Onlyfans 1099 Form

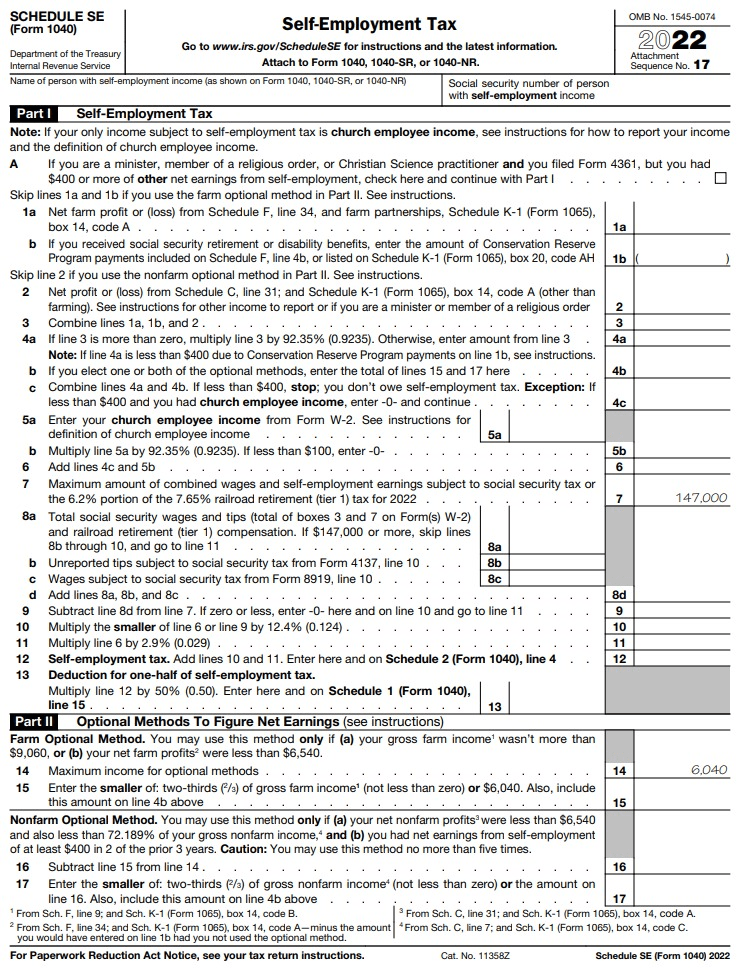

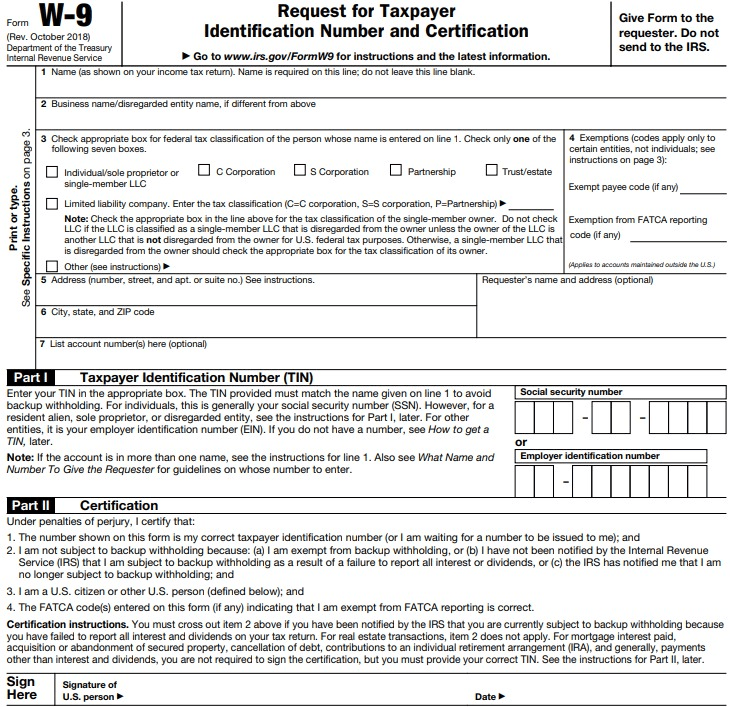

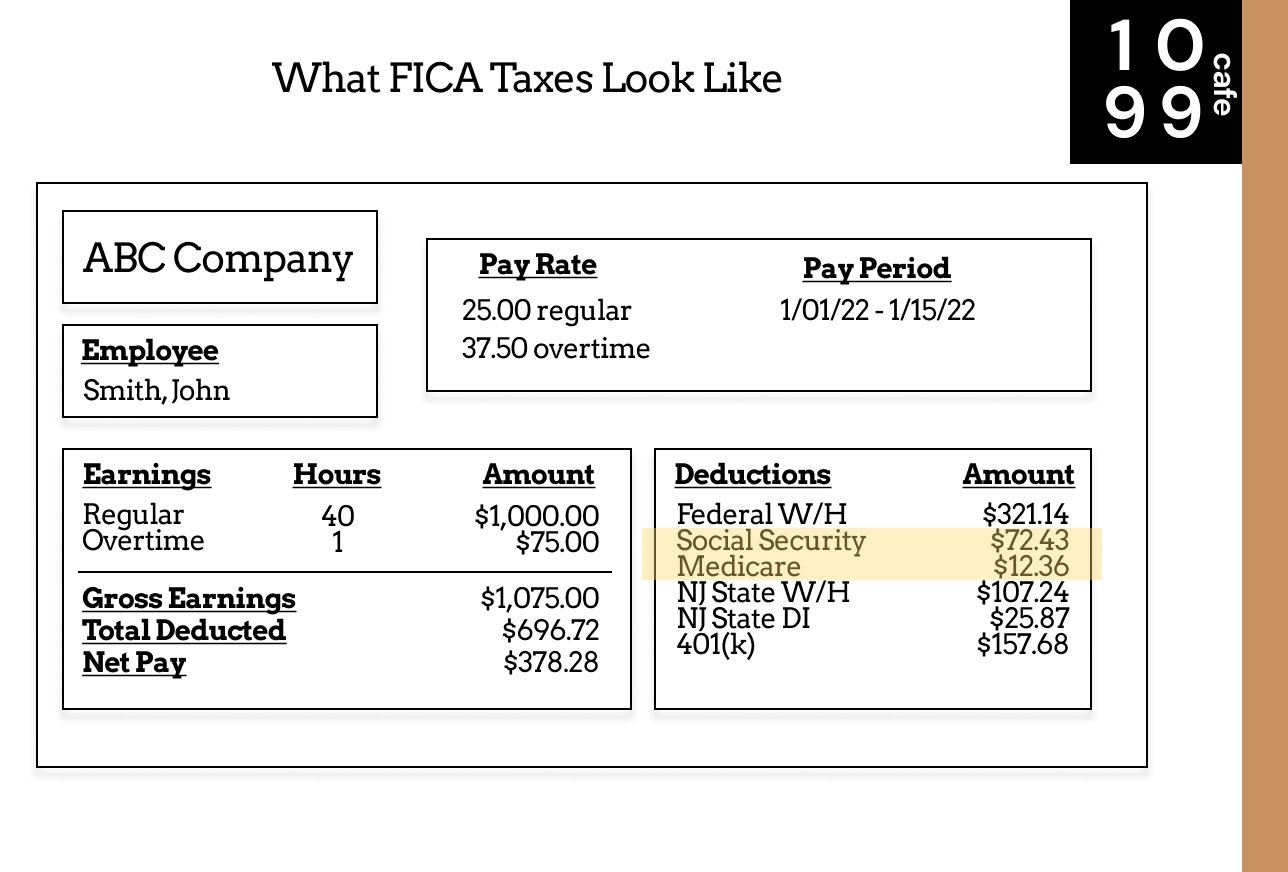

Onlyfans 1099 Form - Consulting with a tax professional can provide. Web united states in the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Web onlyfans will send you a 1099 for your records. Schedule c (form 1040) : I’m unsure how to answer the. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Web 1099 forms & schedules. Web sweet9722 new member i have created an onlyfans page and i need to fill out a w9 tax form to begin receiving payments. Order 1099 forms, envelopes, and software today. Web does onlyfans send you a 1099? Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Schedule c (form 1040) : Web onlyfans will send you a 1099 for your records. Web united states in the united states, anyone who makes a yearly income of $600 is. Onlyfans will issue you these around tax time. Web 1099 forms & schedules. I’m unsure how to answer the. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. Web onlyfans is the social platform revolutionizing creator and fan connections. If you earn more than $600 from onlyfans, you’ll receive this form, detailing your earnings for the tax year. If you earn more than $600 from onlyfans in a year, you’ll receive a 1099. Consulting with a tax professional can provide. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive. If you made less than $600,. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive. Katherine studley, 28, is a financial. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Web sweet9722 new member i have created an onlyfans page and i need to fill out a w9 tax form to begin receiving payments. Web onlyfans will send you a 1099 for your records. Web as an onlyfans independent contractor, you are responsible for. If you earn more than $600 from onlyfans, you’ll receive this form, detailing your earnings for the tax year. Web published on 13 apr 2023 onlyfans taxes: Web understanding the distinction between hobby and business income is crucial for reporting and deducting expenses. Katherine studley is a tax accountant who starting offering tax prep services for onlyfans creators last year.. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. Book a call with us today. Web 1099 forms & schedules. Ad approve payroll when you're ready, access employee services & manage it all in one place. To file your 1099 with the irs,. Web april 20, 2023 53823 views disclaimer the following article is for informational purposes only, it is not intended to provide tax, legal, or accounting advice. The site is inclusive of artists and content creators from all genres and allows them to monetize their. Ad approve payroll when you're ready, access employee services & manage it all in one place.. Order 1099 forms, envelopes, and software today. Web onlyfans is the social platform revolutionizing creator and fan connections. Consulting with a tax professional can provide. Web you can simply download your 1099 form by following this simple video. Payroll seamlessly integrates with quickbooks® online. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Schedule c (form 1040) : Order 1099 forms, envelopes, and software today. Web published on 13 apr 2023 onlyfans taxes: Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Ad shop our selection of 1099 forms, envelopes, and software for tax reporting. Ad approve payroll when you're ready, access employee services & manage it all in one place. If you earned more than $600, you’ll. Katherine studley is a tax accountant who starting offering tax prep services for onlyfans creators last year. Katherine studley, 28, is a financial. Web april 20, 2023 53823 views disclaimer the following article is for informational purposes only, it is not intended to provide tax, legal, or accounting advice. You will receive an onlyfans 1099 form in january via mail and a digital. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive. Prepare for irs filing deadlines. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Schedule c (form 1040) : If you earn more than $600 from onlyfans, you’ll receive this form, detailing your earnings for the tax year. Web sweet9722 new member i have created an onlyfans page and i need to fill out a w9 tax form to begin receiving payments. The most common form creators will receive if they earn more. Web published on 13 apr 2023 onlyfans taxes: In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Book a call with us today. The site is inclusive of artists and content creators from all genres and allows them to monetize their.Why hasn’t the 1099 form popped up for me on onlyfans yet? I’ve made

How Is from OnlyFans Taxed AZ Guide Supercreator

OnlyFans Taxes What Taxes Do I File? [2024 US Guide]

How to file OnlyFans taxes (W9 and 1099 forms explained)

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

How to file OnlyFans taxes (W9 and 1099 forms explained)

How to file OnlyFans taxes (W9 and 1099 forms explained)

Onlyfans downloading your 1099 form for taxes. YouTube

Onlyfans downloading your 1099 form for taxes. YouTube

OnlyFans Taxes in 2022 A Comprehensive Guide — 1099 Cafe

Related Post:

![OnlyFans Taxes What Taxes Do I File? [2024 US Guide]](https://freecashflow.io/wp-content/uploads/2021/11/W-9.png)