Prizepicks 1099 Form

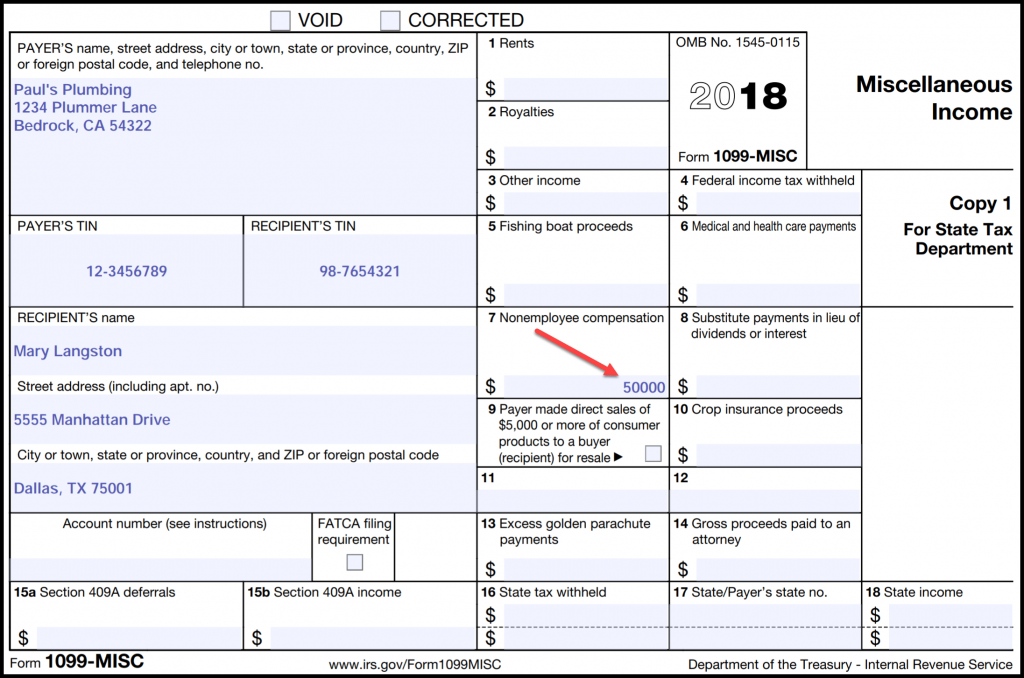

Prizepicks 1099 Form - Web american eagle promo codes. I believe the irs takes 24% of the winnings. The amount shown may be payments received as the beneficiary. How old do i have to be to playprizepicks? 1+ active prizepicks promo codes, coupons & deals for oct 2023. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. See how we can help! Web from my understanding, once your net profit is 600 dollars, you’re required to file this form to the irs. If the payer does not. Do i need to pay taxes on my prizepicks winnings? Web if your net profit is $600 or more then prize picks will send you a 1099 at the end of the year. The government and tax professionals. For 2020, the irs ruled that gifts made to pay school tuition or medical bills are excluded, but to be. If the payer does not. If your net profit is less than. Net profit meaning sum of all winnings minus sum of all entry fees. For 2020, the irs ruled that gifts made to pay school tuition or medical bills are excluded, but to be. Can i change the email address. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web 28k subscribers in the. At least $10 in royalties or broker. If your net profit is less than $600 then you won’t owe any taxes. Web from my understanding, once your net profit is 600 dollars, you’re required to file this form to the irs. Web taxes | prizepicks. Web a 1099 tax form is used to report income from sources other than regular. Web generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. Web from my understanding, once your net profit is 600 dollars, you’re required to file this form to the irs. Web american eagle promo codes. Web if your net profit is $600 or more then prize picks will send you a. If your net profit is less than $600 then you won’t owe any taxes. We have 8 prizepicks coupon codes today, good for discounts at prizepicks.com. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. Web taxes | prizepicks. Do i need to pay taxes on my prizepicks winnings? We have 8 prizepicks coupon codes today, good for discounts at prizepicks.com. Do i need to pay taxes on my prizepicks winnings? Web daily fantasy made easy. I seen someone say that you’ll only owe taxes if you make more than $600 profit. For 2020, the irs ruled that gifts made to pay school tuition or medical bills are excluded,. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. Web if your net profit is $600 or more then prize picks will send you a 1099 at the end of the year. Section references are to the internal. Web taxes | prizepicks. Web contact the irs and give details on. Web prize picks will send you a 1099 at the end of the year if you’ve exceeded $600 profit. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. Ad for more than 20 years, iofm has reduced. I believe the irs takes 24% of the winnings. For 2020, the irs ruled that gifts made to pay school tuition or medical bills are excluded, but to be. New members must be 19 or older to sign up and play prizepicks. Web if your net profit is $600 or more then prize picks will send you a 1099 at. Cash gifts of up to $15,000 per year do not need to be reported. See how we can help! Web daily fantasy made easy. Not necessarily ur ‘ amount won ‘ i’m confused on how pp. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. We have 8 prizepicks coupon codes today, good for discounts at prizepicks.com. 1+ active prizepicks promo codes, coupons & deals for oct 2023. New members must be 19 or older to sign up and play prizepicks. For 2020, the irs ruled that gifts made to pay school tuition or medical bills are excluded, but to be. Web how does prizepicks do taxes ?. Web generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. Web if your net profit is $600 or more then prize picks will send you a 1099 at the end of the year. Web american eagle promo codes. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Web you can request a withdrawal to any bank account, paypal account, or debit card that you have previously used to deposit funds into your prizepicks account. Ad formswift.com has been visited by 100k+ users in the past month Web daily fantasy made easy. Get your first deposit matched up to $100. Prizepicks is available in 31 states, washington dc, and canada. How old do i have to be to playprizepicks? Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. The amount shown may be payments received as the beneficiary. Please follow this link to reset your password: Do i need to pay taxes on my prizepicks winnings? Not necessarily ur ‘ amount won ‘ i’m confused on how pp.Irs Printable 1099 Form Printable Form 2022

1099 Form Misc Copy C Universal Network

What is a 1099Misc Form? Financial Strategy Center

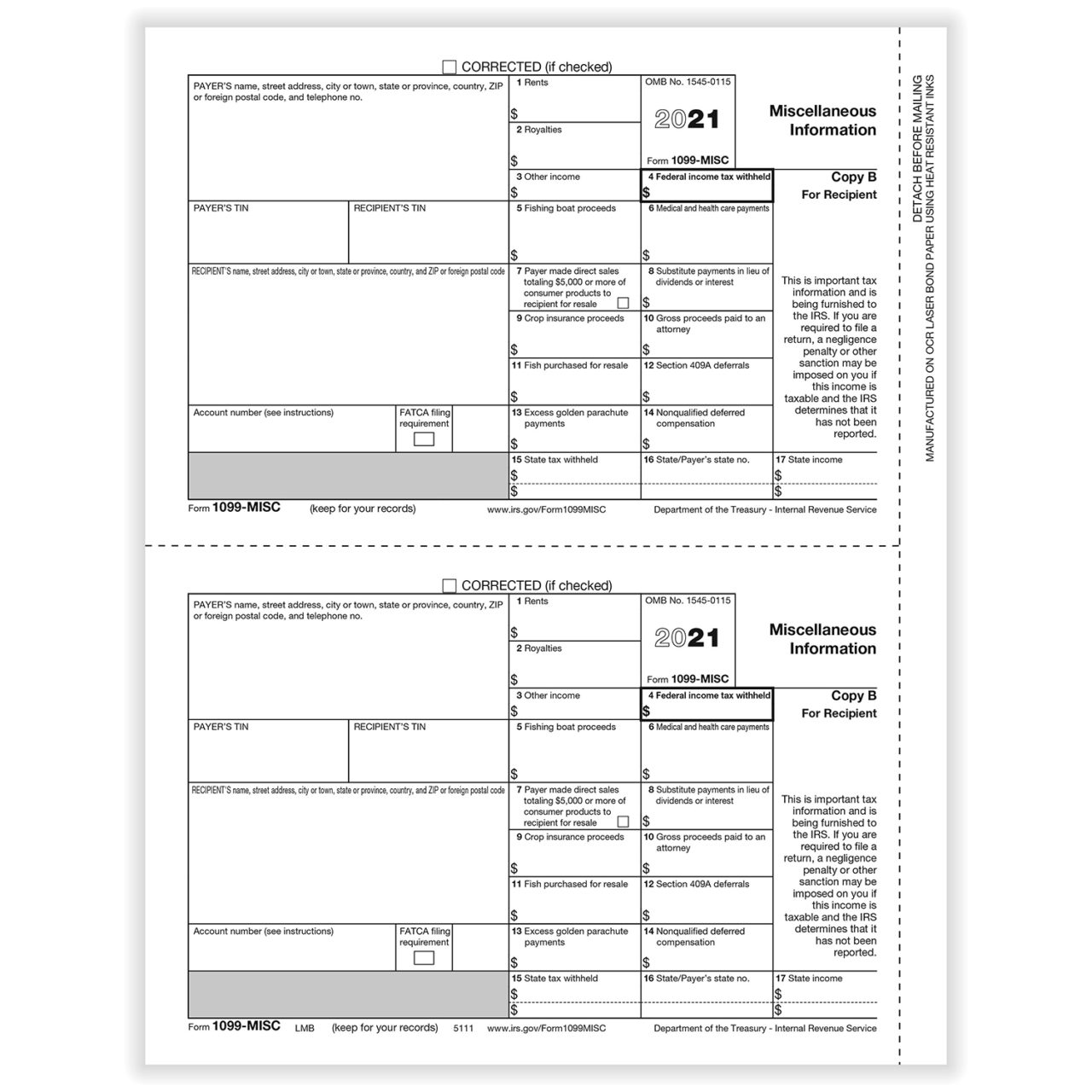

1099MISC Recipient Copy B LMB Forms & Fulfillment

Form 1099DIV, Dividends and Distributions, State Copy 1

1099 Form Template Word Resume Examples

1099MISC Form Printable and Fillable PDF Template

1099 Format, 1099 Forms, 1099 Tax Forms Print Forms

Federal Tax Filing Free Federal Tax Filing With 1099 Misc

Forms 1099 The Basics You Should Know Kelly CPA

Related Post: