Shipt 1099 Form

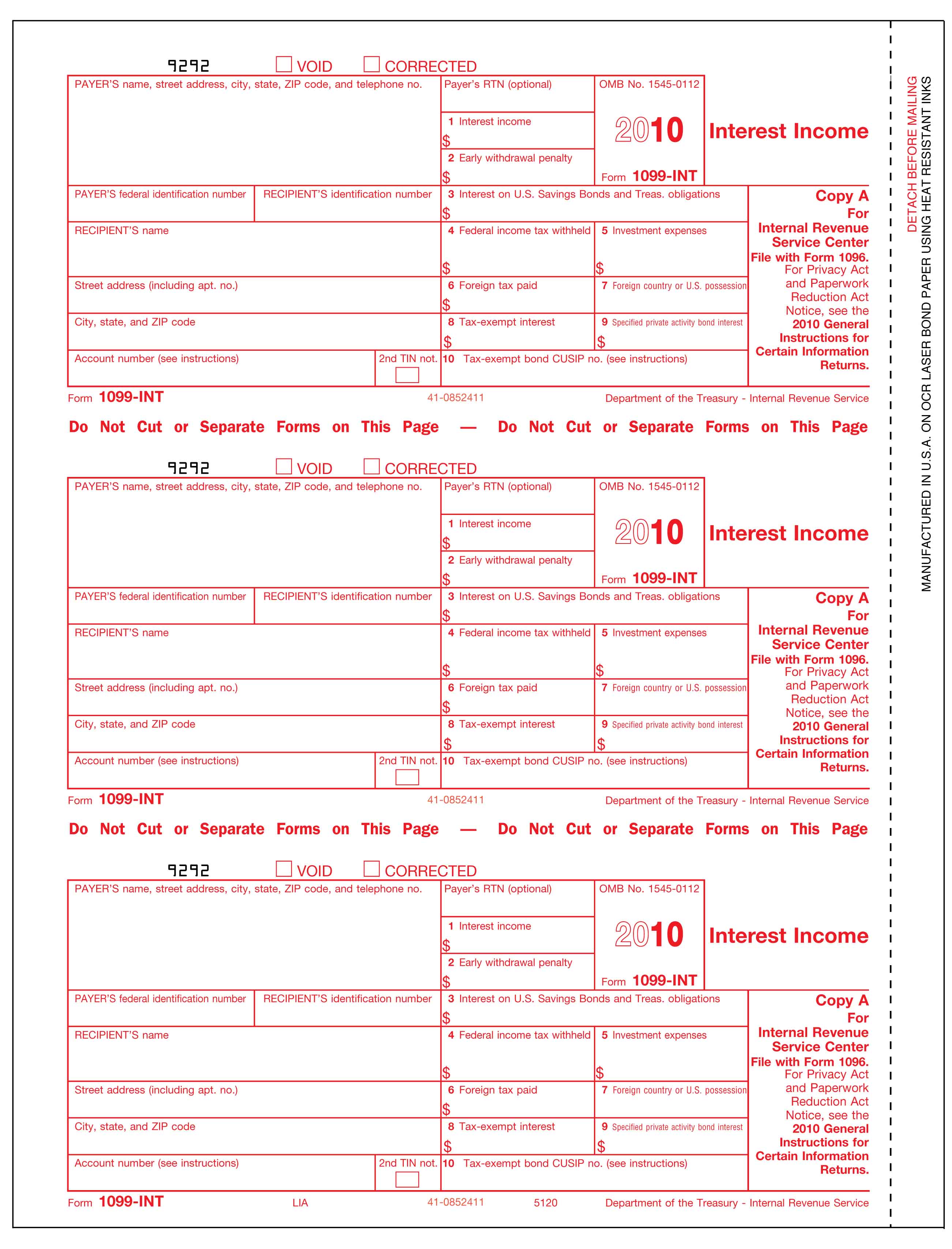

Shipt 1099 Form - Web schedule d (form 1040). See how we can help! Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web no matter who you work for as a grocery delivery driver, whether it is for shipt or similar businesses, keep reading to learn about the tax forms you are required to. Learn how to file 1099 forms with the appropriate revenue authorities, such as the irs and state tax authorities. Learn about requirements, how to apply, faq, safety, shopper perks, and increasing your earnings! As independent contractors, shoppers with shipt are. Say hello to your next step. As independent contractors, shoppers with shipt are responsible for filing. You don't own shipt, but you do own your own delivery business, which operates under contract to shipt. Web you do own the business. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web shipt does not withhold any taxes from our shoppers' weekly paychecks. Web how does that work? Head to the stripe express support site to learn. Learn about requirements, how to apply, faq, safety, shopper perks, and increasing your earnings! As independent contractors, shoppers with shipt are responsible for filing their own taxes. Web stripe partners with online platforms like doordash, instacart, and shipt to deliver 1099 tax forms and collect w8/w9 tax forms. Generate 1099s within. Payroll seamlessly integrates with quickbooks® online. As independent contractors, shoppers with shipt are. As independent contractors, shoppers with shipt are responsible for filing their own taxes. As independent contractors, shoppers with shipt are responsible for filing. Say hello to your next step. Stripe provides capabilities and a tax reporting dashboard to. Shows interest or principal forfeited because of. Before you can file your 1099 tax. Learn about requirements, how to apply, faq, safety, shopper perks, and increasing your earnings! Shipt does not withhold any taxes from our shoppers' weekly paychecks. Web you do own the business. Web 1099 tax forms for shipt shoppers. Shipt partners with stripe to file 1099 tax forms that summarize shoppers’ earnings. 25k views 3 years ago. Web how does that work? Web how does that work? Web file your 1099 tax forms. See how we can help! You are in business for yourself, or self. As independent contractors, shoppers with shipt are responsible for filing their own taxes. Web stripe partners with online platforms like doordash, instacart, and shipt to deliver 1099 tax forms and collect w8/w9 tax forms. Shows interest or principal forfeited because of. You will get a shipt 1099 if you earn more than. If you receive income from 1099, gig economy, freelance work, or independent contractor work. If you work for shipt as a. Web schedule d (form 1040). Web shipt does not withhold any taxes from our shoppers' weekly paychecks. Web shipt does not withhold any taxes from our shoppers' weekly paychecks. Web stripe partners with online platforms like doordash, instacart, and shipt to deliver 1099 tax forms and collect w8/w9 tax forms. Shipt does not withhold any taxes from our shoppers' weekly. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web shipt does not withhold any taxes from our shoppers' weekly paychecks. As independent contractors, shoppers with shipt are responsible for filing. Head to the stripe express support site to learn. Web for more information, see form 8912. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Web schedule d (form 1040). As independent contractors, shoppers with shipt are responsible for filing their own taxes. 25k views 3 years ago. Payroll seamlessly integrates with quickbooks® online. Shipt does not withhold any taxes from our shoppers' weekly paychecks. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate income tax form. Head to the stripe express support site to learn. 25k views 3 years ago. Web your 1099 tax form will be sent to you by january 31, 2024 (note: Learn about requirements, how to apply, faq, safety, shopper perks, and increasing your earnings! Generate 1099s within seconds 2, using data that’s already been collected in your stripe account. Web 1099 tax forms for shipt shoppers. Payroll seamlessly integrates with quickbooks® online. Stripe provides capabilities and a tax reporting dashboard to. Web schedule d (form 1040). Shipt partners with stripe to file 1099 tax forms that summarize shoppers’ earnings. See how we can help! See the instructions above for a taxable covered security acquired at a premium. Learn how to file 1099 forms with the appropriate revenue authorities, such as the irs and state tax authorities. Web for more information, see form 8912. Shipt does not withhold any taxes from our shoppers' weekly paychecks. Ad approve payroll when you're ready, access employee services & manage it all in one place. As independent contractors, shoppers with shipt are responsible for filing. If you work for shipt as a shopper in the us, visit our.How To Fill Out A 1099 B Tax Form Universal Network

Office Depot Brand 1099Nec Laser Tax Forms, 2Up, 4Part, 81/2'' X 11

1099MISC Form Sample

Federal Tax Filing Free Federal Tax Filing With 1099 Misc

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

How To Complete A 1099 Form

What is a 1099Misc Form? Financial Strategy Center

The 1099 Package

Printable Blank 1099 Nec Form Printable World Holiday

Guide to 1099 tax forms for Shipt Shoppers Stripe Help & Support

Related Post: