South Carolina State Tax Form

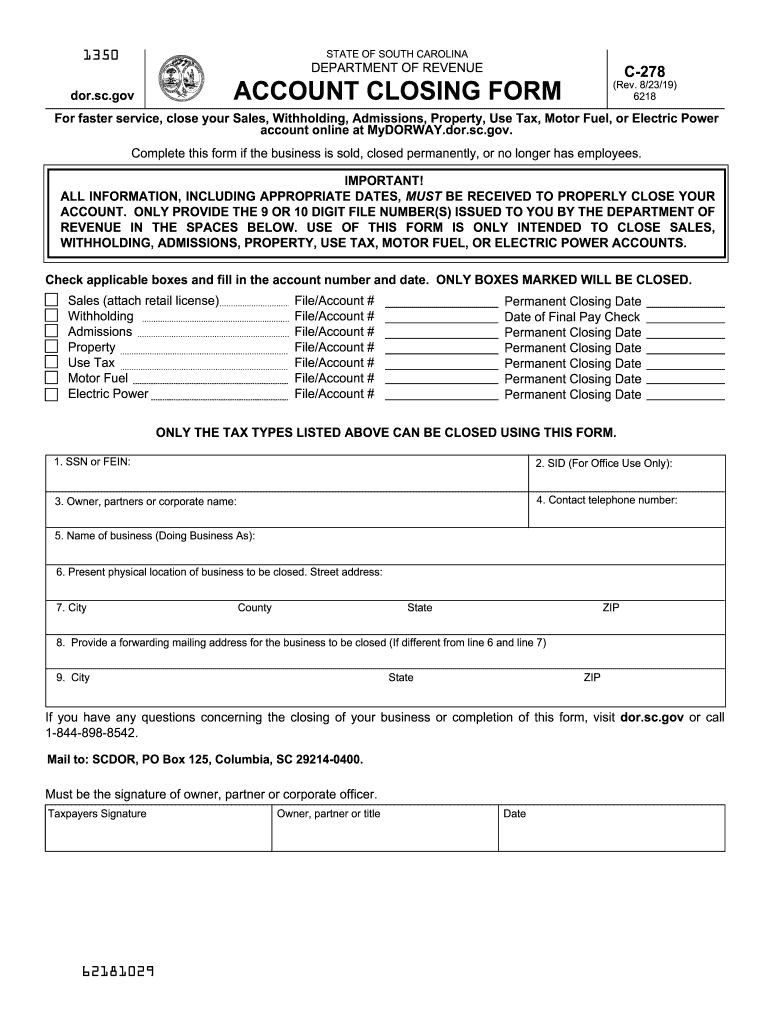

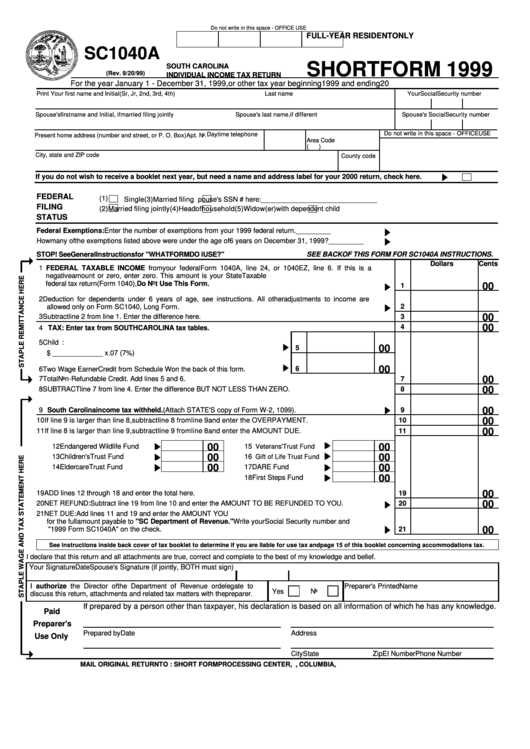

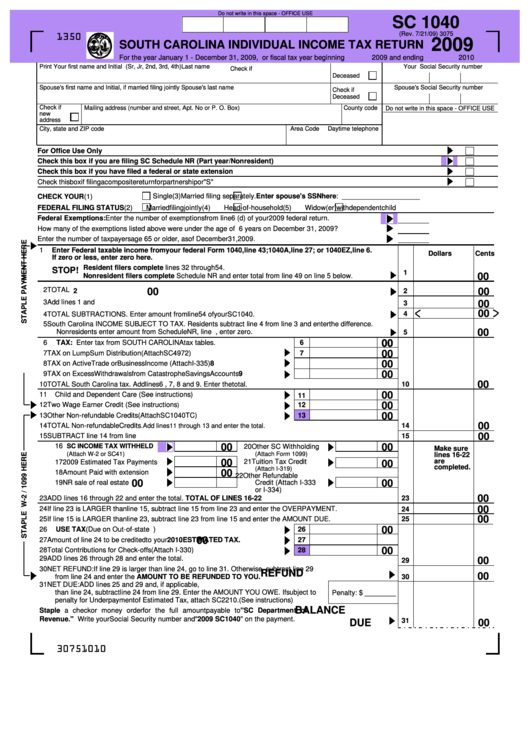

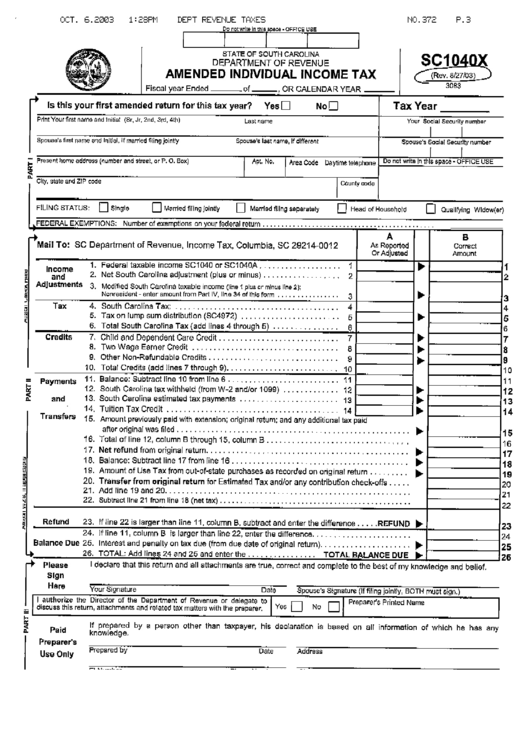

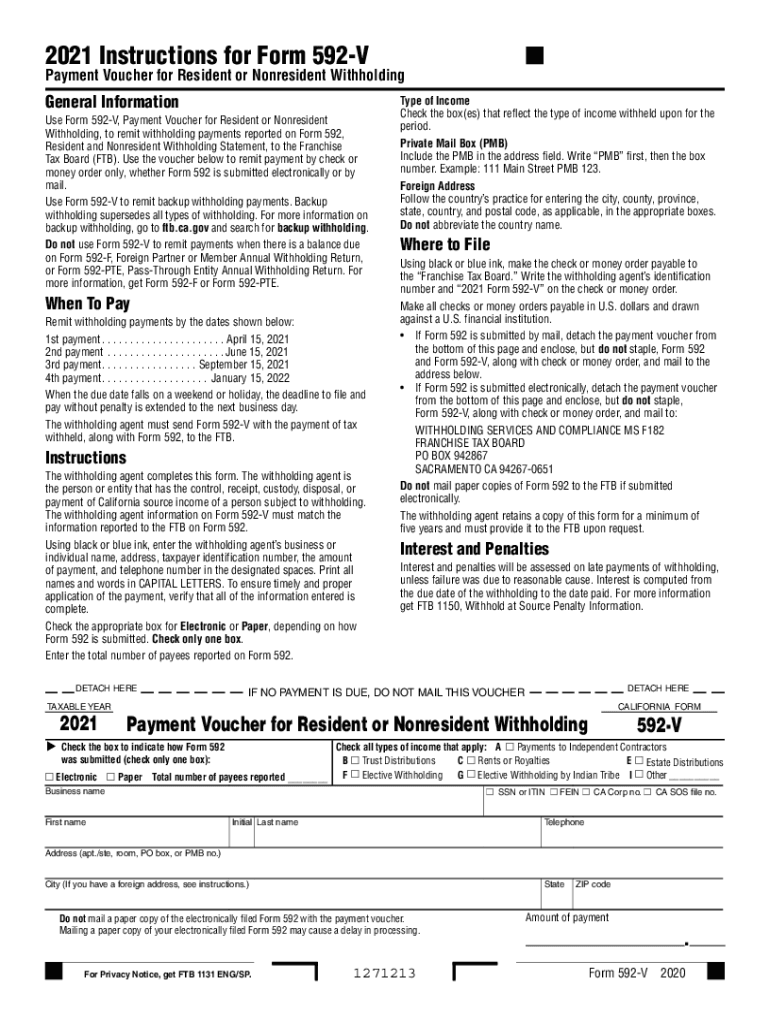

South Carolina State Tax Form - Tax refund status check the status of your. Web find forms and instructions for state taxes. Web the due date for filing your 2021 south carolina individual income tax return is april 18, 2022. South carolina applies the following marginal tax rates to taxable income after all deductions and exemptions have been subtracted. Previous logins no longer provide access to the program. 2022 sc withholding tax formula. Ad download or email form 1040 & more fillable forms, register and subscribe now! Department of tax and fee administration (cdtfa) current year tax forms [sales] california. Web to check the status of your south carolina refund, visit dor.sc.gov/refund. 1 enter federal taxable income from your federal form. Web sc fillable forms does not store your information from previous tax years. Web sc fillable forms does not store your information from previous tax years. Web the due date for filing your 2021 south carolina individual income tax return is april 18, 2022. 1 enter federal taxable income from your federal form. Web determine the number of withholding allowances. Driver's license renewal [pdf] disabled. Complete, edit or print tax forms instantly. Web find forms and instructions for state taxes. Web determine the number of withholding allowances you should claim for withholding for 2021 and any additional amount of tax to have withheld. Web sc fillable forms does not store your information from previous tax years. Web current year tax forms [sales] california. Web sc fillable forms does not store your information from previous tax years. Individual tax return form 1040 instructions; Ad download or email form 1040 & more fillable forms, register and subscribe now! Taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding. 2022 sc withholding tax formula. Web the due date for filing your 2021 south carolina individual income tax return is april 18, 2022. Web individual income tax packet (iit book) for 2016 and older: Tax publications guides, updates, and summaries for south carolina taxes. Web popular forms & instructions; Tax refund status check the status of your. We last updated the individual income. Web to check the status of your south carolina refund, visit dor.sc.gov/refund. Web sc fillable forms does not store your information from previous tax years. Web state of south carolina department of revenue. Ad download or email form 1040 & more fillable forms, register and subscribe now! Previous logins no longer provide access to the program. Web tax and legal forms. If you do not qualify for free filing using one of. Web current year tax forms [sales] california. Web tax and legal forms. Driver's license renewal [pdf] disabled. Web popular forms & instructions; If you do not qualify for free filing using one of. Taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding. Web determine the number of withholding allowances you should claim for withholding for 2021 and any additional amount of tax to have withheld. Web sc fillable forms does not store your information from previous tax years. South carolina applies the following marginal tax rates to taxable income after all deductions and exemptions have been subtracted. 2022 sc withholding tax formula.. Web sc fillable forms does not store your information from previous tax years. Do not send to the. Notary public application [pdf] motor vehicle forms. Tax refund status check the status of your. Web popular forms & instructions; If you do not qualify for free filing using one of. Tax publications guides, updates, and summaries for south carolina taxes. South carolina applies the following marginal tax rates to taxable income after all deductions and exemptions have been subtracted. 1 enter federal taxable income from your federal form. Download or email sc sc1040 & more fillable forms, register and. Alternatively, you can pay sc income taxes here prior. South carolina applies the following marginal tax rates to taxable income after all deductions and exemptions have been subtracted. Web find forms and instructions for state taxes. Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. Securely file, pay, and register most south carolina taxes using the scdor’s free online tax portal, mydorway. Web individual income tax packet (iit book) for 2016 and older: Web we last updated the form sc1040 instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Individual tax return form 1040 instructions; Iit book 2016 iit book 2015 iit book 2014 iit book 2013 iit book 2012 iit book 2011 iit book 2010 iit book 2009 2022 sc withholding tax formula. Previous logins no longer provide access to the program. Do not send to the. Web tax and legal forms. Web popular forms & instructions; If zero or less, enter zero here dollars. Tax refund status check the status of your. 1 enter federal taxable income from your federal form. Web sc fillable forms does not store your information from previous tax years. Web state of south carolina department of revenue.South Carolina State Tax Withholding Form 2022

South Carolina Fillable Tax Forms Printable Forms Free Online

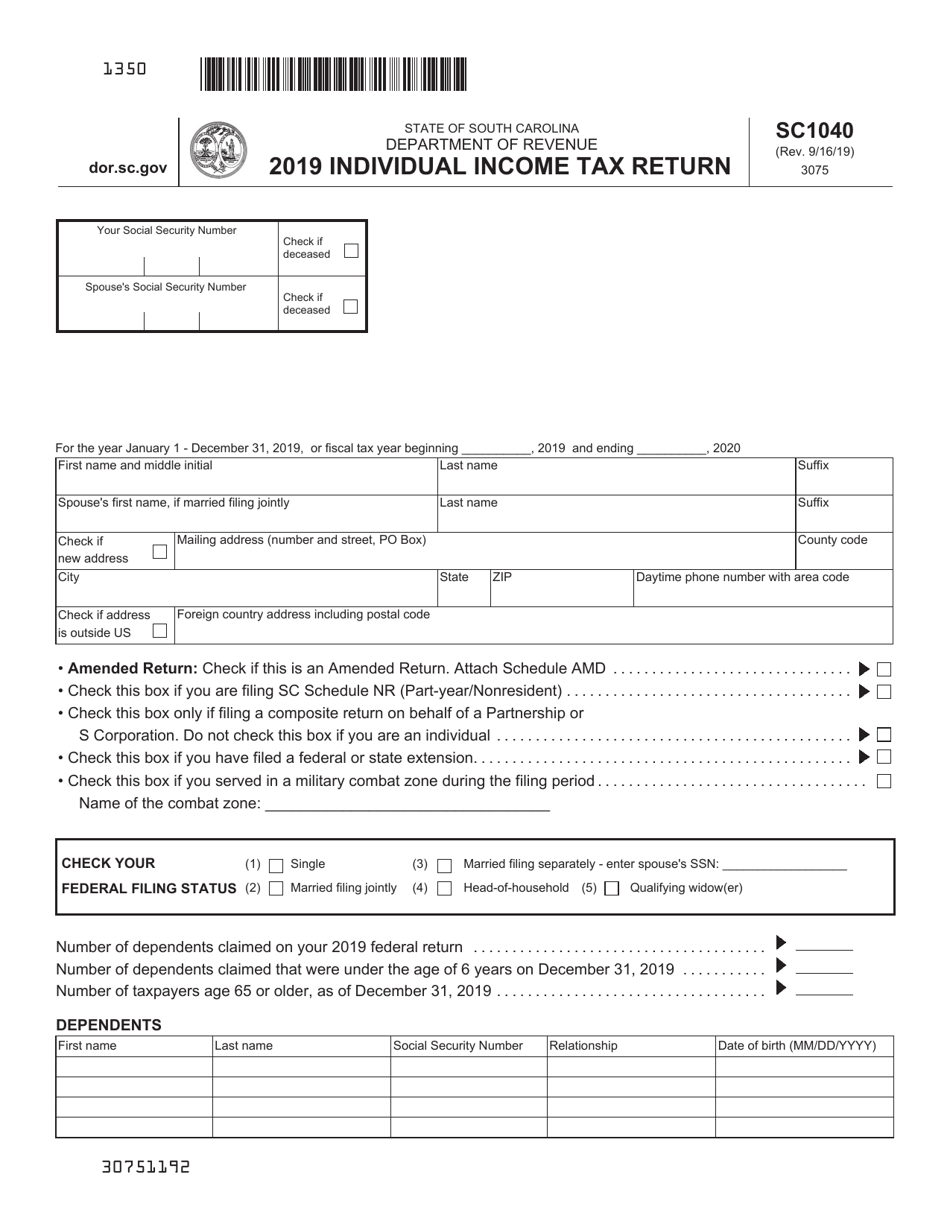

Form Sc 1040 South Carolina Individual Tax Return 2009

Sc1120 t Fill out & sign online DocHub

Nc40 Printable Form

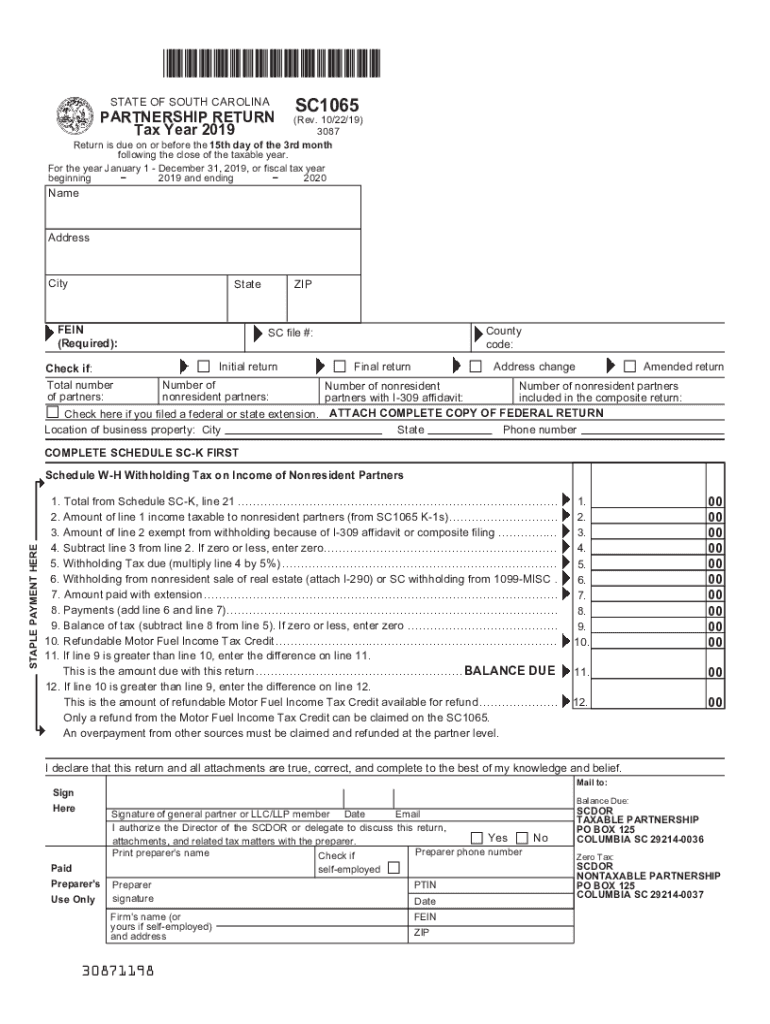

SC DoR SC1065 2019 Fill out Tax Template Online US Legal Forms

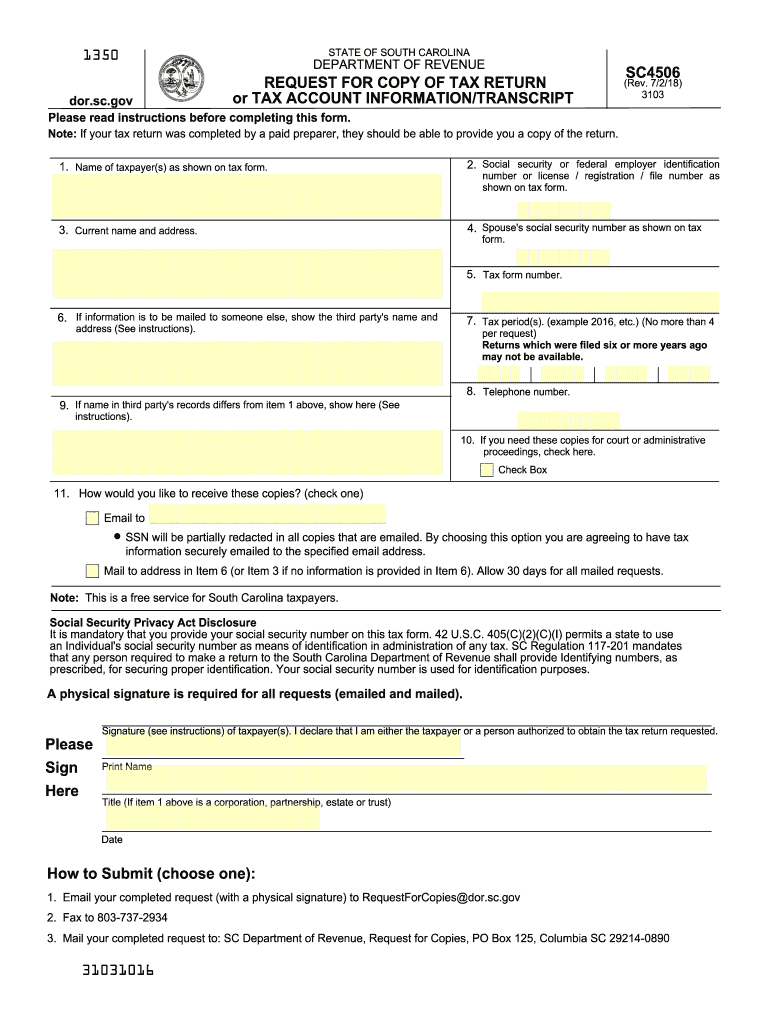

20182022 Form SC DoR SC4506 Fill Online, Printable, Fillable, Blank

Sc1040 Form Fill Out and Sign Printable PDF Template signNow

South Carolina State Tax Withholding Form 2022

Form SC1040 Download Printable PDF or Fill Online Individual Tax

Related Post: