California S Corp Extension Form

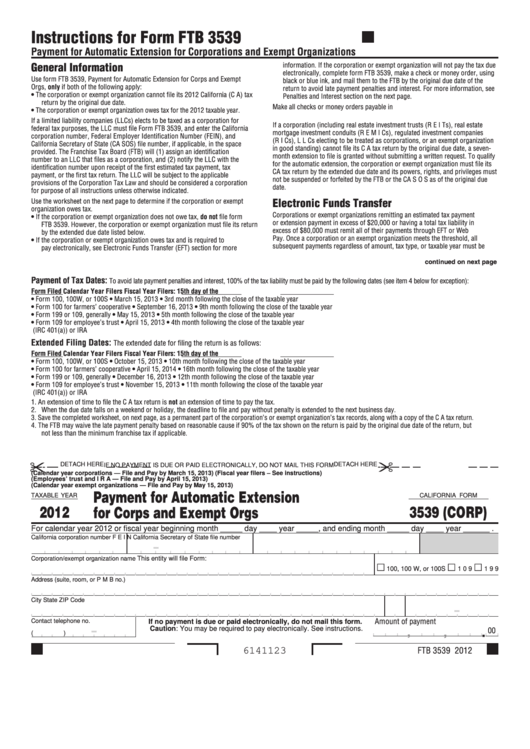

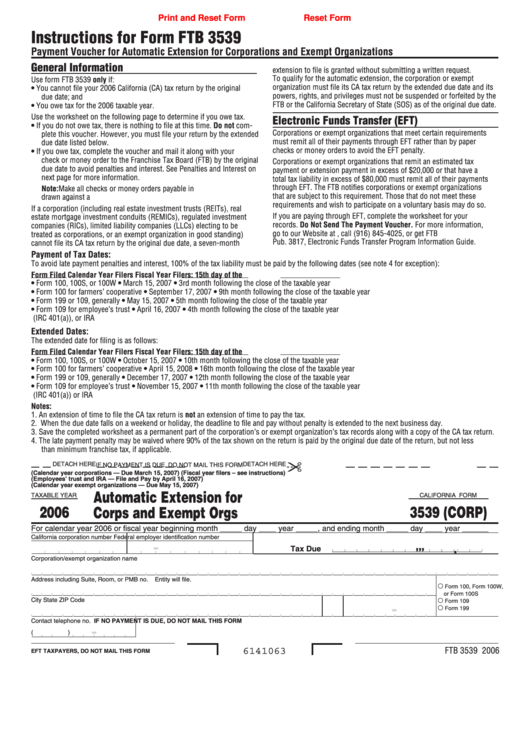

California S Corp Extension Form - Web california extends due date for california state tax returns. Web s corps need to file a tax return and pay any taxes owed for 2019 by july 15, 2020, (four months later than the normal march 16 deadline due to the coronavirus. The original due date to file california corporation franchise or income tax return (form 100), is the 15th day of. We have unmatched experience in forming businesses online. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. Web the april 18 state deadline was originally extended by gov. Web california’s automatic extension for c corporations. In 2000, david's toy, inc., a nevada corporation, opens an office in california. Be received before the extended period ends. Irs further postpones tax deadlines for most california. Web filing requirements you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies. Web forms, samples and fees. Web application for automatic extension of time to file certain business income tax, information, and. Form 7004 (automatic extension of time to. The original due date for this. Web can i get an extension? Web california extends due date for california state tax returns. File request for extension by the due date of. We have unmatched experience in forming businesses online. Securing a california business tax extension depends on the type of business you’re filing for. Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. If they are classified as an s corporation. Web forms, samples and fees. Now, federal filers have another month to file. Be signed by the employer or authorized agent. Web california’s automatic extension for c corporations. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. Complete, edit or print tax forms instantly. © 2023 ca secretary of state Gavin newsom in march to align with the irs’s announcement to push the federal due date to oct. Web california extends due date for california state tax returns. File request for extension by the due date of. Start your corporation with us. Web the april 18 state deadline was originally extended by gov. Web california extends due date for california state tax returns. 16, 2023 washington — the. Be received before the extended period ends. Web form 100s a 1. Web california’s automatic extension for c corporations. Web forms, samples and fees. Web s corps need to file a tax return and pay any taxes owed for 2019 by july 15, 2020, (four months later than the normal march 16 deadline due to the coronavirus. Download or email ca 100s & more fillable forms, register. Irs further postpones tax deadlines for most california. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. Web can i get an extension? Start your corporation with us. Learn more about s corp vs c corp election to get started. We have unmatched experience in forming businesses online. Incorporated in california doing business in. We have unmatched experience in forming businesses online. Find out how to get an extension of time to file your income tax return. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Web s corps need to file a tax return and pay any taxes owed for 2019 by july 15, 2020, (four months later than the normal march 16 deadline due to the coronavirus. Web irs extension california: Pay the. Apply for s corporation status with. We have unmatched experience in forming businesses online. Find out how to get an extension of time to file your income tax return. The original due date to file california corporation franchise or income tax return (form 100), is the 15th day of. Since the corporation is doing business in both nevada and california, it must file a. Start your corporation with us. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies. Start your corporation with us. Web s corps need to file a tax return and pay any taxes owed for 2019 by july 15, 2020, (four months later than the normal march 16 deadline due to the coronavirus. Download or email ca 100s & more fillable forms, register and subscribe now! Be received before the extended period ends. Web limited liability companies classified as c corporations must file form 100, california corporation franchise or income tax return. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). Web 1 min read you can extend filing form 1120s when you file form 7004. Securing a california business tax extension depends on the type of business you’re filing for. The original due date for this. Web form 100s a 1. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Incorporated in california doing business in. File request for extension by the due date of.Federal Extension Is In Effect Fill Out and Sign Printable PDF

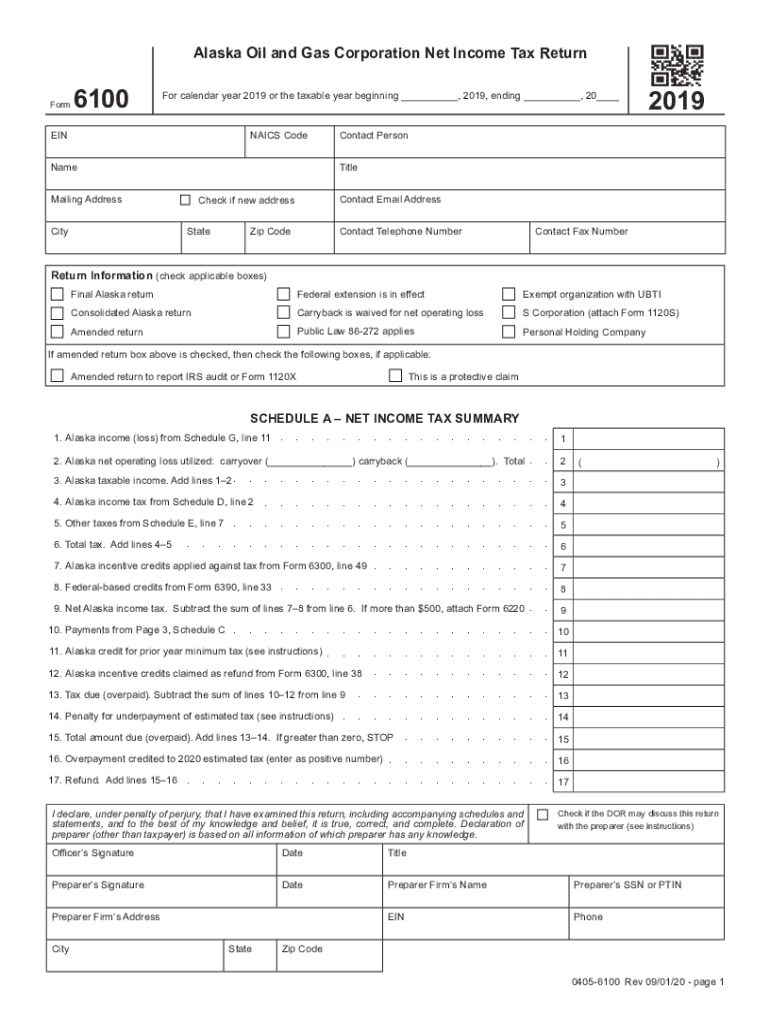

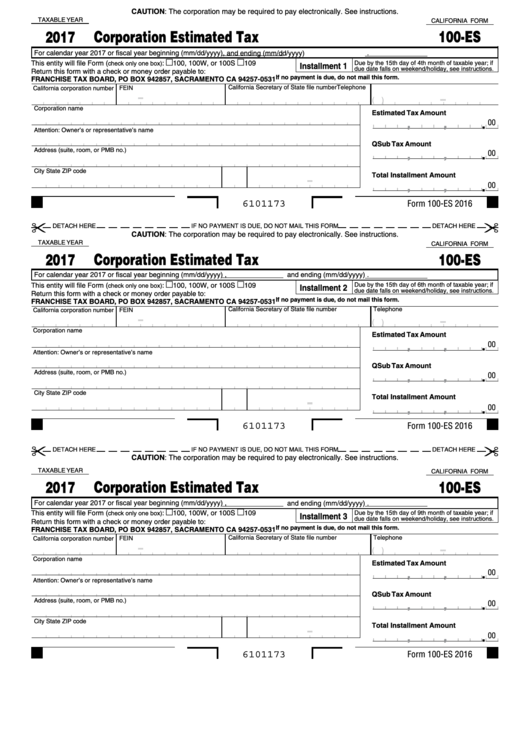

Fillable California Form 100 Es Corporate Esitimated Tax Franchise

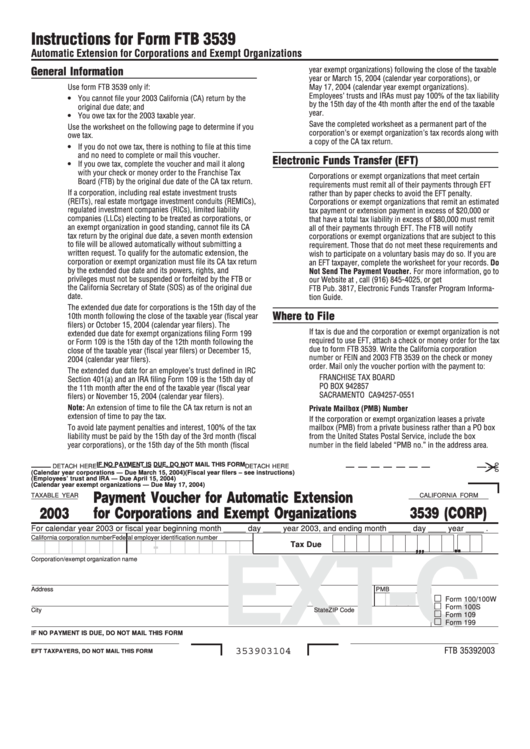

California Form 3539 (Corp) Payment For Automatic Extension For Corps

Fillable Form Ftb 3539 Payment Voucher For Automatic Extension For

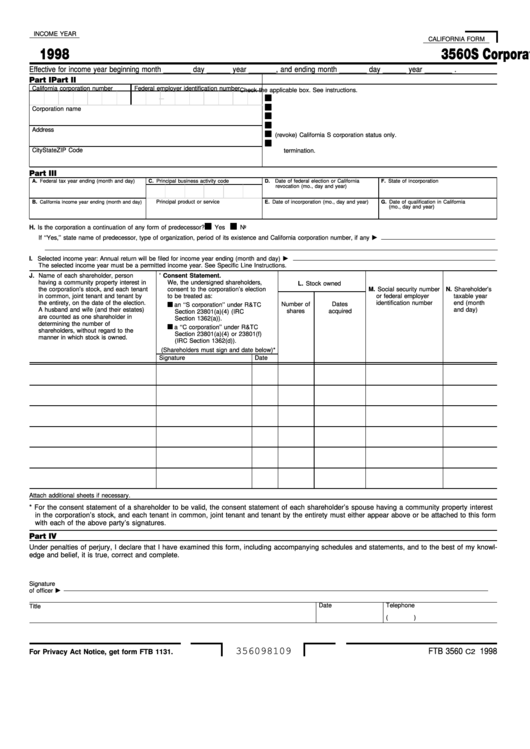

Fillable California Form 3560 S Corporation Election Or Termination

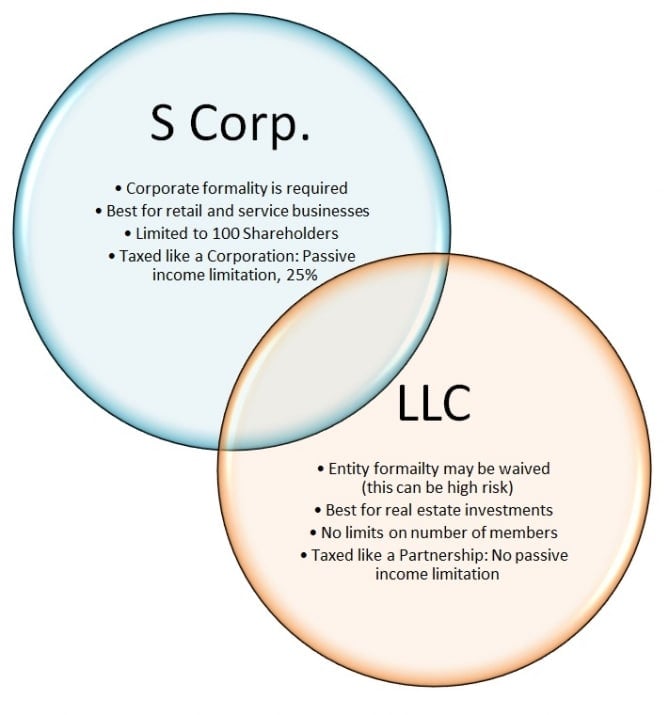

How to Start an S Corp in California California S Corp TRUiC

California Form 3539 (Corp) Payment Voucher For Automatic Extension

How to File an Extension for Your SubChapter S Corporation

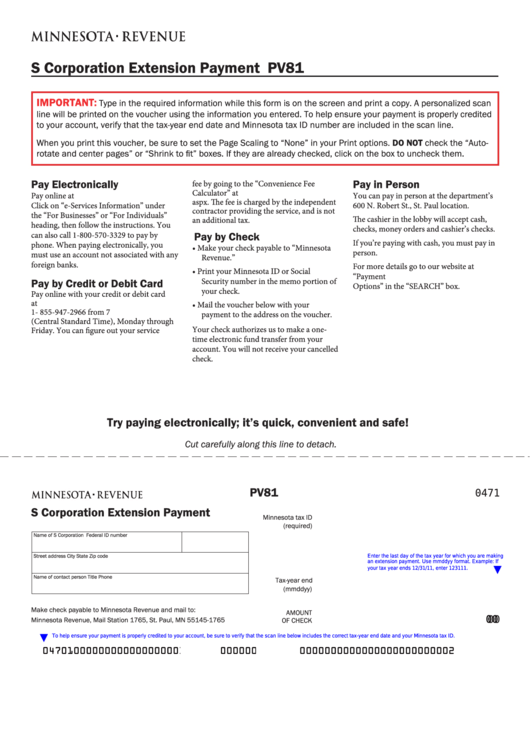

Fillable Form Pv81 S Corporation Extension Payment printable pdf download

Creating an S Corporation in California A People's Choice

Related Post: