Schedule D Form 1120

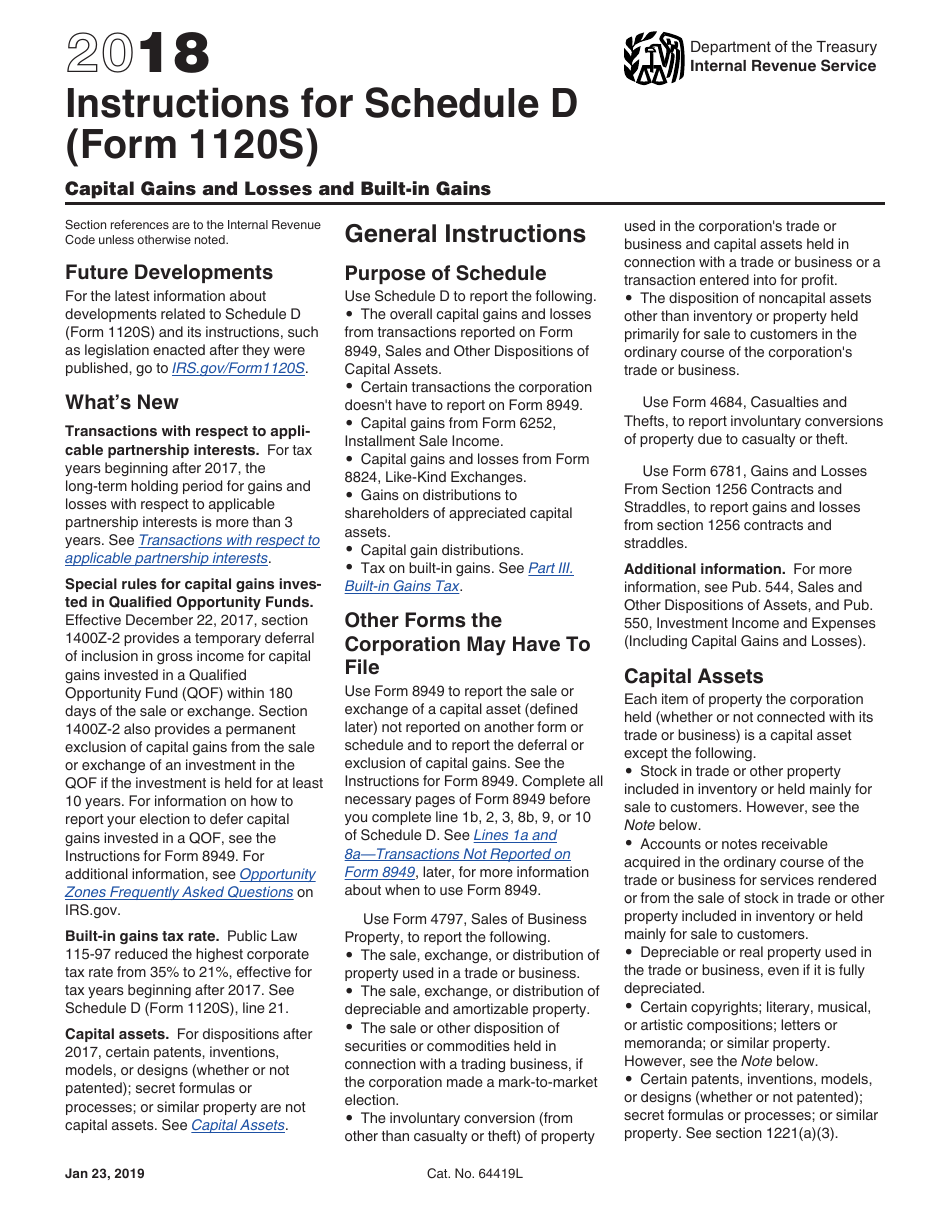

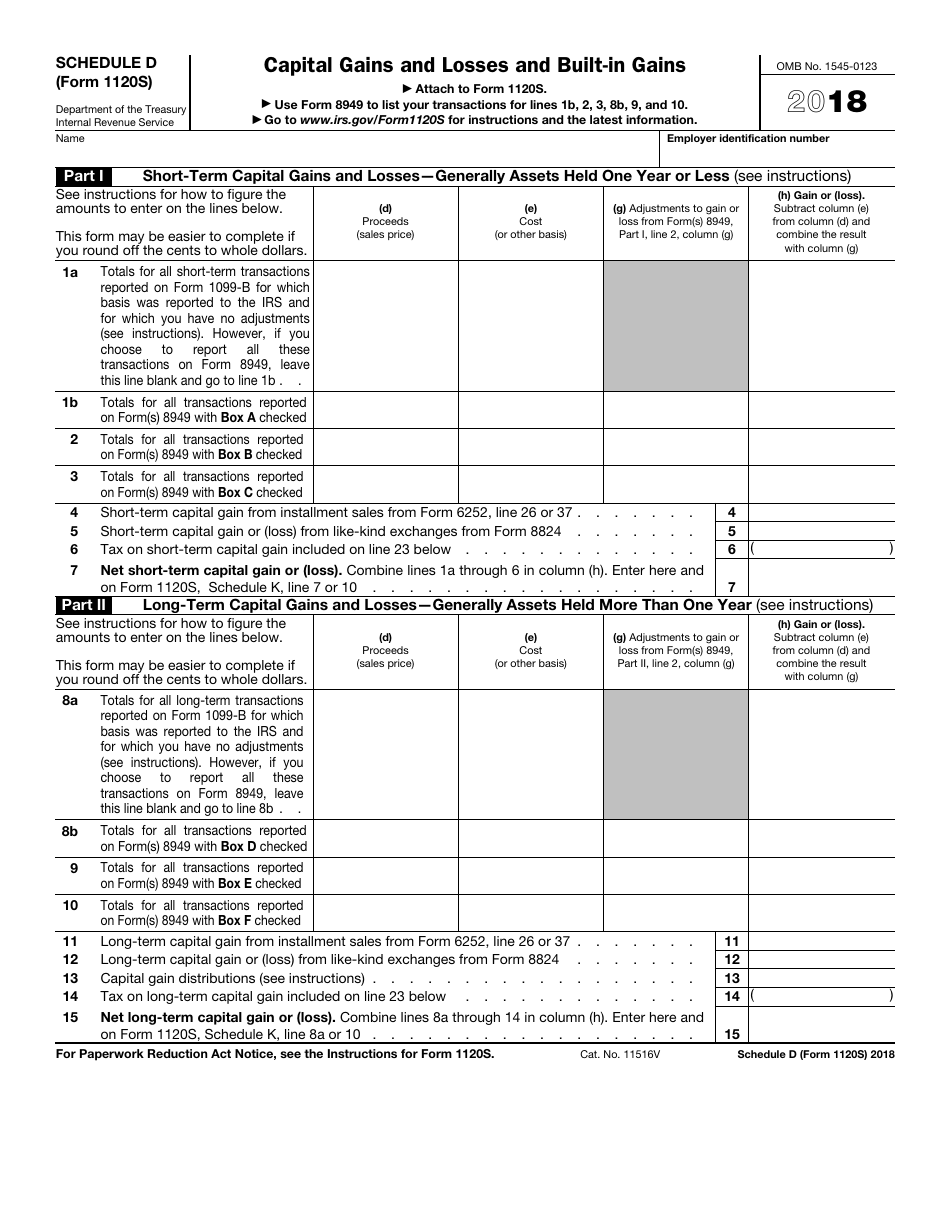

Schedule D Form 1120 - Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service. Web schedule n (form 1120). Use schedule d to report the following. Sales or exchanges of capital assets. Ad get ready for tax season deadlines by completing any required tax forms today. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. For calendar year 2022 or tax year beginning, 2022, ending. Please use the link below to. Web use schedule d (form 1120) to: Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. 52684s schedule g (form 1120) (rev. Complete, edit or print tax forms instantly. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Figure the overall gain or loss from transactions reported on form 8949. Sales or exchanges of capital assets. 52684s schedule g (form 1120) (rev. Figure the overall gain or loss from transactions reported on form 8949. Schedule d is often used to report capital gains from the sale of. Use schedule d to report the following. Use schedule d to report the following. Complete, edit or print tax forms instantly. For the latest information about developments to schedule d (form. The schedule d form is what most people use to report capital gains and losses that result. Ad easy guidance & tools for c corporation tax returns. Ad get ready for tax season deadlines by completing any required tax forms today. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Complete, edit or print tax forms instantly. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web use schedule d (form 1120). Figure the overall gain or loss from transactions reported on form 8949. It appears you don't have a pdf plugin for this browser. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. Ad easy guidance & tools for c corporation tax returns. Please use the link below to. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. The schedule d form is what most people use to report capital gains and losses that result. Please use the link below to. Report certain transactions the corporation does. Web schedule n (form 1120). Schedule d is often used to report capital gains from the sale of. Ad get ready for tax season deadlines by completing any required tax forms today. Web updated for tax year 2022 • june 2, 2023 8:43 am. Use schedule d to report the following. Sales or exchanges of capital assets. Ad easy guidance & tools for c corporation tax returns. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Complete, edit or print tax forms instantly. Figure the overall. Web use schedule d (form 1120) to: For calendar year 2022 or tax year beginning, 2022, ending. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. Web updated for tax year 2022 • june 2, 2023 8:43. Web use schedule d (form 1120) to: 52684s schedule g (form 1120) (rev. The schedule d form is what most people use to report capital gains and losses that result. Web schedule n (form 1120). Sales or exchanges of capital assets. Figure the overall gain or loss from transactions reported on form 8949. Schedule d is often used to report capital gains from the sale of. Sales or exchanges of capital assets. Web schedule n (form 1120). Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. October 05, 2023 tax year 2023 1120 mef ats scenario 3: 52684s schedule g (form 1120) (rev. Please use the link below to. Ad get ready for tax season deadlines by completing any required tax forms today. Web use schedule d (form 1120) to: For calendar year 2022 or tax year beginning, 2022, ending. The overall capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital. Use schedule d to report the following. The schedule d form is what most people use to report capital gains and losses that result. Figure the overall gain or loss from transactions reported on form 8949. It appears you don't have a pdf plugin for this browser. Report certain transactions the corporation does not have to report on. Web federal capital gains and losses. Web use schedule d (form 1120) to: Ad easy guidance & tools for c corporation tax returns.Download Instructions for IRS Form 1120S Schedule D Capital Gains and

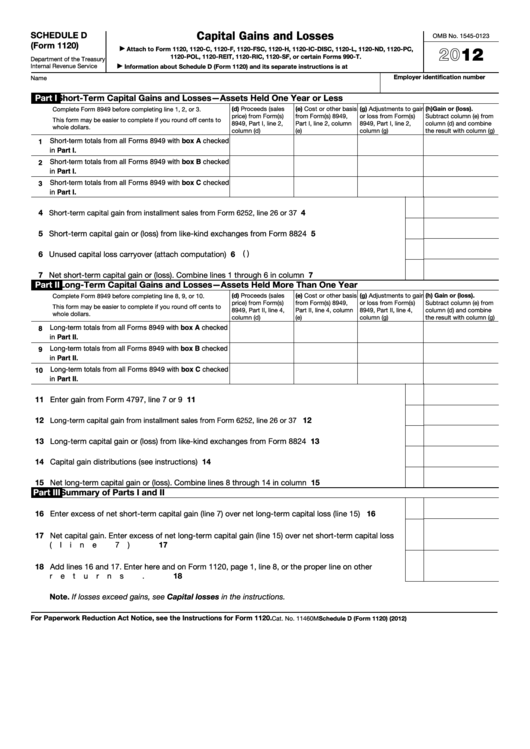

Fillable Schedule D (Form 1120) Capital Gains And Losses 2012

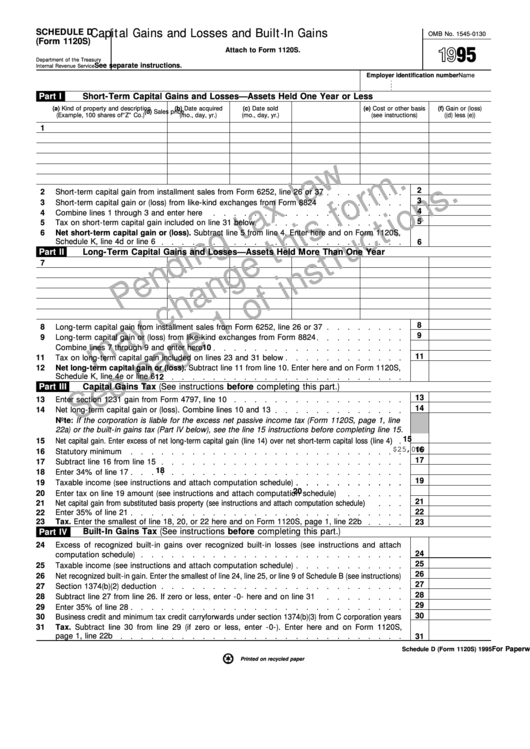

Schedule D (Form 1120s) Capital Gains And Losses And BuiltIn Gains

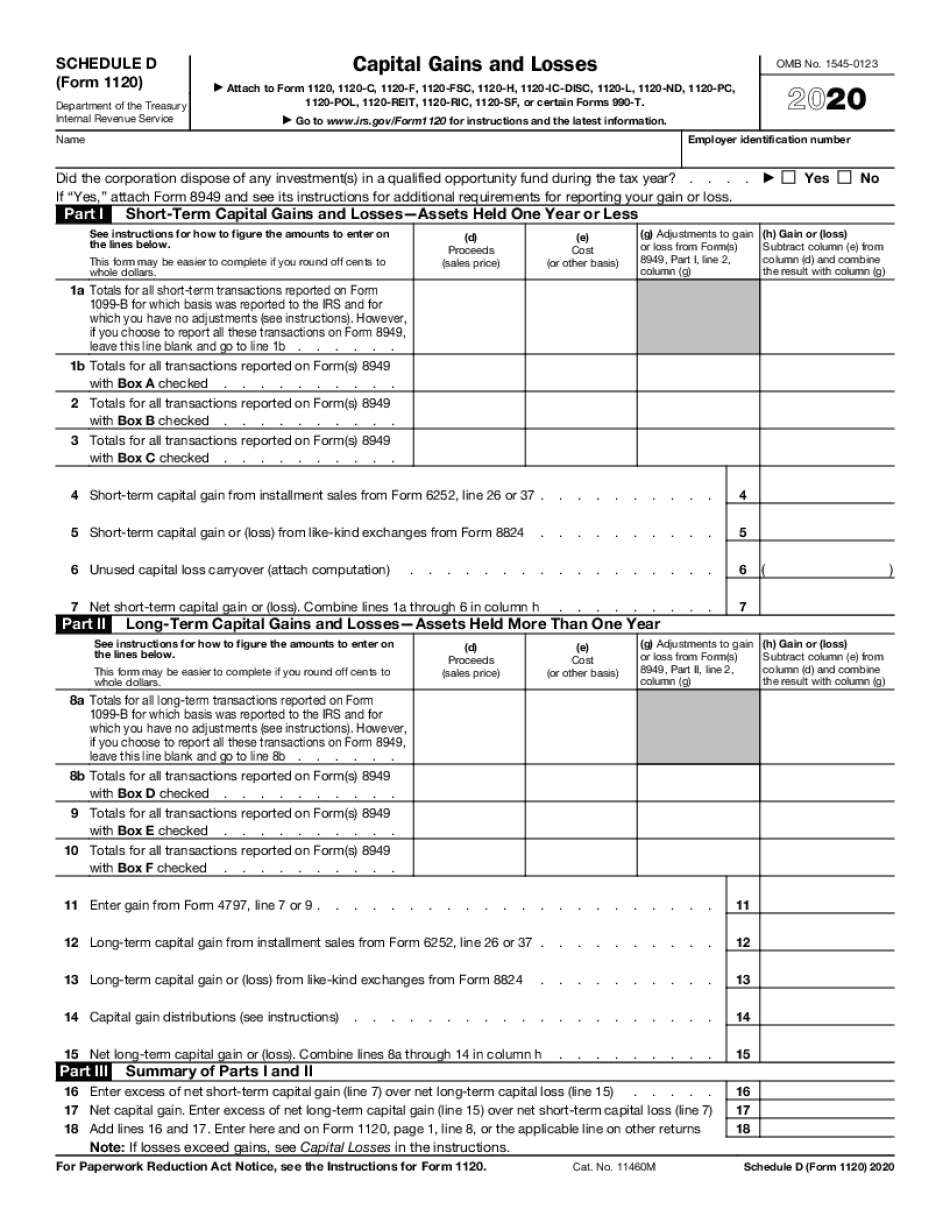

2020 Form 1120 Printable & Fillable Sample in PDF

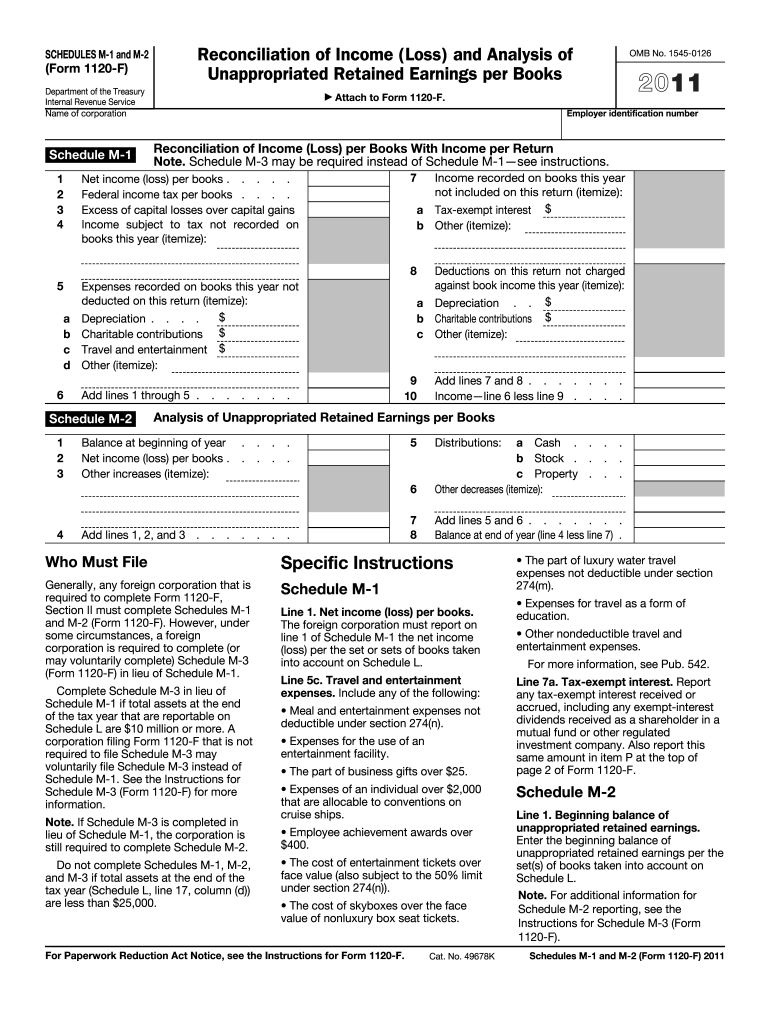

Form 1120 M 2 Fill Out and Sign Printable PDF Template signNow

IRS Form 1120S Schedule D 2018 Fill Out, Sign Online and Download

Form 1120S (Schedule D) Capital Gains and Losses and Builtin Gains

3.11.16 Corporate Tax Returns Internal Revenue Service

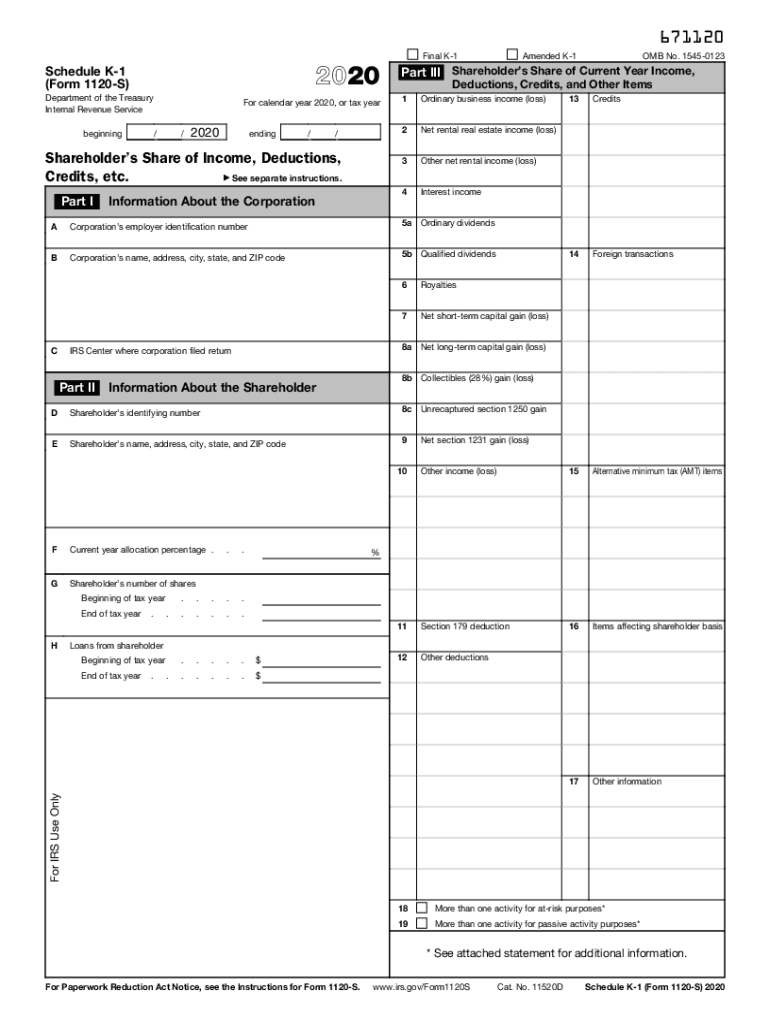

What is Form 1120S and How Do I File It? Ask Gusto

Fillable Federal 1120 Form Printable Forms Free Online

Related Post: