Penn Foster 1098-T Form

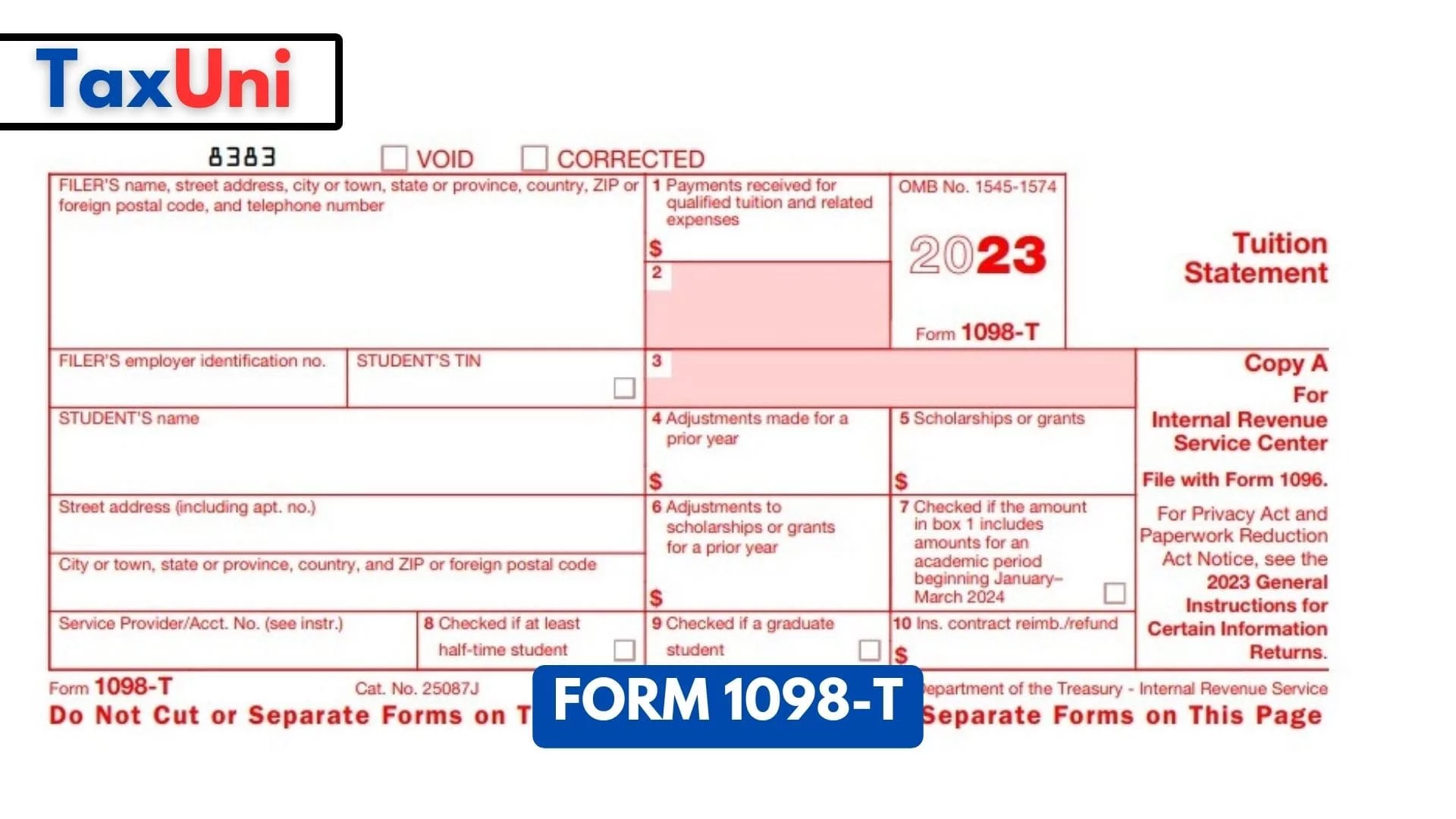

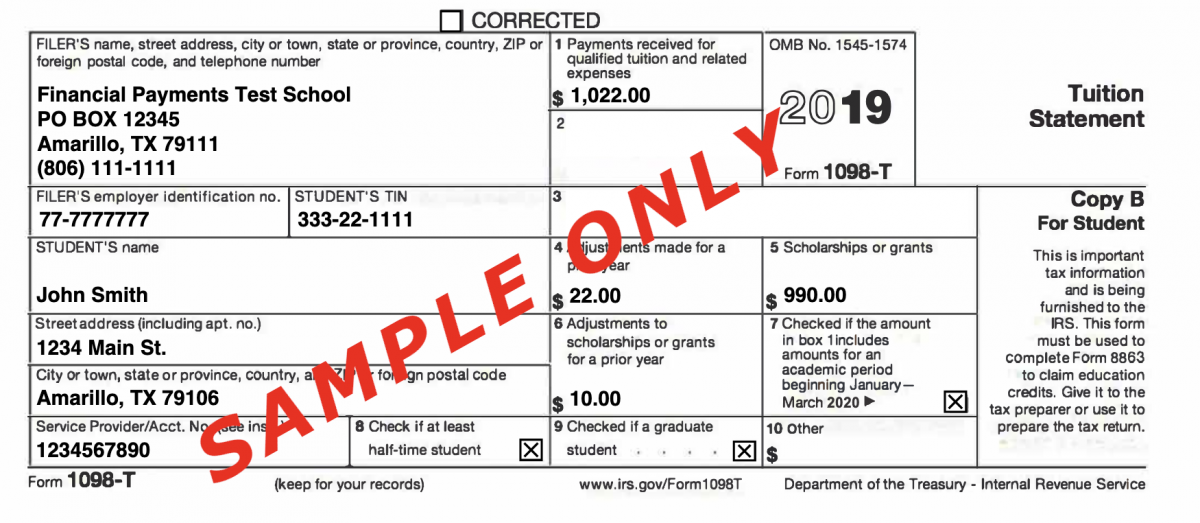

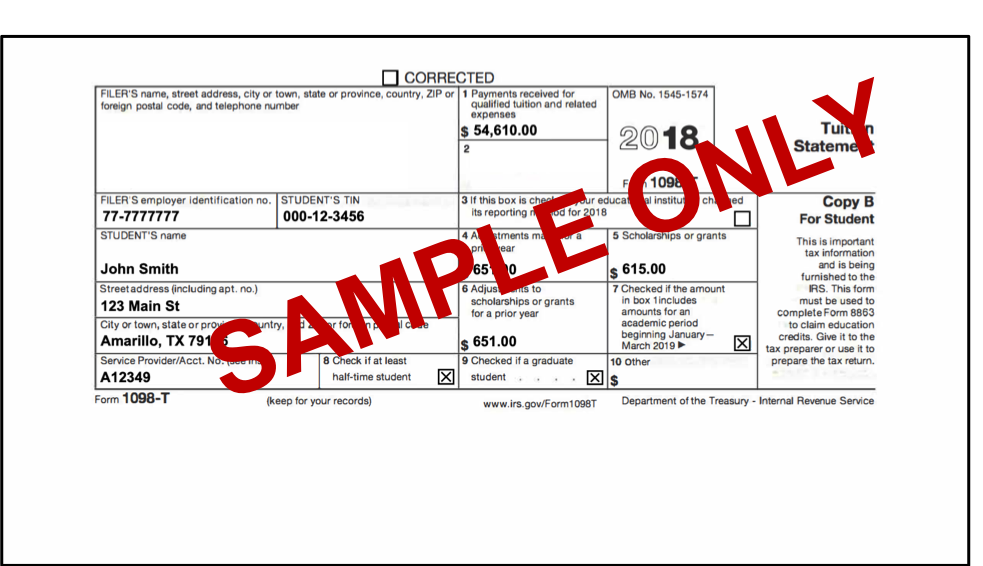

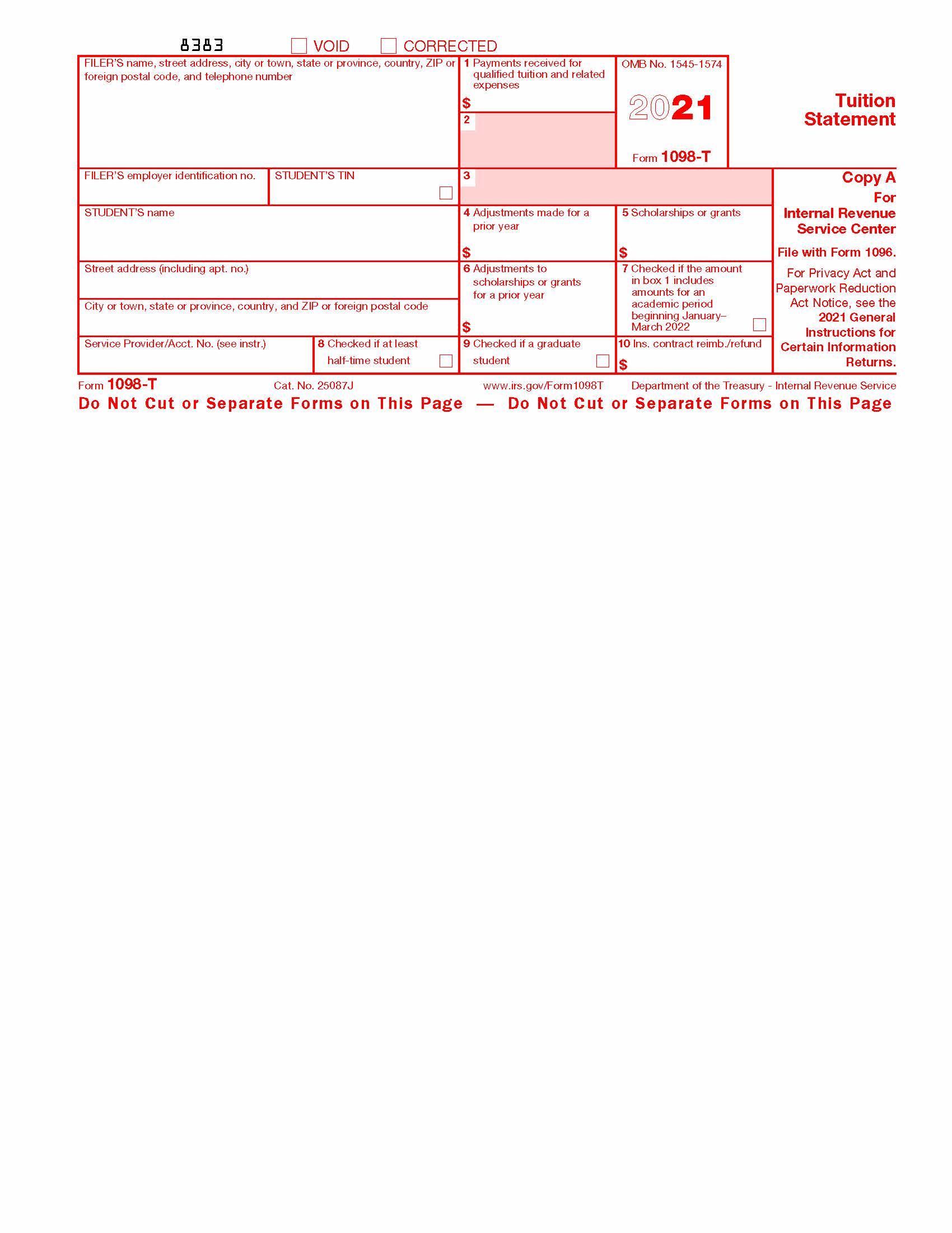

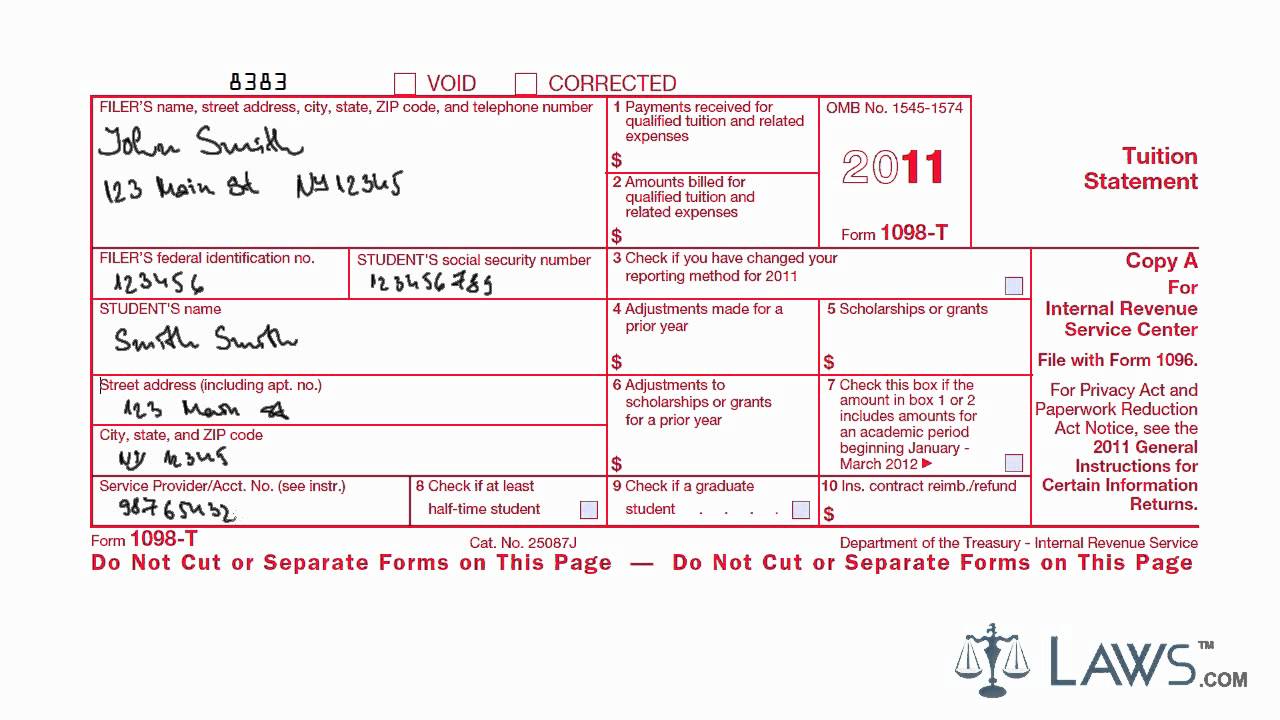

Penn Foster 1098-T Form - Upload, modify or create forms. 31 of the year following the. For the tax year ending december 31, 2018, penn state will report payments received for qualified tuition and related. Ad pennfoster.edu has been visited by 10k+ users in the past month On or about march 15,. Source income subject to withholding: Complete, edit or print tax forms instantly. Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs. Web no, students shouldn’t claim their penn foster tuition payments on their federal or state tax returns. Web federal form 1098 reports mortgage interest of $600 or more received by the university. Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs. *start for $20 offer applies to select programs. Web federal form 1098 reports mortgage interest of $600 or more received by the university. For the tax year ending december 31, 2018, penn state will report payments received for qualified. Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs. You must file for each student you enroll and for whom a. Learn about our programs today. With this in mind, we do. Web we're here to help. The university is required to provide these forms to the recipients by january 31 each. Upload, modify or create forms. For the tax year ending december 31, 2018, penn state will report payments received for qualified tuition and related. With this in mind, we do. On or about march 15,. No, students shouldn’t claim their penn foster tuition payments on their federal or state tax returns. *start for $20 offer applies to select programs. Find our most frequently asked questions here on topics. Because we do not participate in the united states department of education student aid programs, we are not an eligible institution for students to claim or qualify. With this in mind, we do. Upload, modify or create forms. Ad pdffiller.com has been visited by 1m+ users in the past month Web we're here to help. Ad pennfoster.edu has been visited by 10k+ users in the past month On or about january 31, 2021. Source income subject to withholding: Try it for free now! Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs. Ad pennfoster.edu has been visited by 10k+ users in the past month 31 of the year following the. On or about march 15,. Ad pdffiller.com has been visited by 1m+ users in the past month Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs. Web no, students shouldn’t claim their penn foster tuition payments on their federal or state tax. For the tax year ending december 31, 2018, penn state will report payments received for qualified tuition and related. Web no, students shouldn’t claim their penn foster tuition payments on their federal or state tax returns. Complete, edit or print tax forms instantly. Web if you aren't sure if your school is an eligible educational institution: Ad pdffiller.com has been. Upload, modify or create forms. *start for $20 offer applies to select programs. Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs. Because we do not participate in the united states. Because we do not participate in the united states department of education student aid programs, we are. Web as a student, graduate, or former student of penn foster high school, career school, or college, you can request to have your official academic transcript sent. On or about january 31, 2021. Because we do not participate in the united states department of education student aid programs, we are not an eligible institution for students to claim or qualify. On or about march 15,. Web as a student, graduate, or former student of penn foster high school, career school, or college, you can request to have your official academic transcript sent. On or about january 31, 2021. Because we do not participate in the united states. *start for $20 offer applies to select programs. Learn about our programs today. Ad pennfoster.edu has been visited by 10k+ users in the past month Our online courses help you learn tax preparation topics such as taxation laws and regulations, types of tax. With this in mind, we do. Upload, modify or create forms. Try it for free now! For the tax year ending december 31, 2018, penn state will report payments received for qualified tuition and related. Because we do not participate in the united states department of education student aid programs, we are not an eligible institution for students to claim or qualify for various tax credits. Complete, edit or print tax forms instantly. Web no, students shouldn’t claim their penn foster tuition payments on their federal or state tax returns. Ad pdffiller.com has been visited by 1m+ users in the past month No, students shouldn’t claim their penn foster tuition payments on their federal or state tax returns. Web if you aren't sure if your school is an eligible educational institution: 31 of the year following the. Web learn more about penn foster's financial assistance and tuition options for students enrolling in any diploma, degree, or certificate programs.Form 1098T 2022 2023

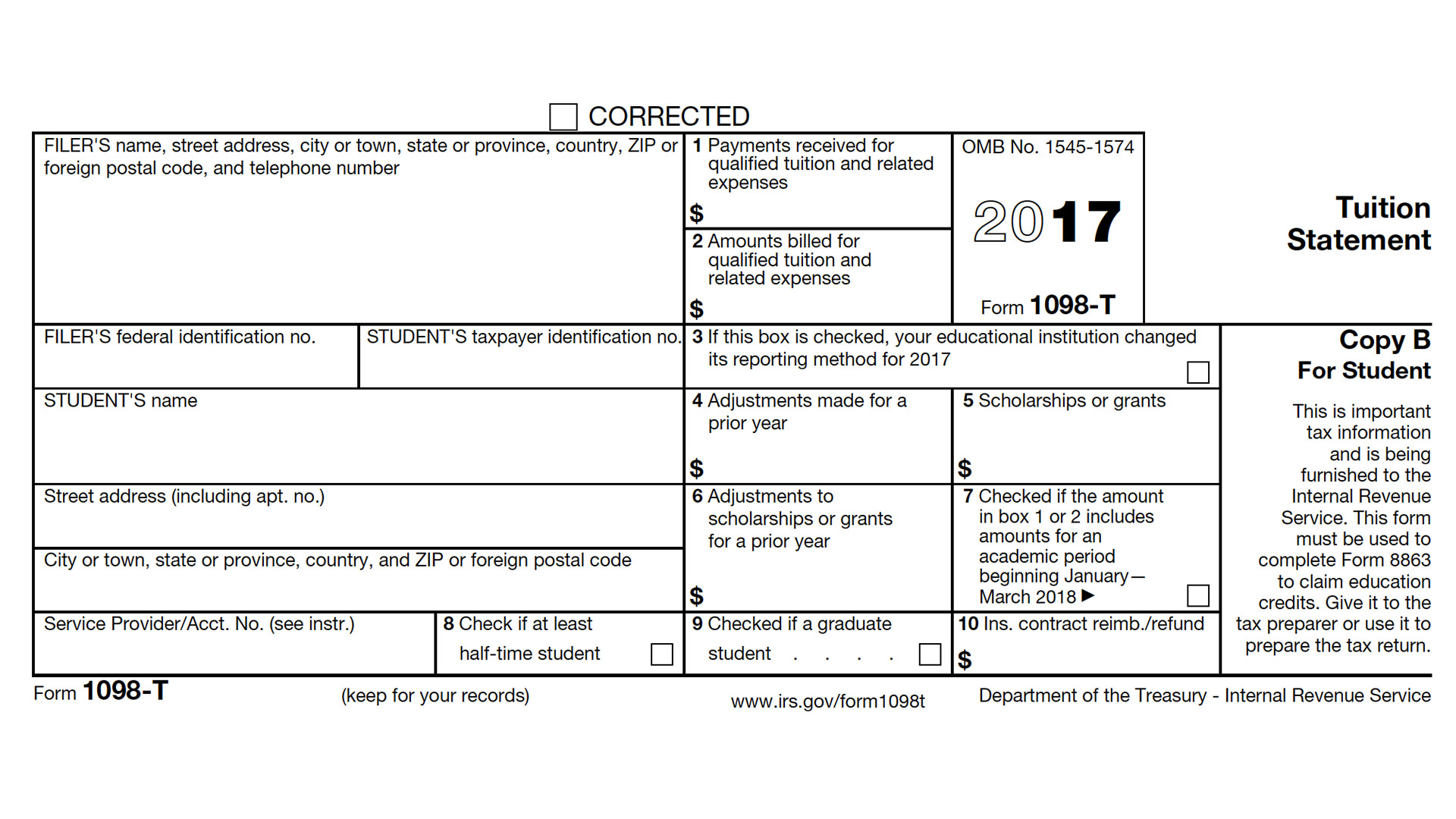

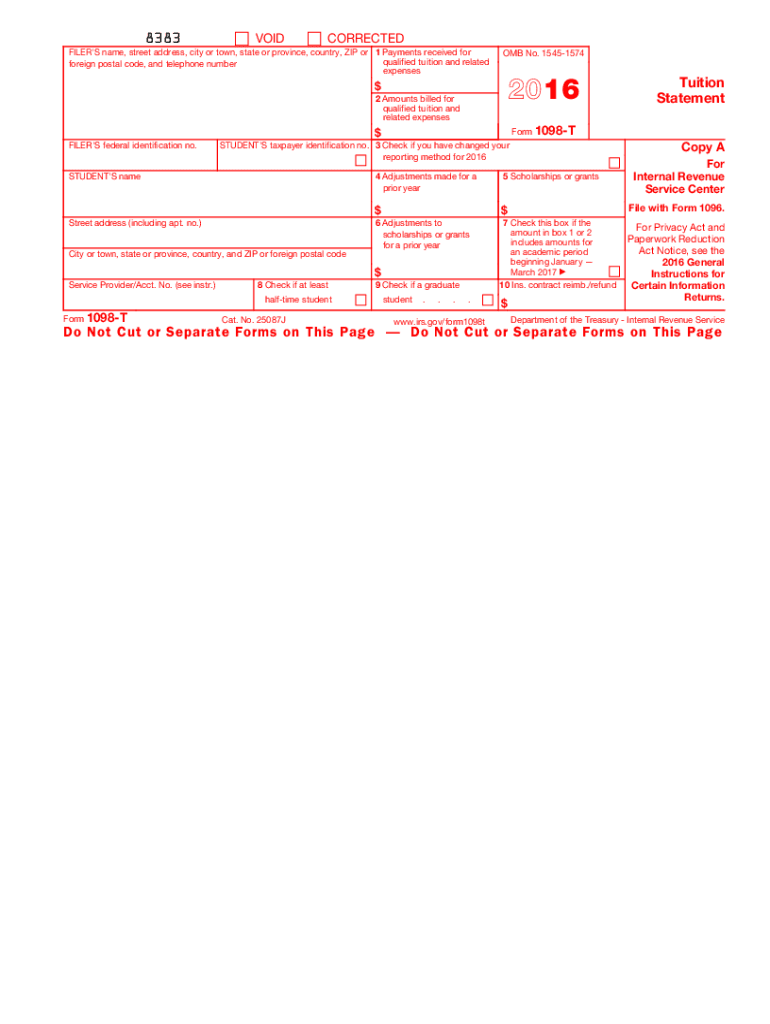

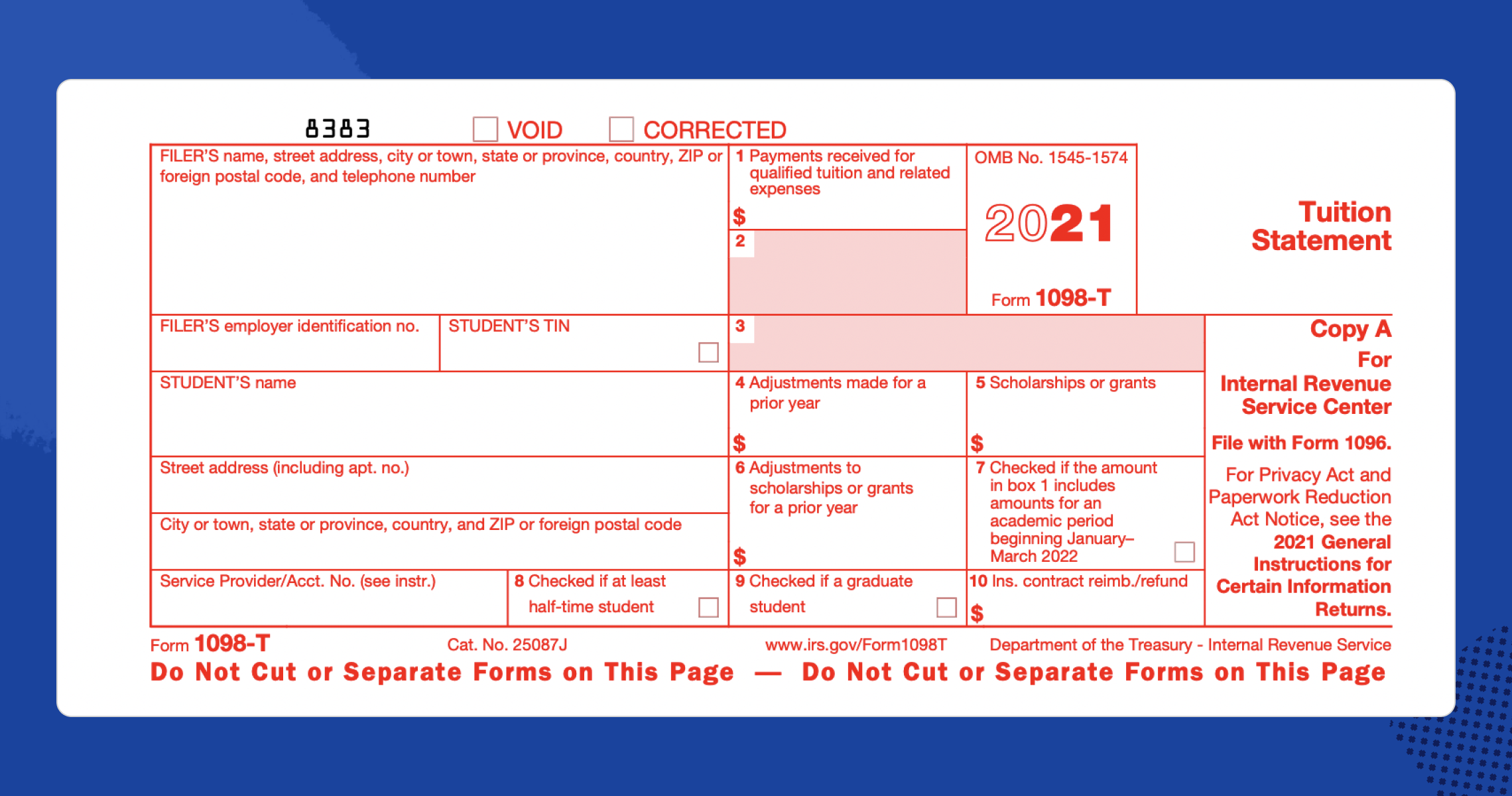

Form 1098T Everything you need to know Go TJC

1098 t form 2016 Fill out & sign online DocHub

Frequently Asked Questions About the 1098T The City University of

1098T Information Bursar's Office Office of Finance UTHSC

1098T Form How to Complete and File Your Tuition Statement

1098T IRS Tax Form Instructions 1098T Forms

Picture16 1098T Forms

Bursar 1098T Tuition Statement Reporting Hofstra University

Learn How to Fill the Form 1098T Tuition Statement YouTube

Related Post: