Oklahoma Form 514

Oklahoma Form 514 - Web separate oklahoma income tax returns. Full diagnostic text oklahoma electronic filing. • 514 partnership income tax form. Partnership income tax forms and instructions: Complete, edit or print tax forms instantly. Use part 3 to determine total oklahoma taxable. Get ready for tax season deadlines by completing any required tax forms today. Web • instructions for completing the form 514. Corporate income tax (form 512). Get your online template and fill it in using progressive features. I understand that any false statement submitted in this affidavit subjects me to prosecution. Enjoy smart fillable fields and interactivity. Agency code '695' form title: Web state of oklahoma, county of : • 514 partnership income tax form. _____ i hereby attest to the following facts and information: For tax practitioners, eros, transmitters, and software developers. Get your online template and fill it in using progressive features. Web use part 2 to compute tax on members who are corporations, s corporations and partnerships taxed at a 6% rate. The oklahoma distributive share of partnership income shall be the. Web form 514, page 3, apportionment formula. in 1065 return using interview forms. Get ready for tax season deadlines by completing any required tax forms today. Use part 3 to determine total oklahoma taxable. Power of attorney oklahoma tax commission (state of. Each partner having oklahoma source income sufficient to make a return,. Corporate income tax (form 512). The instructions are on the back of form. Each partner having oklahoma source income sufficient to make a return,. Web state of oklahoma, county of : Enjoy smart fillable fields and interactivity. Web the 2021 form 514 oklahoma partnership income tax return packet & instructions (state of oklahoma) form is 35 pages long and contains: _____ i hereby attest to the following facts and information: Get ready for tax season deadlines by completing any required tax forms today. Enjoy smart fillable fields and interactivity. Each partner having oklahoma source income sufficient to. Complete, edit or print tax forms instantly. Use part 3 to determine total oklahoma taxable. Web form 514, page 3, apportionment formula. in 1065 return using interview forms. Web form 514, for the calendar year or fiscal year ended on the last day of any month other than december. Power of attorney oklahoma tax commission (state of. I understand that any false statement submitted in this affidavit subjects me to prosecution. Web the 2021 form 514 oklahoma partnership income tax return packet & instructions (state of oklahoma) form is 35 pages long and contains: For tax practitioners, eros, transmitters, and software developers. Web form 514, oklahoma partnership income tax return available unsupported so, i take this to. Web form 514, for the calendar year or fiscal year ended on the last day of any month other than december. Get your online template and fill it in using progressive features. The instructions are on the back of form. _____ i hereby attest to the following facts and information: Each partner having oklahoma source income sufficient to make a. Partnership income tax forms and instructions: The instructions are on the back of form. Web use part 2 to compute tax on members who are corporations, s corporations and partnerships taxed at a 6% rate. Power of attorney oklahoma tax commission (state of. Web form 514, oklahoma partnership income tax return available unsupported so, i take this to mean that. Web how to fill out and sign oklahoma form 514 instructions online? Partnership income tax forms and instructions: The oklahoma distributive share of partnership income shall be the same portion of that. Web form 514, oklahoma partnership income tax return available unsupported so, i take this to mean that form 514 is available in tt for printing, but unsupported. Enjoy. • 514 partnership income tax form. Web form 514, for the calendar year or fiscal year ended on the last day of any month other than december. Get ready for tax season deadlines by completing any required tax forms today. Web the 2021 form 514 oklahoma partnership income tax return packet & instructions (state of oklahoma) form is 35 pages long and contains: Enjoy smart fillable fields and interactivity. _____ i hereby attest to the following facts and information: Web separate oklahoma income tax returns. Web • instructions for completing the form 514. Each partner having oklahoma source income sufficient to make a return,. Agency code '695' form title: The instructions are on the back of form. Partnership income tax forms and instructions: Web form 514, oklahoma partnership income tax return available unsupported so, i take this to mean that form 514 is available in tt for printing, but unsupported. Power of attorney oklahoma tax commission (state of. Web use part 2 to compute tax on members who are corporations, s corporations and partnerships taxed at a 6% rate. The oklahoma distributive share of partnership income shall be the same portion of that. Corporate income tax (form 512). For tax practitioners, eros, transmitters, and software developers. I understand that any false statement submitted in this affidavit subjects me to prosecution. Web how to fill out and sign oklahoma form 514 instructions online?Oklahoma w4 form 2019 Fill out & sign online DocHub

Fill Free fillable 2021 Form 514 Oklahoma Partnership Tax

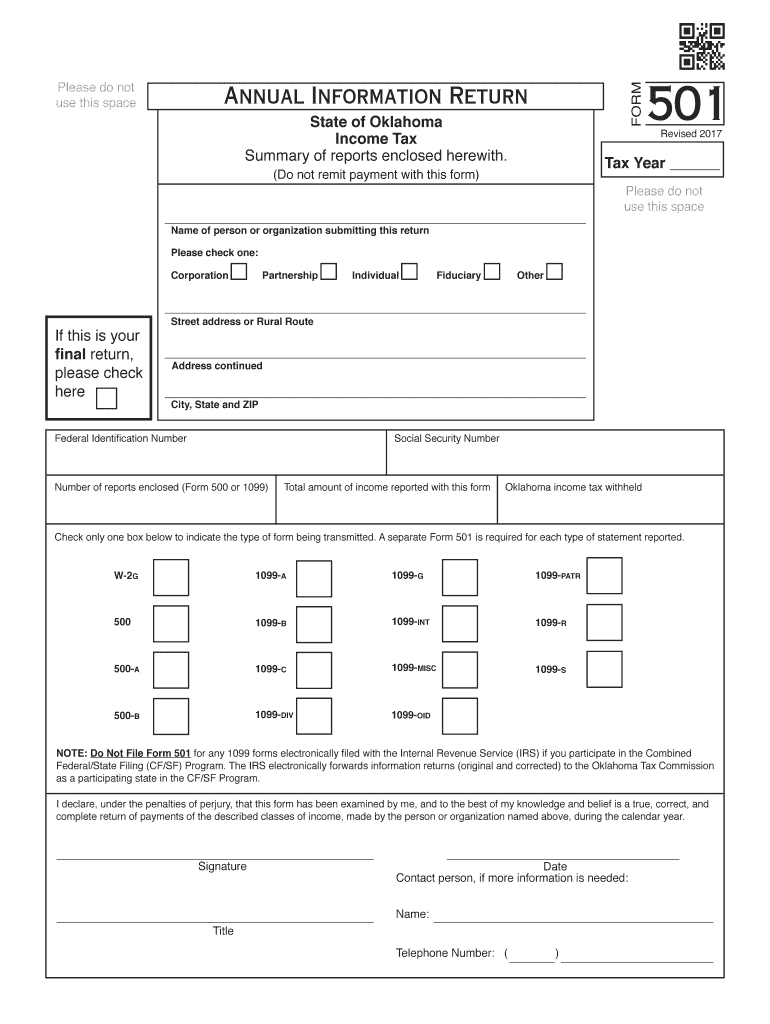

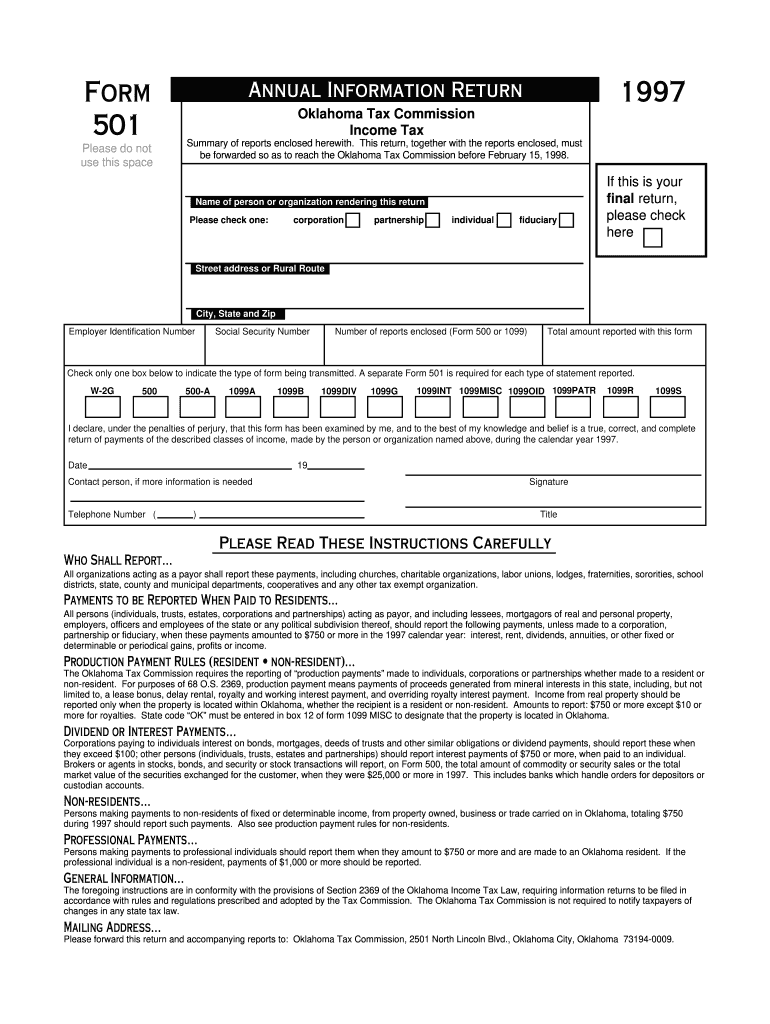

Form 501 Oklahoma Fill Out and Sign Printable PDF Template signNow

Fill Free fillable 2021 Form 514 Oklahoma Partnership Tax

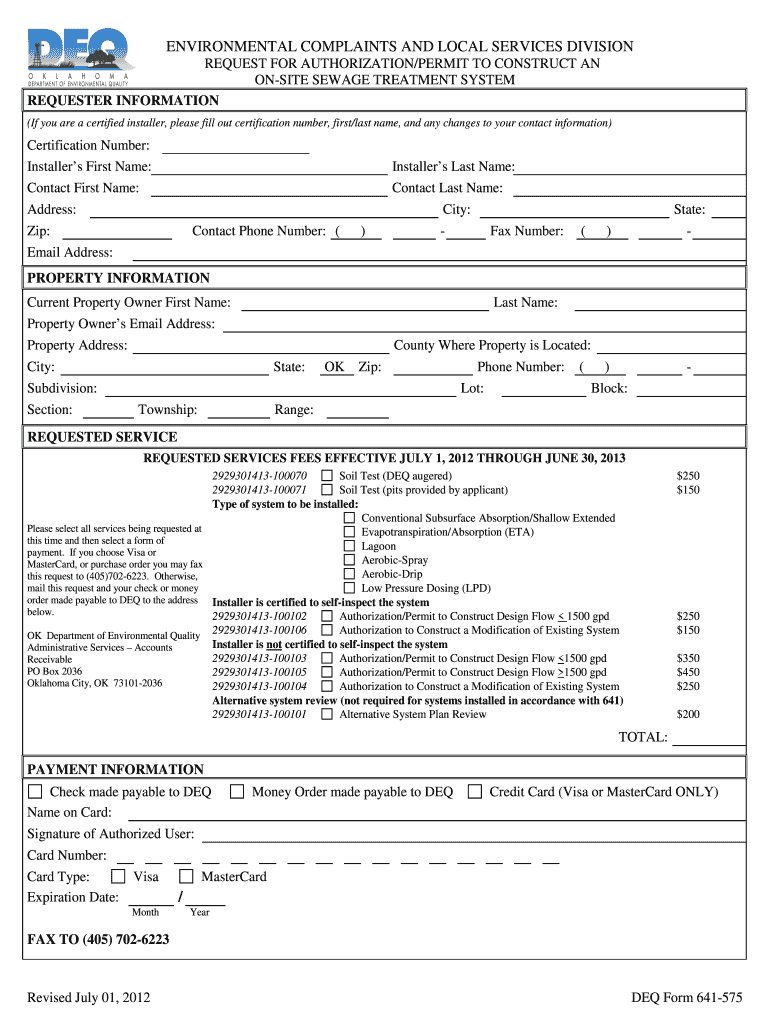

Deq Oklahoma Forms Fill Online, Printable, Fillable, Blank pdfFiller

Fill Free fillable 2021 Form 514 Oklahoma Partnership Tax

OTC Form EFV Fill Out, Sign Online and Download Fillable PDF

Fill Free fillable 2021 Form 514 Oklahoma Partnership Tax

Oklahoma Form 514 Fill Online, Printable, Fillable, Blank pdfFiller

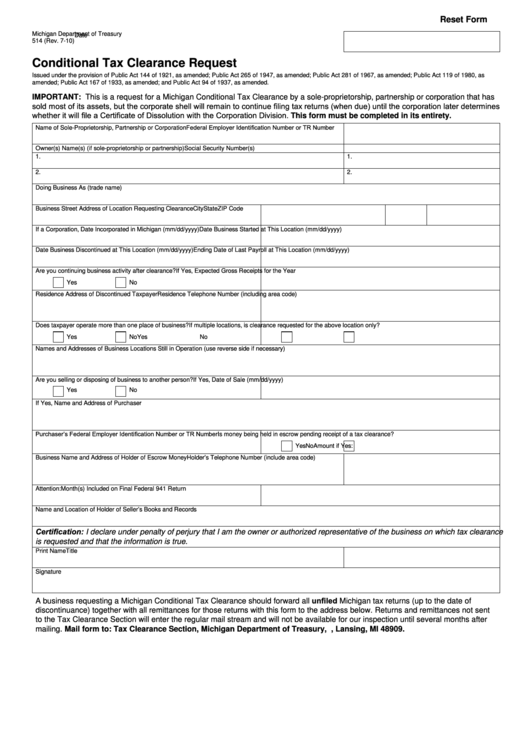

Fillable Form 514 Conditional Tax Clearance Request printable pdf

Related Post: