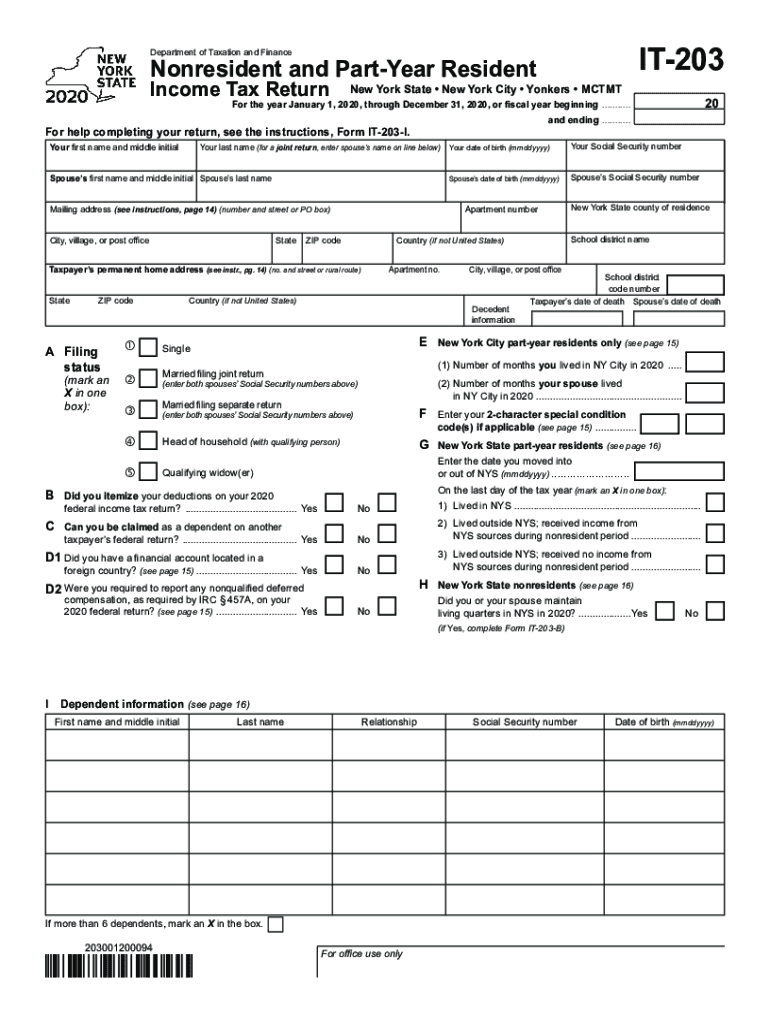

New York City Part Year Resident Tax Form

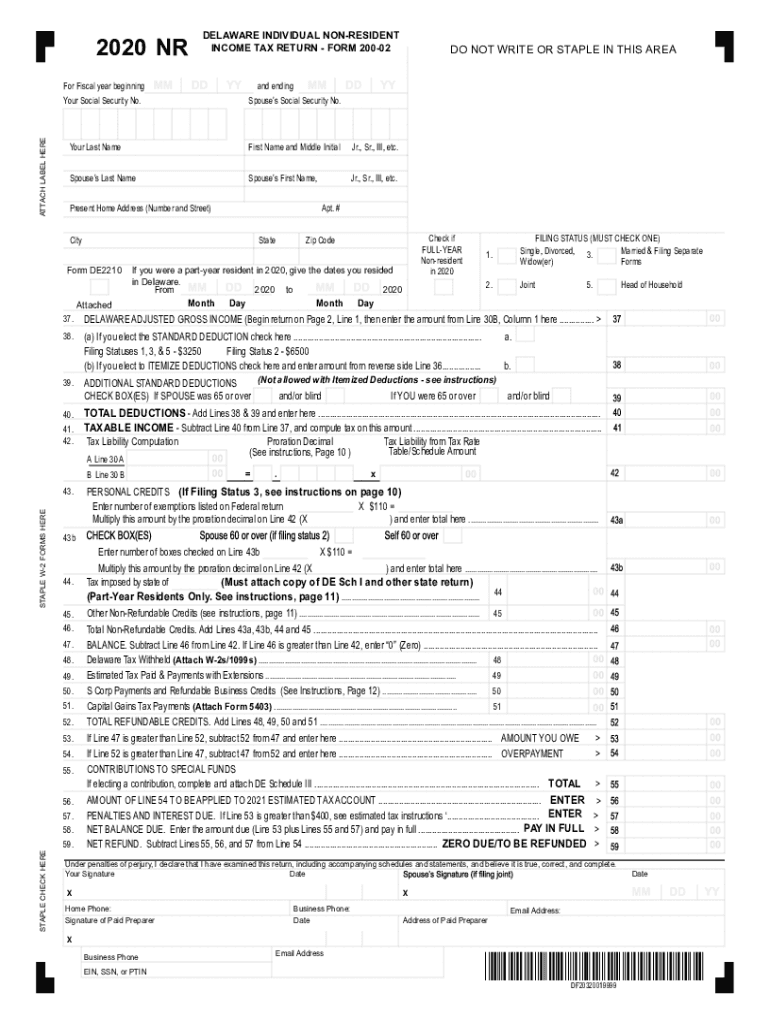

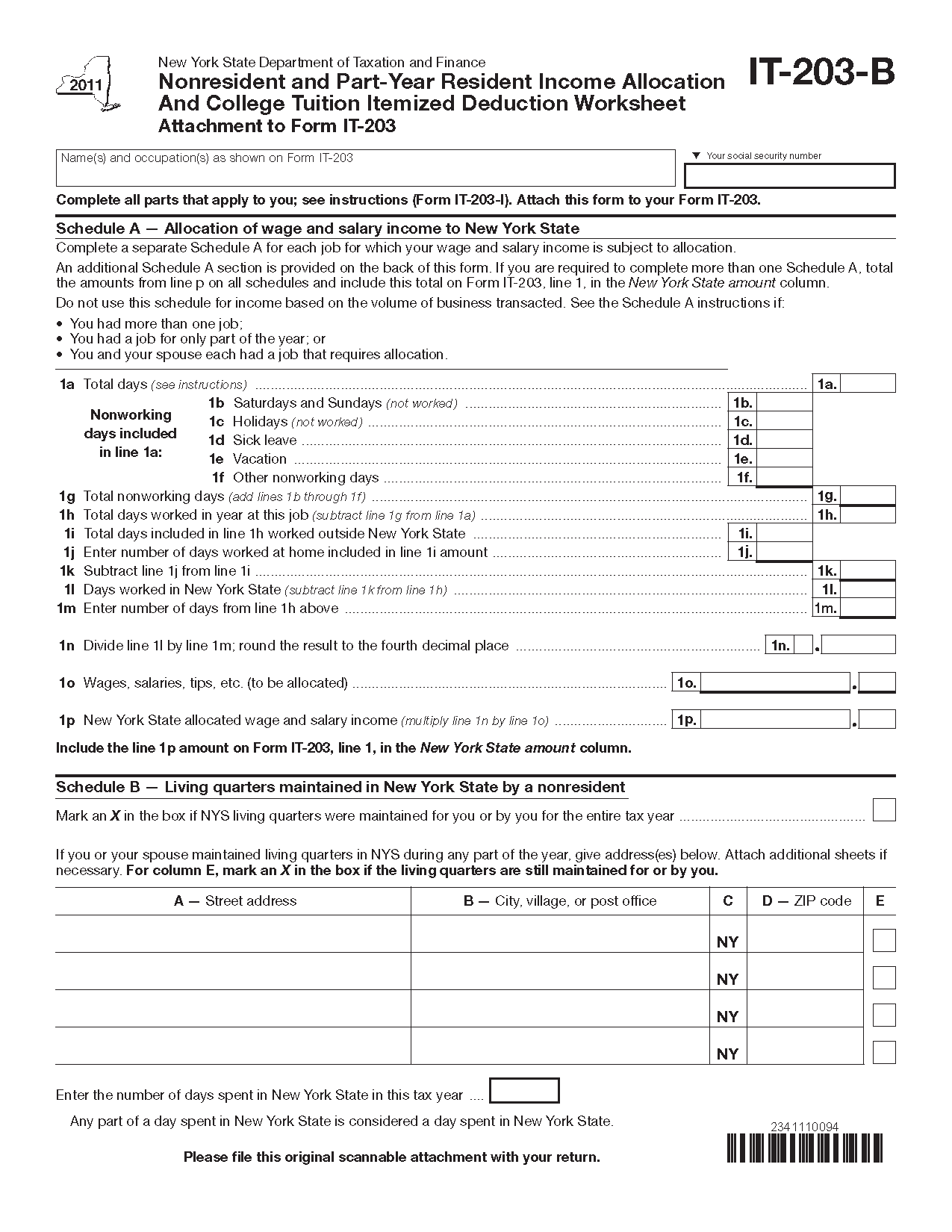

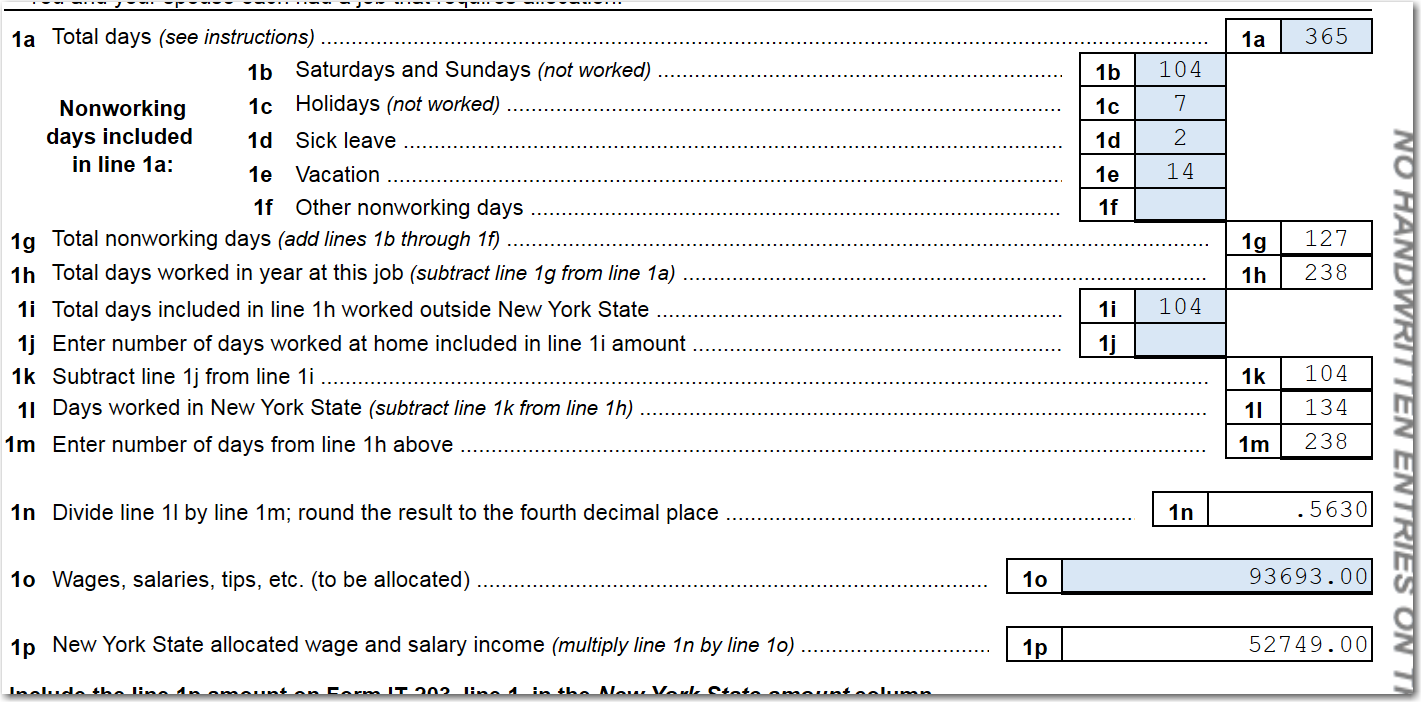

New York City Part Year Resident Tax Form - Generally, you are a new york. Web other forms you may need to complete and submit with your return. Edit, sign and print tax forms on any device with signnow. Go to screen 1, client information. How do i create the return? The following new york city taxes are. Web new york city and yonkers residents. Scroll to the resident status section at the top of the screen. Ad register and subscribe now to work on ny tiaa periodic wdrl that are not rollover eligible. Web documents on this page are provided in pdf format. New york city residents must pay a personal income tax, which is administered and collected by the new york state department of taxation and finance. Complete, edit or print tax forms instantly. Web other forms you may need to complete and submit with your return. Edit, sign and print tax forms on any device with signnow. Web york state personal. Select who the form is. Go to screen 1, client information. Web new york city or yonkers (or both) change of resident status and you were a new york state resident for the entire year. Web other forms you may need to complete and submit with your return. Web york state personal income tax (and new york city and yonkers. Web documents on this page are provided in pdf format. Ad register and subscribe now to work on ny tiaa periodic wdrl that are not rollover eligible. New york city residents must pay a personal income tax, which is administered and collected by the new york state department of taxation and finance. The following new york city taxes are. Edit,. Ad register and subscribe now to work on ny tiaa periodic wdrl that are not rollover eligible. The following new york city taxes are. Web if you moved into or out of new york during the tax year, you will need to file a part year resident return and allocate your income. Web other forms you may need to complete. Web new york city or yonkers (or both) change of resident status and you were a new york state resident for the entire year. Generally, you are a new york. Edit, sign and print tax forms on any device with signnow. Web if you moved into or out of new york during the tax year, you will need to file. Web if you moved into or out of new york during the tax year, you will need to file a part year resident return and allocate your income. Complete, edit or print tax forms instantly. New york city residents must pay a personal income tax, which is administered and collected by the new york state department of taxation and finance.. New york city residents must pay a personal income tax, which is administered and collected by the new york state department of taxation and finance. Generally, you are a new york. Web new york city and yonkers residents. Web documents on this page are provided in pdf format. Edit, sign and print tax forms on any device with signnow. Web new york city or yonkers (or both) change of resident status and you were a new york state resident for the entire year. Edit, sign and print tax forms on any device with signnow. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions in either group. Complete, edit or print tax forms instantly. The following new york city taxes are. Web new york city or yonkers (or both) change of resident status and you were a new york state resident for the entire year. Web documents on this page are provided in pdf format. Web new york city and yonkers residents. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Select who the form is. Generally, you are a new york. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions in either group a or group b: Go to screen 1, client information. Web documents on this page are provided in pdf format. New york city residents must pay a personal income tax, which is administered and collected by the new york state department of taxation and finance. How do i create the return? Get ready for tax season deadlines by completing any required tax forms today. The following new york city taxes are. Web other forms you may need to complete and submit with your return. Edit, sign and print tax forms on any device with signnow. Web new york city and yonkers residents. Select who the form is. Complete, edit or print tax forms instantly. Web if you moved into or out of new york during the tax year, you will need to file a part year resident return and allocate your income. Scroll to the resident status section at the top of the screen. Web new york city or yonkers (or both) change of resident status and you were a new york state resident for the entire year. Ad register and subscribe now to work on ny tiaa periodic wdrl that are not rollover eligible. Web york state personal income tax (and new york city and yonkers personal income tax, if applicable), you must meet the conditions in either group a or group b: Generally, you are a new york.If You Were a Part Year Resident In, Give the Dates You Resided Fill

New York City Part Year Resident Tax Withholding Form

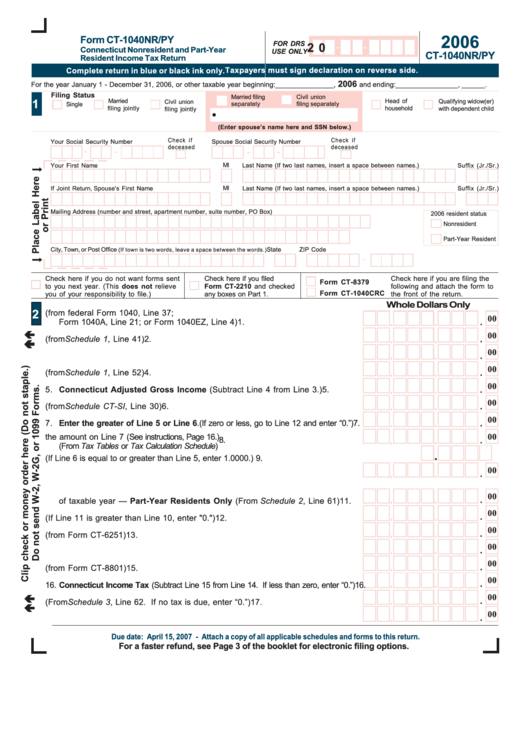

Form Ct1040nr/py Connecticut Nonresident And PartYear Resident

New York City Part Year Resident Tax Withholding Form

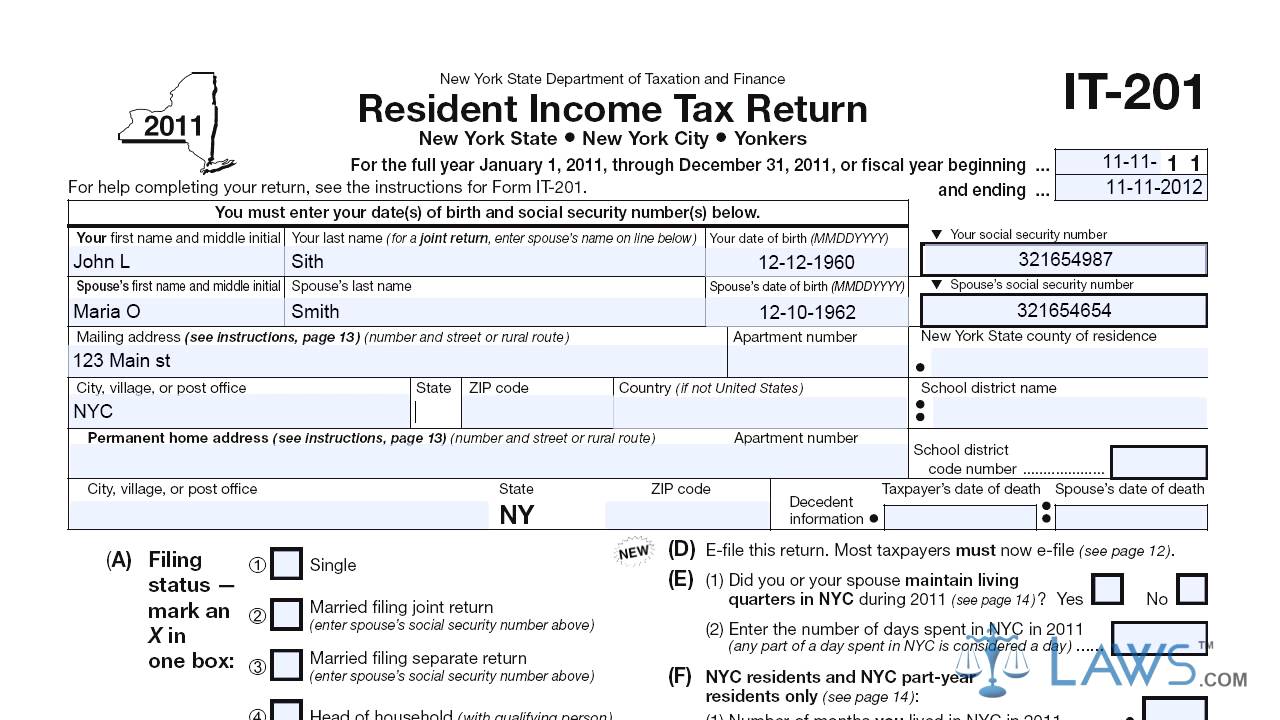

Form IT 201 Resident Tax Return YouTube

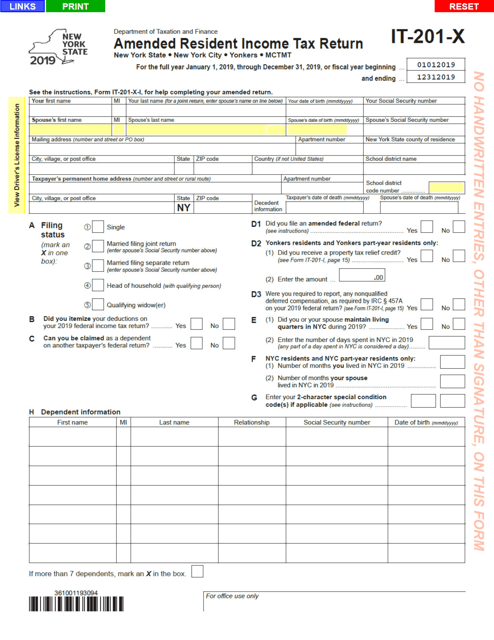

Amended NonResident & Part Year Resident Tax Return

Resident Tax Return New York Free Download

Form IT201X Download Fillable PDF or Fill Online Amended Resident

Resident Tax Return New York Free Download

New York City Part Year Resident General Chat ATX Community

Related Post: