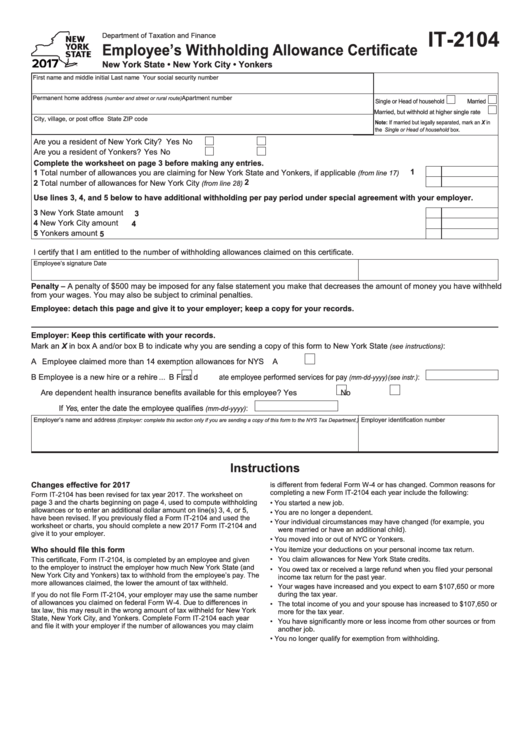

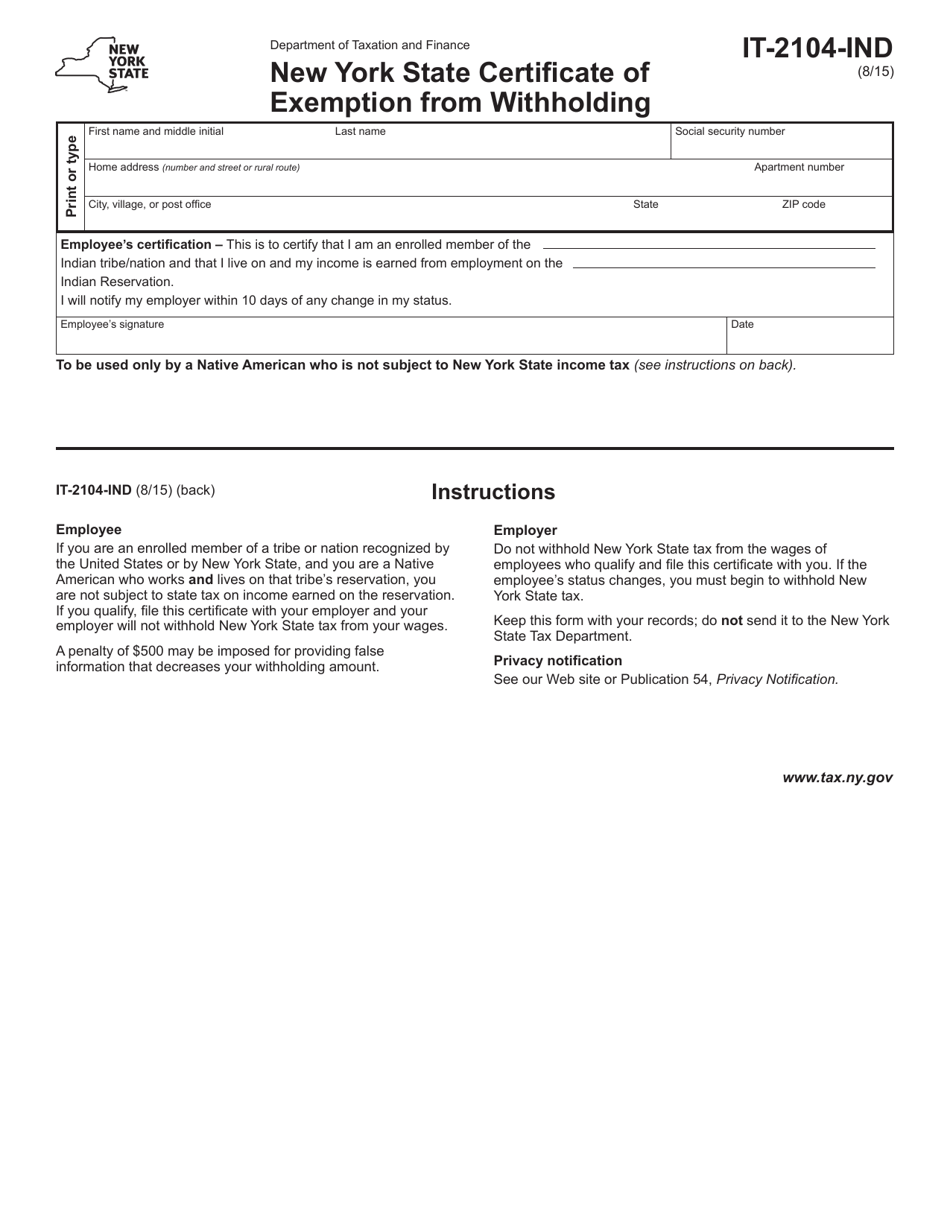

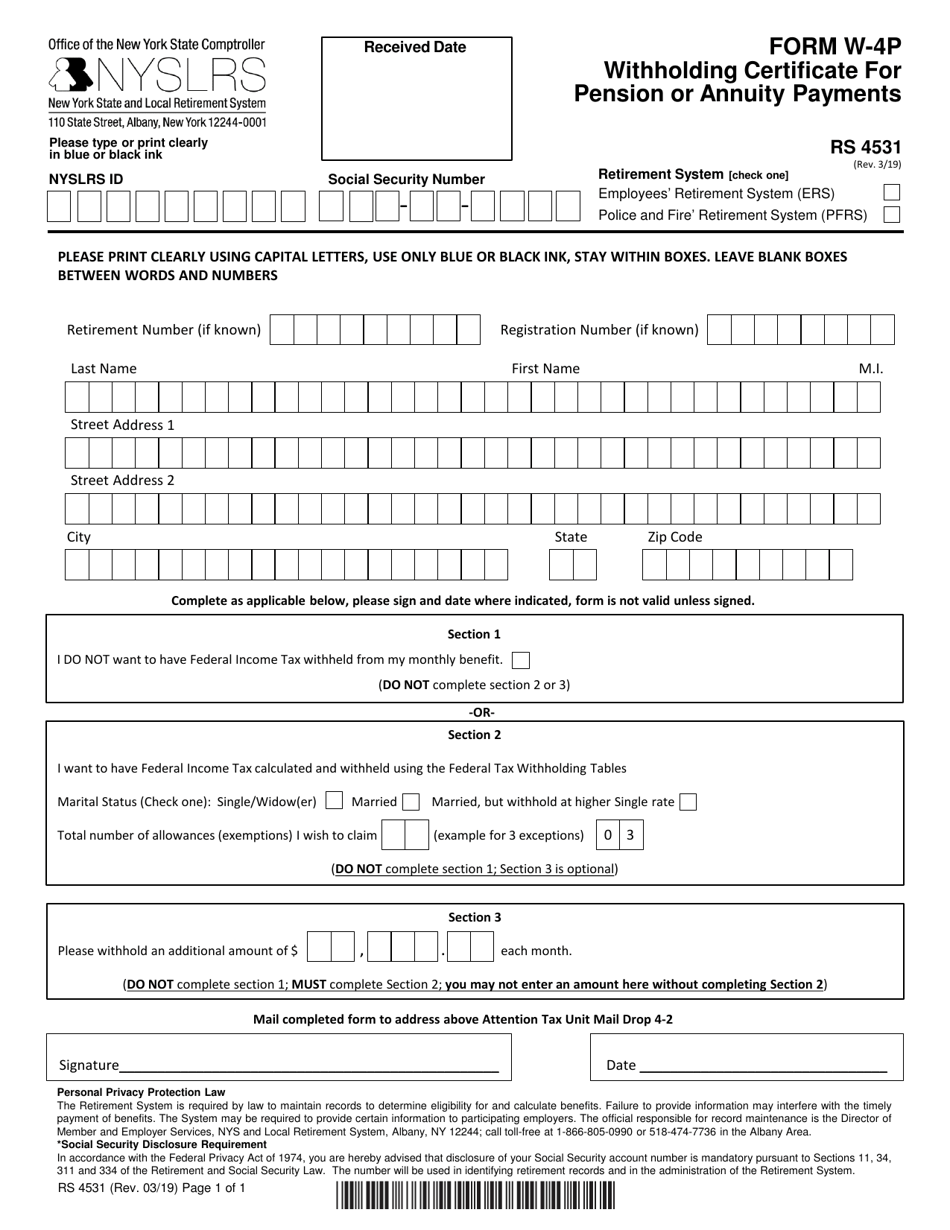

Ny State Withholding Form

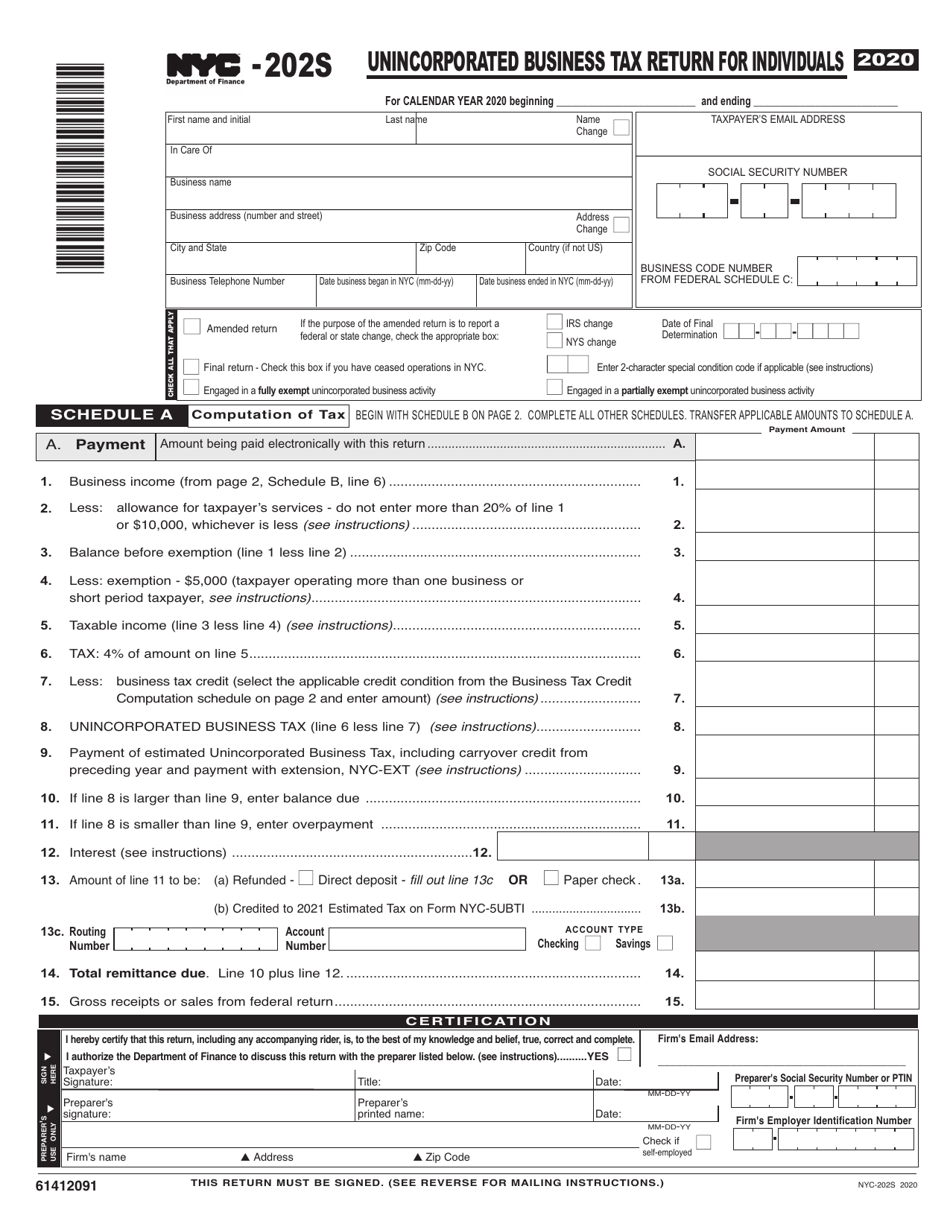

Ny State Withholding Form - To identify and withhold the correct federal income tax from your pay. See employer in the instructions. Web own tax withholding information. Web the new york state excise tax increased on september 1, 2023. It works similarly to a. This publication contains the wage bracket tables and exact calculation method for new york. If you do not submit this form, your withholdings will default to a filing status of. Web what is this form for? Web copy of this form to new york state. Web effective april 30, 2015, you must electronically file your withholding tax returns. (see electronic filing mandate for business taxpayers for details.) review the table below to. Changes to new york state personal income tax have caused withholding tax changes for. Web the new york state excise tax increased on september 1, 2023. Web what is this form for? To identify and withhold the correct federal income tax from your pay. Web the new york state excise tax increased on september 1, 2023. Web effective april 30, 2015, you must electronically file your withholding tax returns. This publication contains the wage bracket tables and exact calculation method for new york. Web copy of this form to new york state. Web what is this form for? This publication contains the wage bracket tables and exact calculation method for new york. If you are a retail dealer, wholesale dealer, or cigarette stamping agent and owe the cigarette floor. Web 8 rows employee's withholding allowance certificate. Web withholding tax filing requirements. See employer in the instructions. Direct payment from your bank account; A penalty of $500 may be imposed for furnishing false information that. Web own tax withholding information. This publication contains the wage bracket tables and exact calculation method for new york. If you do not submit this form, your withholdings will default to a filing status of. This publication contains the wage bracket tables and exact calculation method for new york. See employer in the instructions. Web effective april 30, 2015, you must electronically file your withholding tax returns. This publication contains the wage bracket tables and exact calculation method for new york. Web if you want to continue to claim full exemption, you need to submit. You can submit your federal. Web we also updated the new york state and yonkers withholding tax tables and methods for 2023. A penalty of $500 may be imposed for furnishing false information that. If you are a retail dealer, wholesale dealer, or cigarette stamping agent and owe the cigarette floor. These changes apply to payrolls made on or after. A penalty of $500 may be imposed for furnishing false information that. These changes apply to payrolls made on or after january 1,. Web withholding tax filing requirements. See employer in the instructions. It works similarly to a. See employer in the instructions. A penalty of $500 may be imposed for furnishing false information that. To identify and withhold the correct federal income tax from your pay. Every employee must complete two withholding forms: Web we also updated the new york state and yonkers withholding tax tables and methods for 2023. Web the new york state excise tax increased on september 1, 2023. If you do not submit this form, your withholdings will default to a filing status of. Web we also updated the new york state and yonkers withholding tax tables and methods for 2023. If you are a retail dealer, wholesale dealer, or cigarette stamping agent and owe the. Employers paying wages or other payments subject to new york state withholding must file a return and pay the new. This publication contains the wage bracket tables and exact calculation method for new york. If you are a retail dealer, wholesale dealer, or cigarette stamping agent and owe the cigarette floor. A penalty of $500 may be imposed for furnishing. Web 8 rows employee's withholding allowance certificate. Web use withholding tax web file to file your quarterly return. If you are a retail dealer, wholesale dealer, or cigarette stamping agent and owe the cigarette floor. Employers may also be required to: Web the new york state excise tax increased on september 1, 2023. Direct payment from your bank account; Web own tax withholding information. Certificate of exemption from withholding. These changes apply to payrolls made on or after january 1,. (see electronic filing mandate for business taxpayers for details.) review the table below to. Web we also updated the new york state and yonkers withholding tax tables and methods for 2023. See employer in the instructions. You can submit your federal. Web withholding tax filing requirements. If you do not submit this form, your withholdings will default to a filing status of. This publication contains the wage bracket tables and exact calculation method for new york. A penalty of $500 may be imposed for furnishing false information that. It works similarly to a. Every employee must complete two withholding forms: To identify and withhold the correct federal income tax from your pay.Form NYC202S Download Printable PDF or Fill Online Unincorporated

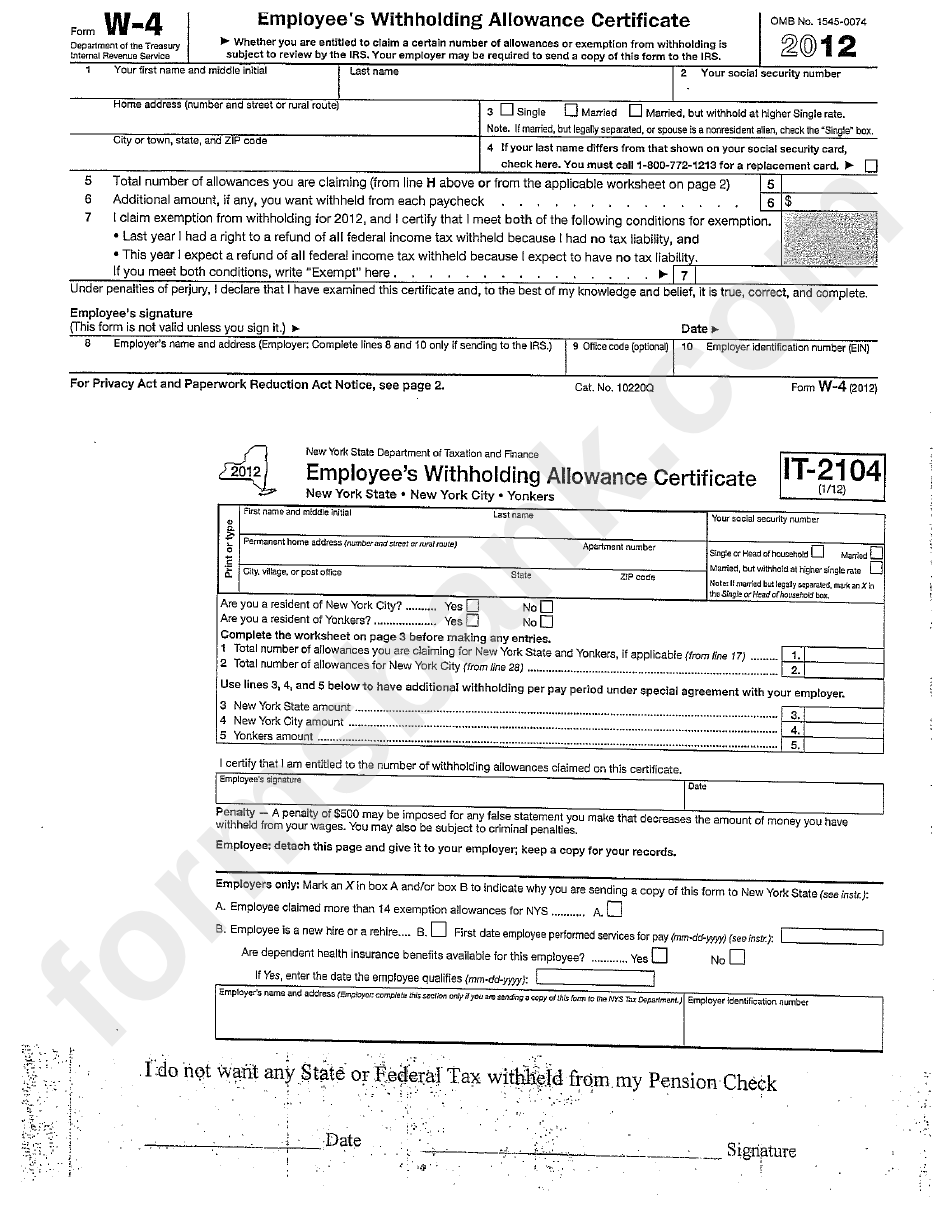

Fillable New York Employee'S Withholding Allowance Certificate

Form IT2104IND Fill Out, Sign Online and Download Fillable PDF, New

Form W4P (RS4531) Fill Out, Sign Online and Download Fillable PDF

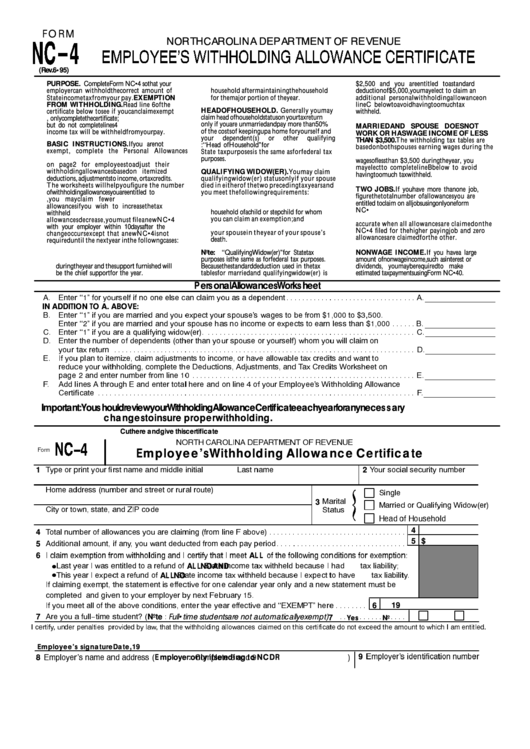

how to fill out new york state withholding form Fill Online

Form NYS100G Download Printable PDF or Fill Online New York State

Form W4 Employee'S Withholding Allowance Certificate 2012, New

Withholding Form For Employee 2023

Nys Employee Withholding Form 2022

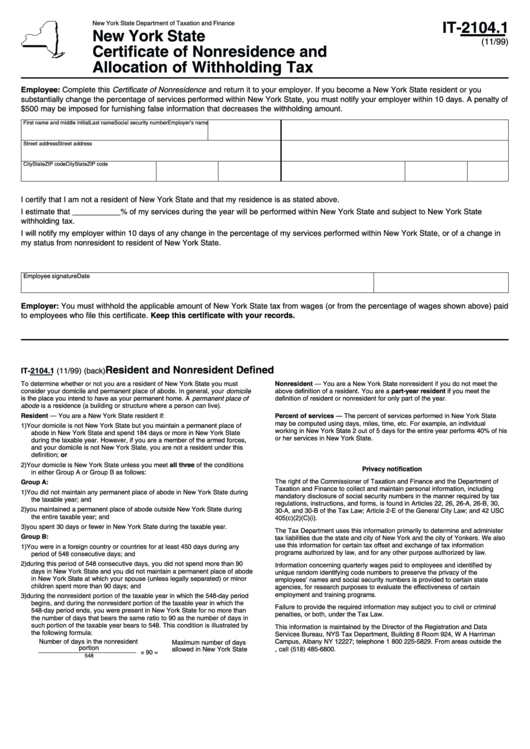

Fillable Form It2104.1 Certificate Of Nonresidence And Allocation Of

Related Post: