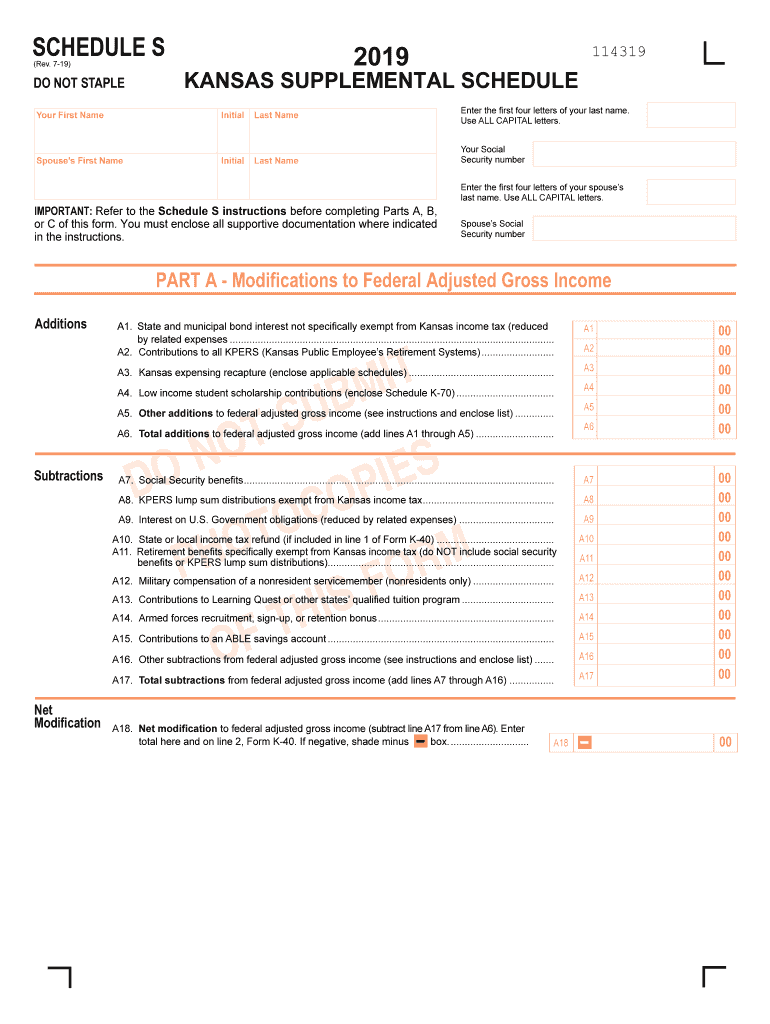

Schedule S Tax Form

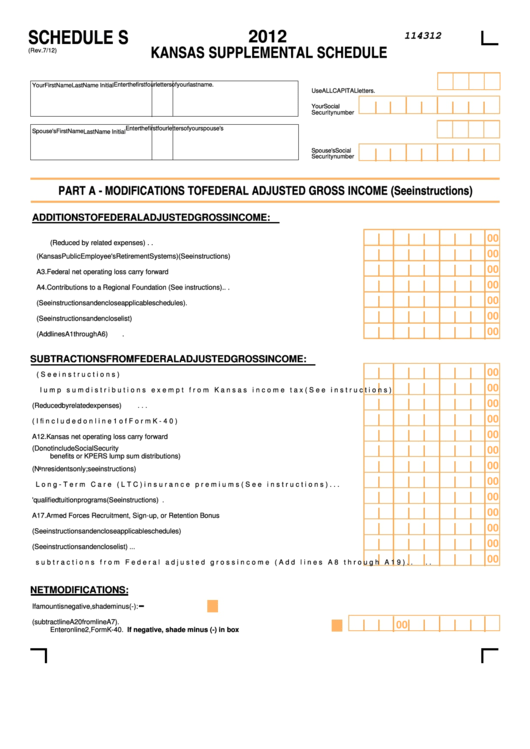

Schedule S Tax Form - To claim itemized deductions you must complete kansas form. Web refer to the schedule s instructionsbefore completing parts a and b of this form. A taxpayer identification number, such as a social security number. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Complete, edit or print tax forms instantly. Taxpayers needn’t itemize on schedule a of the form 1040 to take this. • form 940 • form 940 schedule r. Web about schedule a (form 1040), itemized deductions | internal revenue service. Web office of tax and revenue. An employer whose previous 4 quarter arizona withholding average. To claim itemized deductions you must complete kansas form. Do not file this form unless the corporation has filed or is attaching. Web call to schedule your appointment ahead of time. Complete, edit or print tax forms instantly. Web earlier of the date the entity’s income tax return is filed or the due date of the entity’s income tax return. Web about schedule a (form 1040), itemized deductions | internal revenue service. Best overall payroll software for small businesses by business.com Web tax year 2023 940 mef ats scenario 3 crocus company. There’s a deduction for student loan interest. For tax year 2023, this tax credit is worth up to $7,430 for a family with three. Attach to form 540, form 540nr, or form 541. Web schedule 1 (form 1040), line 17. 1101 4th street, sw, suite 270 west,. Web here’s a helpful guide for what’s generally reported on the following information returns: Web tax year 2023 940 mef ats scenario 3 crocus company. Web schedule 1 (form 1040), line 17. Web earlier of the date the entity’s income tax return is filed or the due date of the entity’s income tax return excluding extensions. Acquisition or abandonment of secured property 1099. State or local income tax refund. 1101 4th street, sw, suite 270 west,. Taxpayers needn’t itemize on schedule a of the form 1040 to take this. Do not file this form unless the corporation has filed or is attaching. Web here’s a helpful guide for what’s generally reported on the following information returns: Income tax return for an s corporation. Web this credit can reduce the taxes you owe and maybe even result. Web arizona state income tax returns for tax year 2022 were due april 18, 2023, or oct. Web but these tax breaks can help ease the pain. Irs schedule 1 lists additional income sources such as taxable state. State or local income tax refund. Web page last reviewed or updated: Department of the treasury internal revenue service. Web refer to the schedule s instructionsbefore completing parts a and b of this form. Web tax year 2023 940 mef ats scenario 3 crocus company. There’s a deduction for student loan interest. Web office of tax and revenue. Best overall payroll software for small businesses by business.com Web refer to the schedule s instructionsbefore completing parts a and b of this form. • form 940 • form 940 schedule r. Web about schedule a (form 1040), itemized deductions | internal revenue service. There’s a deduction for student loan interest. A taxpayer identification number, such as a social security number. Web call to schedule your appointment ahead of time. Payments must be submitted electronically (if. Get ready for tax season deadlines by completing any required tax forms today. Retain a copy of other state tax. An employer whose previous 4 quarter arizona withholding average. There’s a deduction for student loan interest. 1101 4th street, sw, suite 270 west,. Web you must attach schedule s, other state tax credit, and a copy of your tax return (s) filed with the other state (s) to your california tax return. Web page last reviewed or updated: Complete, edit or print tax forms instantly. Web but these tax breaks can help ease the pain. Web here’s a helpful guide for what’s generally reported on the following information returns: Web arizona state income tax returns for tax year 2022 were due april 18, 2023, or oct. For tax year 2023, this tax credit is worth up to $7,430 for a family with three. Web office of tax and revenue. Do not file this form unless the corporation has filed or is attaching. Best overall payroll software for small businesses by business.com A taxpayer identification number, such as a social security number. • form 940 • form 940 schedule r. Department of the treasury internal revenue service. To claim itemized deductions you must complete kansas form. An employer whose previous 4 quarter arizona withholding average. Attach to form 540, form 540nr, or form 541. Web you must attach schedule s, other state tax credit, and a copy of your tax return (s) filed with the other state (s) to your california tax return. Web call to schedule your appointment ahead of time. Web about schedule a (form 1040), itemized deductions | internal revenue service. 1101 4th street, sw, suite 270 west,. Web what are the schedules that go with form 1040? There’s a deduction for student loan interest.Kansas Schedule S Form Fill Out and Sign Printable PDF Template signNow

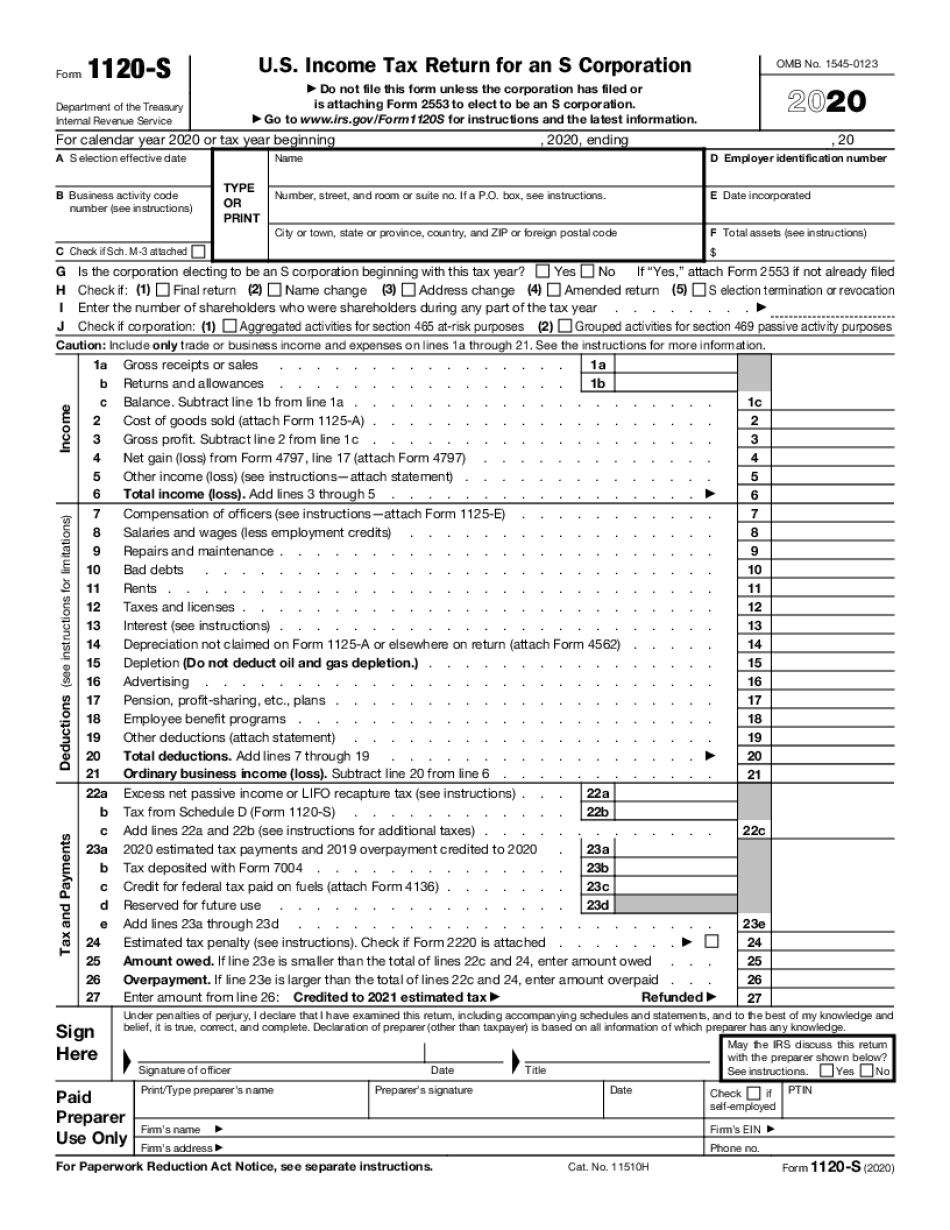

2020 1120s Editable Online Blank in PDF

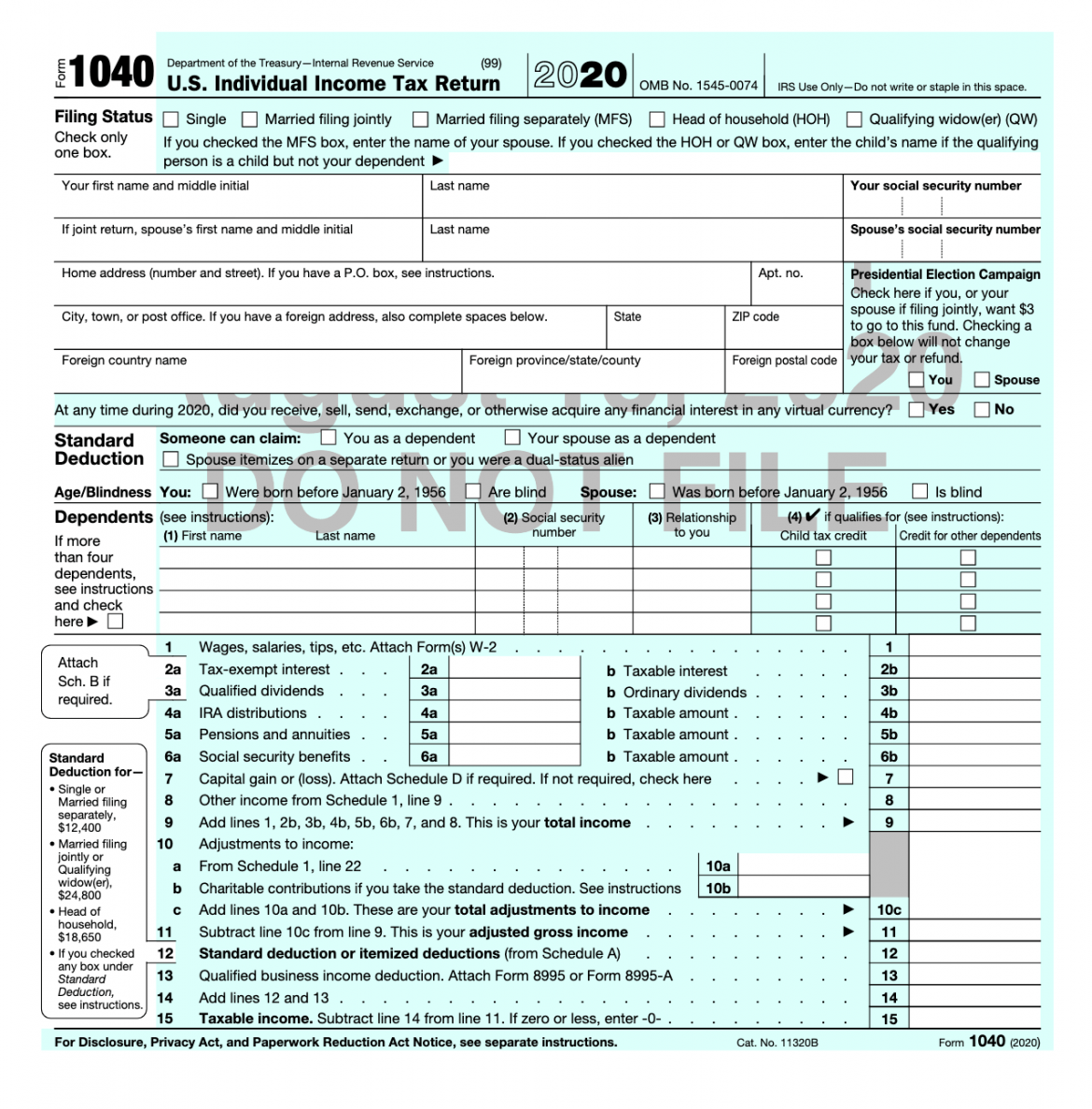

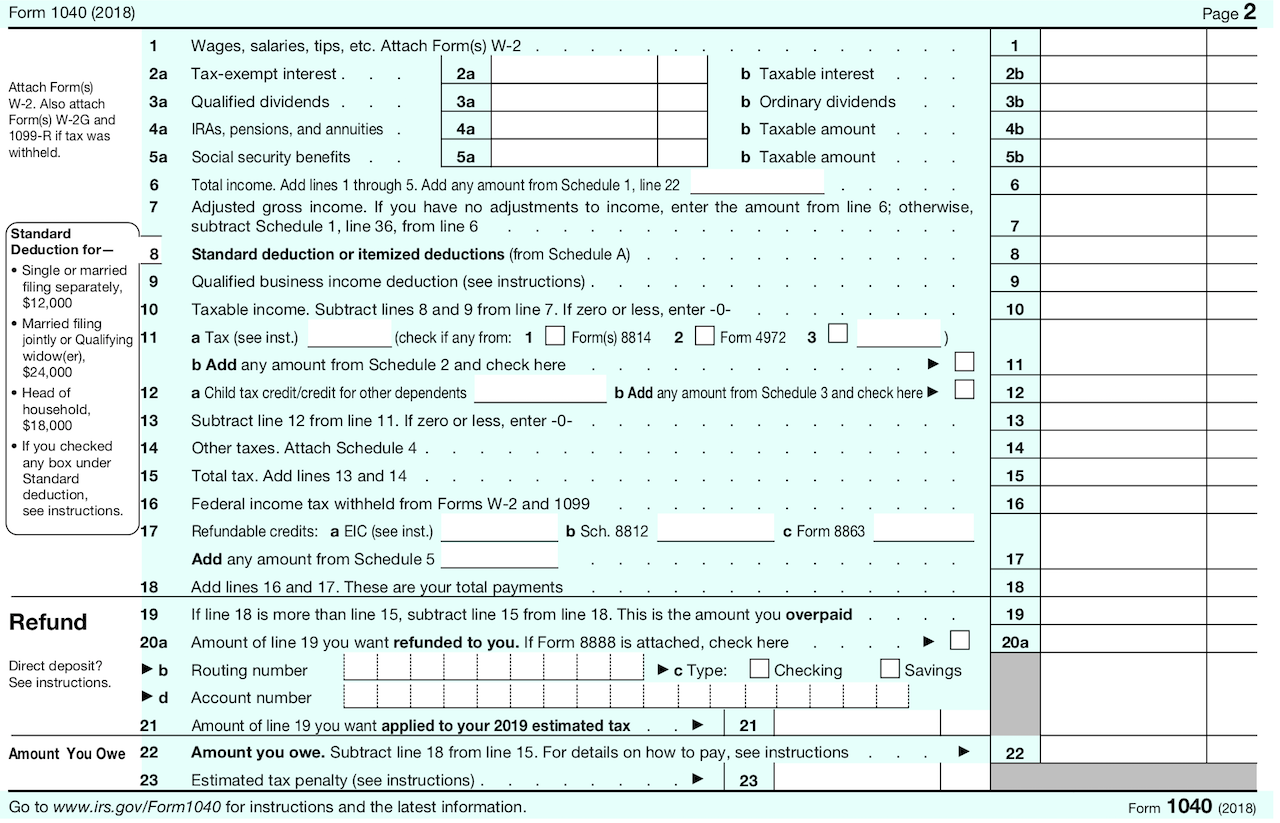

What’s New On Form 1040 For 2020 Taxgirl

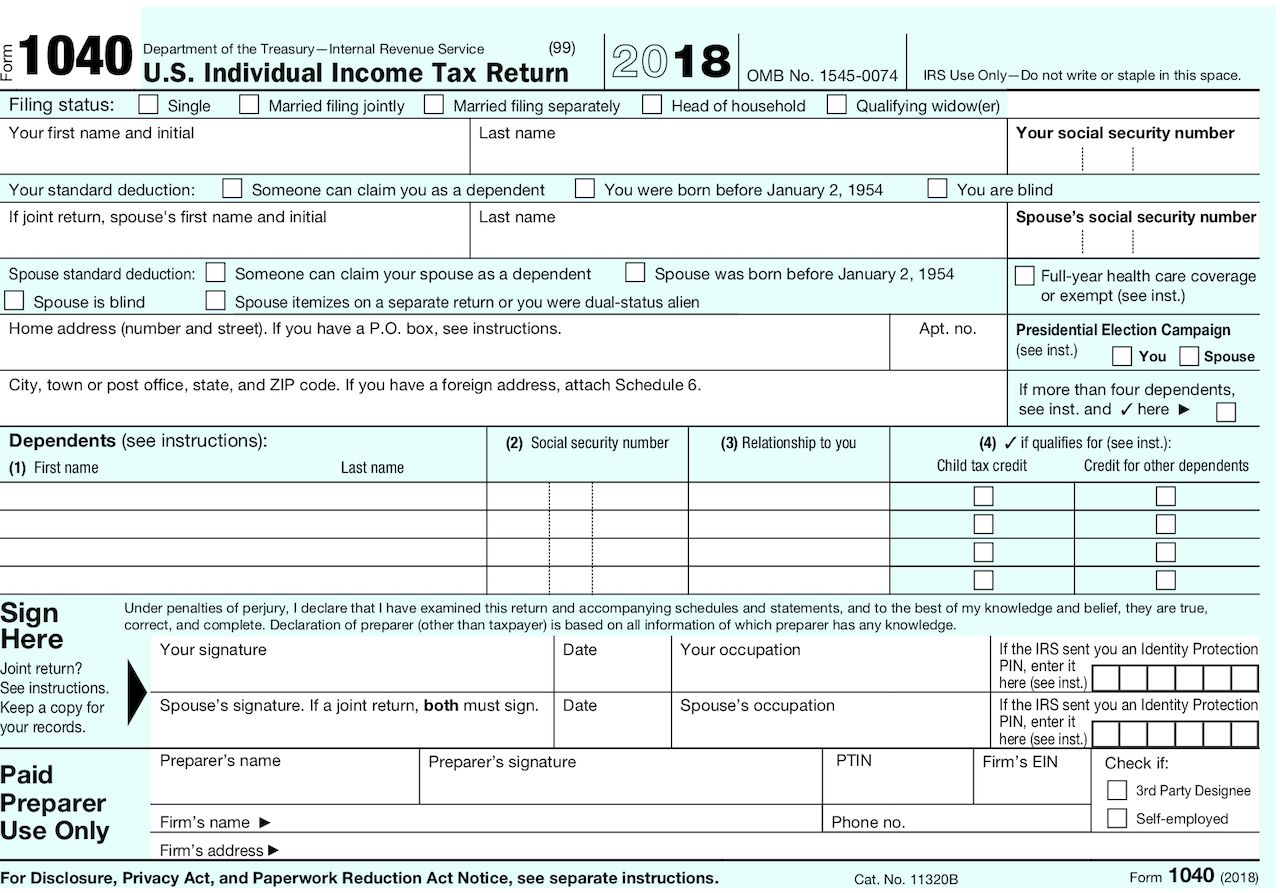

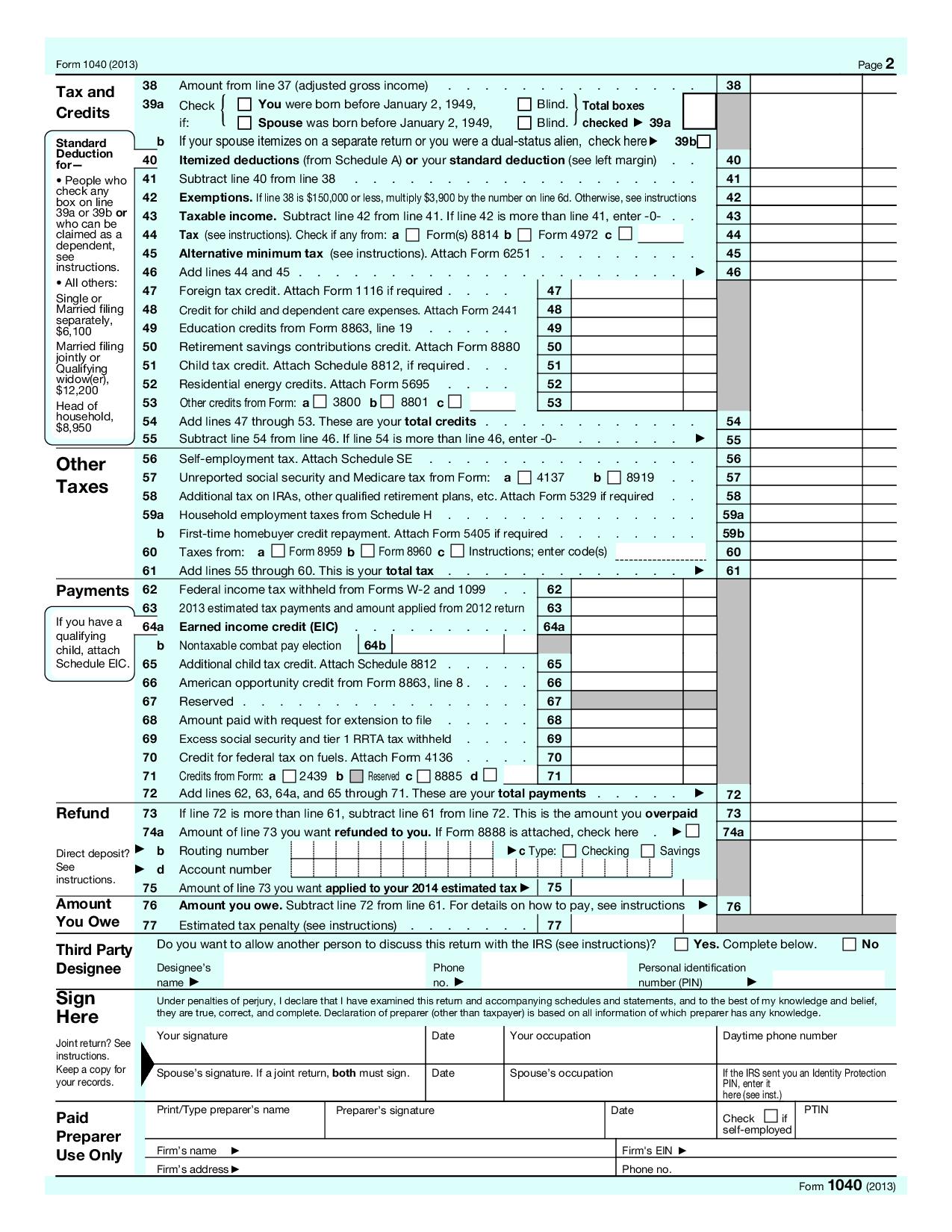

Describes new Form 1040, Schedules & Tax Tables

Describes new Form 1040, Schedules & Tax Tables

1040 U.S. Individual Tax Return with Schedule A

Fillable Form Schedule S Kansas Supplemental Schedule 2012

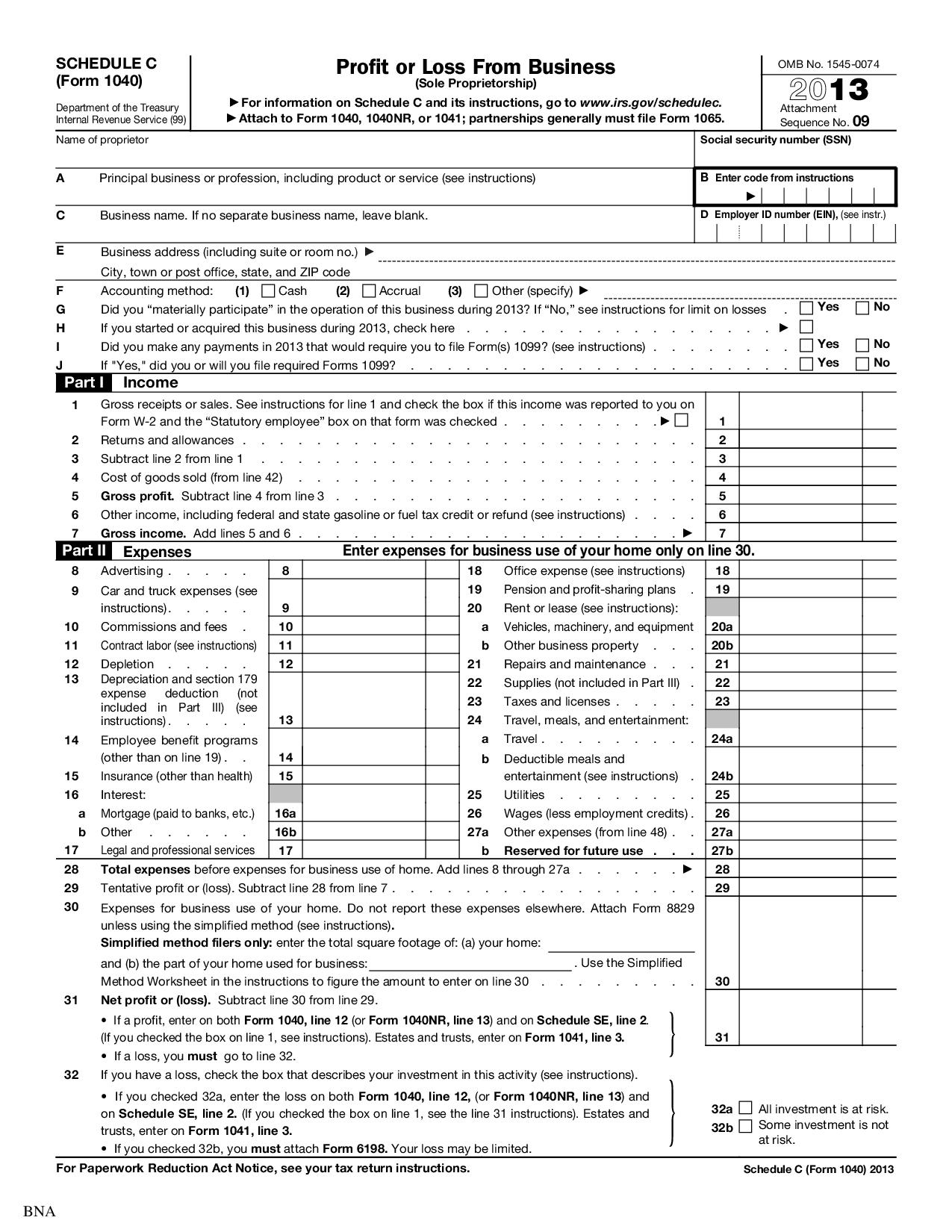

Brief Explanation on 1040 Schedules, IRS Form 1040 Meru Accounting

1040 U.S. Individual Tax Return with Schedule C

IRS releases drafts of 2021 Form 1040 and schedules Don't Mess With Taxes

Related Post: