Redbubble Tax Form

Redbubble Tax Form - Web shipping & manufacturing. Products offered by independent artists on the redbubble marketplace and shipped by 3rd party fulfillers to locations in the us, including territories, may be subject to sales tax. Copy a is printed in red because it prevents duplication. Check box #3 as the reason for exemption. Web yes, the red form is required for copy a of the 1099. This is one of the more important copies of the 1099 because it goes to the irs. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on the tax form. It's a good idea to speak with a competent tax professional. Requirement to file based on your filing status, age, and gross income amount. It’s important to remember that you’re selling your products on redbubble as an independent artist. Enjoy great deals and discounts on an array of products from various brands. Your vendor may require you to give them a new form 5000 each year. Updated october 21, 2022 15:27. In order to pay taxes, you have to file taxes. Shop tote bags, hats, backpacks, water bottles, scarves, pins, masks, duffle bags, and more. It’s important to remember that you’re selling your products on redbubble as an independent artist. Web how do you file taxes for redbubble? This form is being used to transmit the arizona extension payment. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on the tax form. Shop. If you order red 1099 forms online, do so prior to tax season. Shop affordable wall art to hang in dorms, bedrooms, offices, or anywhere blank walls aren't welcome. Requirement to file based on your filing status, age, and gross income amount. It's 39 and counting, right now. Web shipping & manufacturing. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on the tax form. Customs regulations can vary from country to country and frequently change, sometimes causing delays to your order and occasionally incurring. In order to pay taxes, you have to file taxes. Redbubble is not your employer,. Web updated july 28, 2021 02:29. Web yes, the red form is required for copy a of the 1099. Web we would like to show you a description here but the site won’t allow us. Web up to 12% cash back high quality tax form accessories designed and sold by independent artists around the world. Your vendor may require you. It’s important to remember that you’re selling your products on redbubble as an independent artist. Web if you were asked to pay customs to receive your order, please follow the following steps to request a customs refund: 2013 application for electronic filing of extension request for calendar year 2013 individual income tax returns only ador 10742 (13) arizona. You may. This is one of the more important copies of the 1099 because it goes to the irs. Check box #3 as the reason for exemption. You will generally list that under supplemental income on your 1040. In order to pay taxes, you have to file taxes. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster processing. Redbubble will calculate, collect, and remit sales. I joined redbubble late last year and hardly made any money. This is one of the more important copies of the 1099 because it goes to the irs. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on the tax form.. The income you earn from redbubble is treated as royalty payments on your artwork/designs. Web the 2017 tax return. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are reported on the tax form. Shop unique custom made canvas prints,. You may have state and local income and business tax. Shop tote bags, hats, backpacks, water bottles, scarves, pins, masks, duffle bags, and more. It's a good idea to speak with a competent tax professional. Web shipping & manufacturing. Shop affordable wall art to hang in dorms, bedrooms, offices, or anywhere blank walls aren't welcome. Web a federal extension will be used to file this tax return. Web we would like to show you a description here but the site won’t allow us. Your vendor may require you to give them a new form 5000 each year. Will i get charged customs duties for my order? Web redbubble will calculate, collect, and remit applicable state and local sales taxes to the relevant tax authorities on behalf of artists on sales of goods to customers located in the us where marketplace facilitator laws require it. Requirement to file based on your filing status, age, and gross income amount. Web the 2017 tax return. All orders are custom made and most ship worldwide within 24 hours. Web up to 12% cash back you authorize redbubble to deduct the base amount (which includes redbubble’s fee for facilitation services, including tax where applicable) from the sale proceeds for your products before distributing your margin (which will include tax where. Products offered by independent artists on the redbubble marketplace and shipped by 3rd party fulfillers to locations in the us, including territories, may be subject to sales tax. Updated october 21, 2022 15:27. You may have state and local income and business tax filing requirements as well. Ad we offer a variety of software related to various fields at great prices. This is one of the more important copies of the 1099 because it goes to the irs. Enjoy great deals and discounts on an array of products from various brands. Check box #3 as the reason for exemption. Web updated july 28, 2021 02:29. What do i do about contracts that are either in progress at 12/31/14 or were. Web they also have this specific post on us sales tax: Here's the irs guidance on how to handle that (pdf. Web yes, the red form is required for copy a of the 1099.Ms State Tax Form 2022 W4 Form

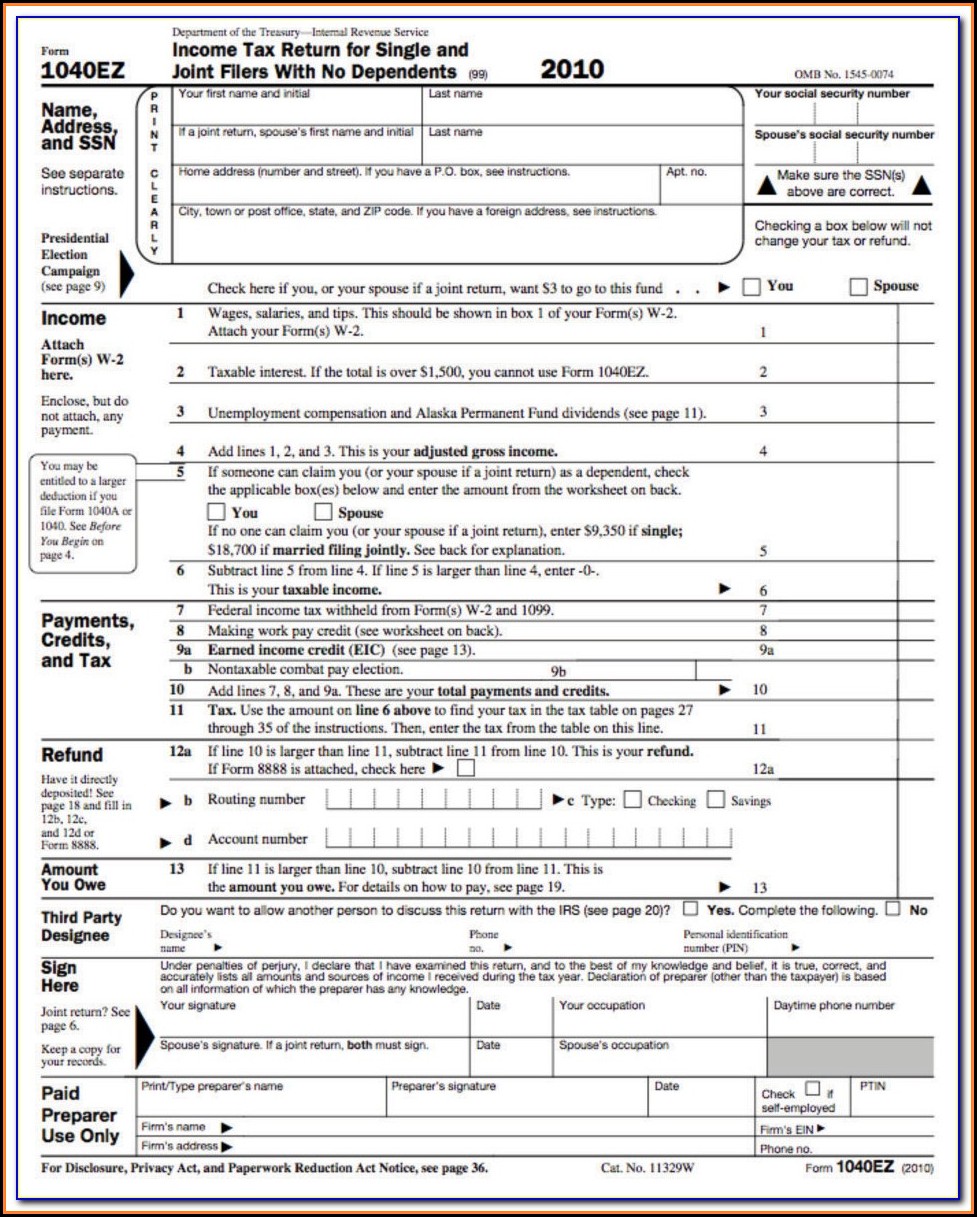

1040ez Tax Form Universal Network

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

IRS urges electronic filing as tax season begins Friday, amid mail

How To Change Tax Withholding With Unemployment Ny YUNEMPLO

Tax The Rich by Redbubble Tax, Rich, Redbubble

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

Tax Posters Redbubble

6.2 The U.S. Federal Tax Process Business LibreTexts

Should I Claim 1 or 0 on my W4 What's Best For your Tax Allowances

Related Post: