State Withholding Form California

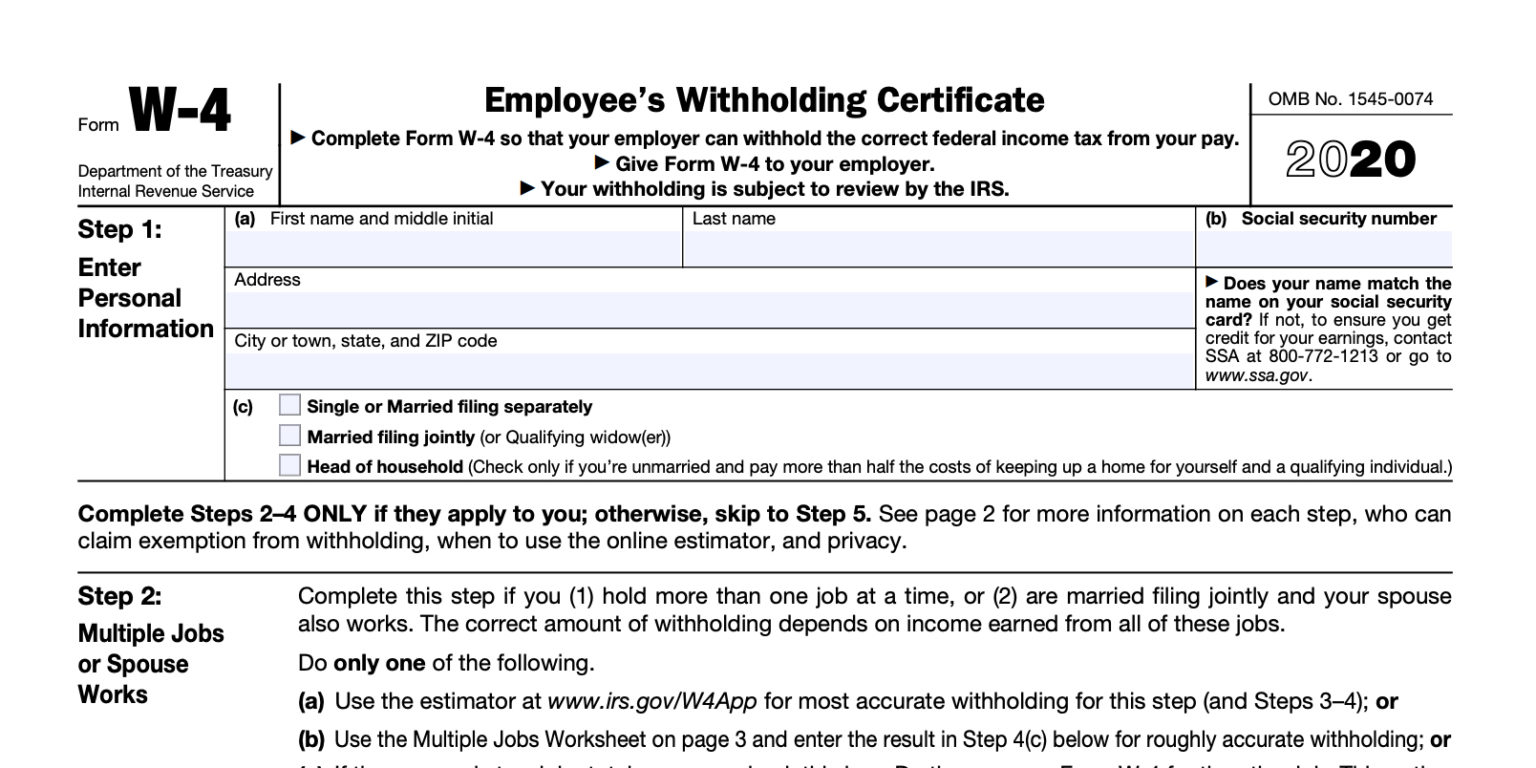

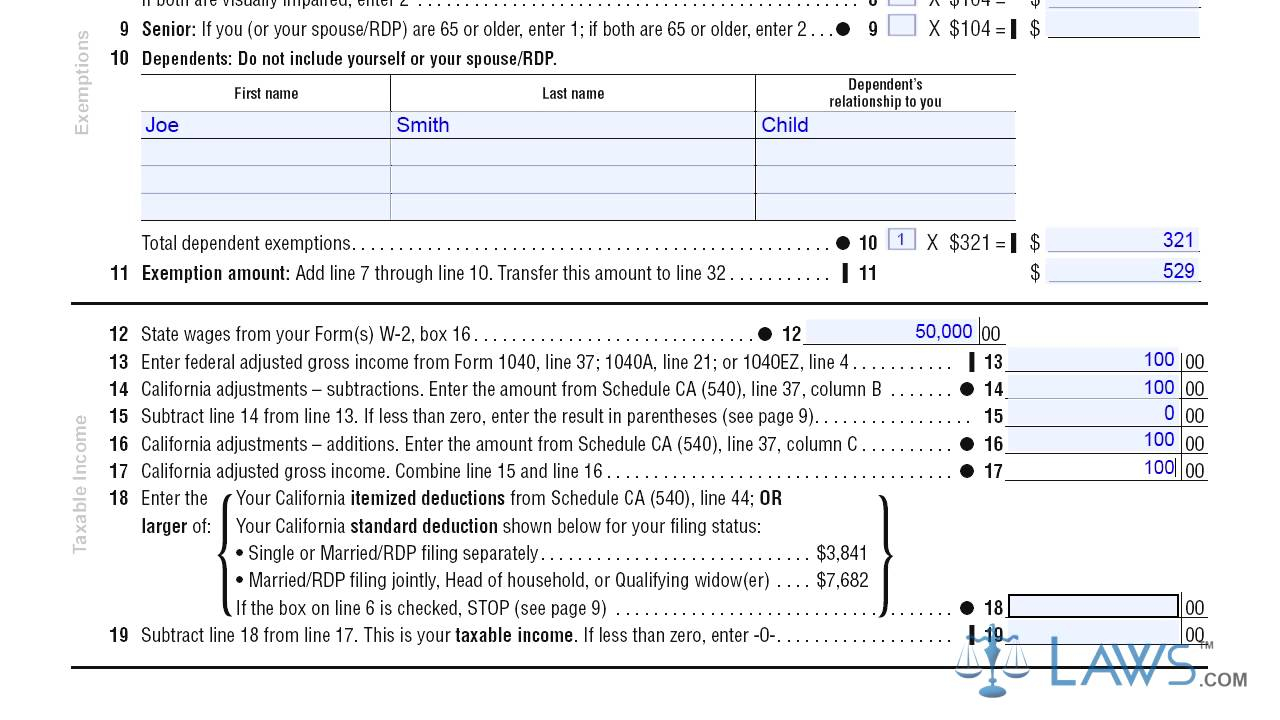

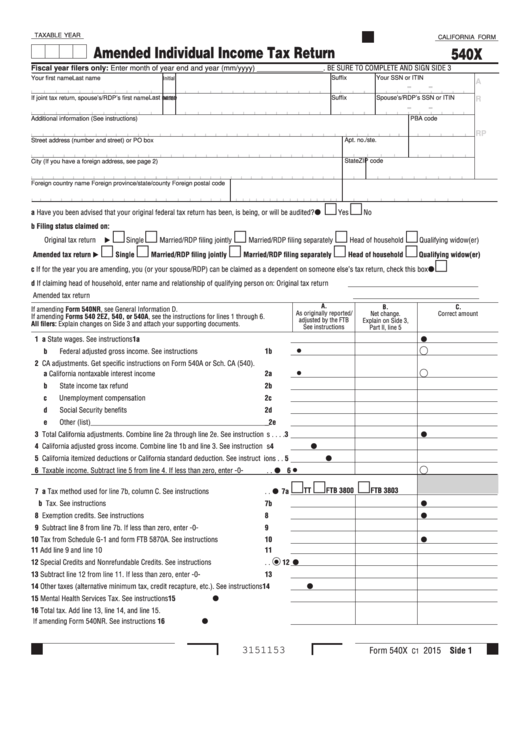

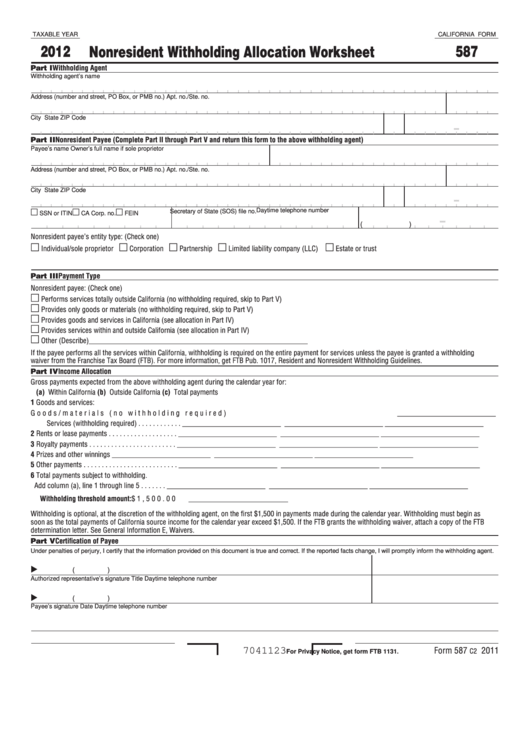

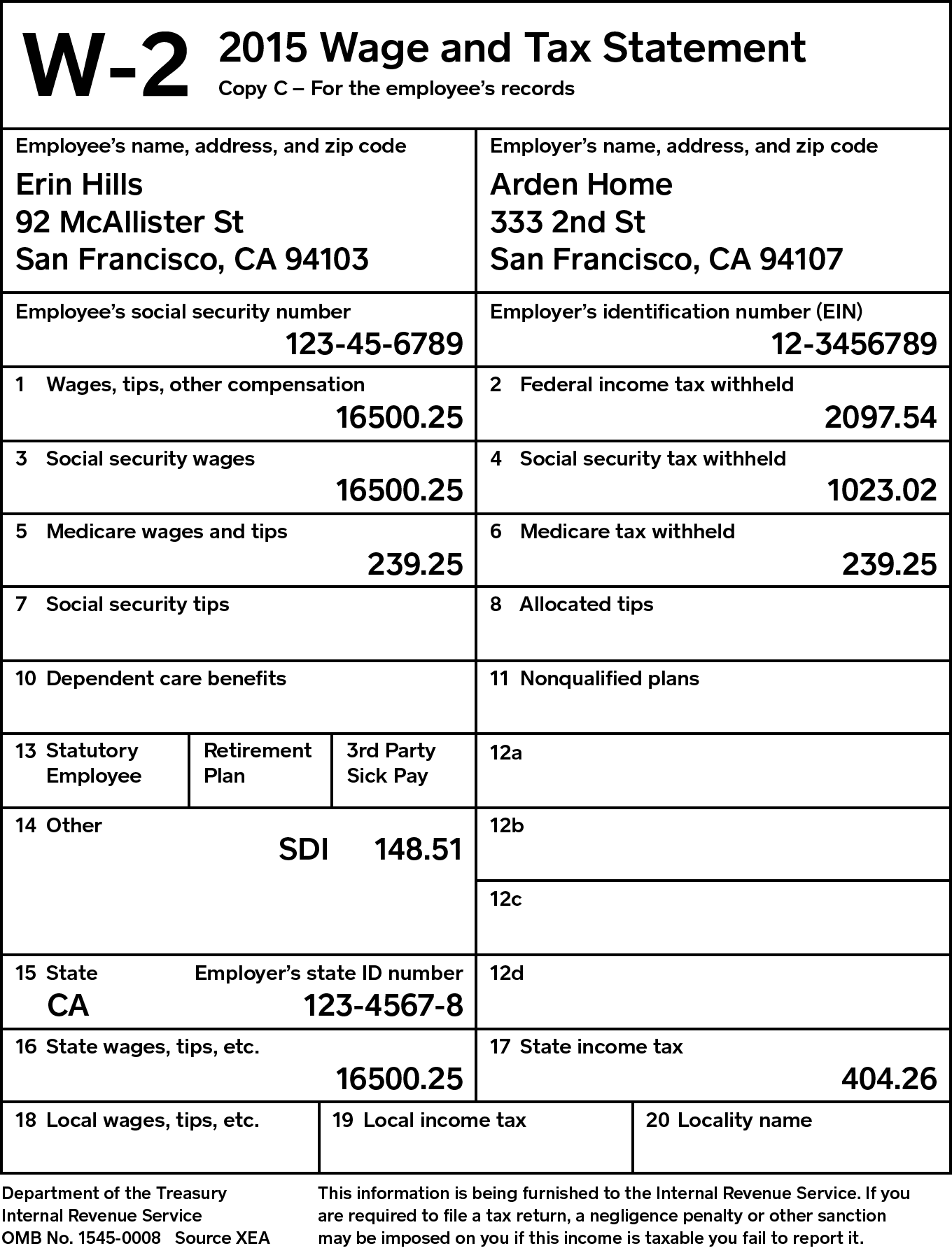

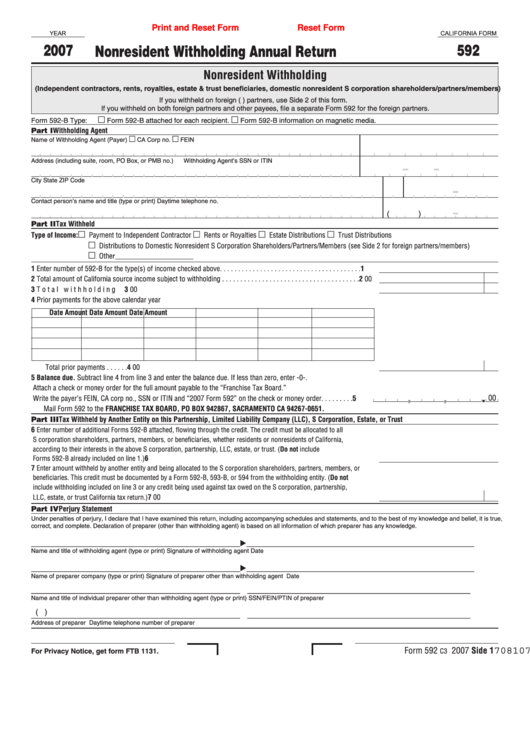

State Withholding Form California - Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. (check one) gross payments expected from the withholding agent during the calendar year for: For state withholding, use the worksheets on this form. Employee's withholding certificate form 941; Web the withholding agent keeps this form with their records. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. You must file a de 4 to determine the appropriate california pit withholding. Web show all contribution rates california withholding schedules meals and lodging values know the current contribution rates, withholding schedules, and meals and lodging values. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Form 592 includes a schedule of. Web form de 4 is used in relation to california personal income tax (pit) withholding. Form 592 includes a schedule of payees section, on side 2, that. Web simplified income, payroll, sales and use tax information for you and your business Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Tax withheld on california. Web simplified income, payroll, sales and use tax information for you and your business 686 (rev 12/2020) withholding change or new employee. The irs welcomed any state to participate in the pilot in a letter. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web up to 10% cash back the california form de. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. 686 (rev 12/2020) withholding change or new employee. Complete, edit or print tax forms instantly. Web disaster victims also may receive free copies of their state returns to replace those. Form 592 includes a schedule of payees section, on side 2, that. The de 4p allows you to: 686 (rev 12/2020) withholding change or new employee. Web show all contribution rates california withholding schedules meals and lodging values know the current contribution rates, withholding schedules, and meals and lodging values. Web this article will assist you with entering the california. To determine the applicable tax rate for. Web the withholding agent keeps this form with their records. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. The irs welcomed any state to participate in the pilot in a letter. Taxpayers may complete form ftb 3516 and write the name of the. For state withholding, use the worksheets on this form. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Form 592 includes a schedule of payees section, on side 2, that. Tax withheld on california source income is reported to. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web form de 4 is used in relation to california personal income tax (pit) withholding. Complete, edit or print tax forms instantly. Form 592 includes a schedule of payees section, on side 2, that. Web simplified income, payroll, sales and use tax information for you and. The irs welcomed any state to participate in the pilot in a letter. For state withholding, use the worksheets on this form. Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: The form helps your employer. Form 590 does not apply to payments of backup withholding. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. The form helps your employer. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Employee's withholding certificate form 941; Web simplified income, payroll, sales and use tax information for. The irs welcomed any state to participate in the pilot in a letter. The form helps your employer. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Download avalara rate tables each month or find rates with the sales tax rate calculator. For state withholding, use the worksheets on this form. To determine the applicable tax rate for. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. You must file a de 4 to determine the appropriate california pit withholding. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Complete, edit or print tax forms instantly. Web simplified income, payroll, sales and use tax information for you and your business Web compare the state income tax withheld with your estimated total annual tax. 686 (rev 12/2020) withholding change or new employee. Taxpayers may complete form ftb 3516 and write the name of the disaster. Web simplified income, payroll, sales and use tax information for you and your business Web the withholding agent keeps this form with their records. Get ready for tax season deadlines by completing any required tax forms today. Web the california state controller’s office publishes current tax rates on their website in the form of tax withholding tables. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web form de 4 is used in relation to california personal income tax (pit) withholding.Ca State Withholding Form 2021 Federal Witholding Tables 2021

California State Withholding Tax Form 2022

State Tax Withholding Form California

1+ California State Tax Withholding Forms Free Download

Ftb 589 Fill out & sign online DocHub

Fillable California Form 587 Nonresident Withholding Allocation

Filing California State Withholding Form

De 4 California State Tax Withholding Form

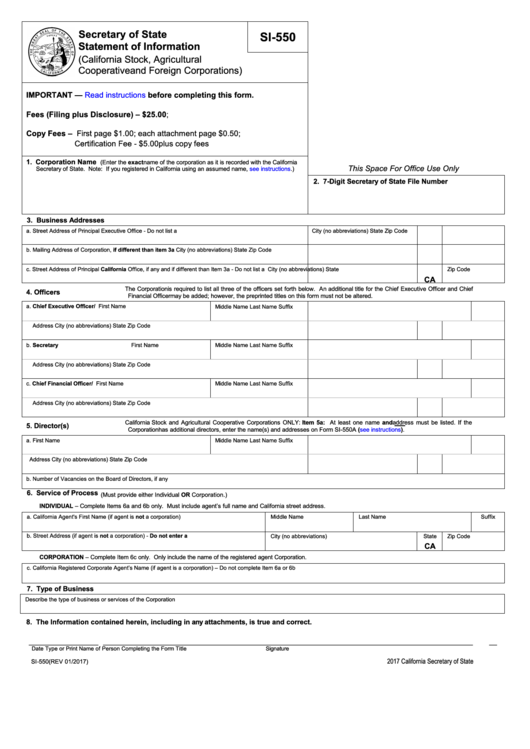

California Withholding Tax Form 592

California Worksheet A Withholding 2022 Calendar Tripmart

Related Post: