Form 886-A Frozen Refund

Form 886-A Frozen Refund - It is available for three tax years. Information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and. Web payments and credits from a filed return that are neither applied to a tax liability nor refunded to the taxpayer are called frozen refunds. Web the title of irs form 886a is explanation of items. To show both of you lived. Learn how to track your federal tax refund and find the status of your direct deposit. The claim for refund or credit must have been for an excessive amount. Payments you authorize from the account associated with your refund transfer will reduce the net proceeds of your refund sent to you. March 2011) begins on the next page. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Documents you need to send. Web enter the number of “same as or substantially similar” transactions reported on this form. Web page last reviewed or updated: It’s important to investigate your case if you. The zip code for where to file separately an exact copy of the initial year filing of form 8886 has. To show both of you lived. March 2011) begins on the next page. Ad learn how to track your federal tax refund and find the status of your paper check. You elected to apply the. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Most often, form 886a is. Instructions for form 8886 (rev. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the. The letter explains the changes to the tax return and. Web the form 3610 format discussed in paragraph (4)(a) can be shown on the tax computation schedule (form 5278, form 4549, etc). Learn how to track your federal tax refund and find the status of your direct deposit. Web payments and credits from a filed return that are neither applied to a tax liability nor refunded to the taxpayer are. Learn how to track your federal tax refund and find the status of your direct deposit. March 2011) begins on the next page. It’s important to investigate your case if you. Information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and. Ad learn how to track your federal tax refund and find the status of your. Information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and. Most often, form 886a is. Web enter the number of “same as or substantially similar” transactions reported on this form. Documents you need to send. March 2011) begins on the next page. Web page last reviewed or updated: If you participated in this reportable transaction through a partnership, s. If the frozen refund is shown on. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. Ad learn how to track your federal tax refund and find the status of your paper check. The check was held or returned due to a problem with the name or address. Web you have unfiled or missing tax returns for prior tax years. Payments you authorize from the account associated with your refund transfer will reduce the net proceeds of your refund sent to you. Since the purpose of form 886a is to explain something, the. The claim for refund or credit must have been for an excessive amount. Documents you need to send. Instructions for form 8886 (rev. Most often, form 886a is. Web the title of irs form 886a is explanation of items. The assistant helps you find out your filing status, determine if your. Instructions for form 8886 (rev. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web use the eitc assistant to find out if you qualify for the eitc. Ad learn how to track your federal tax refund and find. Payments you authorize from the account associated with your refund transfer will reduce the net proceeds of your refund sent to you. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. The zip code for where to file separately an exact copy of the initial year filing of form 8886 has. March 2011) begins on the next page. The check was held or returned due to a problem with the name or address. Web you can file your return and receive your refund without applying for a refund transfer. Documents you need to send. Ad learn how to track your federal tax refund and find the status of your paper check. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the. The claim for refund or credit must have been for an excessive amount. Instructions for form 8886 (rev. Web the form 3610 format discussed in paragraph (4)(a) can be shown on the tax computation schedule (form 5278, form 4549, etc). To show both of you lived. Web you have unfiled or missing tax returns for prior tax years. Most often, form 886a is. If the frozen refund is shown on. Learn how to track your federal tax refund and find the status of your direct deposit. If you participated in this reportable transaction through a partnership, s. You elected to apply the. Web use the eitc assistant to find out if you qualify for the eitc.886 Fill out & sign online DocHub

️Form 886 A Worksheet Instructions Free Download Gmbar.co

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

Home Loan Joint Declaration Form Pdf

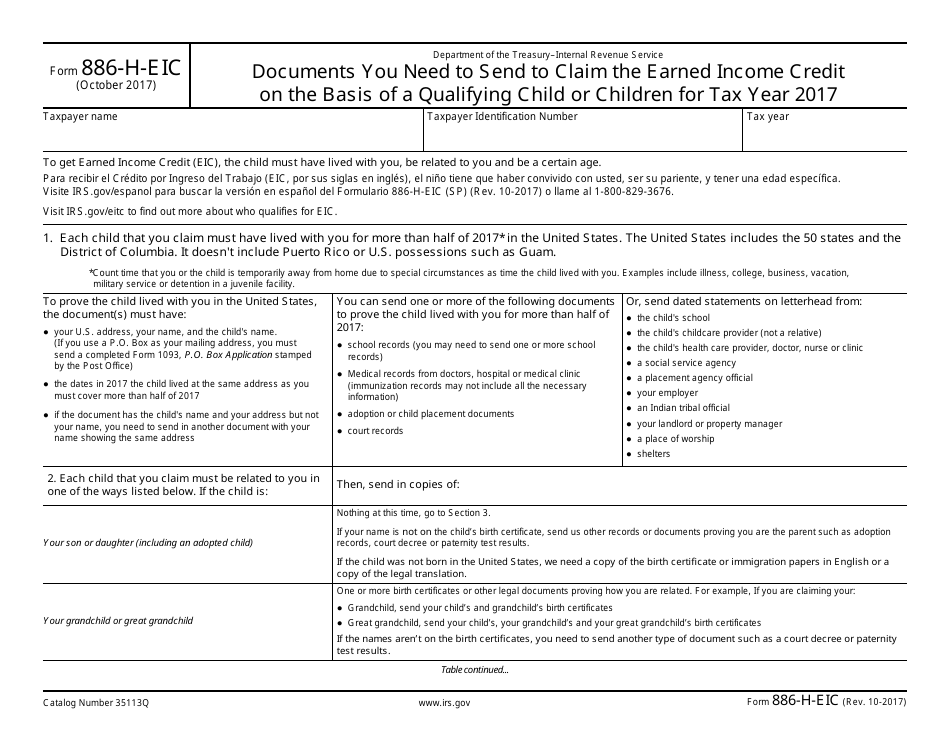

IRS Form 886HEIC Fill Out, Sign Online and Download Fillable PDF

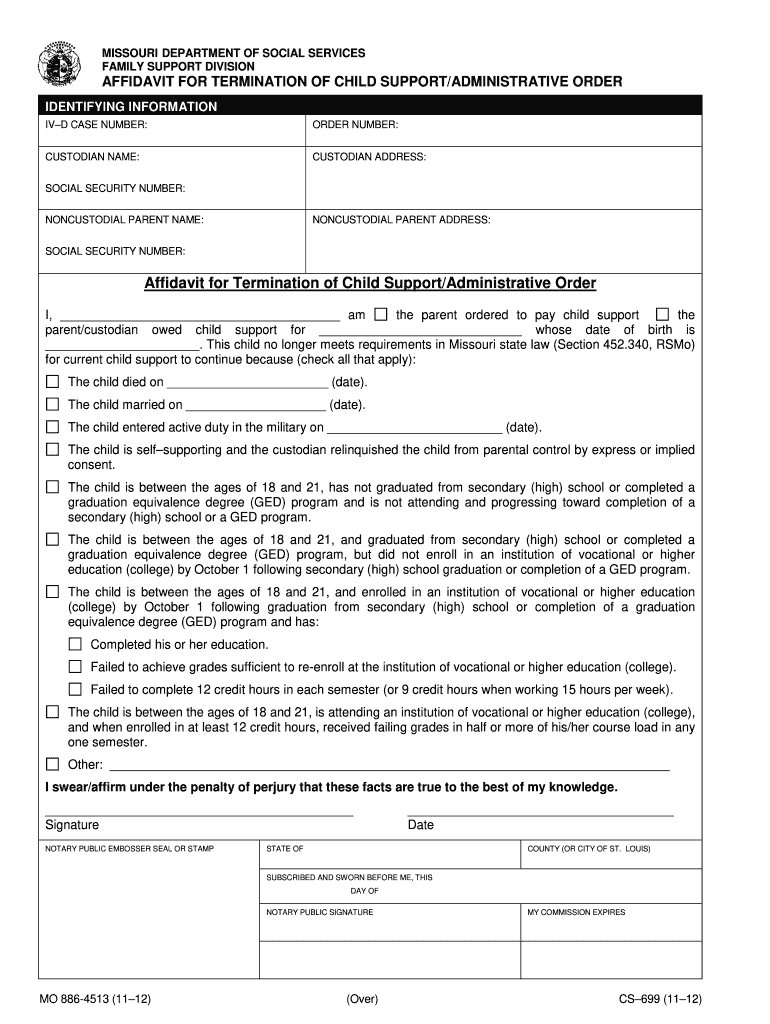

Missouri form mo 886 4513 Fill out & sign online DocHub

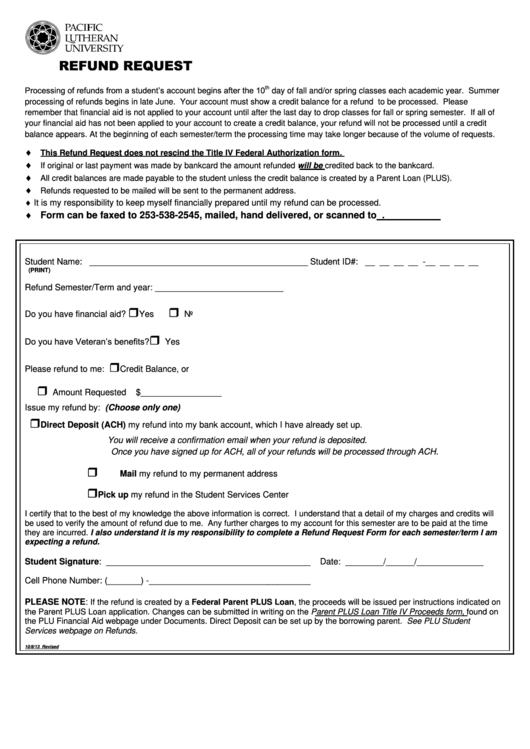

Fillable Refund Request Form printable pdf download

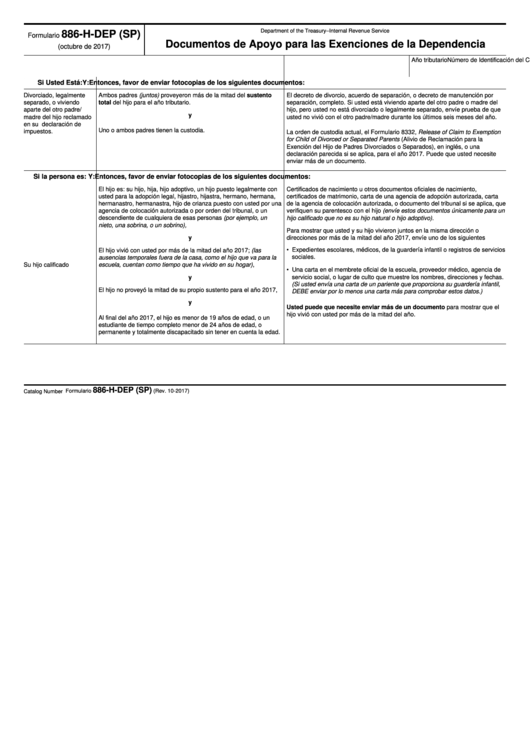

Fillable Form 886HDep (Sp) Supporting Documents For Dependency

36 Irs Form 886 A Worksheet support worksheet

Form 886 A Worksheet Promotiontablecovers

Related Post: