Schedule M-3 Form 1120 Instructions

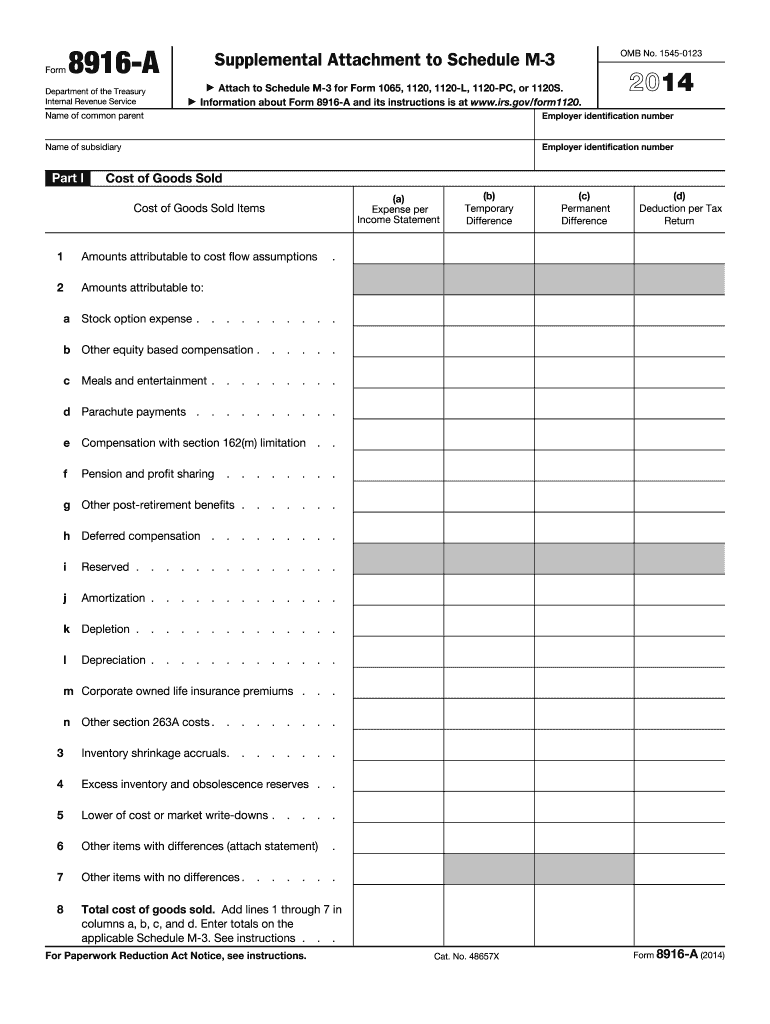

Schedule M-3 Form 1120 Instructions - Ad access irs tax forms. States often have dozens of even hundreds of various tax credits, which, unlike deductions,. Section references are to the. Specifications to be removed before printing. Web go to line 1b. Web the basic document a domestic corporation must file is form 1120. To be removed before printing. 2 federal income tax per books. Complete, edit or print tax forms instantly. Section references are to the. Specifications to be removed before printing. Section references are to the. Web the basic document a domestic corporation must file is form 1120. Web go to line 1b. “who must file any corporation required to file form 1120s. States often have dozens of even hundreds of various tax credits, which, unlike deductions,. Section references are to the. Complete, edit or print tax forms instantly. Top 13mm (1⁄2) center sides. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Web the basic document a domestic corporation must file is form 1120. 1 net income (loss) per books. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Specifications to be removed before printing. Ad access irs tax forms. Top 13mm (1⁄2) center sides. Section references are to the. States often have dozens of even hundreds of various tax credits, which, unlike deductions,. Complete, edit or print tax forms instantly. Section references are to the. 2 federal income tax per books. To be removed before printing. Web go to line 1b. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! December 2019) department of the treasury internal revenue service. States often have dozens of even hundreds of various tax credits, which, unlike deductions,. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. 1 net income (loss) per books. “who must file any corporation required to file form 1120s. Web go to line 1b. Web go to line 1b. “who must file any corporation required to file form 1120s. Section references are to the. Top 13mm (1⁄2) center sides. Complete, edit or print tax forms instantly. Ad easy, fast, secure & free to try! Web the basic document a domestic corporation must file is form 1120. Ad access irs tax forms. Net income (loss) reconciliation for corporations with total assets. Section references are to the. December 2019) department of the treasury internal revenue service. Analysis of unappropriated retained earnings per books. Ad easy, fast, secure & free to try! Section references are to the. Top 13mm (1⁄2) center sides. To be removed before printing. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! December 2019) department of the treasury internal revenue service. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. Web the basic document a domestic corporation must file is form 1120. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web go to line 1b. If the total amount of assets exceeds 10 million usd, the corporation must attach the form under discussion. Net income (loss) reconciliation for corporations with total assets. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. Analysis of unappropriated retained earnings per books. December 2019) department of the treasury internal revenue service. That reports on schedule l of form 1120s. Top 13mm (1⁄2) center sides. Complete, edit or print tax forms instantly. States often have dozens of even hundreds of various tax credits, which, unlike deductions,. Section references are to the. Ad easy, fast, secure & free to try! Web the basic document a domestic corporation must file is form 1120. 1 net income (loss) per books. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. To be removed before printing. Section references are to the. Specifications to be removed before printing.Form 1120 (Schedule M3) Net Reconciliation for Corporations

How to File Tax Form 1120 for Your Small Business (2023)

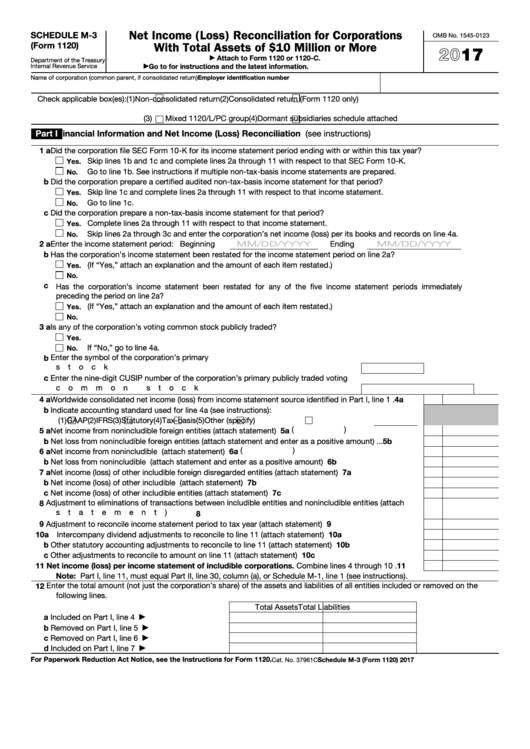

Form 1120 (Schedule M3) Net Reconciliation for Corporations

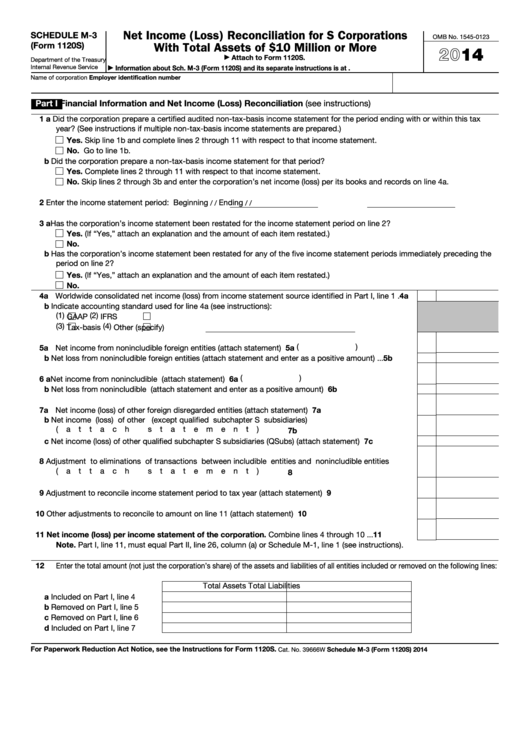

Fillable Schedule M3 (Form 1120s) Net (Loss) Reconciliation

Instructions for Schedule M3 (Form 1120L) (2017 IRS.gov Fill

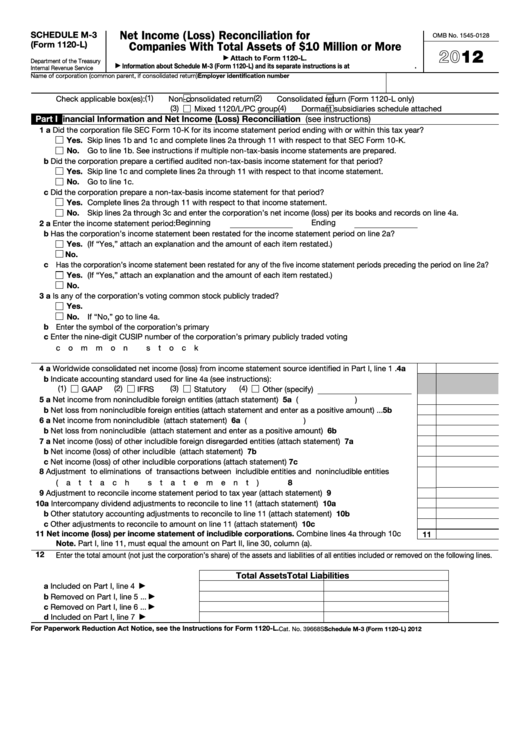

Fillable Schedule M3 (Form 1120L) Net (Loss) Reconciliation

Inst 1120PC (Schedule M3)Instructions for Schedule M3 (Form 1120…

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Fillable Schedule M3 (Form 1120) Net (Loss) Reconciliation

Form 1120L (Schedule M3) Net Reconciliation for U.S. Life

Related Post: