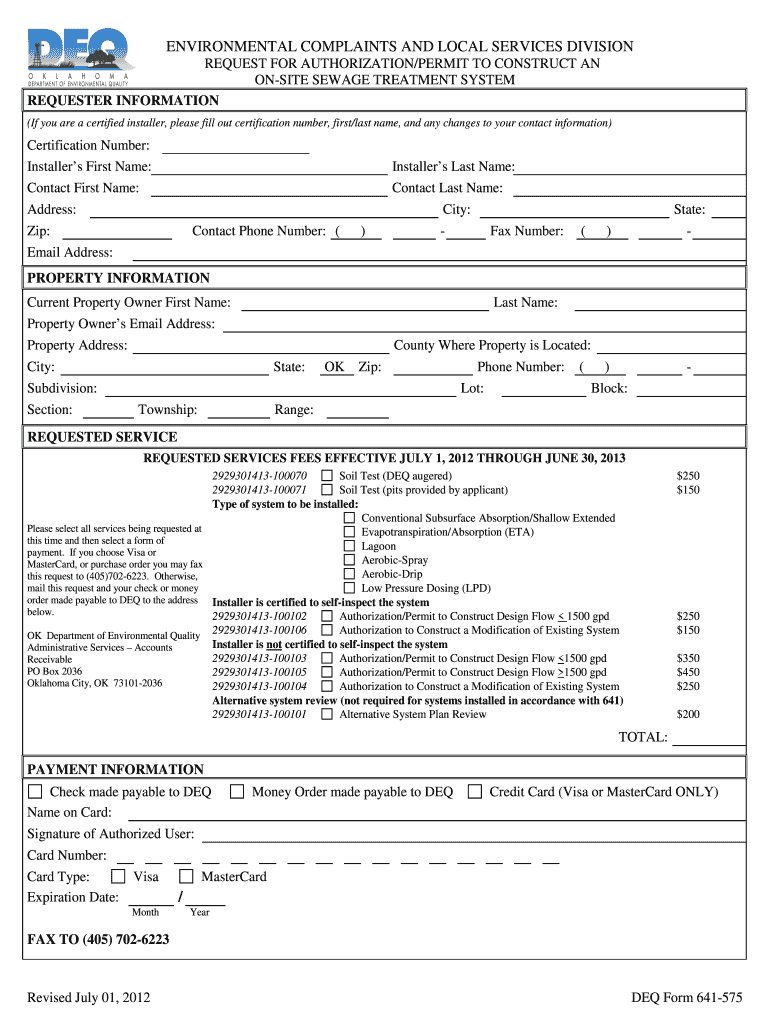

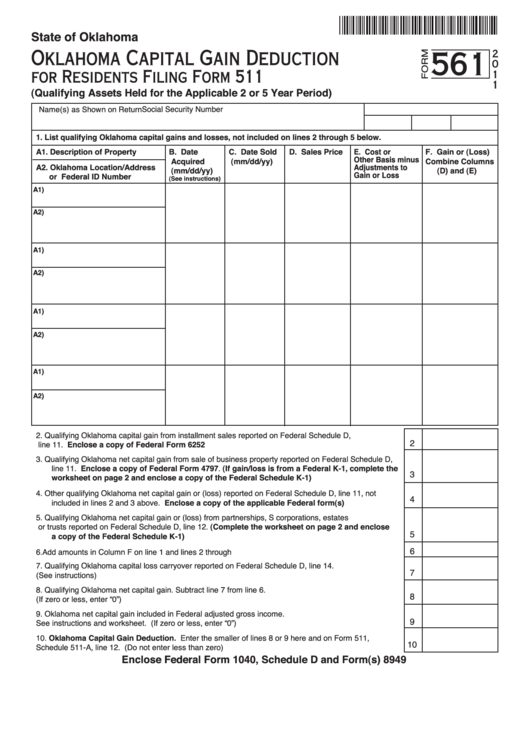

Oklahoma Form 561

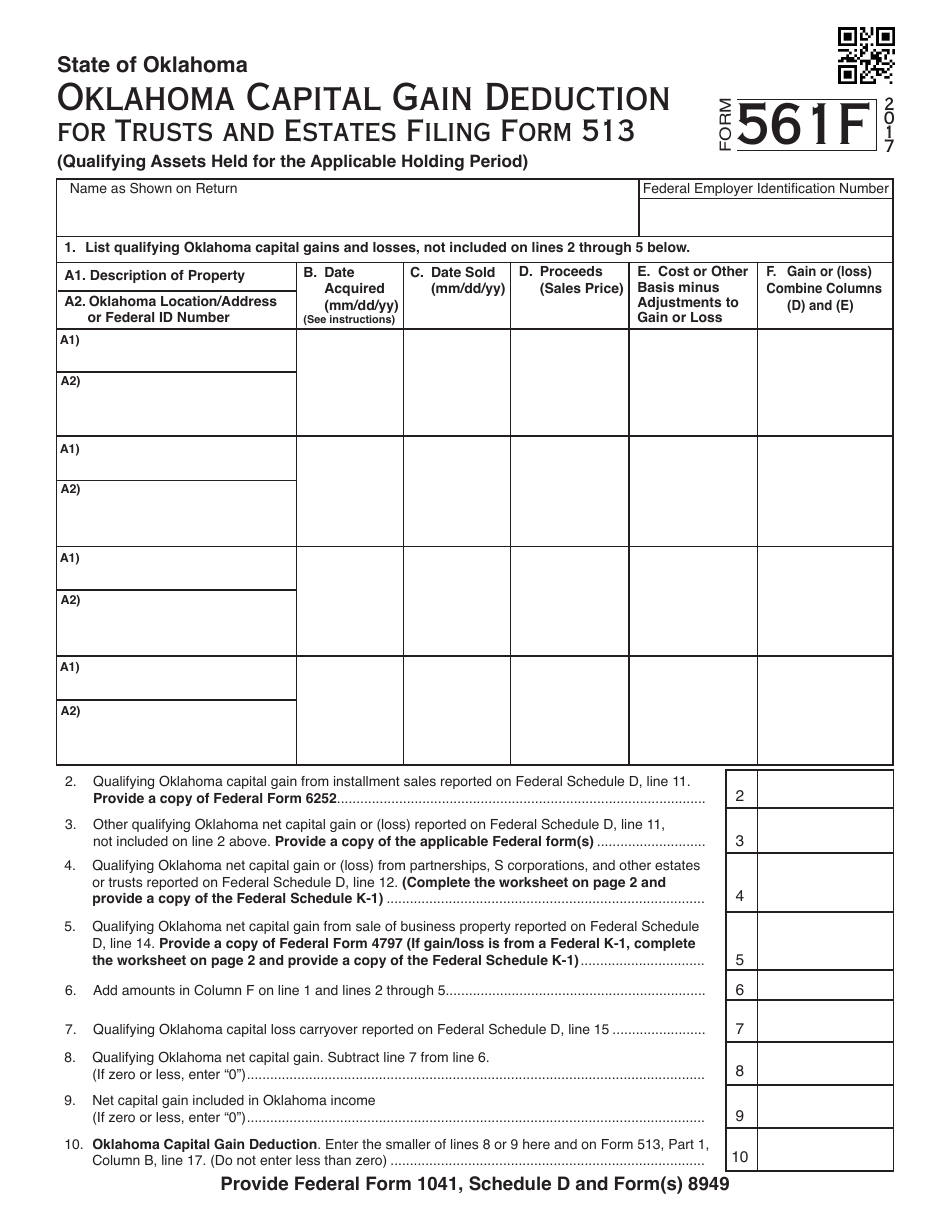

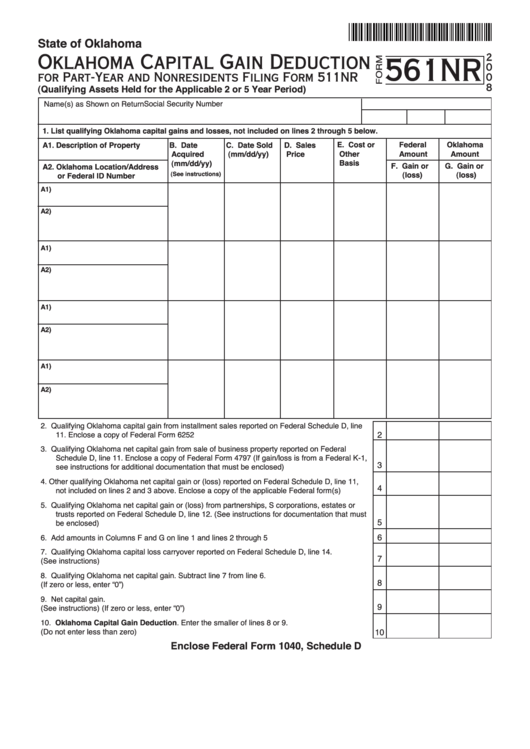

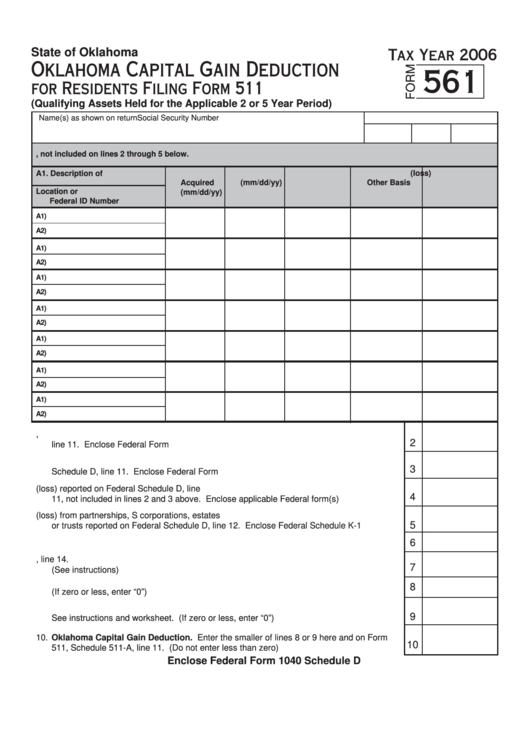

Oklahoma Form 561 - Web form 561 worksheet for (check one): Web form 561 worksheet for (check one): Web which was sourced to oklahoma on form 513nr, column b, line 4 but not included in the income distribution deduction on line 16. Select the document template you need from our collection of legal form. List qualifying oklahoma capital gains and losses from the federal form(s) 8949, part ii or from federal schedule d, line 8a. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web the ok form 561 is used to report sale of ok property or interest (such as stock) in a ok property, company, partnership that resulted in a capital gain. Web form 561p is an oklahoma corporate income tax form. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Amounts entered on federal screen b&d with a state use code 8 are automatically transferred to. Web form 561 worksheet for (check one): Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Web form 561p is an oklahoma corporate income tax form. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os). This form is for income earned in tax year 2022, with tax returns due in. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Use this screen to calculate the oklahoma forms 561 and 561nr. Web the ok form 561 is used to report sale of ok property or interest. Web form 561 worksheet for (check one): Pdffiller allows users to edit, sign, fill & share all type of documents online. Use this screen to calculate the oklahoma forms 561 and 561nr. Select the document template you need from our collection of legal form. Web the ok form 561 is used to report sale of ok property or interest (such. Web form 561 worksheet for (check one): List qualifying oklahoma capital gains and losses from the federal form(s) 8949, part ii or from federal schedule d, line 8a. Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Web the ok form 561 is used to report sale of. Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web 2022 oklahoma resident individual income tax forms and instructions. Web the ok form 561 is used to report sale. Web the ok form 561 is used to report sale of ok property or interest (such as stock) in a ok property, company, partnership that resulted in a capital gain. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web we last updated oklahoma form 561 in january 2023 from. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web form 561p is an oklahoma corporate income tax form. Web form 561 worksheet for (check one): Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. List qualifying oklahoma capital gains. Pdffiller allows users to edit, sign, fill & share all type of documents online. • instructions for completing the oklahoma resident income tax return form. Use this screen to calculate the oklahoma forms 561 and 561nr. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Amounts entered on federal screen. Web form 561 worksheet for (check one): List qualifying oklahoma capital gains and losses from the federal form(s) 8949, part ii or from federal schedule d, line 8a. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. • instructions for completing the oklahoma resident income tax return form. Amounts entered. Pdffiller allows users to edit, sign, fill & share all type of documents online. This form is for income earned in tax year 2022, with tax returns due in. Do not include gains and losses reported on. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. List qualifying oklahoma capital. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Do not include gains and losses reported on. Amounts entered on federal screen b&d with a state use code 8 are automatically transferred to. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Use this screen to calculate the oklahoma forms 561 and 561nr. Web the ok form 561 is used to report sale of ok property or interest (such as stock) in a ok property, company, partnership that resulted in a capital gain. Pdffiller allows users to edit, sign, fill & share all type of documents online. Web form 561 worksheet for (check one): Web fill out oklahoma form 561 in just several moments by simply following the guidelines below: Web form 561 worksheet for (check one): Web which was sourced to oklahoma on form 513nr, column b, line 4 but not included in the income distribution deduction on line 16. List qualifying oklahoma capital gains and losses from the federal form(s) 8949, part ii or from federal schedule d, line 8a. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web 2022 oklahoma resident individual income tax forms and instructions. Select the document template you need from our collection of legal form. Web form 561 worksheet for (check one): Web form 561p is an oklahoma corporate income tax form. This form is for income earned in tax year 2022, with tax returns due in.OTC Form 561F Download Fillable PDF or Fill Online Oklahoma Capital

Fillable Form 561nr Capital Gain Deduction State Of Oklahoma 2008

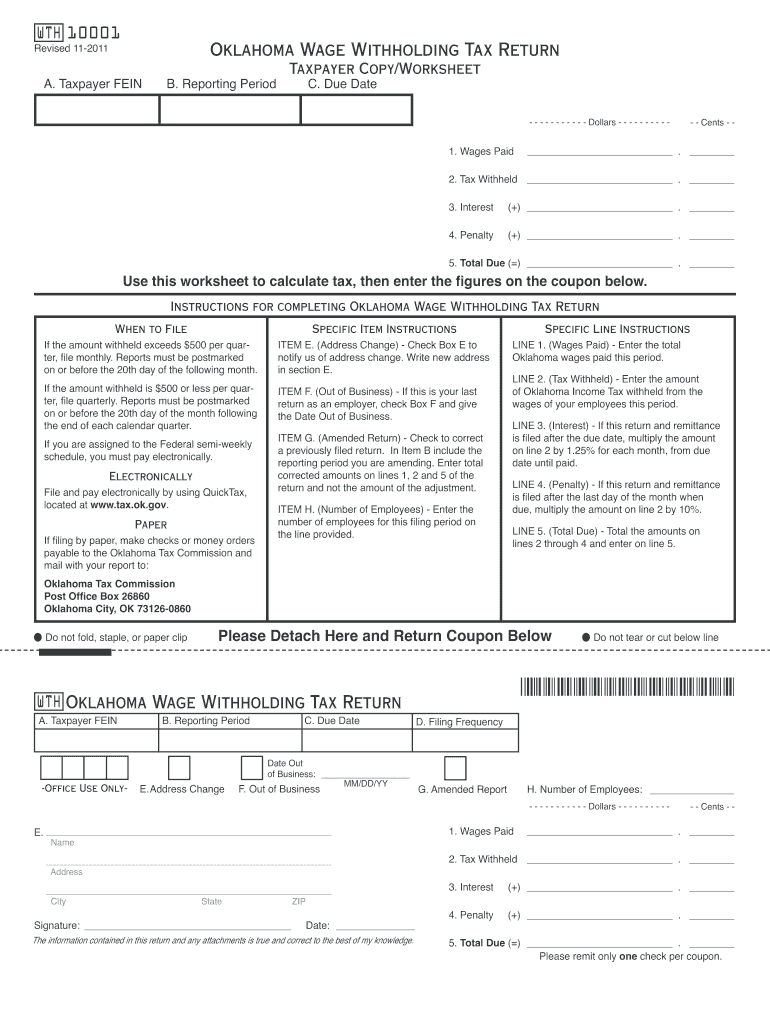

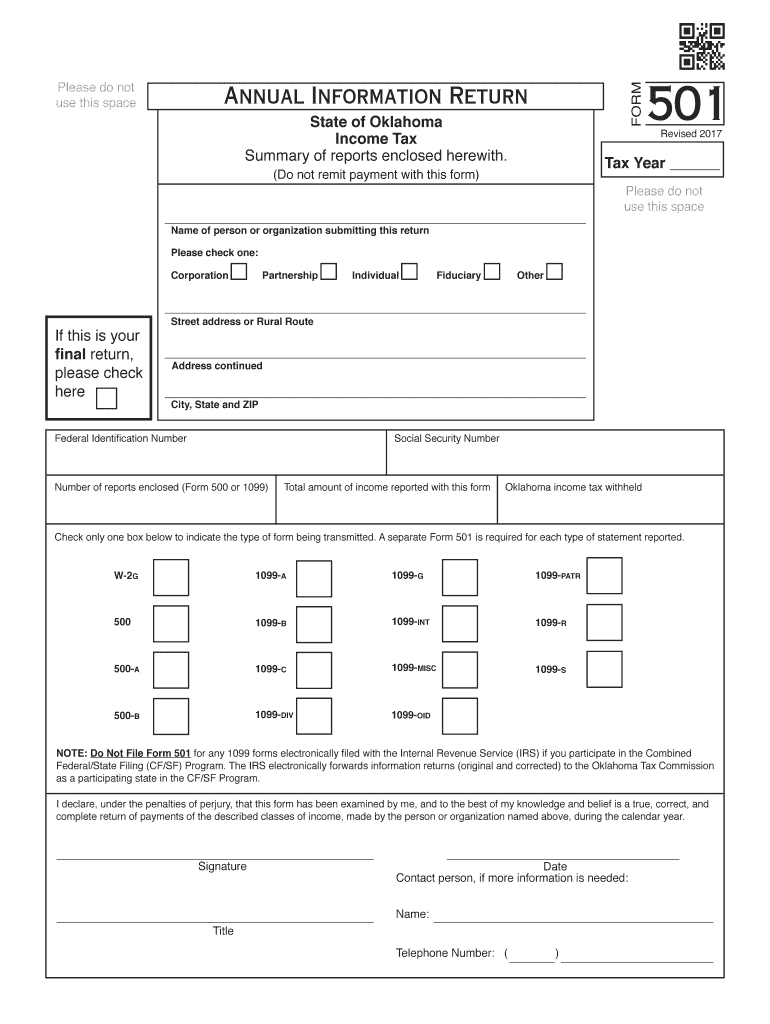

Oklahoma Withholding Tax for Form Fill Out and Sign Printable PDF

Fillable Form 561 Oklahoma Capital Gain Deduction For Residents

20172023 AK Form 561 Fill Online, Printable, Fillable, Blank pdfFiller

Deq Oklahoma Forms Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Form 561 Oklahoma Capital Gain Deduction For Residents

Oklahoma w4 form 2019 Fill out & sign online DocHub

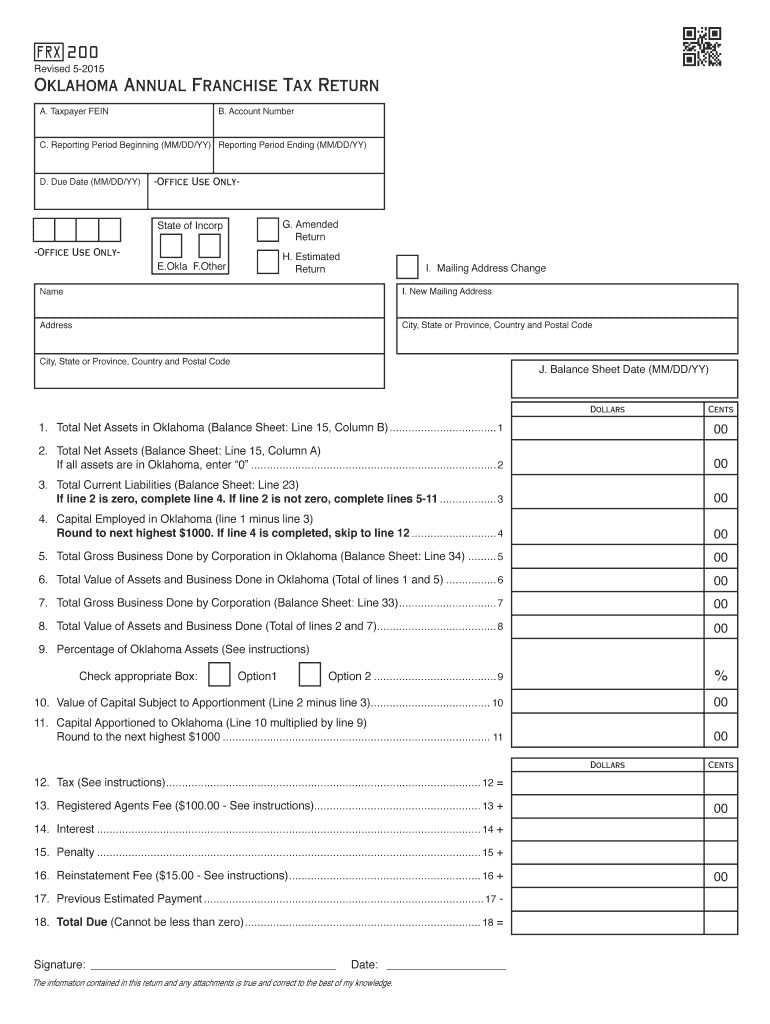

Oklahoma Form Franchise Tax Fill Out and Sign Printable PDF Template

Ok state tax form 2018 Fill out & sign online DocHub

Related Post: