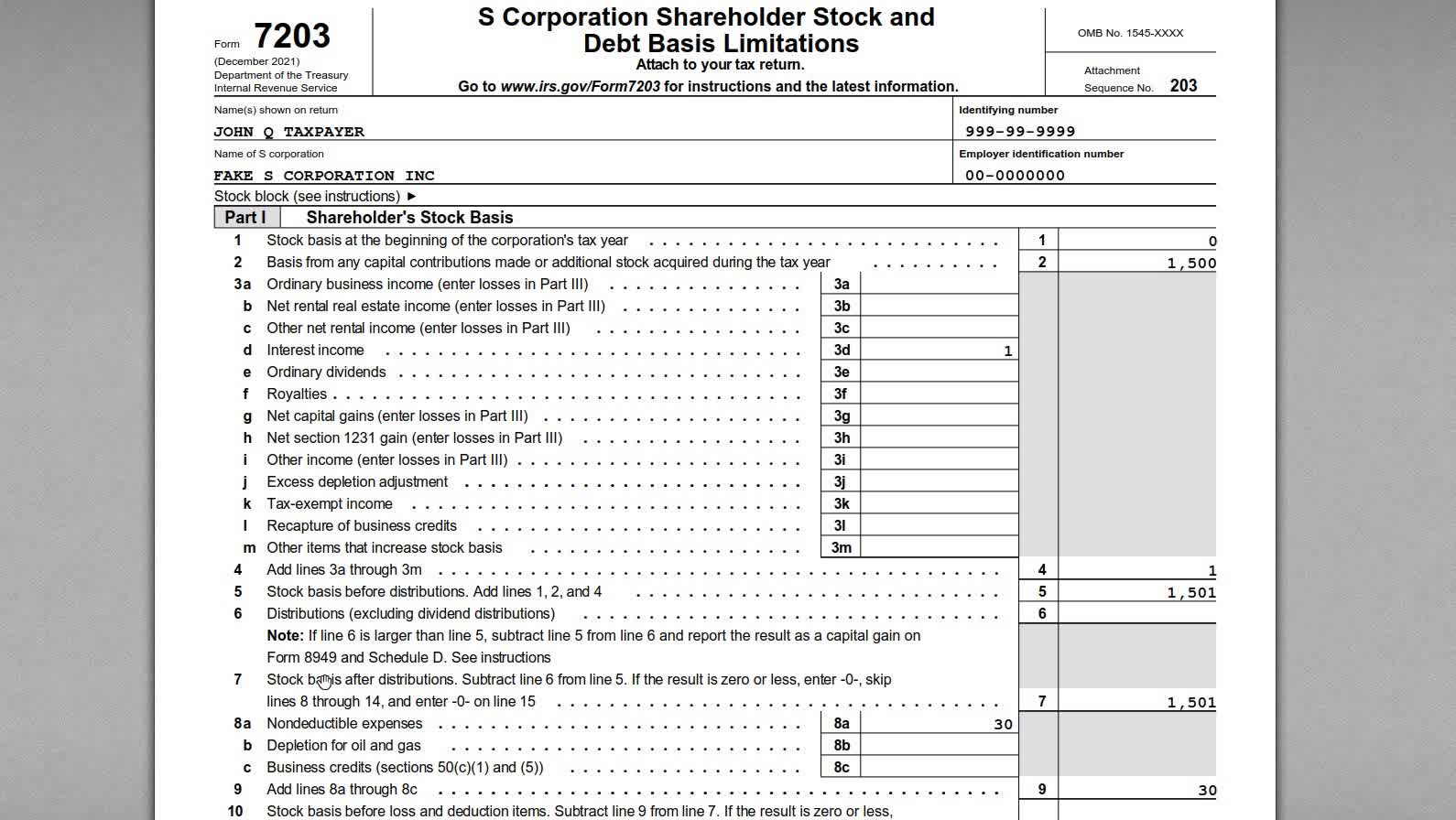

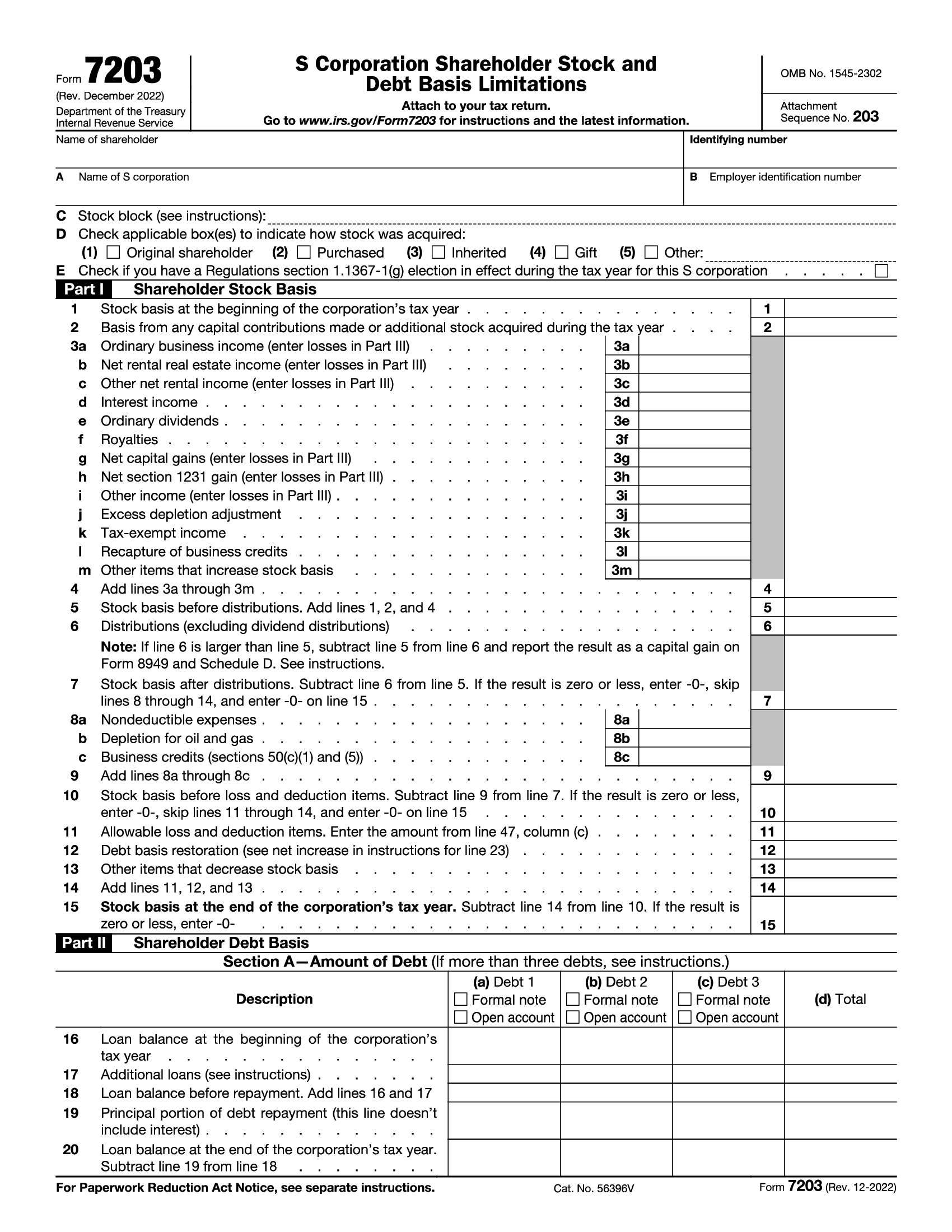

Stock Basis Form 7203 - Form 7203 and the instructions are attached to this article. Basis from any capital contributions made or additional stock acquired during the tax year. Web when is form 7203 required? S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Web form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Web page last reviewed or updated: S corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. Web stock basis at the beginning of the corporation’s tax year. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Web please explain stock block on form 7203. Starting in tax year 2022, the program will no longer. Web for information about completing form 7203, which is produced and filed with the individual 1040, see. To enter basis limitation info in the individual return: S corporation shareholder stock and debt basis limitations section references are to the internal revenue code unless otherwise noted. Web page last reviewed or updated: Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 was released by the irs in december 2021 to keep track. In 2022, john decides to sell 50 shares of company a stock. Web according to the irs, the basis of your stock (cost) is adjusted annually as follows in the order listed (exceptions apply): Web form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt. S corporation shareholder stock and debt basis limitations section references are to the internal revenue code unless otherwise noted. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Go to screen 20.2, s corporation. To enter basis limitation info in the individual return: In 2022, john decides to. Web form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Form 7203 is a new form developed by. I have read all of the instructions for form 7203, but cannot find anything that explains what i am supposed to. Ad instantly find and download legal forms drafted by attorneys for your state. Starting in tax year 2022, the program will no longer. Web stock basis at the beginning of the corporation’s tax year. Web form 7203 has three. Basis from any capital contributions made or additional stock acquired during the tax year. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Real estate, family law, estate planning, business forms and power of attorney forms. Web form 7203 has three parts: Web when is form 7203 required? December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Form 7203 and the instructions are attached to this article. Basis from any capital contributions made or additional stock acquired during the tax year. In 2022, john decides to sell 50 shares of company a stock. Web form 7203. Get access to 500+ legal templates print & download, start for free! Basis from any capital contributions made or additional stock acquired during the tax year. Form 7203 and the instructions are attached to this article. Starting in tax year 2022, the program will no longer. Go to screen 20.2, s corporation. Web when is form 7203 required? Real estate, family law, estate planning, business forms and power of attorney forms. Web according to the irs, the basis of your stock (cost) is adjusted annually as follows in the order listed (exceptions apply): Web for information about completing form 7203, which is produced and filed with the individual 1040, see here. Web. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Go to screen 20.2, s corporation. Ad instantly find and download legal forms drafted by attorneys for your state. Web page last reviewed or updated: Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. Real estate, family law, estate planning, business forms and power of attorney forms. Ad create, edit, and print your business and legal documents quickly and easily! Form 7203 is a new form developed by irs to replace the shareholder’s stock and. To enter basis limitation info in the individual return: S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Form 7203 and the instructions are attached to this article. Web for information about completing form 7203, which is produced and filed with the individual 1040, see here. S corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Basis is increased by (a) all income (including tax. Web form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Get access to 500+ legal templates print & download, start for free! Basis from any capital contributions made or additional stock acquired during the tax year.National Association of Tax Professionals Blog

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

SCorporation Shareholders May Need to File Form 7203

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

More Basis Disclosures This Year for S corporation Shareholders Need

How to Complete IRS Form 7203 S Corporation Shareholder Basis

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

IRS Form 7203 S Corporation Loss Limitations on Stock Basis YouTube

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

Related Post: